Snake Kelter Indicator V2.94 for MT4 — Your Clean, Channel-Based Edge

If you’ve been hunting for a clean, no-nonsense way to read trend strength, spot momentum squeezes, and time pullbacks on MetaTrader 4, the Snake Kelter Indicator V2.94 for MT4 deserves a place in your toolbox. This advanced trading indicator wraps price with adaptive channels so you can quickly see when the market is trending, coiling, or likely to revert toward the mean. Instead of cluttering your chart, it gives you a simple visual roadmap: an objective midline to anchor bias and two dynamic outer bands that expand and contract as volatility shifts.

Below, you’ll find a complete guide—what it is, how it works, smart settings, strategies for scalpers and swing traders, installation tips, and a few pro tricks to keep you out of trouble. No hype, just practical ways to make the most of Snake Kelter V2.94 on MT4.

What is the Snake Kelter Indicator V2.94?

Snake Kelter V2.94 is a channel-style indicator for MT4. It plots:

- A baseline (midline) that tracks the underlying direction of price using a moving-average-type calculation.

- Upper and lower bands that adapt to volatility (the bands widen in fast markets and compress when price quiets down).

Because the bands respond to volatility, you get a living “envelope” around price. That envelope helps you judge trend quality, identify potential breakouts from tight ranges, and locate pullback zones with better risk-to-reward. The result: more disciplined entries and exits, less guesswork.

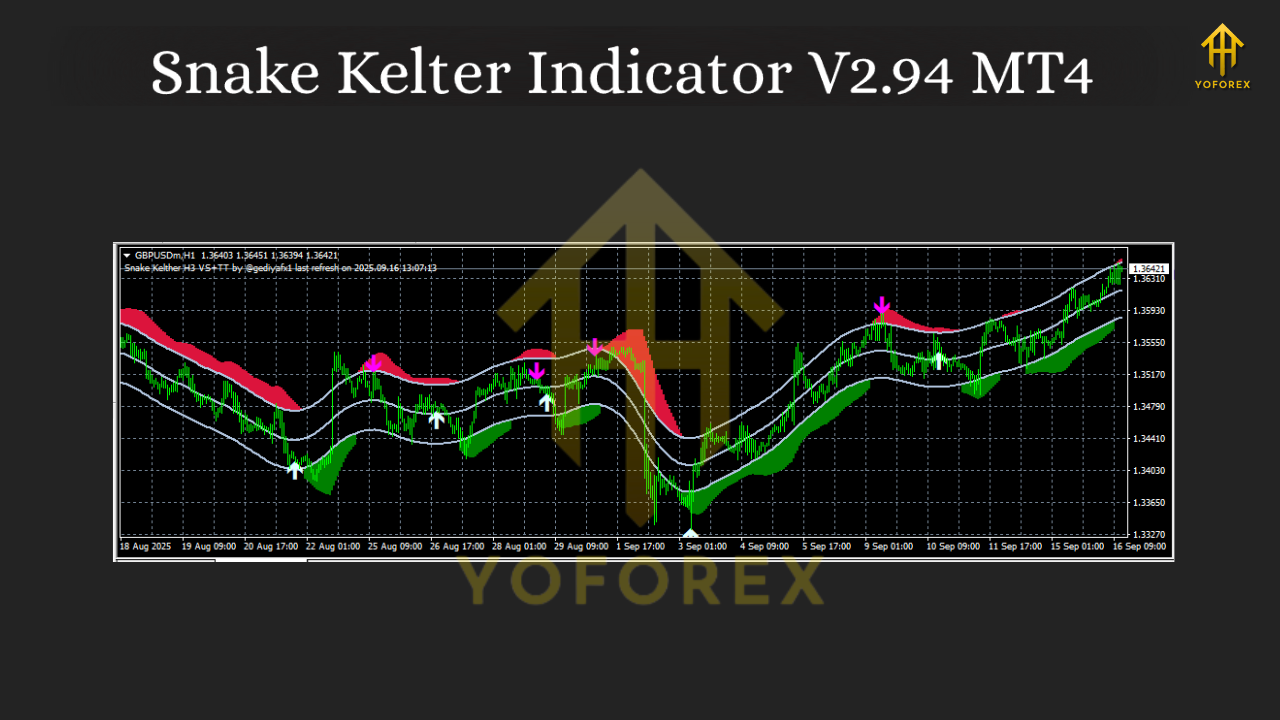

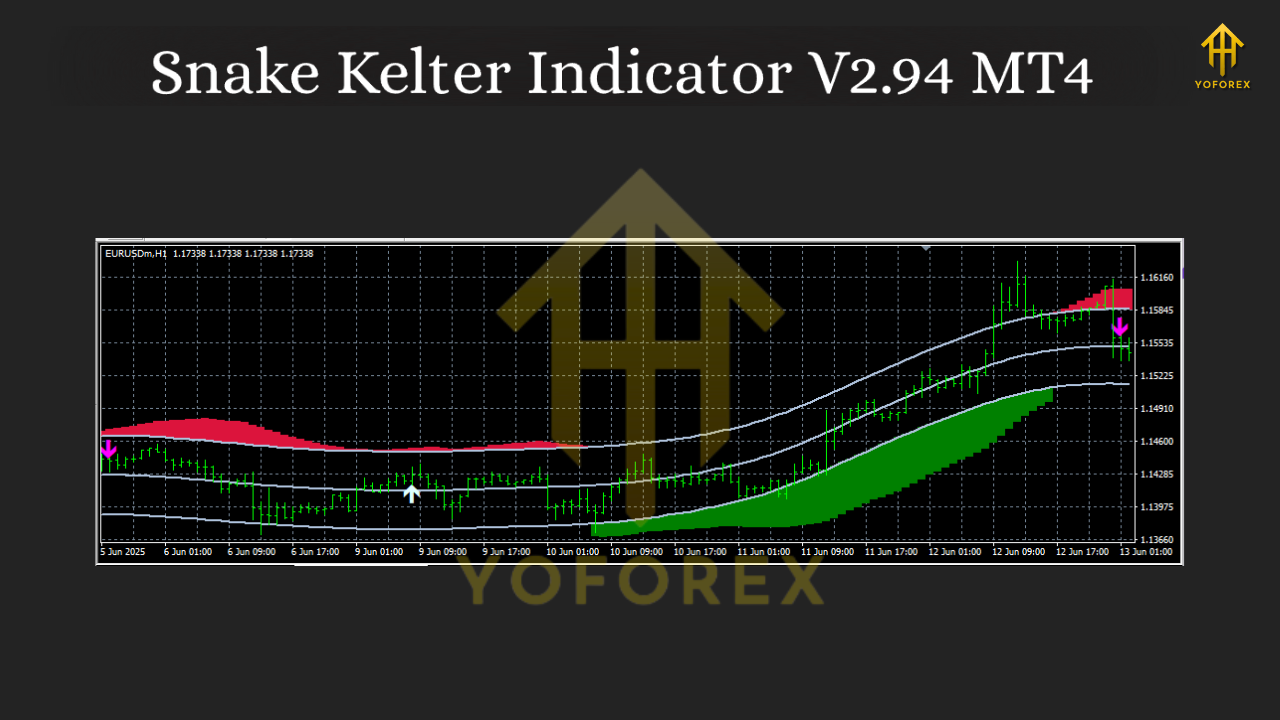

How Snake Kelter Works (In Practice)

- Trend Filter via Midline

When price stays above the midline and the midline is sloping up, the path of least resistance is generally higher; below and sloping down implies a bearish bias. - Momentum Squeeze & Expansion

Bands that compress signal a volatility squeeze—often the calm before a move. Bands that expand confirm a momentum phase. Traders watch for breakouts from compression to catch new legs. - Pullbacks to Value

During trends, pullbacks toward the midline or inner band areas offer “value” entries in the direction of the trend, especially when the band slope agrees. - Mean Reversion in Ranges

When the bands are flat and parallel, price tends to oscillate between them. Mean-reversion traders can fade extremes back toward the midline, using tight stops.

Key Features You’ll Appreciate

- Adaptive volatility channels for instant context on trend vs. range

- Intuitive midline bias filter to keep you trading with the flow

- Clear pullback and breakout zones (no second-guessing entries)

- Configurable band multiplier & period to match your style

- Signal clarity: fewer false positives when markets chop

- Works across pairs & timeframes (M5 scalps to H4 swings)

- Squeeze detection via band compression for early breakout prep

- Confluence-friendly with RSI, MACD, or price action levels

- Low chart clutter—clean look, fast decisions

- Risk-aware structuring (easier stop placement beyond bands)

Recommended Inputs & Settings (Starting Points)

Every trader tunes indicators differently; treat the following as starting points and forward-test on demo first.

- Period: 20–30 on intraday (M5–M30), 30–50 on H1–H4

- Band Multiplier: 1.5–2.0 for balanced sensitivity; 2.25–2.5 to filter noise

- Price Source: Close (default) works well; Experiment with Typical/Median price if you want smoother channels

- Smoothing: Low smoothing for agile scalping; moderate smoothing for swing clarity

- Alerts (if included in your build):

- Price close outside upper/lower band (momentum)

- Midline cross (bias change)

- Band squeeze threshold (e.g., % width below your chosen level)

Tip: If you get too many signals, raise the period or multiplier slightly. If you miss moves, reduce them a notch.

Best Timeframes & Pairs

- Scalpers & day traders: M5–M15 on liquid majors (EURUSD, GBPUSD, USDJPY) to capture pullbacks and breakout legs.

- Swing traders: M30–H4 on majors and cross pairs (EURJPY, GBPJPY, AUDUSD) for cleaner structure and less noise.

- Gold (XAUUSD): Try M15/H1 with a slightly higher multiplier to absorb gold’s impulsive swings.

Proven Trading Setups with Snake Kelter

1) Breakout from Squeeze

- Wait for visible band compression (narrowest width in recent bars).

- Enter on a strong candle close outside the channel in the breakout direction.

- Stops: Just inside the channel or beyond the opposite band.

- Exits: Trail behind the midline or use a fixed multiple of your stop.

2) Trend Pullback to the Midline

- Confirm midline slope (up for longs, down for shorts).

- Let price pull back toward (or slightly through) the midline.

- Look for a reversal candle, higher low (for longs), or confluence with a dynamic level (e.g., prior structure).

- Stops: Below the swing low (longs) or above swing high (shorts).

- Targets: Opposite band or recent swing; trail once momentum resumes.

3) Range Mean-Reversion

- Bands are flat and parallel; price bounces between them.

- Fade the edges toward the midline with smaller size.

- Stops: A few pips beyond the band.

- Targets: Midline first; opposite band if momentum is weak.

Confluence ideas: Add RSI (40–60 as a trend filter), MACD histogram momentum, or round numbers/previous day’s high-low to stack odds.

Risk Management (Non-Negotiable)

- Position size: Base it on stop distance, not hope.

- 1R mindset: Define risk per trade and accept it upfront.

- Daily loss cap: Stop trading if hit—protect your headspace.

- No chase: If a breakout candle is huge and leaves you behind, let it go. Another setup will come.

Installation & Setup (MT4)

- Copy the file: Place

Snake Kelter Indicator V2.94.ex4(or.mq4) intoMQL4/Indicatorsinside your MT4 data folder. - Restart MT4 (or refresh Navigator).

- Attach to chart: Open Navigator → Indicators → double-click Snake Kelter V2.94.

- Configure inputs: Set period, multiplier, smoothing, and any alert options.

- Save a template: Right-click chart → Template → Save so you can reuse your setup easily.

Common Mistakes to Avoid

- Trading against the midline slope just because price poked a band. Wait for alignment or reversal confirmation.

- Using one setting for all markets. Volatility differs—tune multiplier/period by instrument.

- Skipping higher-timeframe context. Always glance at H1/H4 bias before taking M5/M15 signals.

- No stop or averaging losers. A channel break can keep running—respect your invalidation point.

Final Thoughts

Snake Kelter Indicator V2.94 for MT4 gives you a simple, visual way to read the market’s rhythm. Channels expand to signal momentum, compress to warn you of potential breakouts, and wrap price so you can anchor entries, stops, and targets with logic rather than guesswork. Start with conservative settings, layer in a basic filter (RSI or higher-timeframe bias), and maintain strict risk controls. Forward-test on a demo first, collect screenshots of your trades, and refine. Do that, and this indicator can become a reliable, everyday companion on your charts.

YoForex—empowering traders worldwide, one free tool at a time.