Elliott Wave Indicators MT4: A Practical Guide for Traders Who Want Clarity, Not Chaos

If you’ve ever stared at a chart and thought, “This move has to be a wave 3… or maybe a B… ugh,” you’re not alone. Elliott Wave analysis is powerful, but it can feel fuzzy fast—especially when you’re trying to mark swings in real time. That’s where Elliott Wave indicators for MT4 step in. They won’t magically predict the future (nothing does), but they will help you structure the chaos: highlight swings, measure retracements, time entries, and manage risk like a grown-up. In this guide, we’ll cover what to install, how to configure, and exactly how to combine indicators so your wave counts stop wobbling. You’ll also get a step-by-step workflow you can reuse daily—coz consistency beats gut feel, every time.

What Elliott Wave Analysis Actually Aims to Do

At its core, Elliott Wave theory suggests markets move in impulse–corrective cycles: five waves in the direction of the larger trend (1–2–3–4–5) followed by a three-wave correction (A–B–C). The edge is context: if you think you’re in wave 3, you trade with more conviction than you would in wave 5; if you think a correction is unfolding, you look for fading setups or wait it out. Indicators on MT4 can’t “know” the count, but they can confirm structure, momentum, and proportion, which is exactly what manual Elliotticians need.

The MT4 Indicator Stack That Makes Wave Work Easier

You don’t need 20 tools. You need a small, reliable stack that cross-checks structure, momentum, and Fibonacci proportions:

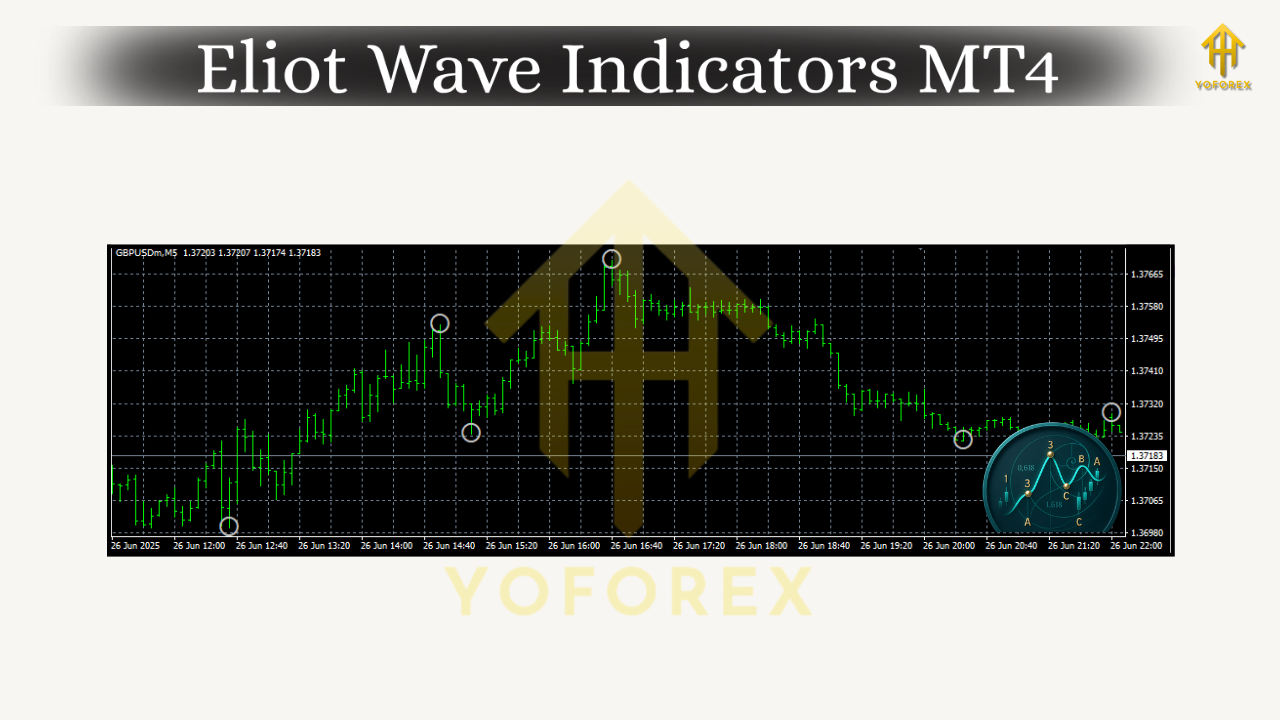

- ZigZag – Cleans up the swing structure so your wave labelling isn’t guessy. Great for spotting 5-wave impulses versus choppy corrections.

- Fractals – Marks local highs/lows; useful anchors for channel lines and stop placement in waves 2 and 4.

- Fibonacci Retracement & Extension – Bread and butter. 38.2%, 50%, 61.8% for retracements; 127.2%–161.8% for wave-3/5 extensions and A=C symmetry.

- MACD or Awesome Oscillator (AO) – Momentum confirmation; wave 3 usually prints the strongest histogram burst.

- RSI (or Stoch RSI) – Divergence helps you spot maturing wave 5s or C-legs that are running out of steam.

- Moving Averages (e.g., 21 & 50 EMA) – Trend filter. Impulses tend to ride above/below the fast EMA; wave-4 pullbacks often hold the 50 EMA.

- Volume (tick volume on MT4) – Not perfect, but spikes often align with wave 3 accelerations and capitulation ends of C-legs.

- Auto Elliott Labelers (optional) – Can be helpful, but don’t outsource your brain; use them to suggest counts, not to decide for you.

How to Install Elliott Wave Indicators on MT4 (Quick Start)

- Download the files (if they’re custom

.ex4or.mq4) and keep them in a labeled folder. - In MT4, go to File → Open Data Folder →

MQL4→ Indicators. - Copy your indicator files into the Indicators folder.

- Restart MT4 or right-click Navigator → Refresh.

- Drag each indicator onto your chart from Navigator → Indicators.

- Save a Template (right-click chart → Template → Save Template) so your wave layout is one click away.

Recommended chart setup: Candle chart; 21 & 50 EMA; ZigZag; MACD or AO; RSI(14); and Fib tools enabled on the toolbar. Keep it clean—no rainbow spaghetti.

A Repeatable Elliott Wave Workflow (So You Don’t Overthink)

Top-down first.

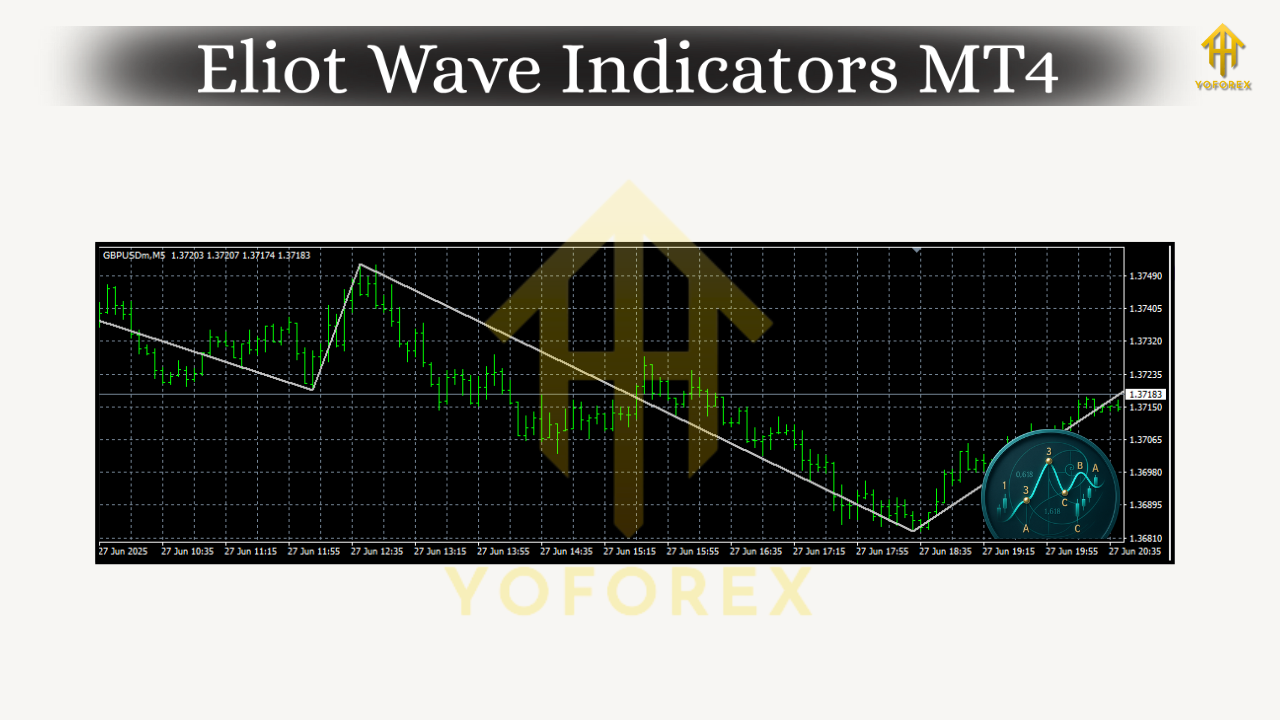

- Start on H4 or Daily: Mark the macro impulse or correction. Draw channels: impulse channels for 1–3–5, corrective channels for A–B–C.

- Drop to H1/M15 for execution: Align your entries with the higher-timeframe map.

Identify swings with ZigZag.

- If the last leg is clean, extended, and momentum-strong (MACD/AO brrr), it’s likely a wave 3.

- If you’re seeing overlapping, shallow moves, you’re probably in a correction (A–B–C, W–X–Y).

Measure with Fibonacci.

- Wave-2 pullbacks often tag 50–61.8% of wave 1 (invalid if price breaks below the start of wave 1 in an uptrend).

- Wave-4 pullbacks are usually 38.2% of wave 3 and often respect prior wave-4 of one lesser degree (fractal support).

- Wave-3 projections commonly reach 161.8% of wave 1; wave-5 often equals wave 1 or hits 127.2–161.8% extensions.

- In A–B–C, A ≈ C or C = 127.2–161.8% of A is common.

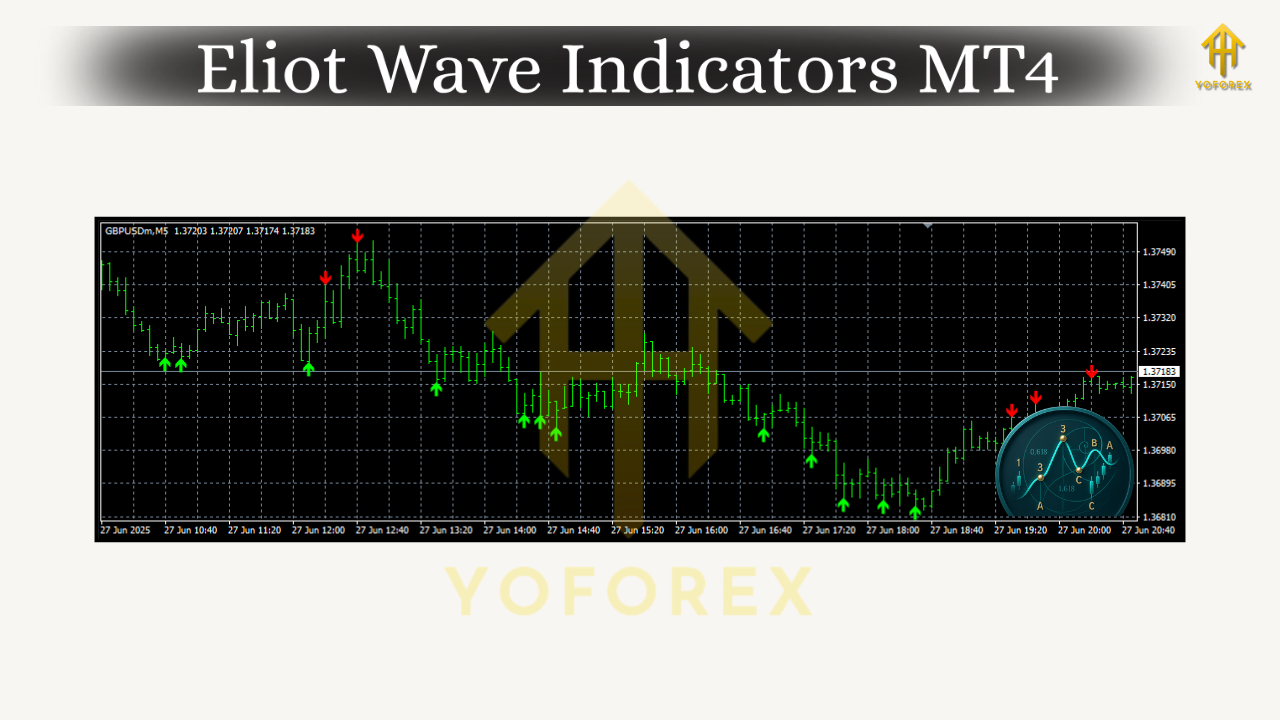

Confirm with momentum and divergence.

- Strongest momentum? That’s usually wave 3.

- RSI/MACD divergence into new price highs/lows? That hints at wave 5 exhaustion or C-leg climax.

Plan the entry/exit.

- Impulse entry idea: After a wave-2 50–61.8% retracement and a bullish rejection candle, enter long with stops below the swing low; target 161.8% of wave 1 or prior structure.

- Correction fade idea: If you’ve mapped a completed 5-wave impulse, look to fade the A–B–C correction into the 50–61.8% zone, only when it aligns with higher-timeframe trend.

Two Elliott Wave Setups You Can Trade on MT4

1) Wave-3 Continuation (The Breadwinner)

- Context: Uptrend on H4; H1 just completed a deep wave-2 pullback to 61.8% with a bullish pin bar.

- Tools: Fibonacci retracement, EMAs, MACD.

- Trigger: Break of pin-bar high above the 21 EMA with increasing MACD histogram.

- Stops/Targets: Stop below wave-2 low; TP1 at 1:1 (risk), TP2 near 161.8% of wave 1. Trail beneath the 21 EMA for runner.

- Why it works: Wave 3 is usually the most explosive; you’re buying a discount in a trend, not guessing tops.

2) Ending-Wave Fade (Divergence Play)

- Context: Price makes a marginal higher high, but RSI/MACD prints lower highs; ZigZag shows a five-wave push.

- Tools: RSI divergence, MACD, Fibonacci extension.

- Trigger: Rejection wick at 127.2–161.8% extension, then a close back inside the prior range.

- Stops/Targets: Tight stop beyond the extreme; first target the 21 EMA, second target the base of the final push.

- Why it works: Wave 5 often lacks momentum; divergence exposes the fragility of that final gasp.

Risk Management for Wave Traders (Non-Negotiable)

- Hard stop always. Your count can be wrong—price action doesn’t care.

- Size by risk %, not by feeling. Keep it 0.5–1.0% per trade until you’ve got months of stats.

- One bias, multiple invalidations. If the market violates your level (e.g., breaks wave-1 start in an upcount), reset the count without ego.

- Don’t stack unrelated counts. If your H4 says “correction,” don’t take five M5 impulse longs against it.

- Journal the count and reason. Over time, you’ll see which legs you misread and why.

Common Mistakes (So You Can Skip the Pain)

- Forcing the count. If you need mental gymnastics to justify a wave, it’s probably wrong.

- Ignoring proportion. Waves should look like waves, not random nubs.

- Trading every squiggle. Elliott Wave is about structure; sometimes the best trade is no trade.

- Relying on auto-labelers. They’re assistants, not authorities.

- Skipping confluence. Waves + Fibs + Momentum + Structure = higher odds. Alone, each is meh.

A Sample MT4 Template You Can Save

- Indicators: ZigZag (default), 21 EMA, 50 EMA, MACD(12,26,9), RSI(14).

- Objects: Fib retracement & extension on toolbar; trendlines/channels enabled.

- Colors: Keep price action visible; avoid neon.

- Hotkeys: Assign hotkeys for Fib tools to map levels quickly during live markets.

Final Word (Keep It Simple, Keep It Consistent)

Elliott Wave isn’t mystical; it’s a framework for structure. On MT4, pair a tight set of indicators—ZigZag, Fibs, MACD/RSI, EMAs—with a repeatable workflow: top-down mapping, measure, confirm, execute, journal. Some days you’ll nail wave 3; other days you’ll mis-label a messy B-wave… that’s trading. What matters is you’re no longer guessing; you’re testing and iterating with a method that actually scales. And yes, you’ll get faster and better with practice, promise.