XanderFX EA V1.0 MT4: Your Ultimate Trading Tool

The XanderFX EA V1.0 is a cutting-edge Expert Advisor designed to optimize trading efficiency for Forex traders. Built for the MetaTrader 4 (MT4) platform, this EA combines advanced algorithms, market trend analysis, and a dynamic trading strategy to help traders maximize their profits. Whether you are a seasoned trader or just starting, XanderFX EA is engineered to provide robust performance and minimize risks.

In this article, we will explore the key features of XanderFX EA V1.0, including the recommended minimum deposit, timeframe, currency pairs, and a detailed breakdown of the strategy that drives this powerful EA.

You can download this EA from our website: https://yoforex.org/ and join our Telegram group for the latest updates and support: https://t.me/yoforexrobot.

Key Features of XanderFX EA V1.0 MT4

- Platform: MetaTrader 4 (MT4)

- Currency Pairs: Multiple pairs (best suited for EURUSD, GBPUSD, USDJPY, AUDUSD)

- Timeframe: M1, M5, M15

- Minimum Deposit: $1000

- Trading Strategy: Multi-strategy approach (Scalping, Trend Following, Risk Management)

Minimum Deposit and Recommended Settings

The XanderFX EA is designed to deliver optimal performance with a minimum deposit of $1000. This deposit size ensures that the EA has sufficient capital to manage multiple trades while minimizing risk. For traders looking for increased stability, a higher deposit amount is recommended, particularly if you plan to trade across several currency pairs simultaneously.

Timeframe to Run XanderFX EA

The recommended timeframe for XanderFX EA is M1, M5, and M15, which suits both scalping and trend-following strategies. These shorter timeframes allow the EA to detect market movements quickly and execute trades efficiently. Whether the market is trending or ranging, XanderFX EA adapts its approach to capture profitable opportunities.

Suitable Currency Pairs for XanderFX EA

XanderFX EA is highly versatile and can be used across multiple currency pairs. However, it performs exceptionally well with the following pairs:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

These currency pairs offer high liquidity, narrow spreads, and consistent market movements, making them ideal for the EA’s advanced algorithms.

The Strategy Behind XanderFX EA

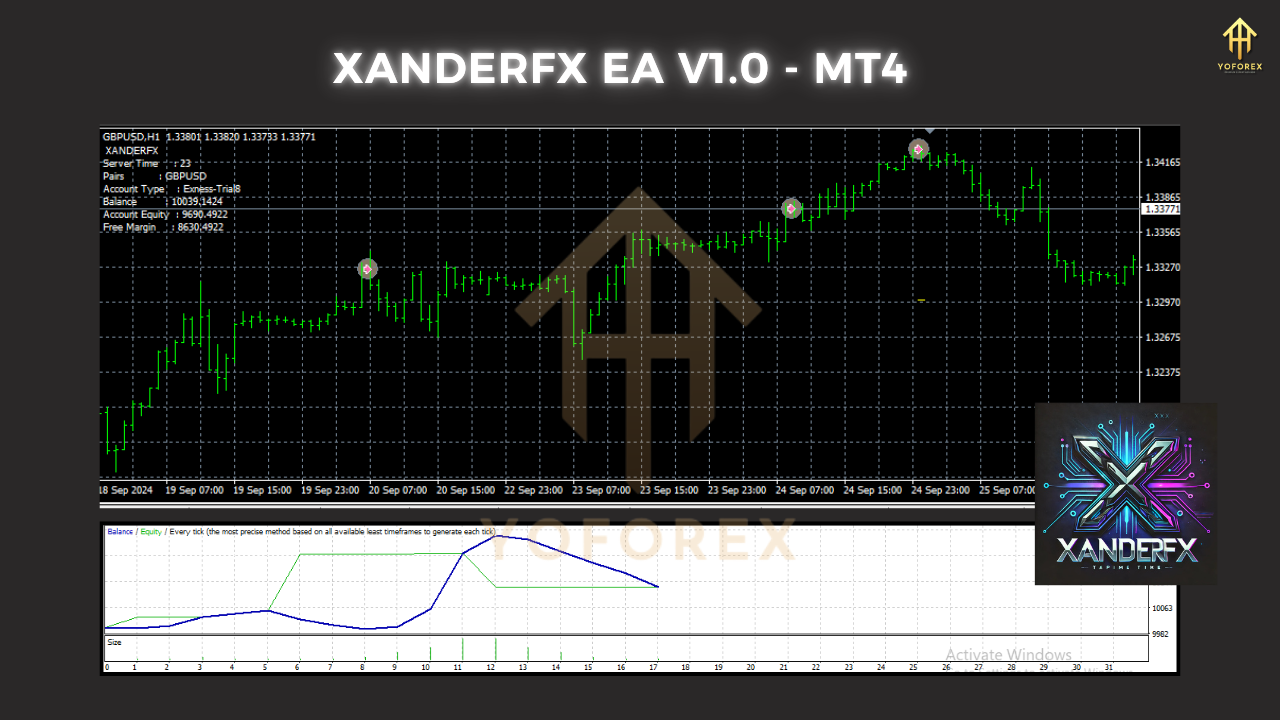

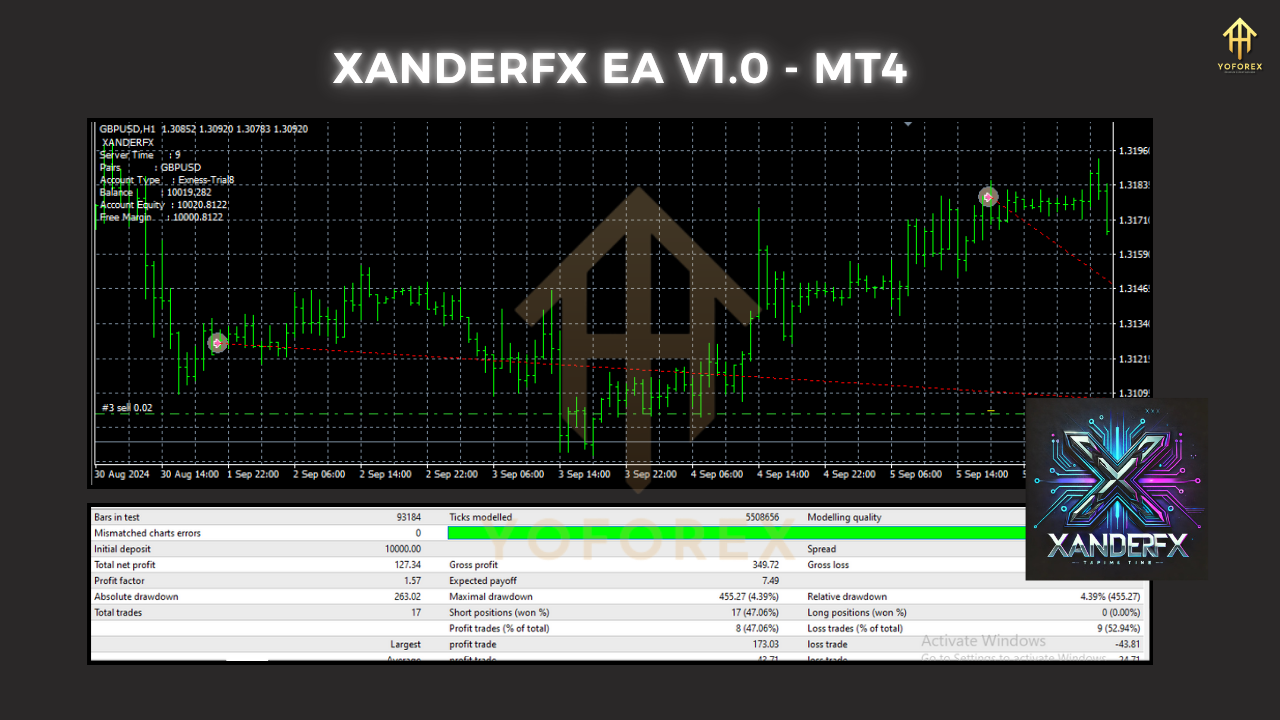

The core strength of XanderFX EA lies in its multi-strategy trading approach. It combines scalping, trend-following, and advanced risk management techniques to execute trades efficiently. Let’s break down how this EA takes trades and manages risks:

1. Scalping Strategy

- XanderFX EA primarily uses scalping to capture small price movements within a short period. It takes advantage of market volatility, particularly during the M1 and M5 timeframes, to open and close trades quickly.

- By analyzing support and resistance levels, the EA enters trades during short-term pullbacks and price reversals.

- Scalping ensures that the EA opens multiple small trades with high probability, reducing the risk per trade while increasing the chance of capturing consistent profits.

2. Trend Following

- XanderFX EA incorporates a trend-following strategy that tracks the overall direction of the market. This allows the EA to stay on the right side of the market when trends are strong.

- Using moving averages, trendlines, and momentum indicators, the EA identifies strong upward or downward trends and enters trades accordingly.

- The M15 timeframe is particularly suited for this trend-following technique, as it captures medium-term trends and helps traders stay in the market longer for bigger profits.

3. Risk Management

- Effective risk management is at the heart of XanderFX EA’s strategy. The EA uses stop-loss (SL) and take-profit (TP) levels to protect capital and lock in profits.

- Trades are never left unmonitored, as the EA continually adjusts SL and TP levels based on market conditions, ensuring that losses are minimized, and profits are maximized.

- The EA incorporates dynamic lot sizing, adjusting the lot size based on account balance, margin requirements, and risk tolerance. This ensures that traders do not overexpose themselves to market risk.

4. Adaptive Market Analysis

- One of the most significant advantages of XanderFX EA is its ability to adapt to different market conditions. Whether the market is trending, consolidating, or showing signs of high volatility, the EA dynamically switches between its scalping and trend-following strategies to optimize performance.

- The EA uses real-time data and technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands to gauge market sentiment and momentum.

- The adaptability of the EA allows it to thrive in both trending and sideways markets, reducing the risk of significant drawdowns.

5. News Filter

- To avoid volatile price movements during major news events, the XanderFX EA incorporates a news filter that prevents it from opening trades during high-impact news releases. This helps traders avoid unnecessary risks when the market becomes unpredictable.

- The EA automatically scans for major economic reports, central bank announcements, and geopolitical events that could affect market conditions, and it pauses trading to safeguard the trader’s capital.

How XanderFX EA Executes Trades

XanderFX EA’s ability to execute trades seamlessly stems from its multi-layered algorithm. Here’s how it typically opens, manages, and closes trades:

- Entry Points:

- The EA scans for potential entry points by analyzing price action and technical indicators. Once it identifies a high-probability setup (such as price nearing a support or resistance zone), it automatically opens a position.

- Entry points are confirmed using oscillators and moving averages to ensure that the trade is in line with the prevailing market trend.

- Position Management:

- After entering a trade, the EA carefully monitors market conditions to adjust stop-loss and take-profit levels dynamically. This reduces the risk of premature exits and ensures that profits are maximized when a trend continues.

- The EA uses a trailing stop feature to lock in profits as the market moves in the desired direction, while still allowing for market fluctuations.

- Exit Strategy:

- XanderFX EA closes trades either when the take-profit level is hit or when the trend shows signs of reversal. The exit is determined by trailing stops or specific reversal patterns detected by the EA’s technical analysis tools.

- The exit strategy ensures that the EA doesn’t hold onto losing positions for too long, minimizing drawdown and preserving capital.

Why Choose XanderFX EA V1.0?

- Fully Automated: Set it and forget it. XanderFX EA handles all the heavy lifting.

- Adaptive Trading Strategy: Combines scalping, trend-following, and dynamic risk management to optimize trade entries and exits.

- Risk Management: Protects your capital with stop-loss, take-profit, and dynamic lot sizing.

- News Filter: Safeguard your trading account during volatile market conditions.

- Versatility: Suitable for various currency pairs, including EURUSD, GBPUSD, USDJPY, and AUDUSD.

Conclusion

XanderFX EA V1.0 is an advanced Expert Advisor that helps traders capitalize on the Forex market’s volatility through a combination of scalping, trend-following, and dynamic risk management strategies. With a minimum deposit of $1000, traders can expect to gain from high-frequency trades and trend-following positions that maximize profit while reducing risk.

Join Our Telegram for Updates and Support: https://t.me/yoforexrobot

Please Join: https://t.me/+M-kFQePDgy5lZjY1

Stay Updated:

Instant Download: https://www.yoforex.org/product/xanderfx-ea-v1-0/

https://yoforexea.com/product/xanderfx-ea-v1-0/

https://www.fxcracked.org/product/xanderfx-ea-v1-0/

https://www.mql5.software/product/xanderfx-ea-v1-0/

https://www.forexfactory.cc/product/xanderfx-ea-v1-0/

Happy Trading

Happy Trading

There are no reviews yet.