WMA Indicator MT4: A Complete Guide to Weighted Moving Average in Forex Trading

The WMA Indicator MT4 (Weighted Moving Average) is a powerful technical analysis tool that helps traders smooth price data and identify market trends with greater accuracy. Unlike the Simple Moving Average (SMA), which assigns equal weight to all data points, the WMA prioritizes recent price movements, making it more responsive to market changes.

In this comprehensive guide, we will cover everything you need to know about the WMA Indicator MT4, including its features, settings, how to use it effectively, and why it is an essential tool for forex traders.

What is the WMA Indicator in MT4?

The Weighted Moving Average (WMA) is a type of moving average that gives greater importance to the most recent price data. This means that it reacts faster to price fluctuations, making it ideal for short-term traders and scalpers.

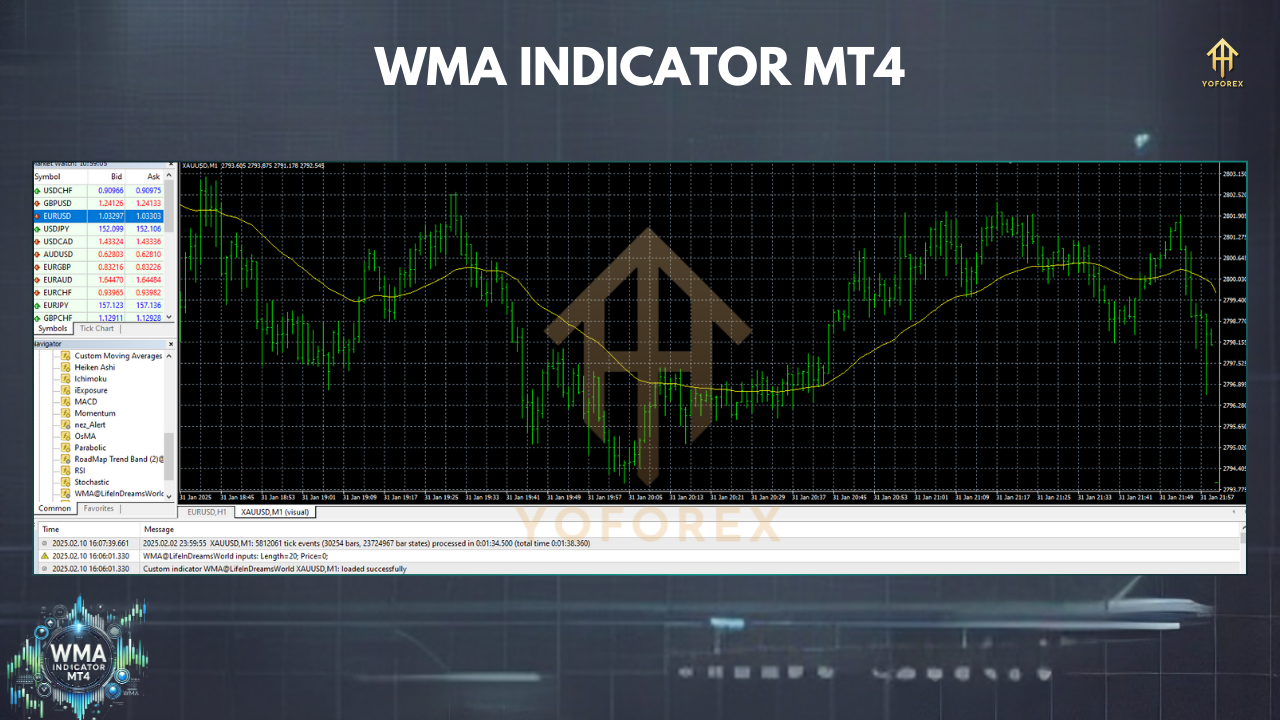

In MetaTrader 4 (MT4), the WMA Indicator can be added directly to the chart and customized to suit different trading strategies. By applying this indicator, traders can identify market trends, reversals, and potential trade opportunities with improved accuracy.

Key Features of WMA Indicator MT4

- Responsive to Price Changes: Unlike SMA, which lags in volatile markets, WMA quickly adapts to price movements.

- Customizable Period Settings: Traders can adjust the WMA period to fit their trading style (e.g., short-term or long-term analysis).

- Integration with Other Indicators: Works well with RSI, MACD, Bollinger Bands, and other indicators to confirm signals.

- Smoothens Market Noise: Reduces unnecessary fluctuations, helping traders make informed decisions.

- Easy to Use on MT4: Available by default in the MT4 platform and can be applied to any time frame.

How to Add WMA Indicator in MT4

- Open MT4 and select the currency pair chart where you want to apply the indicator.

- Click on Insert → Indicators → Trend → Moving Average.

- In the Moving Average Properties window:

- Set Period (e.g., 14 for short-term, 50 for medium-term, 100 for long-term analysis).

- Choose MA Method as Weighted (WMA).

- Select Apply to Close (or Open, High, Low depending on preference).

- Customize the color and line style for better visibility.

- Click OK, and the WMA line will appear on your chart.

Best WMA Indicator Settings for MT4

-

Scalping & Day Trading:

- WMA (9) and WMA (21) for quick price movement analysis.

- Works well with MACD or Stochastic Oscillator.

-

Swing Trading:

- WMA (50) for identifying medium-term trends.

- Can be combined with RSI for confirming overbought/oversold conditions.

-

Long-Term Trading:

- WMA (100) or WMA (200) for major trend identification.

- Often used by institutional traders for strong trend confirmations.

How to Use WMA Indicator for Trading

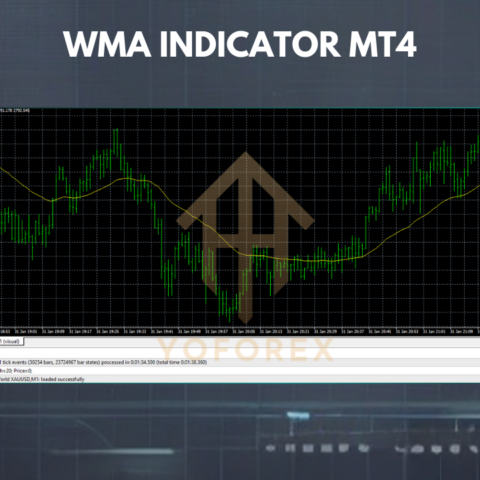

1. Trend Identification

- If the price is above the WMA line, it indicates an uptrend.

- If the price is below the WMA line, it signals a downtrend.

2. Entry & Exit Points

- Buy Signal: When the price crosses above the WMA from below, indicating bullish momentum.

- Sell Signal: When the price crosses below the WMA from above, indicating bearish momentum.

3. Using WMA with Other Indicators

- WMA + RSI: Helps confirm overbought/oversold levels.

- WMA + MACD: Identifies trend momentum and potential reversals.

- WMA + Bollinger Bands: Confirms price breakouts.

Join Our Telegram

You Can visit other Websites & Download this Bot

- https://yoforexea.com/product/wma-indicator-v1/

- https://www.mql5.software/product/wma-indicator-v1/

- https://www.forexfactory.cc/product/wma-indicator-v1/

- https://www.fxcracked.org/product/wma-indicator-v1/

Happy Trading

Happy Trading

There are no reviews yet.