Supply Demand EA ProBot V1.9

Original price was: $589.00.$140.00Current price is: $140.00.

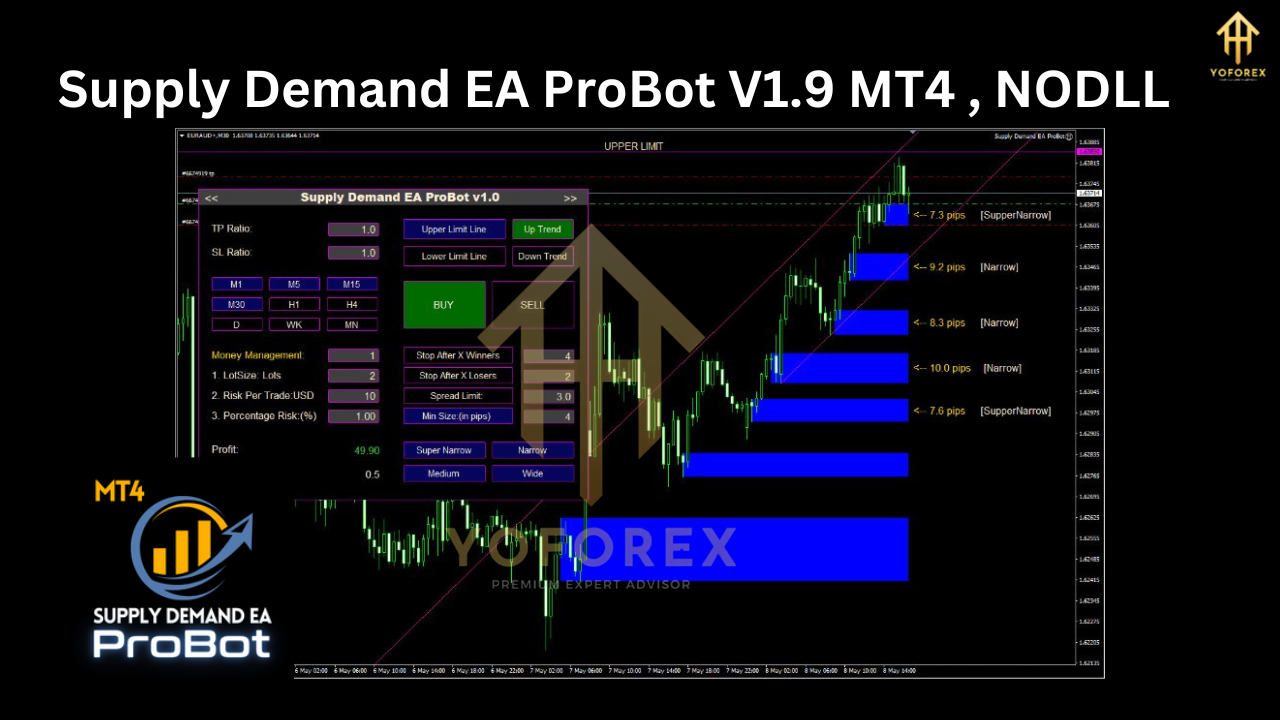

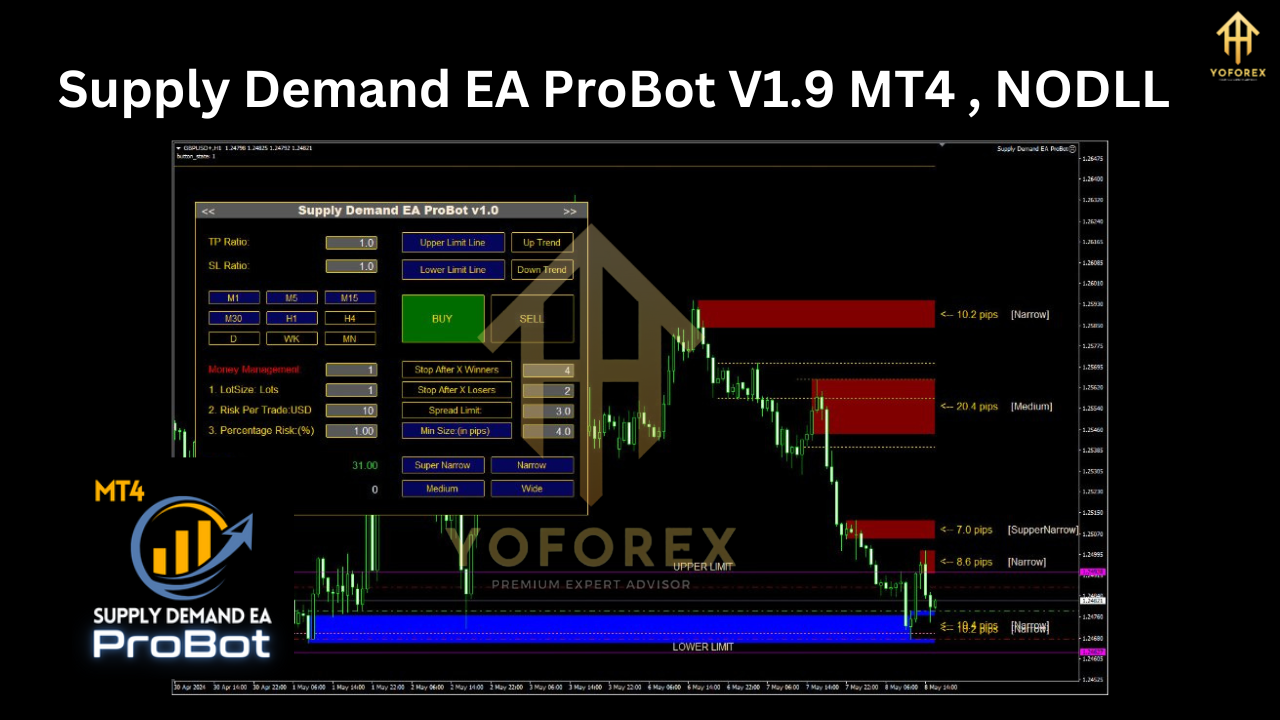

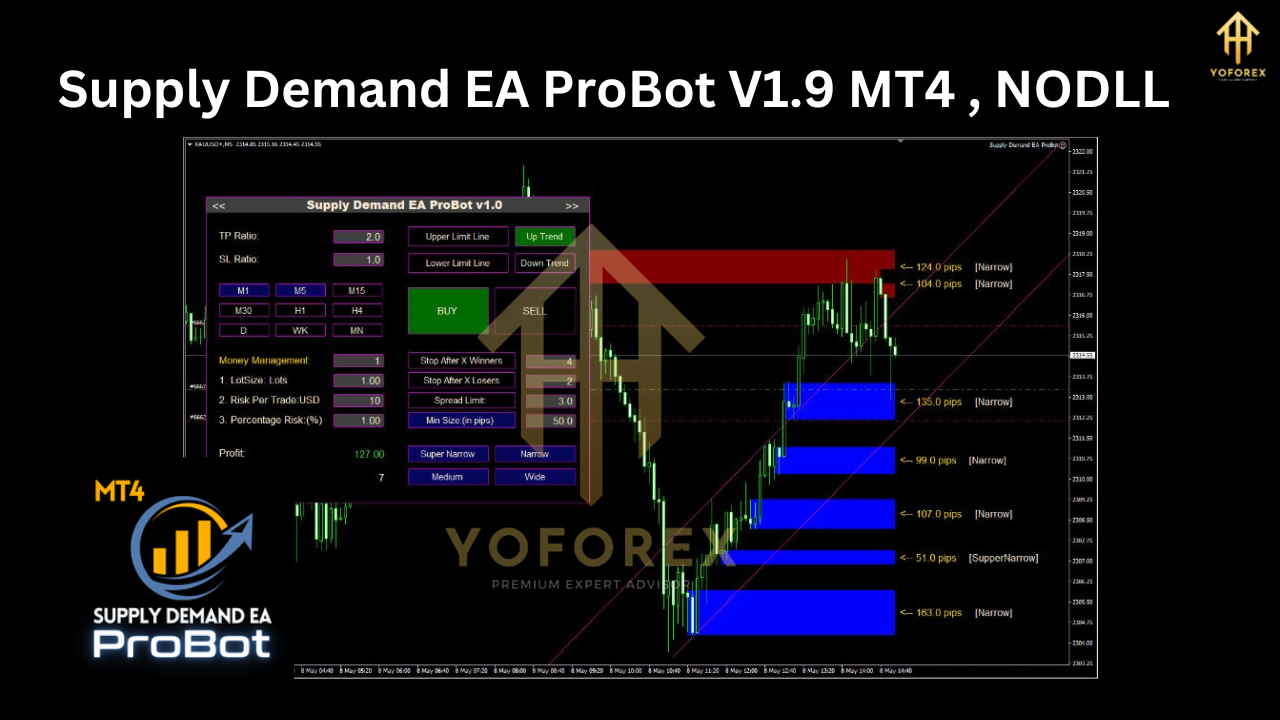

The Supply Demand EA ProBot V1.9 MT4 is a sophisticated trading tool designed to identify key supply and demand zones, helping traders capitalize on market reversals. By automating the analysis of these critical price levels, this EA spots areas of buying and selling pressure, allowing for strategic entries and exits with precision. Optimized for major currency pairs and adaptable to various timeframes—M30, H1, H4, and D1—the EA offers flexibility for different trading styles. With a minimum deposit requirement of just $200, it’s accessible for both new and experienced traders.

Supply Demand EA ProBot V1.9 MT4: A Comprehensive Guide

For traders aiming to leverage the Supply and Demand zones in Forex, the “Supply Demand EA ProBot V1.9 MT4” offers a sophisticated approach that automatically identifies these critical zones, entering trades with precision. Below, you’ll find details on the recommended minimum deposit, time frames, and suitable currency pairs, along with a closer look at how the EA selects and executes trades.

Key Features of Supply Demand EA ProBot V1.9 MT4:

- Currency Pair: EURUSD, GBPUSD, USDJPY.

- Time Frames: M30, H1, H4, D1

- Minimum Deposit: $200

- Platform: MetaTrader 4 (MT4)

For further details or to download the EA, visit our website or join our Telegram community for additional support and insights.

1. Overview of Supply and Demand Trading Strategy

The EA operates by focusing on two essential trading zones:

- Supply Zones: Areas where price reaches a peak before selling pressure drives it down.

- Demand Zones: Points where buying pressure begins, causing prices to increase from a support level.

These zones are often associated with reversals and are ideal for catching high-probability trades. By monitoring price action around these areas, the EA enters trades when a strong reversal is anticipated.

2. Setting Up Supply Demand EA ProBot V1.9 MT4

Before diving into the trade strategy, it’s essential to set up the EA for optimal performance:

| Parameter | Details |

|---|---|

| Platform | MT4 |

| Time Frames | M30, H1, H4, D1 |

| Currency Pairs | Major Pairs (EURUSD, GBPUSD, USDJPY) |

| Minimum Deposit | $200 |

| Lot Sizes | Adjustable based on risk preference |

Recommended time frames such as M30 and H1 offer quick trade entries, while longer time frames like H4 and D1 provide additional trade opportunities, especially for higher probability setups.

3. The Trading Strategy: How Supply Demand EA ProBot V1.9 MT4 Takes Trades

Supply Demand EA ProBot V1.9 MT4 focuses on an algorithm that combines price action analysis with Supply and Demand zones. Here’s how the strategy works:

Step 1: Zone Identification

The EA scans the charts to identify zones where significant buying (demand) or selling (supply) pressure is likely to re-emerge. This analysis is done through historical price movements, looking for areas with large candlestick moves away from price levels.

Step 2: Confirming Zone Validity

Once a zone is identified, the EA confirms its validity by assessing several factors, including:

- Volume Indicators: Zones with higher trading volume are considered stronger and more likely to generate a reversal.

- Market Momentum: The EA evaluates the market’s momentum and the speed of price movements, ensuring only high-probability zones are used.

This verification process helps reduce false signals and ensures trades are taken in zones with robust demand or supply pressure.

Step 3: Placing Entry Orders

Upon confirmation, the EA automatically places pending orders in anticipation of the price reaching the zone. Here’s how this process is managed:

- Entry Points: The EA waits for price to move within the identified demand or supply zone.

- Risk Control: Each entry includes a predetermined stop-loss level slightly beyond the zone, mitigating potential losses from unexpected breakouts.

- Take-Profit: The EA sets a target price outside the zone in line with the expected reversal strength.

Step 4: Dynamic Adjustments and Trade Management

The EA actively manages trades by:

- Trailing Stop-Loss: To secure profits as price moves favorably.

- Dynamic Scaling: Adjusting trade size based on zone strength and market volatility.

- Partial Exits: Closing portions of the trade as profits accumulate, especially when approaching key resistance or support areas.

4. Optimal Time Frames and Currency Pairs for Trading

Recommended Time Frames:

- M30: Ideal for quick entries and exits, capturing shorter-term reversals.

- H1: A balanced time frame, suitable for both intraday trading and swing trades.

- H4 and D1: Effective for catching larger trends and potential longer-term reversals.

Currency Pairs:

- Major currency pairs like EURUSD, GBPUSD, and USDJPY are recommended. These pairs often exhibit clear supply and demand zones and experience regular market movements, ideal for this EA’s strategy.

Note: Lower volatility pairs may yield fewer signals, while high-volatility pairs could generate more frequent entries but with potentially greater risk.

5. Minimum Deposit and Risk Management

To ensure safe trading, the Supply Demand EA ProBot V1.9 MT4 requires a minimum deposit of $200. For more aggressive trading or with larger positions, a higher deposit is recommended.

| Minimum Deposit | $200 |

|---|---|

| Recommended | $500 (for additional trade capacity) |

By keeping the deposit at a sustainable level, users can avoid margin calls and trade with greater stability, especially on longer time frames like H4 and D1.

6. Conclusion: Why Choose Supply Demand EA ProBot V1.9 MT4?

The Supply Demand EA ProBot V1.9 MT4 offers Forex traders a robust, automated tool for trading supply and demand zones. By leveraging an algorithmic strategy rooted in key price action principles, it reduces manual effort and enhances precision in trade execution.

Key Benefits:

- Automated Supply/Demand Zone Recognition: Saves time and increases trade precision.

- Risk Management: Built-in stop-loss and take-profit settings ensure controlled trade environments.

- Dynamic Trade Adjustment: Trailing stops, scaling, and partial exits adapt to market conditions.

For traders seeking to capitalize on reversals and trade key zones with confidence, the Supply Demand EA ProBot V1.9 MT4 provides an effective solution.

Join our Telegram for the latest updates and support: https://t.me/yoforexrobot

Please Join: https://t.me/+M-kFQePDgy5lZjY1

Stay Updated:

Instant Download: https://yoforexea.com/product/supply-demand-ea-probot-v1-9/

https://www.fxcracked.org/product/supply-demand-ea-probot-v1-9/

https://www.mql5.software/product/supply-demand-ea-probot-v1-9/

https://www.forexfactory.cc/product/supply-demand-ea-probot-v1-9/

https://www.yoforex.org/product/supply-demand-ea-probot-v1-9/

Happy Trading

Happy Trading

There are no reviews yet.