Boost Your Trading with the Royal Hedge Fund Source Code EA V1 MQ4: A Game-Changer for Forex Traders

The Royal Hedge Fund Source Code EA V1 MQ4 is a sophisticated Expert Advisor that utilizes a powerful hedging strategy to safeguard your trades while maximizing profits. Built specifically for MetaTrader 4, it integrates seamlessly with the platform, offering traders an automated solution for opening and managing positions.This EA applies a hedging approach, which involves opening buy and sell positions at the same time, to capitalize on market movements in both directions. With automatic risk management features, such as adjustable stop loss and take profit settings, it ensures traders can protect their capital while still reaping the rewards of the forex market.

How the Royal Hedge Fund Source Code EA V1 MQ4 Works

- Grid-Based Hedging: The EA opens buy and sell trades at calculated price intervals, forming a grid. The hedging mechanism helps minimize risk by ensuring that the trader can profit regardless of the market’s direction.

- Dynamic Trade Management: The EA continuously monitors market movements and adjusts its strategy accordingly. If the market moves in a certain direction, the EA will open new positions to capture additional profits. On the other hand, if the market goes against the trade, the EA opens opposite positions to hedge the losses.

- Risk Management: The EA includes automatic stop loss (SL) and take profit (TP) settings for each trade. This ensures that risks are controlled and that profits are locked in when the market moves in your favor. Traders can also customize these settings for more personalized control over their trades.

- Adaptive to Market Conditions: The Royal Hedge Fund Source Code EA V1 MQ4 adapts to different market conditions, whether the market is trending, consolidating, or experiencing significant volatility. This flexibility ensures the EA remains effective under various circumstances.

- Customization and Control: Traders can adjust grid levels, lot sizes, risk percentage, and other settings to tailor the EA to their trading style. This level of customization allows traders to implement conservative or aggressive strategies depending on their preferences.

Recommended Settings

- Timeframe: Use the H1 (1-hour) timeframe for optimal performance. This timeframe allows the EA to capture both short-term and long-term price movements without overexposing your trades.

- Lot Size: Start with a small lot size, such as 0.1, to reduce risk, especially if you’re new to the EA. As you gain confidence, you can adjust the lot size according to your risk appetite and capital.

- Risk Level: Set the risk level to a comfortable range. Beginners should keep the risk level at 1% to 2%, while more experienced traders can experiment with higher levels based on their trading goals.

- Stop Loss and Take Profit: It’s recommended to set a reasonable stop loss and take profit level based on the market’s volatility. The EA provides flexibility in adjusting these settings to ensure that both risk and reward are balanced effectively.

- Grid Distance: Adjust the grid distance according to market volatility. In periods of low volatility, use tighter grid levels, while during higher volatility, use wider grid levels to avoid frequent trades.

Why Choose the Royal Hedge Fund Source Code EA V1 MQ4?

- Advanced Hedging Strategy: Unlike many other EAs, this one uses a powerful hedging strategy to hedge your positions and reduce risk. This allows traders to profit from both rising and falling markets, providing greater flexibility.

- Complete Automation: With this EA, you don’t need to monitor the markets constantly. Once set up, it will automatically execute trades according to your parameters, freeing up your time and reducing the stress of manual trading.

- Risk Management: The built-in risk management system ensures that every trade is automatically protected. Traders can set their stop loss and take profit parameters, ensuring that their exposure to the market is controlled.

- High Customization: This EA offers a wide range of customization options, from grid levels to lot sizes, allowing traders to optimize the EA for their own risk tolerance and trading style.

- Profitable in Volatile Markets: The Royal Hedge Fund Source Code EA V1 MQ4 works well in volatile markets. Its ability to hedge positions means that it can profit from quick market fluctuations while reducing risk.

- User-Friendly: Despite its advanced features, this EA is easy to install and use, even for beginners. The user-friendly interface and detailed instructions make it simple to get started.

Best Strategy for Using the Royal Hedge Fund Source Code EA V1 MQ4

- Monitor Market Conditions: While the EA is automated, it’s still important to keep an eye on major economic events and news releases that could affect the market. If necessary, pause the EA during high-impact news events.

- Use Conservative Settings Initially: If you’re new to using this EA, start with conservative risk settings and a smaller lot size. This will help you gain experience without exposing your account to high risks.

- Adjust Grid Levels Based on Volatility: Use tighter grid levels during periods of low volatility and wider grid levels when the market is moving quickly. This ensures that your trades are executed efficiently without overexposure.

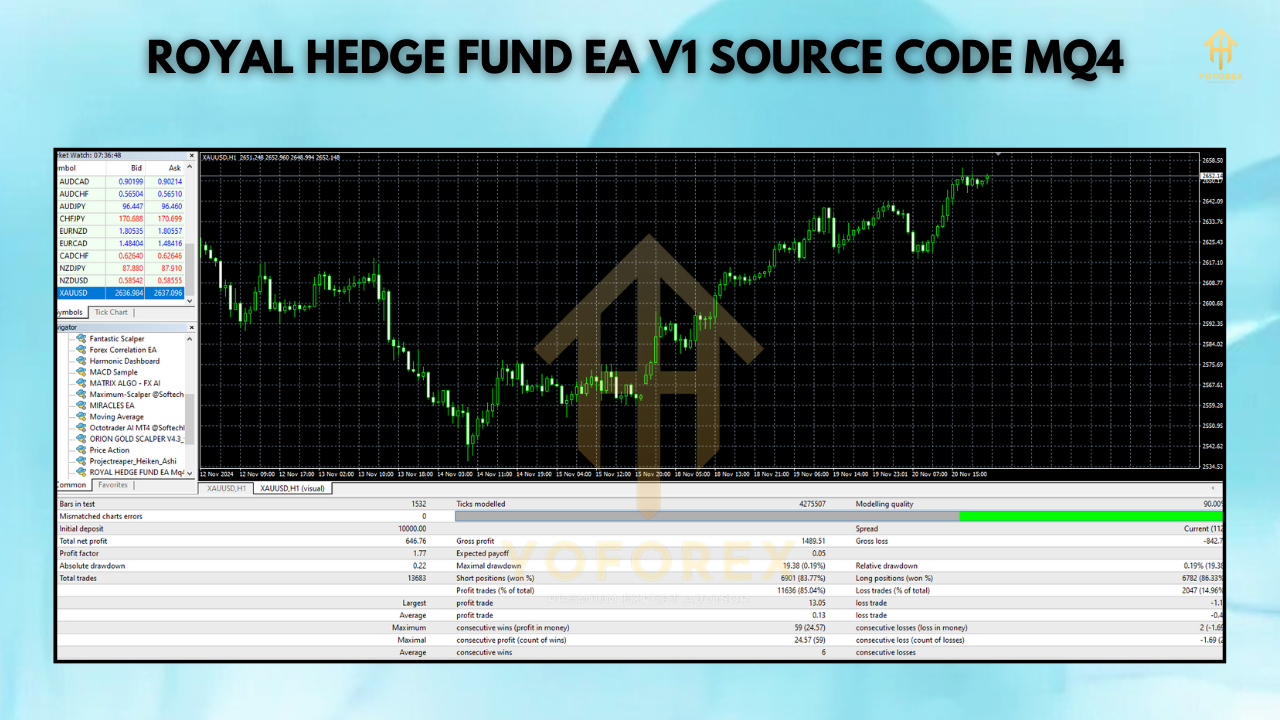

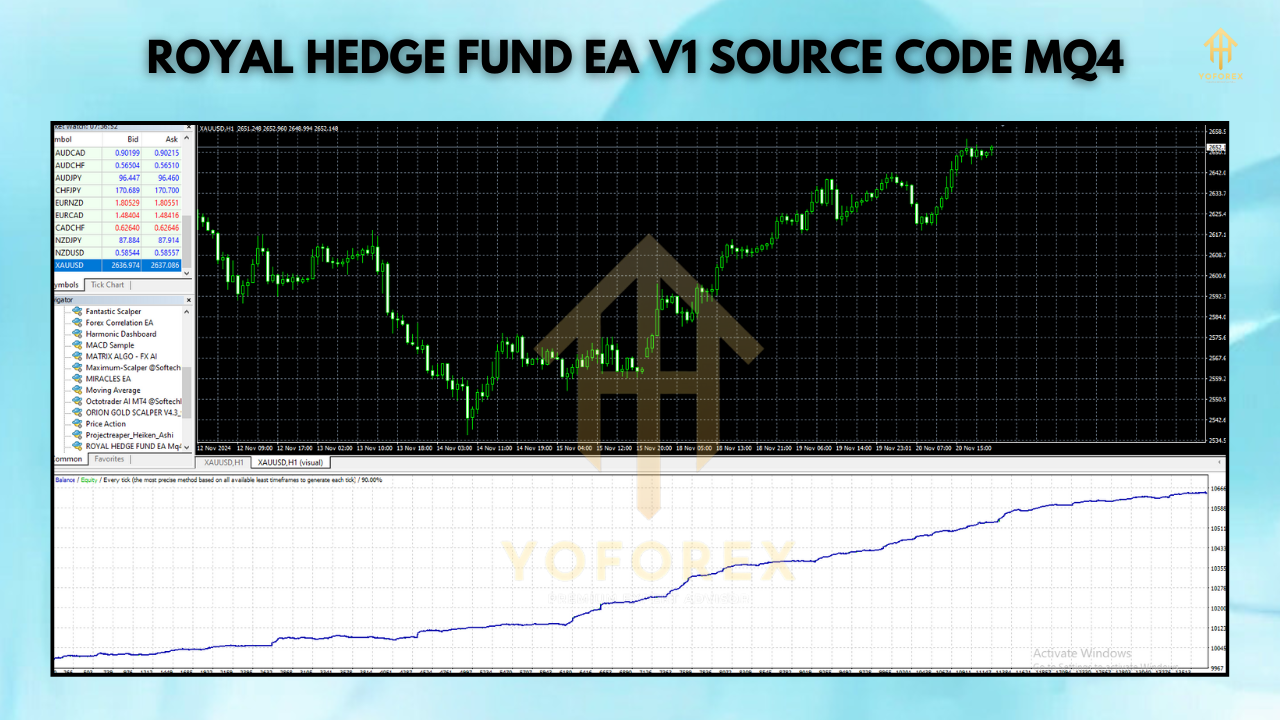

- Backtest the EA: Before going live with the EA, backtest it on historical data to understand how it performs under different market conditions. This helps you fine-tune the settings for maximum profitability.

- Regularly Update Settings: As market conditions change, periodically review and update your EA settings. Keeping your strategy aligned with current market conditions will help maximize your profits.

Join Our Telegram

You Can visit other Websites & Download this Bot

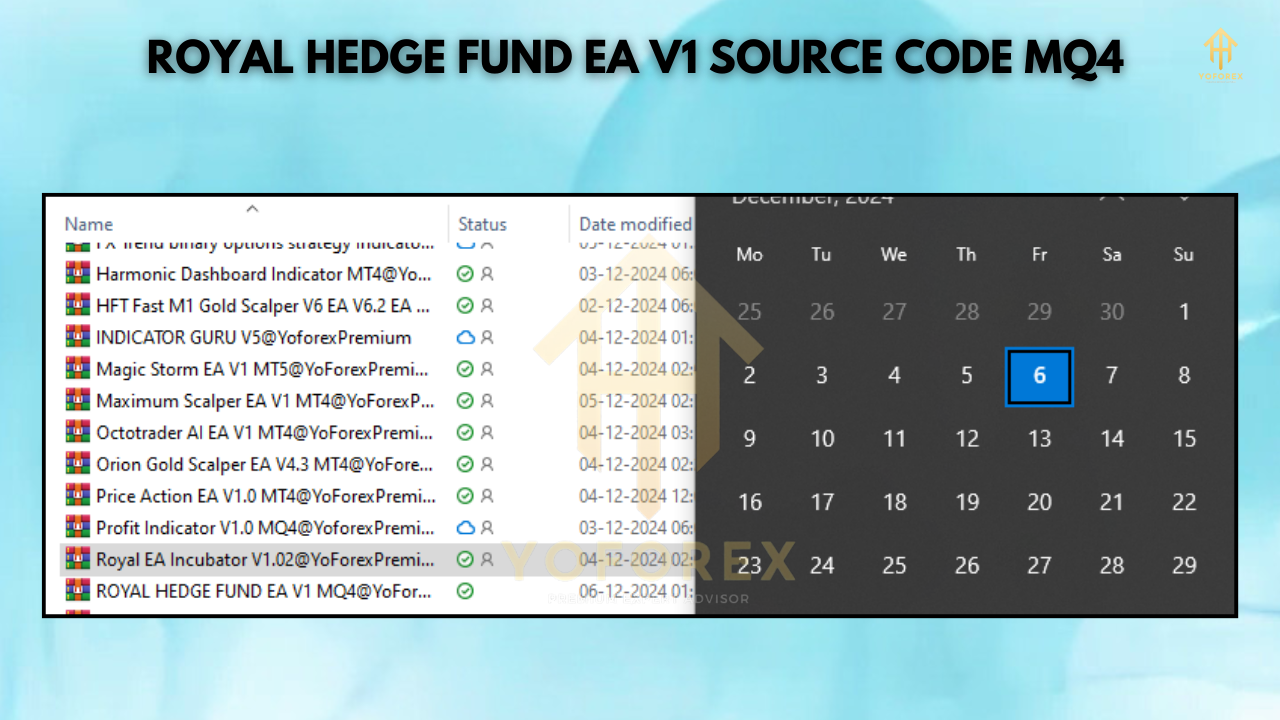

https://www.fxcracked.org/product/royal-hedge-fund-source-ea-v1/

https://yoforexea.com/product/royal-hedge-fund-source-code-ea-v1/

https://www.yoforex.org/product/royal-hedge-fund-source-code-ea-v1/

There are no reviews yet.