Robot Forex EA V1.0 MT4: Optimizing Your Forex Trades

Unlock the full potential of automated trading with Robot Forex EA V1.0 on MT4. This powerful Expert Advisor is designed to maximize trading opportunities by utilizing advanced algorithms that adapt to changing market conditions. Deploying strategic entries and exits, it minimizes risk while enhancing profit potential. Here, we’ll explore the key specifications, including minimum deposit, recommended time frames, and currency pairs, and delve into the unique strategy that makes Robot Forex EA V1.0 an exceptional tool for modern traders.

Key Specifications for Optimal Performance

| Specifications | Details |

|---|---|

| Minimum Deposit | $100 |

| Time Frame | M15, H1 |

| Currency Pairs | EURUSD, GBPUSD, USDJPY, AUDUSD, and NZDUSD |

| Telegram Support Link | Join Us on Telegram |

Robot Forex EA V1.0 is optimized for beginner and advanced traders with accessible starting capital and adaptable trading strategies, focusing on high-volume currency pairs for consistent trading conditions. It’s recommended to use a minimum deposit of $100 to ensure the EA can manage drawdowns while taking advantage of market movements effectively.

Key Features of Robot Forex EA V1.0

- Adaptive Algorithms: Adapts to live market conditions and trends.

- Strategic Entry and Exit Points: Uses historical data and technical indicators.

- Risk Management: Integrates stop-loss and take-profit parameters.

- Scalping Mechanism: Finds quick opportunities for shorter profit cycles.

- Hedging Techniques: Minimizes risks during high volatility periods.

Core Strategy: How Robot Forex EA V1.0 Takes Trades

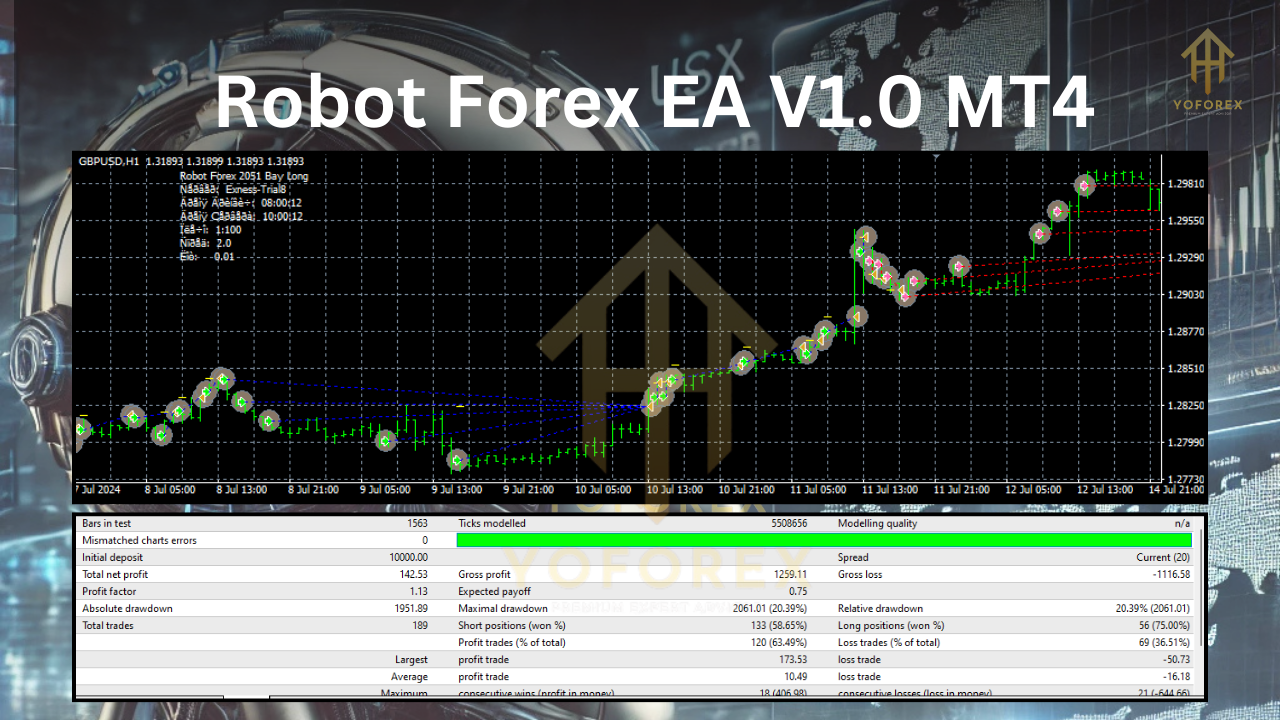

Robot Forex EA V1.0’s approach revolves around a dual strategy combining trend-following and reversion trading techniques. These strategies are built to analyze market trends, allowing the EA to enter positions with a high probability of success while managing risks through stop-loss and take-profit settings. Here’s a breakdown of the steps the EA takes to ensure effective trade execution:

1. Trend Identification

The first step involves identifying the prevailing trend using a blend of technical indicators such as moving averages and relative strength index (RSI):

- Moving Averages: Robot Forex EA V1.0 uses short-term and long-term moving averages to determine the current trend.

- RSI Analysis: By analyzing the RSI values, the EA evaluates whether the currency pair is overbought or oversold.

Once a strong trend is confirmed, the EA prepares to enter a trade in the trend’s direction to maximize the potential for profitable outcomes.

2. Entry Signals Based on Momentum

When the trend aligns, Robot Forex EA V1.0 employs additional indicators like Bollinger Bands and MACD to time entries more precisely.

- Bollinger Bands: If the price is within the upper or lower band, it may indicate strong buying or selling momentum.

- MACD Crossover: The EA waits for a MACD crossover that aligns with the trend direction, ensuring that the entry has momentum behind it.

This process of aligning multiple indicators helps to reduce false signals and enhance the accuracy of each entry, especially on M15 and H1 time frames.

3. Risk Management and Lot Sizing

Robot Forex EA V1.0 integrates an automated lot-sizing mechanism that adapts based on the account balance and risk tolerance. Key points include:

- Fixed and Dynamic Lot Sizing: Uses either a fixed lot size or adjusts dynamically to market conditions and account balance.

- Stop-Loss and Take-Profit Targets: Each trade is set with pre-determined stop-loss and take-profit levels based on recent price action and market volatility.

- Drawdown Control: The EA ensures drawdown levels remain manageable by adjusting lot sizes when significant market shifts are detected.

This risk management strategy is essential for capital preservation and allows the EA to stay in trades longer to capture potential profit without overexposing the account to loss.

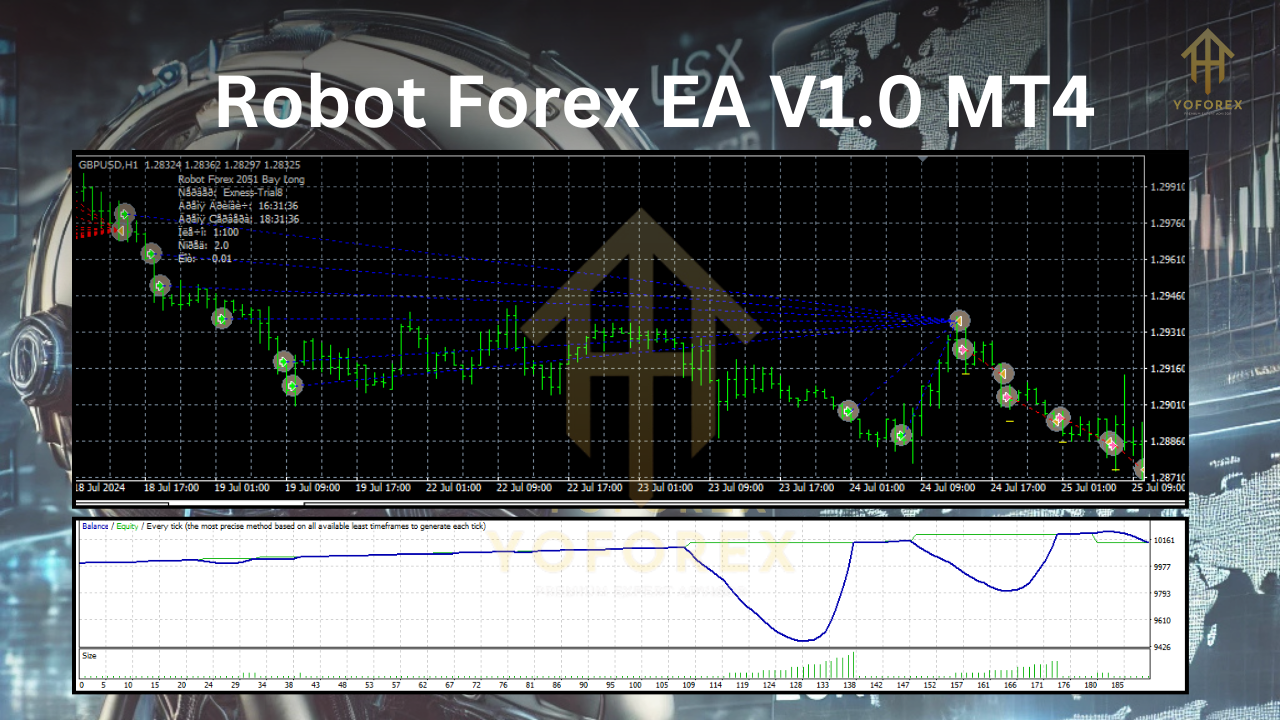

4. Exit Strategy with Scalping Mechanism

The EA frequently monitors open trades to identify optimal exit points by using a short-term scalping approach. In scalping mode, Robot Forex EA V1.0 seeks quick profits by entering and exiting trades multiple times within a short time frame:

- Trailing Stop: As trades gain positive momentum, a trailing stop moves along with the price, locking in profits while allowing room for further gains.

- Profit Target Adjustments: If the market demonstrates strong momentum, the EA may adjust the profit target dynamically to capitalize on additional opportunities.

- Partial Closures: In volatile markets, the EA may close parts of a trade to secure profits while keeping the remaining position open.

The scalping mechanism allows the EA to take advantage of micro-trends within the larger market movement, providing additional profit opportunities, especially in liquid currency pairs like EURUSD and GBPUSD.

5. Hedging Strategy for Volatility Management

During high volatility or news events, Robot Forex EA V1.0 activates its hedging function to manage risk effectively. Hedging involves opening countertrades to offset potential losses from the primary trade. Key points include:

- Hedge Activation: If the market shifts against the trade direction by a specified percentage, the EA will open a countertrade in the opposite direction.

- Dual Profit Potential: By leveraging hedging, the EA can profit from both directions of the market, reducing the risk associated with volatile market conditions.

- Minimal Drawdown: Hedging ensures that potential drawdowns are minimized by balancing losses with gains on counter trades.

Hedging is particularly effective during major economic announcements, ensuring that trading capital remains protected even during unpredictable market conditions.

Tips for Optimizing Performance with Robot Forex EA V1.0

- Choose Stable Pairs: Focus on high-volume pairs such as EURUSD, GBPUSD, USDJPY, AUDUSD, and NZDUSD for lower spreads and more predictable movements.

- Monitor Account Balance: Ensure a minimum of $100 to provide sufficient margin for the EA to handle trades efficiently.

- Avoid Overleveraging: The EA manages risk automatically, but overleveraging can still lead to unexpected results.

- Check News Events: Pause trading during significant economic news if manual oversight is available to avoid heightened volatility.

By following these tips, traders can maximize the potential of Robot Forex EA V1.0, enhancing both profitability and safety in the trading process.

Why Choose Robot Forex EA V1.0 for MT4?

Robot Forex EA V1.0 is engineered for traders who seek consistency and effectiveness in the forex market. Its dual strategy of trend-following and hedging ensures balanced trading, while the scalping mechanism allows for quick profits on volatile currency pairs. With robust risk management, adaptable entry points, and real-time adjustments, this EA delivers precision trading, ensuring a competitive edge in dynamic markets.

Join our Telegram for the latest updates and support: https://t.me/yoforexrobot

Please Join: https://t.me/+M-kFQePDgy5lZjY1

Stay Updated:

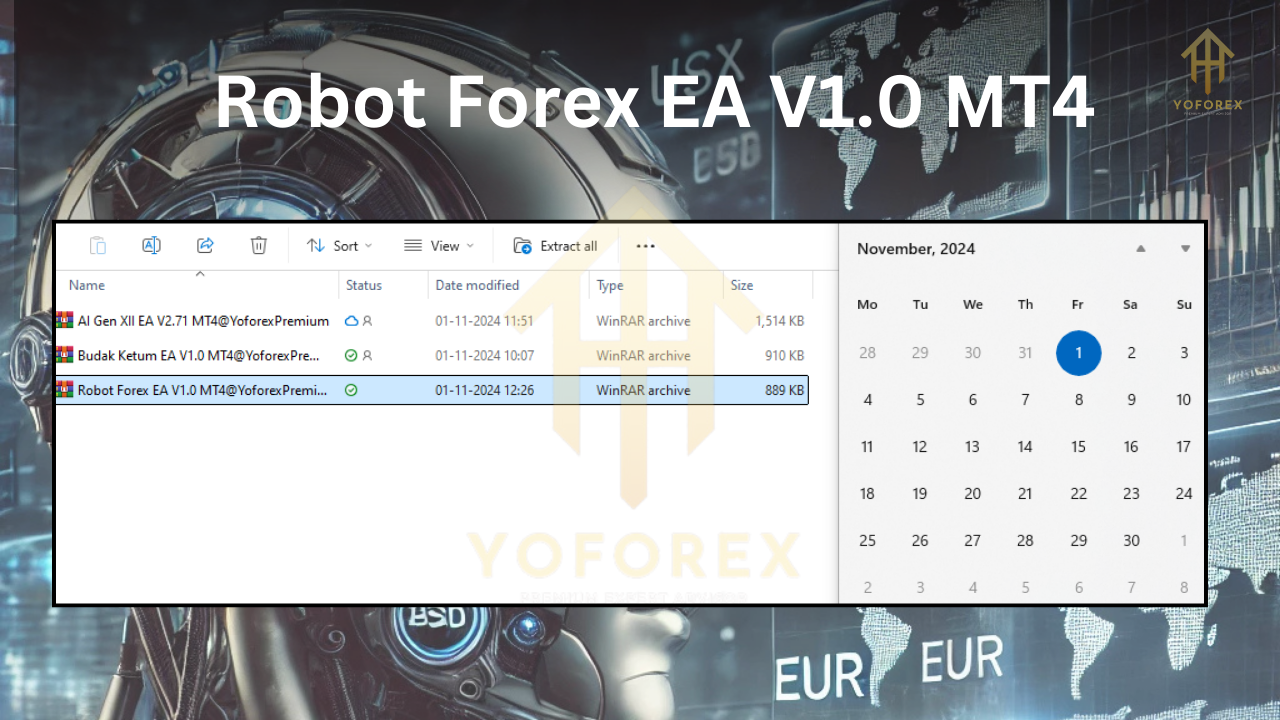

Instant Download: https://www.yoforex.org/product/robot-forex-ea-v1-0/

https://yoforexea.com/product/robot-forex-ea-v1-0/

https://www.mql5.software/product/robot-forex-ea-v1-0/

https://www.forexfactory.cc/product/robot-forex-ea-v1-0/

https://www.fxcracked.org/product/robot-forex-ea-v1-0/

Happy Trading

Happy Trading

There are no reviews yet.