Range Breakout Day Trader EA V2.2 MT4

The Range Breakout Day Trader EA V2.2 MT4 is a powerful automated trading tool designed for Forex traders who want to capitalize on range breakout strategies. This EA is optimized for short-term trading, making it ideal for day traders. Below, we break down the key details, including the minimum deposit, recommended time frame, currency pairs, and how the EA executes trades.

Key Features

| Aspect | Details |

|---|---|

| Minimum Deposit | $100 (recommended for optimal risk management) |

| Time Frame | M1, M5, M15, M30, H1 – Ideal for capturing intraday range breakouts |

| Currency Pairs | Major pairs like EUR/USD, GBP/USD, USD/JPY, and AUD/USD (high liquidity pairs) |

| Trading Strategy | Range Breakout – Identifies key support/resistance levels and trades breakouts |

| Risk Management | Built-in stop-loss, take-profit, and trailing stop features |

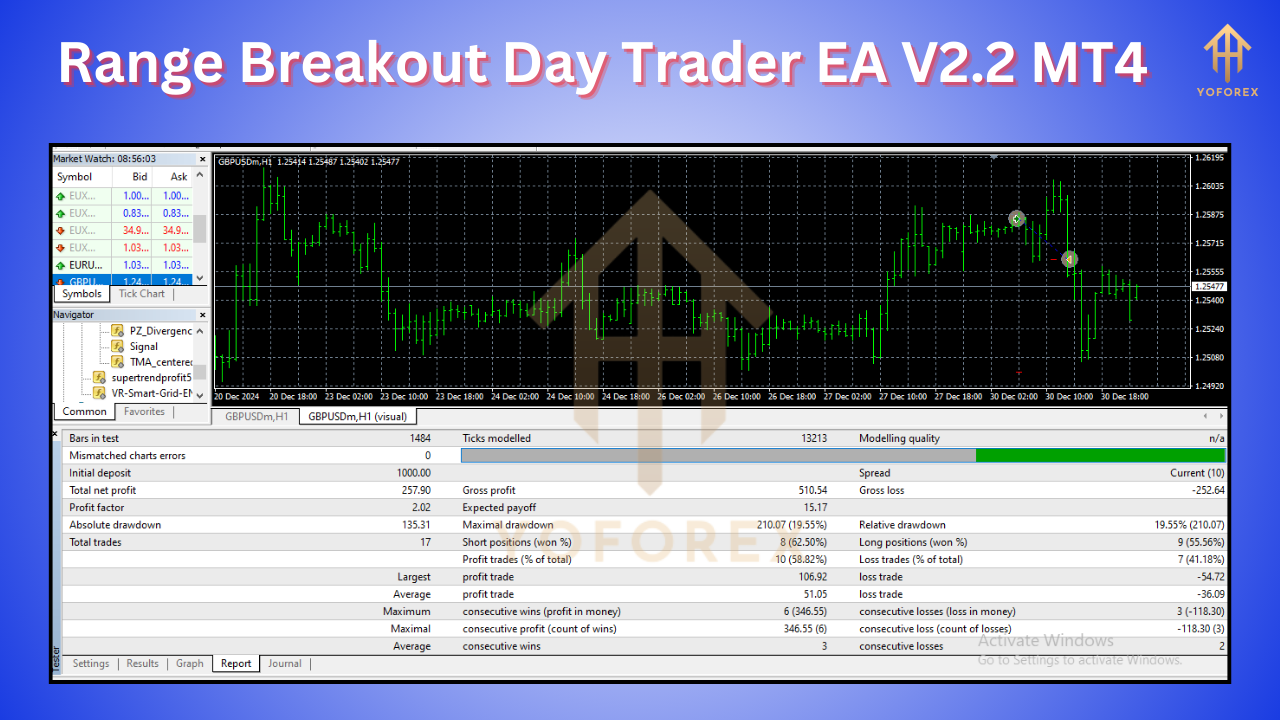

How the EA Executes Trades: The Range Breakout Strategy

The Range Breakout Day Trader EA V2.2 MT4 uses a systematic approach to identify and trade breakouts. Here’s how it works:

- Identifies Key Levels:

- The EA analyzes the market to identify significant support and resistance levels within a defined range.

- These levels are calculated based on recent price action and volatility.

- Waits for Breakout:

- Once the range is established, the EA waits for a breakout.

- A breakout occurs when the price moves above resistance (for a buy) or below support (for a sell).

- Enters the Trade:

- The EA enters a trade in the direction of the breakout.

- For example, if the price breaks above resistance, the EA opens a buy order.

- Manages the Trade:

- The EA uses predefined stop-loss and take-profit levels to manage risk.

- It may also use trailing stops to lock in profits as the trade moves in your favor.

- Exits the Trade:

- The trade is closed either when the take-profit level is hit or the trailing stop is triggered.

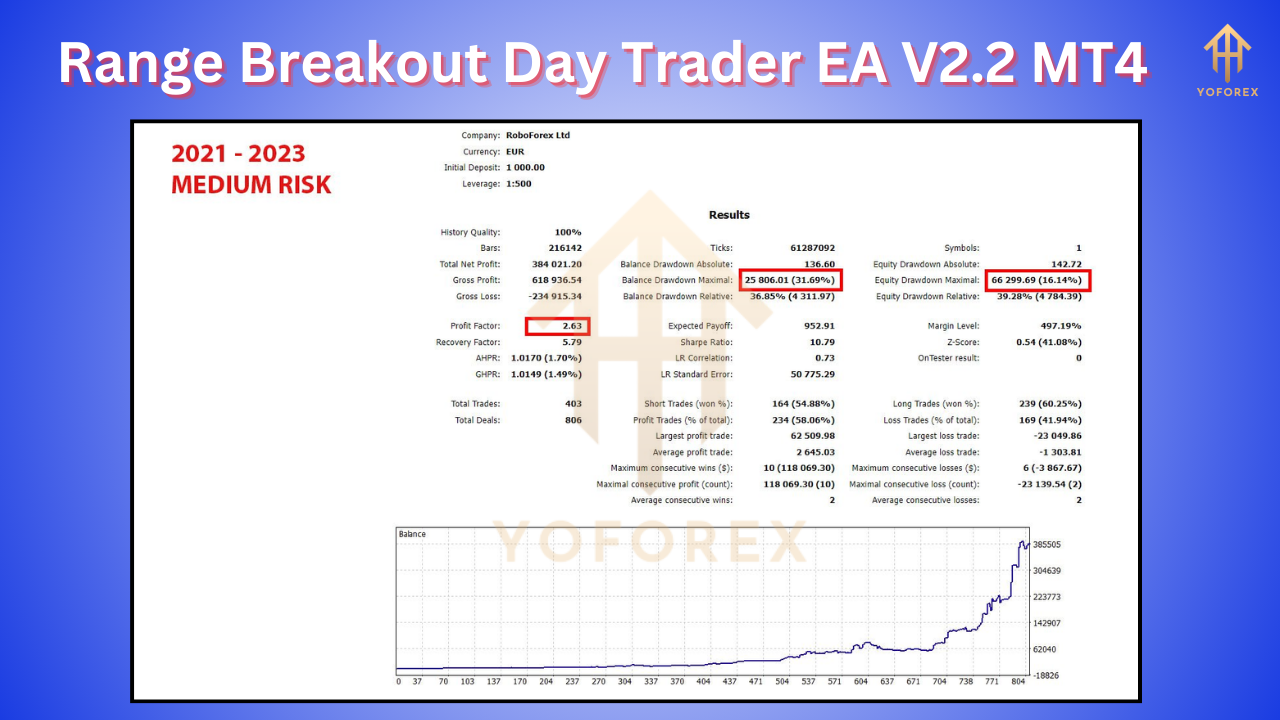

Why This Strategy Works

- Volatility Advantage: Breakout strategies thrive in volatile markets, and this EA is designed to capitalize on such conditions.

- Clear Entry Signals: By focusing on key levels, the EA eliminates guesswork and provides clear entry points.

- Risk Control: The built-in risk management tools ensure that losses are minimized while allowing profits to run.

Optimal Settings for Range Breakout Day Trader EA V2.2 MT4

| Parameter | Recommended Setting |

|---|---|

| Lot Size | 0.01 for every $100 in account balance (adjust based on risk tolerance) |

| Stop-Loss | 20-30 pips (depending on pair volatility) |

| Take-Profit | 40-60 pips (adjust based on market conditions) |

| Trailing Stop | 10-15 pips (to lock in profits) |

| Trading Hours | Major session overlaps (e.g., London-New York overlap for high liquidity) |

Tips for Success

- Use a VPS: Ensure uninterrupted trading by running the EA on a Virtual Private Server (VPS).

- Monitor Performance: Regularly review the EA’s performance and adjust settings if necessary.

- Stick to Major Pairs: Focus on high-liquidity pairs to avoid slippage and ensure smooth trade execution.

The Range Breakout Day Trader EA V2.2 MT4 is a reliable tool for traders looking to automate their day trading strategies. By understanding its strategy and optimizing its settings, you can maximize your chances of success in the Forex market.

Disclaimer: Trading involves risks, and past performance is not indicative of future results. Always conduct thorough research and seek professional advice before trading.📈🍀

Stay Updated:

For more support join our Telegram Channel : https://t.me/+eo74nsL9xXI1YTFl

Additional Resources:

Instant Download: https://yoforexea.com/product/range-breakout-day-trader-ea-v2-2/

You can also download from other websites:

https://www.forexfactory.cc/product/range-breakout-day-trader-ea-v2-2/

https://www.fxcracked.org/product/range-breakout-day-trader-ea-v2-2/

https://www.mql5.software/product/range-breakout-day-trader-ea-v2-2/

https://www.yoforex.org/product/range-breakout-day-trader-ea-v2-2/

There are no reviews yet.