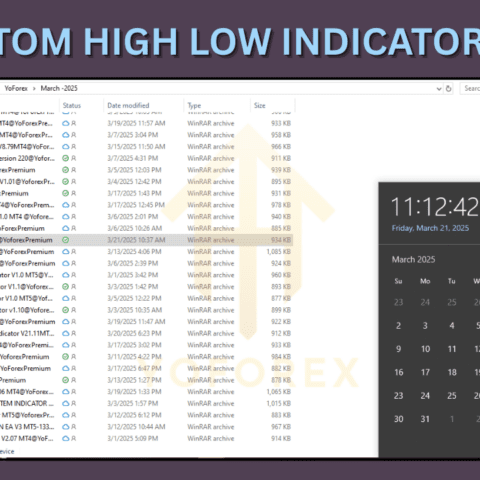

KT Custom High Low Indicator MT5: Key Details for Optimal Use

If you’re considering using the KT Custom High Low Indicator MT5, it’s essential to understand the minimum deposit requirements, the ideal time frame to run the indicator, and the best currency pairs to trade. Below is a breakdown of these critical factors to help you maximize your trading efficiency and profitability.

Key Details

| Aspect | Details |

|---|---|

| Minimum Deposit | – Recommended: 100−500 (depending on broker and leverage) |

| – Allows sufficient margin for trading and risk management. | |

| Time Frame to Run | – Best Time Frames: M15 (15-minute), M30 (30-minute), H1 (1-hour) |

| – Higher time frames (H4, D1) can also be used for more reliable signals. | |

| Currency Pairs to Run | – Major Pairs: EUR/USD, GBP/USD, USD/JPY, AUD/USD |

| – Cross Pairs: EUR/GBP, GBP/JPY, AUD/JPY | |

| – Avoid exotic pairs for better accuracy and liquidity. |

Why These Details Matter

- Minimum Deposit: Ensures you have enough capital to withstand market volatility while using the indicator effectively.

- Time Frame: The KT Custom High Low Indicator works best on short to medium time frames, providing timely and accurate signals.

- Currency Pairs: Major and cross pairs are recommended due to their high liquidity and lower spreads, which align well with the indicator’s strategy.

Tips for Success

- Start with a demo account to familiarize yourself with the indicator’s signals.

- Use proper risk management (e.g., 1-2% risk per trade).

- Combine the indicator with other technical analysis tools for confirmation.

By following these guidelines, you can leverage the KT Custom High Low Indicator MT5 to its fullest potential and enhance your trading performance.

Happy Trading

Happy Trading

There are no reviews yet.