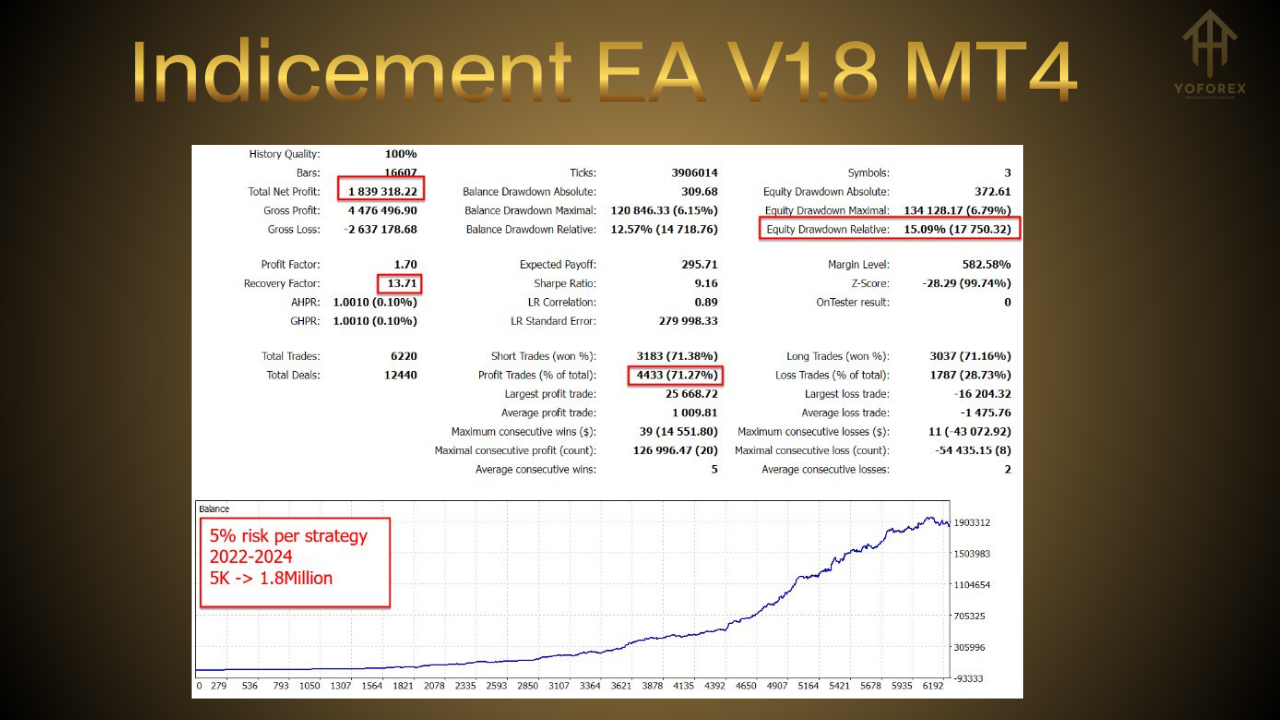

Indicement EA v1.8 MT4: Precision Index Trading Solution

Indicement EA v1.8 is a specialized trading tool developed for high-volatility indices, including US30, US500, and NAS100. Designed to work on the H1 timeframe, this EA provides traders with a low-risk entry into the world of indices with a minimum deposit requirement, efficient trade execution, and highly adaptable risk settings. Indicement EA v1.8 adopts a scalping strategy, focusing on small, frequent gains and quick exits to keep trades efficient and profitable.

Key Specifications of Indicement EA v1.8

| Parameter |

Details |

| Minimum Deposit |

$150 (Recommended: $300) |

| Timeframe |

H1 |

| Supported Indices |

US30, US500, NAS100 |

| Platform |

MT4 |

| Lot Size |

Flexible, adjustable based on risk tolerance |

Strategy Overview: Scalping with Precision

Indicement EA v1.8 follows a scalping strategy specifically designed for trading indices. Unlike longer-term trading, scalping focuses on capturing smaller market movements within the H1 timeframe. This EA capitalizes on high-frequency, low-margin trades, ensuring consistent, incremental gains by entering and exiting trades swiftly. Here’s how it executes trades effectively:

- Scalping Strategy: Targets short-term price fluctuations on US30, US500, and NAS100, taking advantage of high liquidity in these instruments.

- Quick Entry and Exit: The EA scans the market for momentum shifts and executes trades precisely, keeping each trade open for minimal time to avoid market volatility risks.

- Dynamic Lot Sizing: Allows traders to adjust lot sizes based on their risk tolerance, making it versatile for both conservative and aggressive trading styles.

- Stop-Loss & Take-Profit Optimization: Each trade includes predefined stop-loss and take-profit levels, minimizing risk while capturing profits effectively.

How Indicement EA v1.8 Takes TradesIndicement EA v1.8 employs intelligent algorithms that continuously monitor the market for favorable trade setups. It focuses on finding the optimal entry points where momentum indicates a potential price movement. Using the scalping strategy, it enters trades with a calculated approach, aiming for small but consistent profits. Below is a step-by-step outline of how Indicement EA v1.8 operates:

- Market Monitoring: Scans high-volatility indices for short-term opportunities on the H1 chart.

- Signal-Based Entry: Uses momentum signals to detect favorable market entry points for quick trade entries.

- Controlled Exposure: Executes trades with short holding times, minimizing exposure to prolonged market fluctuations.

- Risk-Managed Exits: Incorporates tight stop-loss settings and adaptable take-profit points, ensuring each trade remains within risk limits.

Advantages of Using Indicement EA v1.8

| Feature |

Benefit |

| Index-Focused |

Designed specifically for US30, US500, NAS100 |

| Low Initial Investment |

Starts with as little as $150 (recommended $300) |

| High-Frequency Scalping |

Consistent small gains through quick trade cycles |

| Customizable Lot Sizes |

Adjusts to different risk profiles, ideal for scalping |

Redesigned Image

The accompanying image showcases Indicement EA v1.8’s efficiency and adaptability, encapsulating its core strengths: low deposit requirements, scalping precision, and high-frequency index trading.

Indicement EA v1.8 is ideal for traders looking to explore index trading without committing substantial capital. Its scalping strategy offers a fast-paced yet controlled approach to trading US30, US500, and NAS100, making it a valuable tool for consistent profit generation with low market exposure. With customizable risk settings and a user-friendly MT4 interface, this EA is built to align with your trading goals while managing risks effectively.

📲 Download the EA from our website: https://www.yoforexea.com/

🔗 Join our community on Telegram: https://t.me/yoforexrobot

😎Happy Trading😎

There are no reviews yet.