Heikin Ashi Indicator V1.0 for MT4: Optimize Your Trades with Enhanced Market Insights

The Heikin Ashi Indicator V1.0 for MT4 is a powerful tool designed for traders looking to improve their trading precision by capturing market trends with clarity. Its unique approach filters market noise, providing a smoother view of price movements, which makes it ideal for trend-following strategies. With just a minimum deposit of $200, this indicator helps traders capitalize on clear trend signals, enhancing entry and exit points for profitable trading.

Key Specifications

- Currency Pairs: EURUSD, GBPUSD, USDJPY, and other major pairs

- Timeframe: M1, M5, M15, H1, H4 (optimal for different trading styles)

- Minimum Deposit: $200

- Platform: MT4

Benefits of Using Heikin Ashi Indicator V1.0

The Heikin Ashi Indicator V1.0 MT4 is built on the renowned Heikin Ashi candlestick method, smoothing out price action to make it easier for traders to recognize trends, consolidations, and reversals. This indicator is especially valuable for those who prefer a trend-based strategy, as it filters out minor fluctuations, focusing on the prevailing market direction.

How Heikin Ashi Indicator V1.0 Enhances Trading

The Heikin Ashi Indicator is uniquely suited for:

- Smoother Trend Detection: By averaging out price data, the indicator provides a clearer, less volatile view of trends, ideal for capturing long-term movement.

- Improved Entry & Exit Signals: Heikin Ashi helps you enter trades in the direction of the main trend and recognize early exit signals when trends lose momentum.

- Enhanced Risk Management: The indicator aids in identifying reversal points, allowing for tighter stop-loss settings and more accurate risk control.

Strategy & Execution: How the Indicator Takes Trades

The Heikin Ashi Indicator V1.0 follows a clear, step-by-step approach for optimal entry and exit points, maximizing profits while reducing risk exposure.

| Trade Setup | Execution Details |

|---|---|

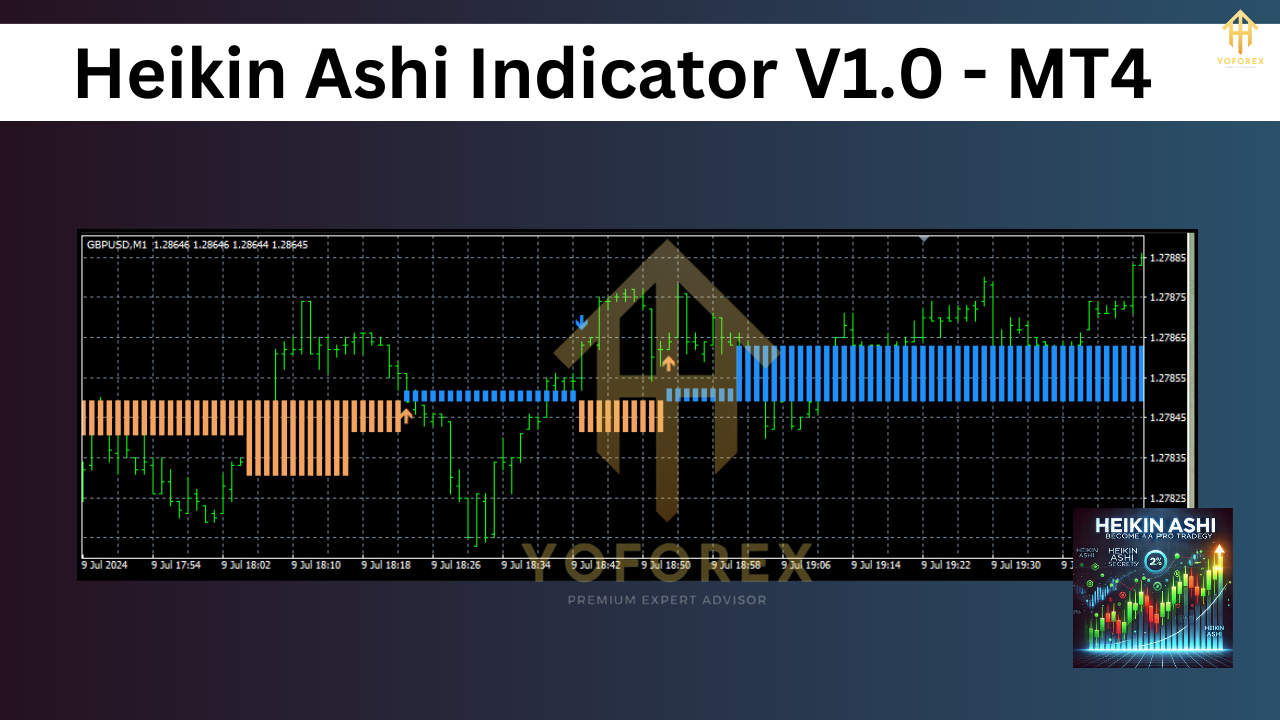

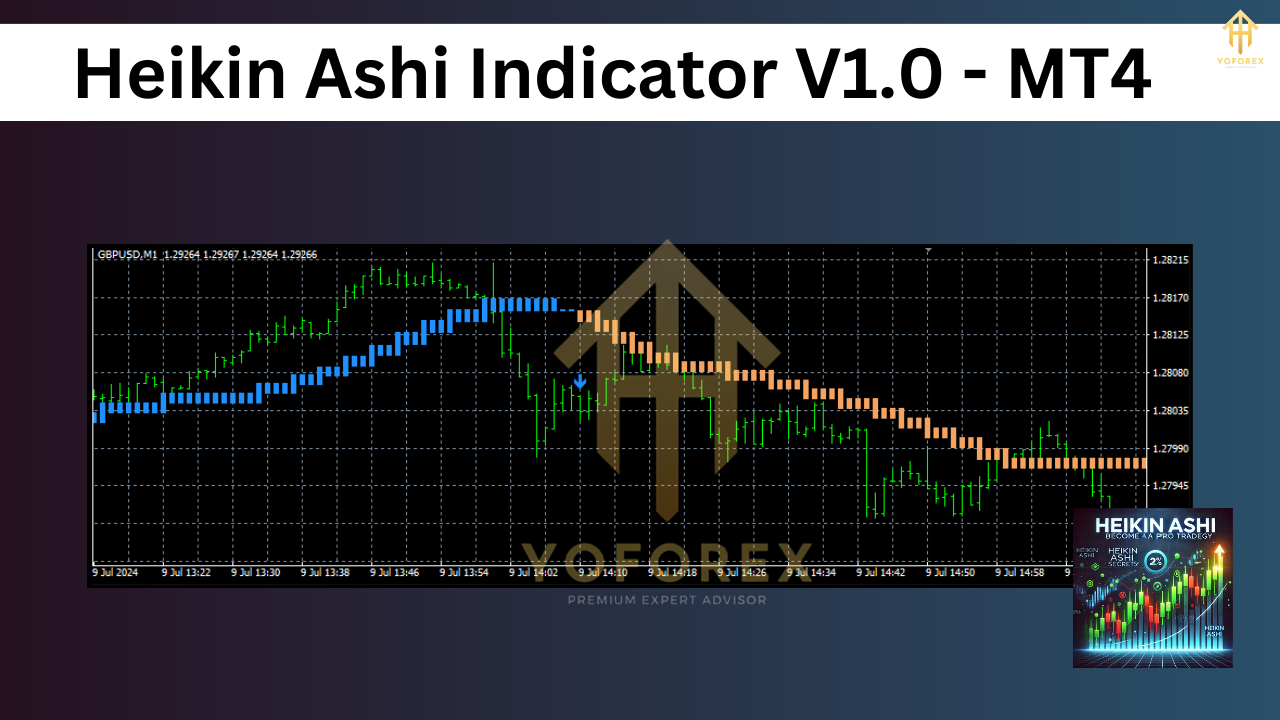

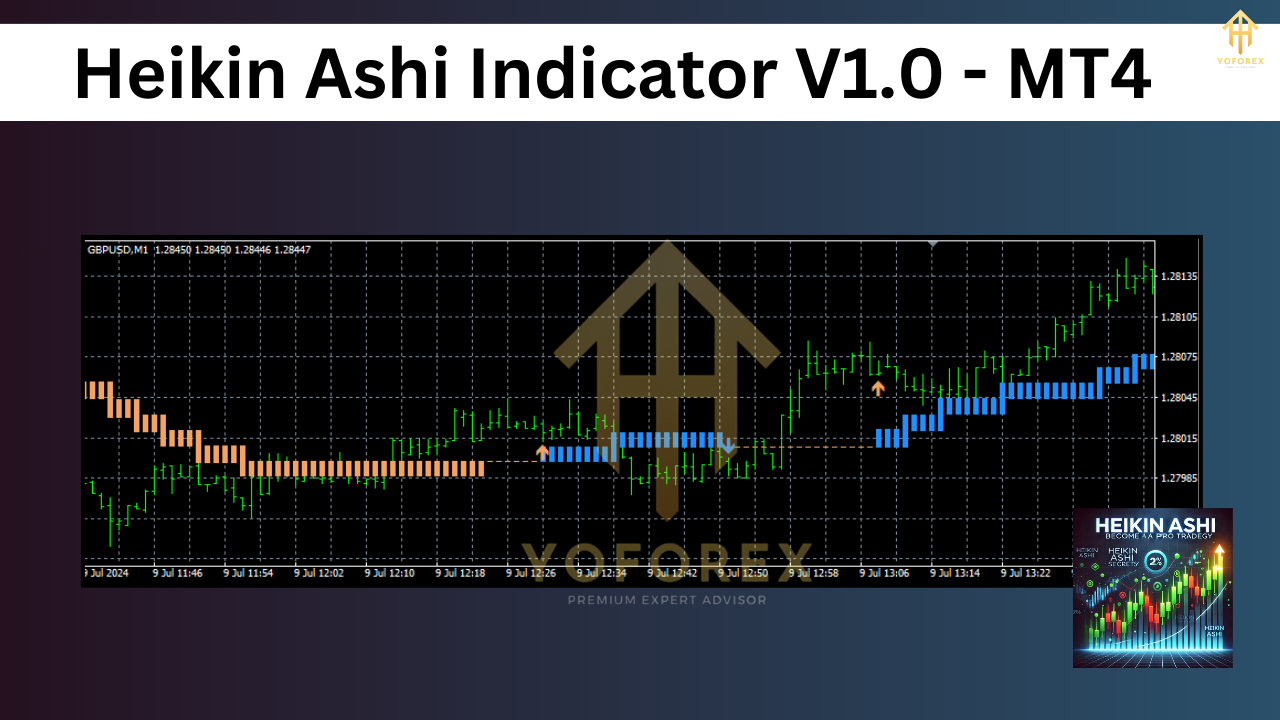

| 1. Trend Identification | Smooth Candlesticks: The indicator transforms traditional candlesticks into Heikin Ashi bars, making trends more apparent. Use the indicator to identify trends that are clearly moving in one direction, as they suggest optimal moments for entries. Green Heikin Ashi candles suggest a bullish trend, while red candles signal a bearish trend. |

| 2. Entry Signals | Confirmation of Trend Strength: Enter trades when the candles align in the direction of the trend for at least 3-5 consecutive bars. Ensure no “wicks” on the Heikin Ashi candles before entering to confirm a strong trend. |

| 3. Exit Strategy | Exit at Reversal or Weakness: Look for candles with wicks on both ends, as they often signal a possible trend reversal. This is a clear exit signal to secure profits and minimize risk. |

| 4. Risk Management | Stop Loss and Take Profit: A standard stop-loss setting of 20-30 pips below the entry point can be used in this setup. For take profit, aim for a 2:1 reward-to-risk ratio, or exit at the next key support or resistance level. |

Key Steps for Implementing the Strategy

The Heikin Ashi Indicator V1.0 is particularly advantageous for both novice and advanced traders, thanks to its simplicity and the clarity of its signals. Here’s a detailed breakdown of the strategy and how to execute it successfully:

Step 1: Identify the Main Trend

- Start by setting up the Heikin Ashi Indicator on your MT4 platform.

- Choose the desired currency pair and the recommended timeframe (M5, M15, or H1).

- Observe the color and direction of the Heikin Ashi candles:

- Green Heikin Ashi Candles indicate a bullish trend.

- Red Heikin Ashi Candles indicate a bearish trend.

Step 2: Entering the Trade

- Wait for at least 3-5 consecutive Heikin Ashi candles in the same color to confirm a solid trend.

- Ensure that the candles are full-bodied with minimal or no upper wicks (in a downtrend) or lower wicks (in an uptrend).

- Enter the trade in the direction of the trend as soon as you confirm strength.

- Recommended Currency Pairs: The Heikin Ashi Indicator V1.0 can be applied to any major currency pair; however, it is particularly effective on pairs with clear, trending behavior such as EUR/USD, GBP/USD, and USD/JPY.

Step 3: Setting Your Stop Loss and Take Profit

- Stop Loss: Place the stop-loss order approximately 20-30 pips below the last Heikin Ashi candle.

- Take Profit: For a safe approach, use a 2:1 reward-to-risk ratio, or exit when the trend shows signs of weakening, indicated by a Heikin Ashi candle with wicks on both ends.

Step 4: Exiting the Trade

- Monitor the trend for any signs of reversal, such as candles with wicks on both sides.

- Once the trend shows signs of slowing, it is wise to exit and lock in profits.

Using the Heikin Ashi Indicator for Multiple Timeframe Analysis

By using the Heikin Ashi Indicator across multiple timeframes, you can enhance your strategy further:

- Higher Timeframe (H4 or Daily): Analyze the long-term trend direction.

- Lower Timeframe (M5 or M15): Look for specific entry points within the larger trend, confirming trend continuation or reversal signals.

Pro Tips for Effective Use of Heikin Ashi Indicator V1.0

- Combine with Moving Averages: Using a 20-period moving average with the Heikin Ashi Indicator can provide additional trend confirmation.

- Avoid Range-Bound Markets: The Heikin Ashi Indicator is less effective in choppy or range-bound conditions, as trends are unclear.

- Pair with Volume Indicators: To confirm the strength of a trend, use a volume indicator alongside Heikin Ashi for added confidence.

Risk Management and Final Thoughts

The Heikin Ashi Indicator V1.0 allows traders to take a structured approach to trend-based trading, with clear entry and exit points. To minimize risks:

- Always set a stop loss to protect against unexpected market reversals.

- Adhere to the recommended minimum deposit of $200 to manage trades effectively without over-leveraging.

For updates, guidance, or further support, join our Telegram channel for valuable insights and trading tips: https://t.me/yoforexrobot. Here, you’ll find a community of traders utilizing the Heikin Ashi Indicator V1.0 to maximize their market potential.

Join our Telegram for the latest updates and support: https://t.me/yoforexrobot

Please Join: https://t.me/+M-kFQePDgy5lZjY1

Stay Updated:

Instant Download: https://www.yoforex.org/product/heikin-ashi-indicator-v1-0/

https://yoforexea.com/product/heikin-ashi-indicator-v1-0/

https://www.fxcracked.org/product/heikin-ashi-indicator-v1-0/

https://www.forexfactory.cc/product/heikin-ashi-indicator-v1-0/

https://www.mql5.software/product/heikin-ashi-indicator-v1-0/

There are no reviews yet.