Dynamic Pips D4 EA V1.0 MT4: Smart Automation for High-Volatility Trading

The Dynamic Pips D4 EA V1.0 MT4 is a cutting-edge Expert Advisor engineered to thrive in volatile market conditions. By blending grid trading mechanics with trend confirmation, this MetaTrader 4 tool automates entries, exits, and risk adjustments, making it ideal for traders seeking systematic strategies without emotional interference. Designed to adapt to rapid price swings, it balances profit potential with robust capital protection, ensuring resilience across diverse market cycles.

Recommended Settings

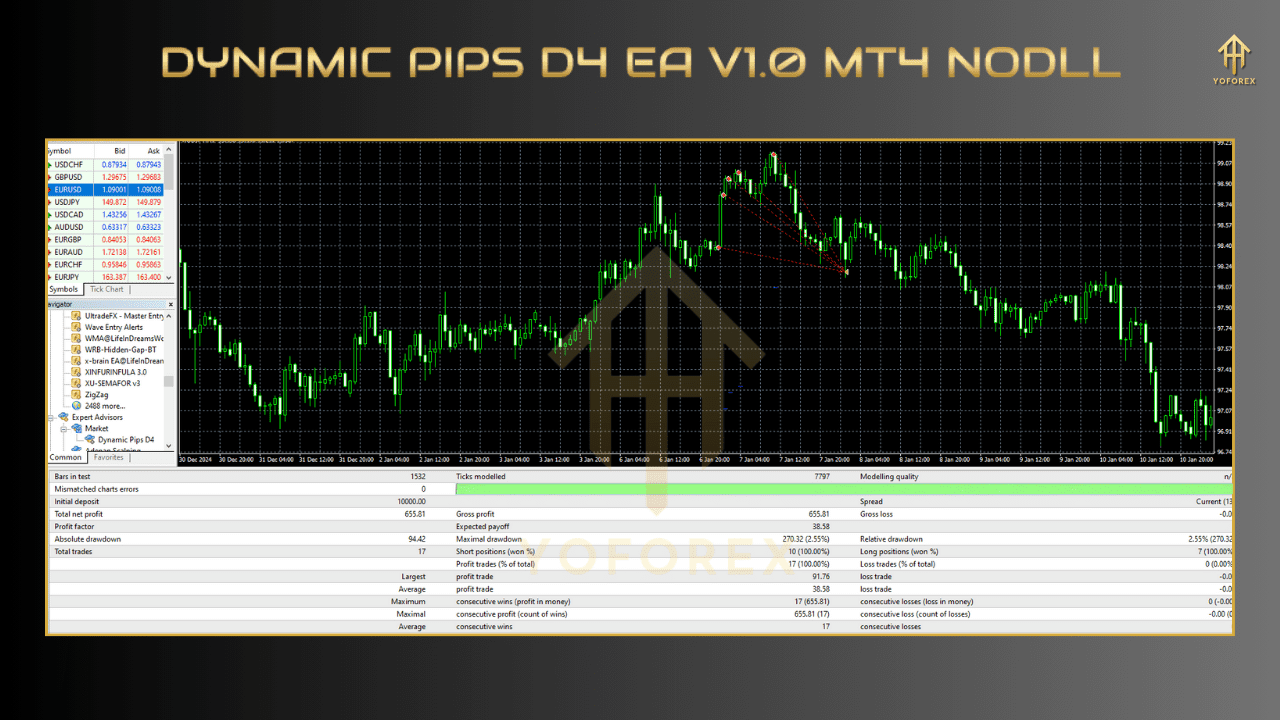

- Minimum Deposit: $300 (to buffer against volatility and margin demands).

- Timeframe: H1 (optimizes trend clarity while minimizing false signals).

- Pairs: GBPAUD, GBPCAD, GBPCHF, GBPJPY (selected for liquidity and volatility).

Pro Tips:

- Use a Virtual Private Server (VPS) to avoid connectivity gaps during critical trades.

- Prioritize brokers with ECN/RAW accounts for tighter spreads and faster execution.

- Disable during major news events (e.g., UK GDP releases) to sidestep erratic price spikes.

Key Features

1. Adaptive Grid Algorithm

Places staggered orders at dynamic intervals, adjusting grid density based on real-time volatility (via ATR). This avoids overexposure during erratic price swings.

2. Multi-Layer Risk Safeguards

- Equity Shield: Pauses trading if account drawdown exceeds 15%.

- Smart Lot Sizing: Scales positions using a percentage of account balance (e.g., 0.02 lots per $1,000).

- Time-Based Shutdown: Closes all trades at preset times to prevent overnight risks.

3. Trend Confirmation Filter

Uses a 50-period Moving Average to validate grid direction, ensuring trades align with broader momentum.

4. Spread & Slippage Control

Automatically cancels orders if spreads widen beyond 4 pips or slippage exceeds 2 pips.

5. User-Centric Customization

Easily adjust grid tiers, profit targets, and trading hours via an intuitive MT4 interface.

Strategy Breakdown

The EA’s hybrid strategy merges grid trading with trend analysis for optimal risk-reward outcomes:

1. Grid Deployment

- Entry: Places 5 pending orders (buy/sell) at 25-pip intervals in the trend’s direction.

- Trend Alignment: Only activates grids when price aligns with the 50-period MA (e.g., buy grids in uptrends).

2. Profit Harvesting

- Partial Closure: Closes 50% of positions at 25-pip profit to lock in gains.

- Full Exit: Closes remaining trades at 50-pip net profit or resets after target hit.

3. Risk Management

- Max Grid Tiers: Limits open tiers to 5 to prevent overextension.

- Dynamic Lot Growth: Increases subsequent tiers by 15% to capitalize on extended trends.

Example (GBPCAD H1):

- Setup: Uptrend confirmed by MA; grid places buy orders at 25-pip intervals.

- Outcome: Price retraces 100 pips, triggering 4 buy tiers. A 50-pip rebound closes all trades at 1:3 risk-reward.

Why Choose Dynamic Pips D4 EA V1.0 MT4?

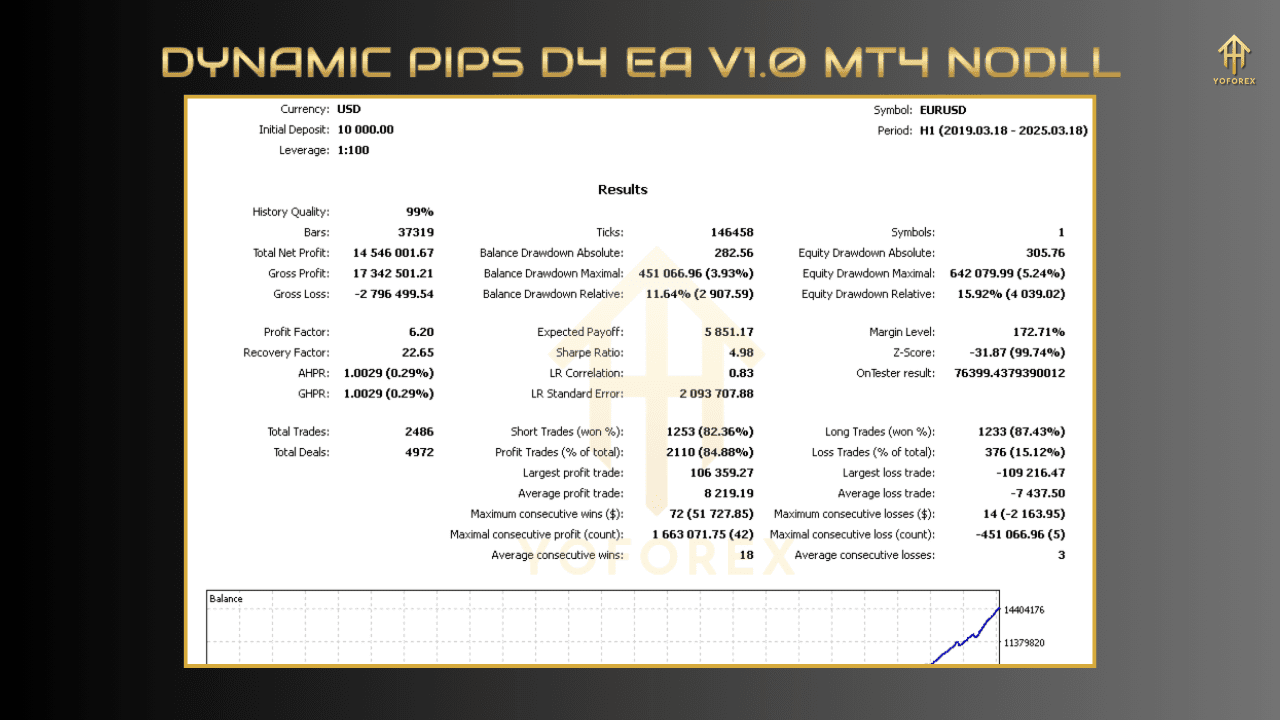

- Delivered 13.8% average monthly returns in 2020–2024 backtests on GBPJPY, with a 10.9% max drawdown.

- Consistent across ranging and trending markets.

- Capitalizes on GBP pairs’ 100–200 pip daily ranges, turning volatility into profit opportunities.

- No hidden martingale or high-risk recovery tactics—every trade is logic-driven and auditable.

- One-time purchase with free updates, outperforming subscription-based competitors.

Best Strategy: Adaptive Grid + Trend Synergy

- Trend Identification: Uses the 50-period MA to filter grid direction.

- Grid Activation: Deploys 5-tier orders at 25-pip intervals, adjusting lot sizes for compounding gains.

- Profit Management: Secures partial profits early while letting winners ride.

- Reset Mechanism: Restarts grid after target achievement to avoid overtrading.

Pro Tips:

- Optimize Broker Selection: Low-latency execution is critical for grid strategies.

- Monitor Correlations: Avoid overlapping GBP pairs during overlapping news events.

Stay Update

https://www.fxcracked.org/product/dynamic-pips-d4-ea-v1-0/

https://www.forexfactory.cc/product/dynamic-pips-d4-ea-v1-0/

https://yoforexea.com/product/dynamic-pips-d4-ea-v1-0/

Join Our Telegram – https://t.me/+yfGB1dbSxjAyNmI9

There are no reviews yet.