Zahav AI Trade EA V1.19 MT5 — Tick-Based Gold Trading Built for Precision

If you trade Gold (XAUUSD), you already know how quickly spreads widen, ticks fly, and momentum can flip on a dime. Zahav AI Trade EA V1.19 (MT5) is designed with that reality in mind. Its tick-based logic means the EA reacts to the raw flow of ticks rather than relying on any single timeframe’s candles. You can visualize on H1 for clarity (recommended), but the decision engine itself works tick-to-tick—useful when you need responsive execution on a fast instrument like gold.

Below is a practical, trader-first breakdown of what Zahav AI Trade EA requires, how to set it up correctly, and how to run it with discipline.

Quick Facts (At a Glance)

- Symbol: XAUUSD (Gold)

- Platform: MetaTrader 5 (MT5)

- Logic: Tick-based (timeframe agnostic; H1 recommended for clean visualization)

- Account Type: Hedging (required)

- Broker Setup: Low-spread ECN/Raw account strongly recommended

- Leverage: 1:500 or higher suggested (use responsibly)

- Minimum Deposit: $2,000 (or 200,000 USC on a cent account)

- Recommended for Default Settings: $3,000 (or 300,000 USC) for more comfortable risk management

- Best Practice: Always backtest and forward-test to align with your capital and risk tolerance

Why Tick-Based Logic Matters for Gold

Gold is notorious for micro-structure moves—rapid bursts, shallow fades, and quick liquidity pockets that don’t always show up neatly on traditional candle charts. A tick-driven engine can:

- React to intra-bar changes instead of waiting for a candle close.

- Be more sensitive to micro-volatility during busy sessions.

- Reduce the mismatch between chart timeframe and actual execution behavior.

You still see trades clearly on H1 (that’s the recommendation for readability), but under the hood the EA is processing every tick—which is what your broker actually executes on.

Account & Broker Requirements (Non-Negotiables)

- Hedging Account (Required)

Zahav AI Trade EA must run on a hedging account. If your broker only offers netting, switch or open a compatible account first. - Low-Spread ECN or Raw Spread

Tighter spreads and faster execution help tick-based systems significantly. A raw/ECN account reduces slippage and keeps costs in check. - Leverage 1:500 or Higher (Use Responsibly)

Leverage simply gives margin flexibility; it’s not a free pass to over-risk. Keep your per-trade risk fixed and modest. - Capital

- Minimum: $2,000 (or 200,000 USC on cent)

- Recommended (defaults): $3,000 (or 300,000 USC) for a smoother risk profile with the out-of-box settings

Installation & First-Run Checklist (MT5)

- Copy the EA

MT5 → File → Open Data Folder →MQL5/Experts→ paste the EA file. - Restart MT5

So the platform registers the new Expert Advisor. - Open the XAUUSD Chart

Any timeframe works (logic is tick-based), but attach on H1 for cleaner visuals. - Attach the EA & Enable Algo Trading

From Navigator → Experts, drag the EA onto the chart → tick Allow Algo Trading.

Ensure the main Algo Trading button (toolbar) is enabled (green). - Input Parameters

- Start with default settings if you’re at $3,000 recommended deposit.

- If starting at $2,000, consider more conservative lot sizing until you gather forward data.

- Confirm any max spread or slippage protections (if available) to match your broker conditions.

- Confirm Logs

Check Experts/Journal tabs to ensure proper initialization and no broker-side rejections.

Smart Operating Practices

- 1) Backtest → Demo → Small Live

- Backtest across varied market regimes (quiet weeks, high-vol weeks).

- Forward test on demo for 2–4 weeks to see live spreads and slippage.

- Move to small live only after you’re comfortable with behavior.

- 2) Session Awareness

- Gold often moves most during London and NY sessions (and the overlap).

- If your broker’s spreads balloon at rollover or illiquid times, consider pausing or letting the EA trade only during your preferred session window.

- 3) News Discipline

- High-impact events (CPI, FOMC, NFP, central bank decisions) can cause abnormal spikes.

- Decide whether to pause the EA around red-flag news or reduce exposure into those windows.

- 4) VPS & Latency

- A reliable VPS near your broker’s servers keeps latency low and uptime consistent—important for tick-sensitive logic.

- 5) Risk, Always Risk

- Fix a per-trade risk percent that respects your account size and psychological comfort.

- Don’t “revenge-tweak” settings after a single loss; review performance by batches of trades.

Suggested Starting Settings (Guidance, Not Gospel)

- Deposit: $3,000 (or 300,000 USC) for defaults; $2,000 is minimum but start gentler.

- Lot Size: Keep conservative initially (e.g., 0.01–0.03 on standard accounts depending on the EA’s defaults and your broker’s contract size).

- Spread Filter (if available): Set within a realistic threshold for your broker’s typical XAUUSD spread during active hours.

- Slippage Guard (if available): Reasonable but not too tight; excessive rejections can cause missed trades.

- Trading Window: Optional—focus on liquid sessions; monitor your broker’s behavior and adapt.

Risk Management Mindset

- Drawdown happens. Have a line in the sand where you cut risk or pause.

- Consistency beats heroics. Keep position sizing stable and scale only after data supports it.

- Correlation risk. If you run other gold EAs, watch combined exposure and overlapping entries.

- Logs matter. Review the Experts/Journal output weekly—spot patterns early.

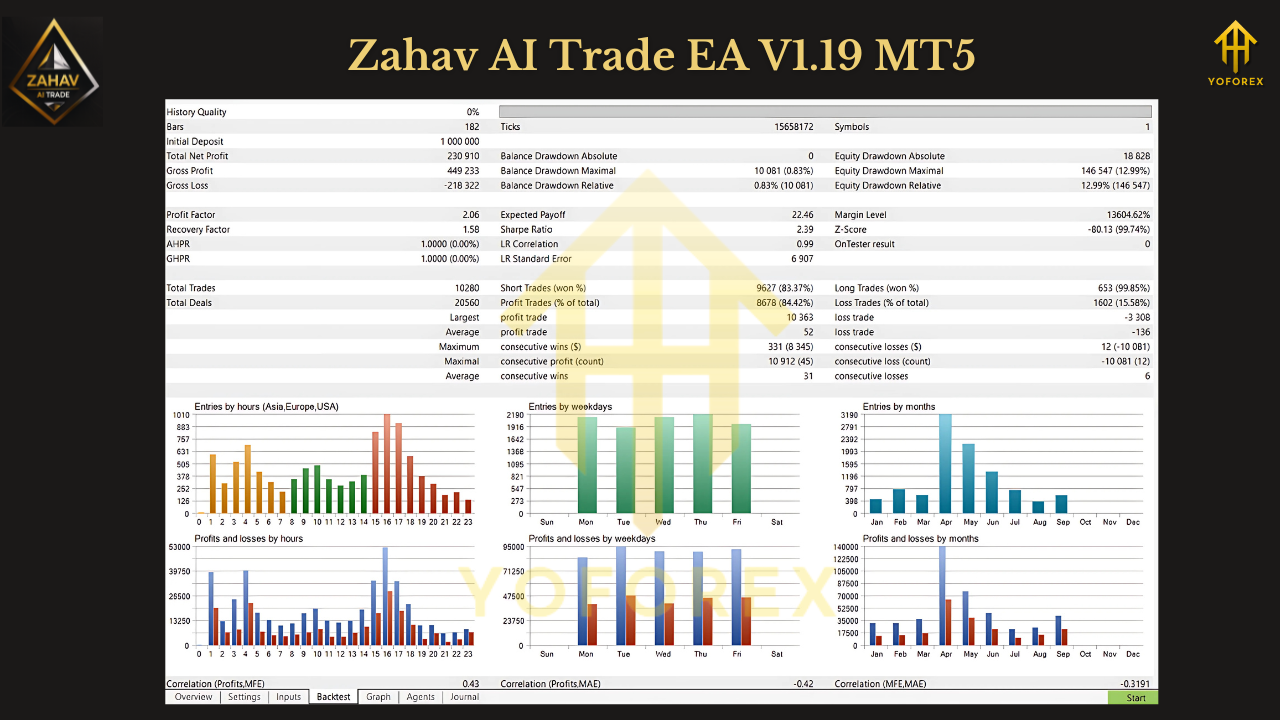

Backtesting Tips for Zahav AI Trade EA

- Data Quality: Use the highest tick model available in your tester for more realistic fills.

- Periods: Include both calm and volatile spans; gold’s regime changes are common.

- Walk-Forward Validation: If you optimize, validate on out-of-sample dates to avoid curve-fit traps.

- Metrics to Watch:

- Max Drawdown (absolute and % terms)

- Profit Factor and Sharpe/Sortino-like measures

- Average trade length (can hint at overexposure during slow times)

- Win rate vs. R-multiple (quality of risk/reward, not just raw wins)

Final Word

Zahav AI Trade EA V1.19 MT5 brings a tick-based execution engine to a market that demands it—Gold. Give it the right environment (hedging account, low-spread ECN/Raw, reliable VPS), the right capital ($2,000 minimum; $3,000 recommended for defaults), and a disciplined risk framework. Do your homework: backtest thoroughly, forward-test on demo, then go live with small risk. With that workflow, you’re setting yourself up to judge the EA by data—not emotions.

Trading involves risk. Past performance is not indicative of future results. Trade responsibly.

Join our Telegram for the latest updates and support

Comments

Leave a Comment