XTrader Pro Gold EA V1.0 MT4 – High-Frequency Gold Scalping With Smarter Portfolio Risk Control

If you’ve been trading Gold for a while, you probably know the pain all too well—those sudden XAUUSD spikes that wipe out perfectly good setups, the long drawdowns coz your bot kept averaging when it shouldn’t, or EAs that show fancy backtests but fail miserably in the live market. Yeah… every trader has been there. And that’s kinda why XTrader Pro Gold EA V1.0 MT4 grabs attention so quickly. It doesn’t try to be flashy or unrealistic; instead, it focuses on portfolio-level risk management, something most retail bots simply ignore.

This EA is built purely for the XAUUSD pair, optimized for high-frequency scalping during premium market hours (05:00–21:59), and structured to avoid the classic pitfalls of dangerous strategies. What makes it stand out is its intelligent basket exit logic, replacing traditional stop-loss styles with smarter, collective trade management. And to make things even better, the system has live Myfxbook-verified performance, not just backtests. With 287.92% total gain, 85% win rate, and 3,130+ executed trades, the EA showcases transparency that’s honestly hard to find these days.

Let’s deep-dive into how XTrader Pro Gold EA works, why traders are switching to it, and whether it truly holds up as a long-term automated Gold trading solution on MetaTrader 4.

Introduction – Why a Gold-Focused Expert Advisor Matters Today

Gold (XAUUSD) has become one of the most traded instruments worldwide, thanks to insane volatility, tighter spreads on ECN accounts, and constant price action during almost all trading sessions. But with that comes the struggle: XAUUSD doesn’t behave like Forex pairs. It moves fast, sweeps liquidity aggressively, and punishes late entries brutally.

Most EAs built for currency pairs fall apart when placed on Gold. They either:

• overtrade and blow accounts

• use risky martingale or grid recovery

• depend on indicators that lag too much

• can’t read session-based volatility shifts

XTrader Pro Gold EA gets around these problems by focusing purely on directional bias + session timing + basket-level exits, allowing much more controlled exposure on a pair that moves unpredictably.

Even beginners with small accounts can use it—starting with just $100, or even $10 on a cent account, which is kinda rare for a Gold EA.

Overview of XTrader Pro Gold EA V1.0 MT4

At its core, the EA is built to maintain consistent automation without taking reckless trades. It applies a rule-based model that adapts to the flow of the market rather than forcing trades in every candle.

Key Principles Behind the System

- Directional Bias Scalping

The EA identifies micro-trends and scalps tiny but frequent moves. Perfect for Gold’s natural speed. - Portfolio-Level Risk Management

Instead of treating each trade as an isolated idea, the EA treats multiple trades collectively—allowing smarter exits and reducing emotional pressure. - Basket Exit Logic

This is one of its biggest strengths. When in drawdown, the EA exits groups of trades at calculated points, reducing the risk of large equity damage. - Premium Market Session Trading (05:00–21:59)

This avoids extremely volatile rollover periods and avoids thin-liquidity conditions where spreads widen. - Live-Market Verified Performance

Myfxbook tracking means the EA isn’t hiding behind doctored backtests.

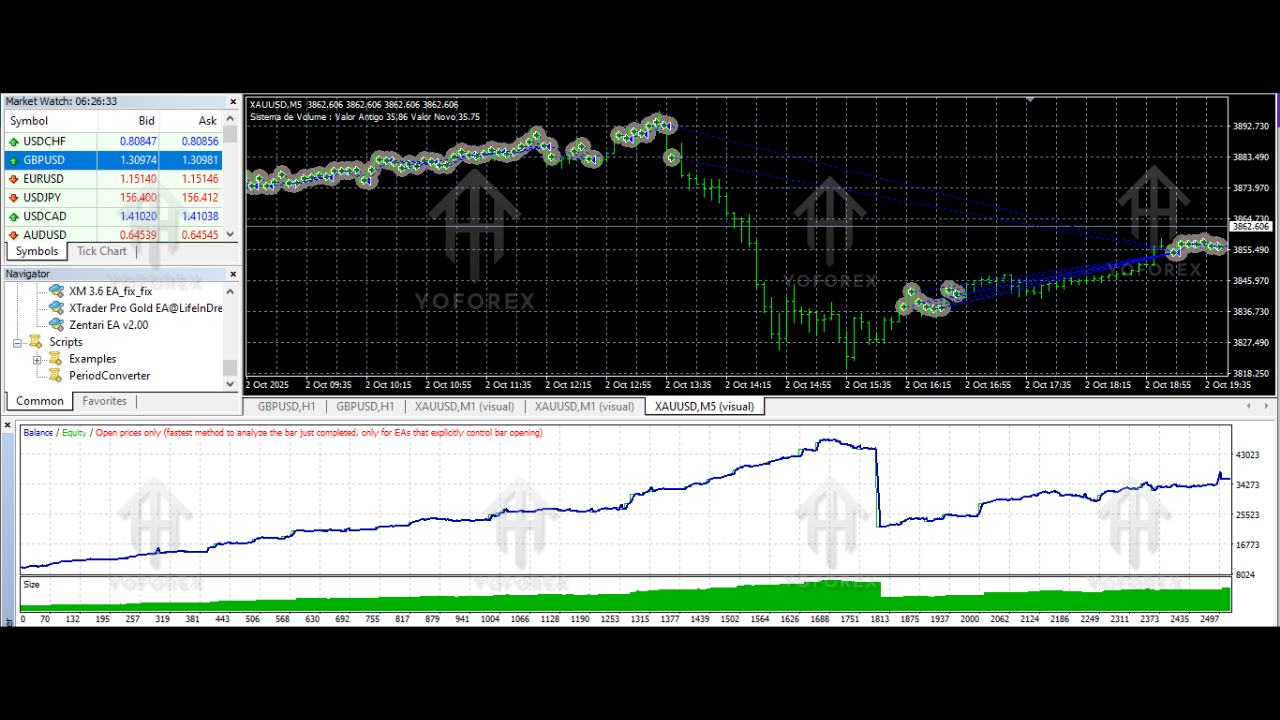

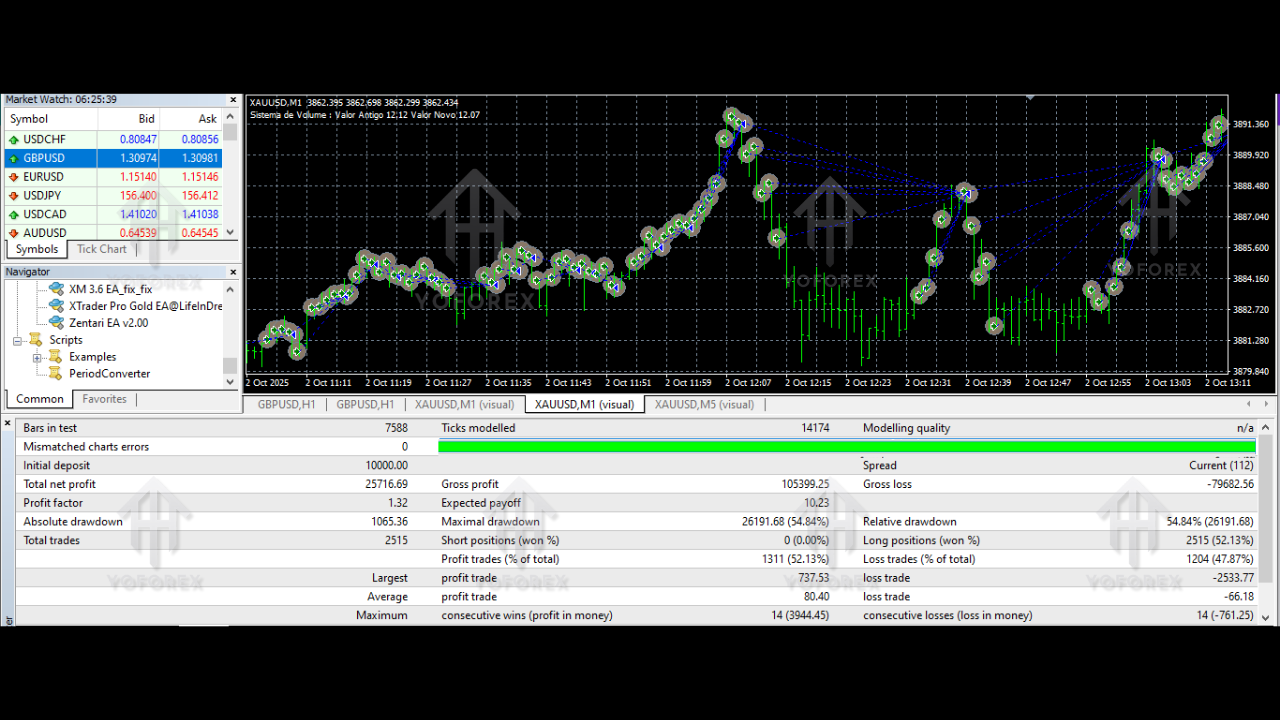

XTrader Pro Gold EA is not tied to any specific timeframe; you can run it on any chart, but Gold scalpers generally prefer M1 or M5 because that’s where the EA naturally performs best.

How the EA Enters & Manages Trades

The EA uses a combination of three operational layers:

1. Entry Logic

Instead of entering randomly or using repainting indicators, the EA:

• monitors tiny structure shifts

• reads momentum bursts

• waits for volatility confirmation

• checks session-based volumes

This gives it an edge that fits Gold’s rhythm.

2. Position Management

Trades are opened in micro-lots (depending on balance), allowing the EA to scale exposure smoothly without over-leveraging.

There’s no pure martingale, no forced lot-doubling. Instead, the EA uses progressive scaling, adjusting lot sizes only if the risk profile remains safe.

3. Basket Exit & Risk Logic

Rather than setting individual stop losses, the EA calculates the collective drawdown of all open trades and triggers exits at optimal moments—often during volatility reversals or liquidity taps.

This reduces:

• random stop-loss hits

• unnecessary losses

• high stress during spikes

And no, this isn’t the irresponsible “never take a loss” approach. Losses are managed responsibly—just intelligently.

Performance – Verified Myfxbook Results

The highlight of this EA is its live-verified performance, which is rare in today’s EA industry filled with fakes.

What the Live Data Shows

- 287.92% total gain

- 85% win rate across thousands of trades

- 3,130+ executed trades, not cherry-picked

- Consistent monthly returns, not huge but stable

- Controlled drawdown due to portfolio-level logic

These aren’t demo tricks. The Myfxbook data shows a real account running the EA and performing steadily over time.

In the world of Gold trading—where many EAs blow up within weeks—this consistency is a big deal.

Account Requirements & Recommended Setup

One thing traders appreciate is that XTrader Pro Gold EA doesn’t demand unrealistic deposits.

Minimum Deposit

- $100 on a normal MT4 account

- Or $10 on a cent account (great for beginners)

Leverage

- Works with any leverage, though 1:500 gives the most flexibility.

Broker Types

Works best with:

• ECN brokers

• Raw spread or low-spread accounts

• Fast execution environments

(You can still run it on standard accounts, but spreads affect scalping profits.)

VPS Recommendation

Gold scalping benefits from:

• latency under 10ms

• stable 24/7 connection

A VPS is not mandatory, but definitely increases consistency.

Timeframes

Although the EA adapts to any timeframe, for best performance:

• M1 or M5 is recommended.

Who Should Use XTrader Pro Gold EA?

This EA works amazingly well for three types of traders:

1. Beginners With Small Accounts

The ability to start with $100 (or $10 on cent) makes it super beginner-friendly.

Even tho Gold is volatile, the EA handles exposure intelligently.

2. Intermediate Traders Seeking Automation

If you’re tired of manually scalping XAUUSD all day—especially during London/NY overlap—this bot removes that pressure.

3. Advanced Traders Wanting Smart Risk Logic

Grid and martingale blow accounts because they lack collective management.

This EA does the opposite—it controls risk through portfolio logic, not blind averaging.

Pros & Cons of XTrader Pro Gold EA

Pros

- Verified Myfxbook results

- No blind martingale

- Intelligent basket exit

- Perfect for fast Gold scalping

- Low starting capital

- Trades only during stable liquidity

- Excellent win rate

- Transparent, data-driven logic

Cons

- Doesn’t trade 24 hours (but that’s actually safer)

- Requires a low-spread broker for best results

- Some traders may see fewer trades if market stays quiet

Final Verdict – Is XTrader Pro Gold EA Worth It?

If you’re looking for an EA that can actually handle Gold’s madness—without artificial hype—XTrader Pro Gold EA V1.0 MT4 is genuinely one of the safer options out there. It has a very realistic approach to profitability: small, frequent wins backed by smart collective risk control.

Comments

Leave a Comment