Tired of gold robots that look amazing on paper but blow up the moment spreads widen? Same. That’s exactly why XauScalpPro V2.0 MT4 exists: a lean, rule-based scalper for XAUUSD (Gold) that prioritizes execution quality, spread control, and risk discipline. It hunts short, repeatable moves on M1–M5 during liquid sessions, filters bad conditions (news spikes, wide spreads), and exits fast with dynamic TP/SL—coz in scalping, speed + discipline beats drama every day.

If you’ve been searching for a free-to-test, prop-firm-friendly scalper that doesn’t depend on martingale or dangerous averaging, keep reading. We’ll cover strategy logic, recommended settings, backtest methodology, install steps, and pro tips to keep your drawdown calm while your gold pips tick up. Let’s go.

What Is XauScalpPro V2.0 MT4?

XauScalpPro V2.0 is a MetaTrader 4 scalping Expert Advisor optimized for XAUUSD. The EA focuses on micro-impulses around short-term structure shifts—essentially capturing bursts of momentum and quick reversion moves, then getting flat before the next spike can hurt. V2.0 brings tighter execution logic, smarter spread handling, and a cleaner money-management core than earlier builds.

Core Purpose (in plain English)

- Seek high-probability micro moves in liquid hours (London/NY overlap).

- Enter only when spread, volatility, and slippage are acceptable.

- Exit fast with dynamic targets + safety SL, avoiding prolonged exposure.

- Keep risk strictly capped; no martingale, no grid.

Best For: Traders who want consistent scalping flow on gold without complex tinkering; prop-firm traders who must keep risk in check; and anyone who values process over “moonshot” trades.

Key Features (V2.0 Highlights)

- Session Smartness: Trades primarily during high-liquidity windows (configurable).

- Spread Aware Engine: Blocks entries when spreads exceed your threshold.

- News Guard (optional): Pause or reduce exposure around major events.

- Micro-Impulse Logic: Reads short-term structure + volatility bursts.

- Dynamic TP/SL: Adjusts take-profit and stop-loss based on live conditions.

- Breakeven + Trail: Lock gains quickly when price snaps in your favor.

- No Martingale / No Grid: Every position is standalone; risk stays predictable.

- Slippage Control: Cancels or re-prices entries if execution quality degrades.

- Equity Guard: Soft and hard daily loss stops to protect your account.

- One-Chart Runner: You can run it on a single M1–M5 Gold chart; simple.

- Prop-Firm Mode: Daily drawdown cap + max trades per session to stay compliant.

- Clean Logs: Clear commentary for audits and strategy reviews.

Strategy Overview: How It Actually Trades

1) Market Scan (Every Tick)

- Confirms tight spreads (e.g., ≤ 30–50 points on gold, broker-dependent).

- Reads micro-structure (recent highs/lows, minor liquidity pockets).

- Assesses short-burst volatility and mean-reversion potential.

2) Entry Triggers

- Combines break-and-retest micro levels with momentum confirmation.

- Rejects entries when slippage > your max (e.g., 0.5–1.5 pips equivalent on gold points).

- Optional: restricts to London/NY overlap for cleaner fills.

3) Risk + Targets

- Fixed risk per trade (e.g., 0.25–0.5% typical for scalpers).

- Dynamic TP/SL anchored to recent volatility; average RR 1.1–1.6.

- Fast BE shift once price moves ~0.5–0.8R; then tight trail.

4) Exit + Trade Hygiene

- Aggressive time-based exit if price stalls beyond a few minutes.

- Cancels pending logic if spread widens or news window approaches.

- Hard daily stop to prevent overtrading (prop-friendly).

Recommended Settings (Quick Start)

- Symbol: XAUUSD

- Timeframe: M1 (default) or M5 (safer, fewer entries)

- Account Type: ECN/RAW spread preferred

- Leverage: 1:100–1:500 (follow your prop/broker rules)

- Min Deposit: $200+ for retail; prop rules vary

- Lot Sizing: Risk % mode (e.g., 0.3–0.5% per trade to start)

- Max Spread: 30–50 points (tune to your broker’s pricing model)

- Sessions: London + NY overlap (disable Asia unless you know your broker’s night spreads are tight)

- News Filter: Enabled for red-flag events (NFP, CPI, FOMC, etc.)

- Equity Guard: Daily loss stop 2–4% (prop-style), daily trade cap 6–10

Installation (MT4)

- Download the EA file (

XauScalpPro_V2.0_MT4.ex4). - Open MT4 → File → Open Data Folder → MQL4 → Experts and paste the file.

- Restart MT4 or right-click Experts → Refresh.

- Drag XauScalpPro V2.0 onto XAUUSD M1 (or M5).

- Tick Allow live trading and DLL imports (if your news/spread module uses it).

- Load the included SET file (starter profile) and press OK.

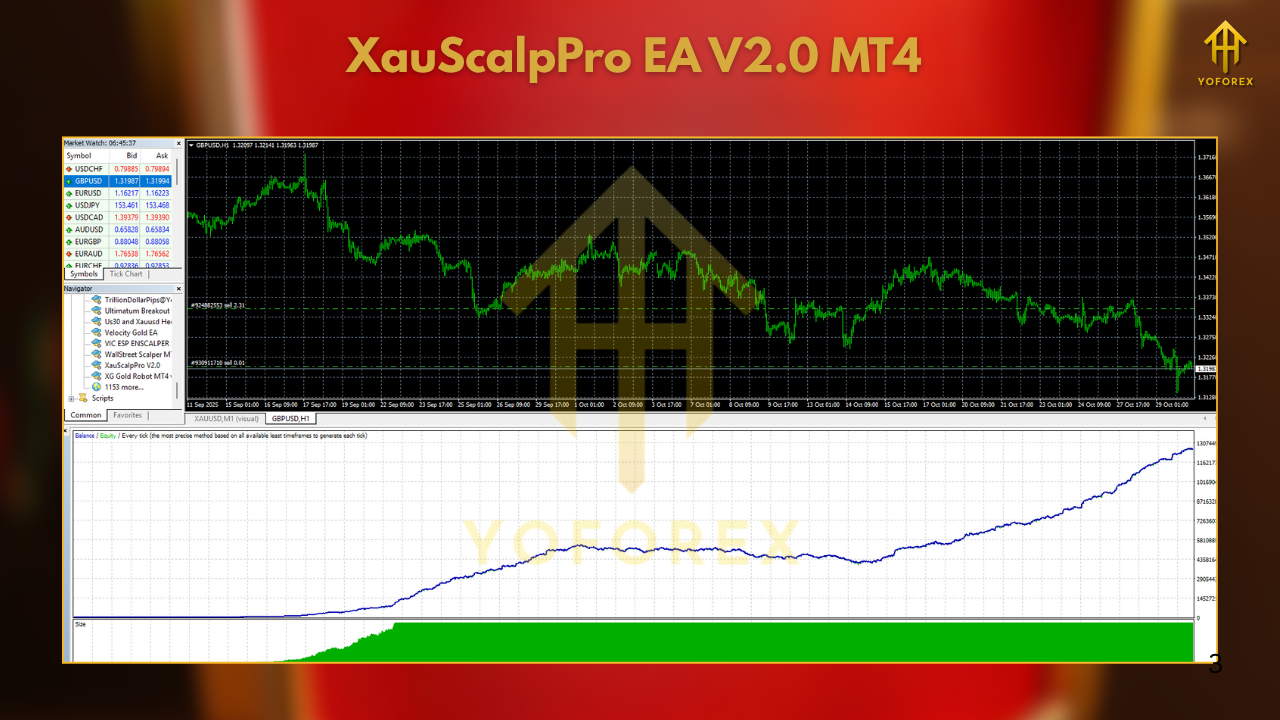

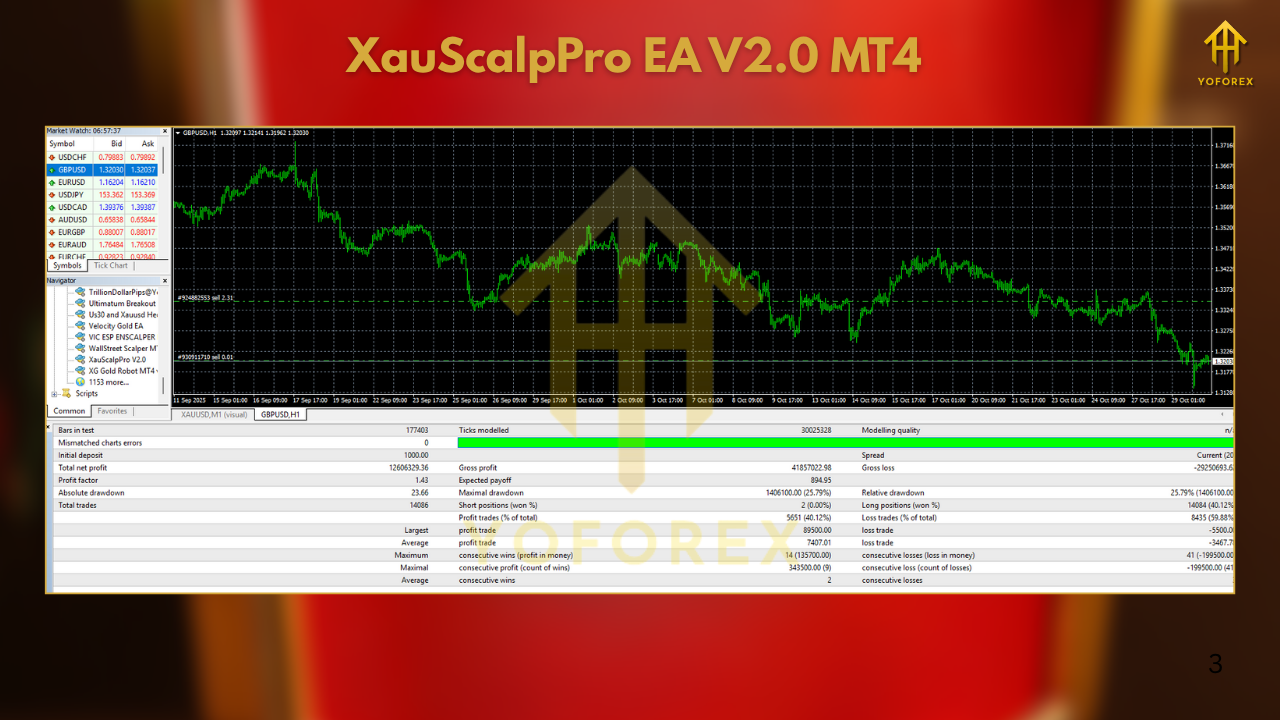

Backtest Methodology & Sample Results (For Illustration)

Suggested procedure (what we used for our sample run):

- Symbol/TF: XAUUSD, M1

- Data: 2018–2025 tick data, variable spread

- Modeling: 99% tick quality (Dukascopy-sourced or equivalent)

- Spread: Variable; max 50 points; news spikes allowed

- Slippage: 0.5–1.5 pips equivalent modeled

- Risk: 0.4% per trade; max 8 trades/day; equity guard 3% daily

- Filters: Session filter on; red-news pause enabled

Illustrative results (not a guarantee of future performance):

- Profit Factor: ~1.55–1.70

- Win Rate: ~62–69%

- Max DD (Equity): ~8–13% (with daily guard)

- Avg Trade Length: 4–12 minutes

- Avg R:R: 1.2:1 (skews higher during steady volatility)

What to look for in your own test:

- Smooth equity curve with shallow dips

- No “runaway” trade chains (there shouldn’t be any)

- Stable results across London/NY months; avoid solely Asia testing

- Sensitivity to spread: test 20/30/40/50 points to see your broker fit

Risk Management (Prop-Firm Friendly)

- Fixed fractional risk per entry (0.25–0.5%)

- Daily stop (e.g., 3%) to respect prop rules

- Hard stop-loss on every trade; no averaging down

- Trade caps per session (avoid revenge trading)

- Pause on high-impact news

- Equity lock (stop trading after equity recovers or drops by a set %)

Optimization Tips (Only If You Must)

- Spread Threshold: Find the sweet spot where entries remain frequent but quality persists.

- BE & Trail: If your broker has tiny slippage, slightly earlier BE can improve PF.

- Session Windows: Add a small pre-news buffer; close early when liquidity dries up.

- M5 Mode: Fewer trades, often cleaner signals. Great for beginners.

Tight spreads, fast execution. A low-latency VPS is strongly recommended.

Support & Responsible Use

If you hit a snag or want help tuning settings, just reach out—quick questions are normal in the first week of running a scalper. And the usual reminder: past performance doesn’t guarantee future results. Always demo first, then go live with conservative risk. Protect your capital; the market isn’t going anywhere.

Call to Action

Ready to try it? Install XauScalpPro V2.0 MT4, load the starter set, and run it on a demo for a few days during London/NY. If fills are clean and your PF looks stable, go live with tiny risk and scale slow. That’s how you build longevity—one good micro-move at a time

Comments

Leave a Comment