Xaurus Pro100 EA V8.0 MT5 is one of the newer automated trading systems designed for traders who want consistent entries, fast execution, and hands-free trading on the MetaTrader 5 platform. Over the past few years, many Expert Advisors have attempted to combine intelligent algorithms with risk-controlled trading methods, but Xaurus Pro100 V8.0 aims to differentiate itself through structured trade filtering, adaptive strategy behavior, and long-term stability. This review covers everything a beginner or experienced trader needs to know before using it on a live or funded trading account.

The EA is built with an upgraded core engine in version 8.0 that focuses on improved trend identification, enhanced position scaling, and reduced exposure during high volatility phases. The developers claim that the EA can filter out low-probability trades by analyzing market cycles, micro-momentum, price displacement, and volatility bands. While many EAs tend to over-optimize strategies for a specific period, Xaurus Pro100 V8.0 MT5 attempts to remain consistent across multiple market conditions.

This blog post provides a full review of the system’s design, strategy principles, recommended settings, and overall performance expectations. Traders looking for a stable MT5 Expert Advisor may find Xaurus Pro100 EA V8.0 MT5 as a flexible option, especially for those interested in diversification alongside manual and semi-automated strategies.

Overview of Xaurus Pro100 EA V8.0 MT5

Xaurus Pro100 EA V8.0 MT5 is built for MetaTrader 5 and is compatible with both standard and ECN accounts. Its primary strength lies in dynamic filtering. Instead of blindly opening orders, it evaluates trend direction, momentum exhaustion, and market structure before placing trades. This helps reduce unnecessary drawdowns and overtrading, which are common weaknesses in lower-quality automated systems.

The EA uses a combination of trend-following confirmation, volatility breakout logic, and micro-retracement entries. The goal is to enter positions when the market is showing clear directional intent but without exposing the account to excessive risk.

Another important aspect is the EA’s ability to adapt position sizes based on market behavior. Version 8.0 improved how the EA manages trade sequences and drawdowns by implementing configurable risk blocks, which prevent the system from overloading the account during turbulent markets. Traders can adjust lot sizing, risk percentage, and maximum concurrent trades depending on their capital and risk appetite.

How the Strategy Works

The system uses a blend of smart execution rules that trigger positions only when multiple criteria align. While the exact proprietary algorithm is not disclosed publicly, the strategy can be summarized with three major components:

1. Trend Identification

The EA scans the market using directional filters to determine whether the trend is bullish, bearish, or ranging. It looks for higher highs and higher lows or lower lows and lower highs to ensure positions follow market structure rather than countering it.

2. Volatility Analysis

Before entering a trade, Xaurus Pro100 evaluates market volatility to avoid sudden spikes, news-driven movements, and unstable sessions. This reduces the probability of entering at the peak of a move or in a choppy zone.

3. Dynamic Entry and Scaling

Once the market condition is validated, the EA opens positions using a precise set of rules. If the market continues in the expected direction, the EA may scale in with controlled additional entries. These scaled entries help maximize profits in strong trends without introducing unnecessary risk.

Each component plays a vital role in maintaining long-term performance and reducing the overall uncertainty of automated trading.

Supported Timeframes and Currency Pairs

Xaurus Pro100 EA V8.0 MT5 works best on fast yet predictable price movements. Although the EA supports multiple symbols, the most commonly used pairs in testing environments include:

- XAUUSD

- EURUSD

- GBPUSD

- USDJPY

Timeframes may vary depending on the trader’s preference, but the recommended timeframes for stable execution are:

- M15

- M30

- H1

These timeframes provide enough market data for the algorithm to identify genuine momentum shifts while avoiding the noise present in very low timeframes.

Recommended Minimum Deposit and Account Requirements

The minimum recommended deposit for this EA depends on the risk level:

- Low Risk: $500–$1000

- Medium Risk: $250–$500

- High Risk: $100–$250

For best execution, use:

- Leverage: 1:500 or higher

- Account Type: ECN or Raw Spread

- Platform: MT5

- VPS: Recommended for uninterrupted operations

Running the EA on a stable VPS ensures faster order execution and avoids chart freezes or disconnections.

Key Features of Xaurus Pro100 EA V8.0 MT5

1. Adaptive Algorithm

The EA dynamically adjusts to market structure and volatility. This is essential for minimizing losses during uncertain market conditions.

2. Multi-Pair Support

You can run the EA on several pairs at once, which helps diversify trade opportunities and reduce dependence on a single market.

3. Improved Version 8.0 Core Engine

The update includes smoother filtering, more precise execution logic, and better risk handling.

4. User-Friendly Input Settings

Even beginners can configure risk percentage, lot sizing, stop loss levels, and maximum trades.

5. Compatibility with Funded Accounts

The EA can be tuned for prop-firm rules by adjusting risk, max drawdown, and lot behavior.

6. Non-Martingale Structure

The EA avoids traditional martingale doubling, which significantly reduces blown-account risk.

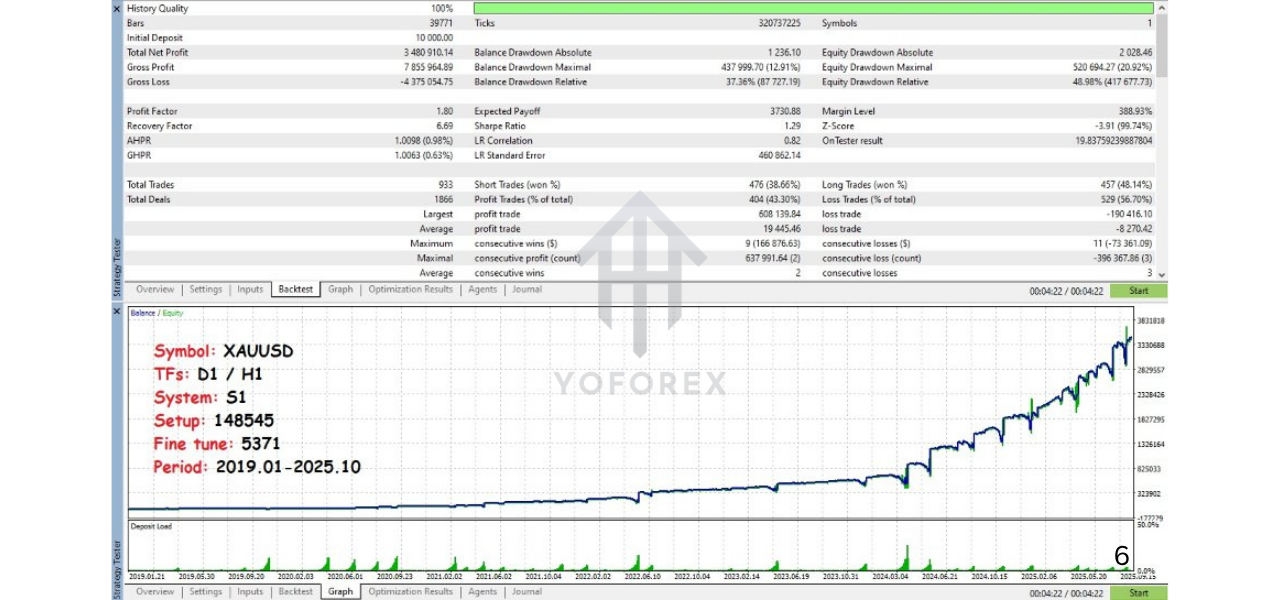

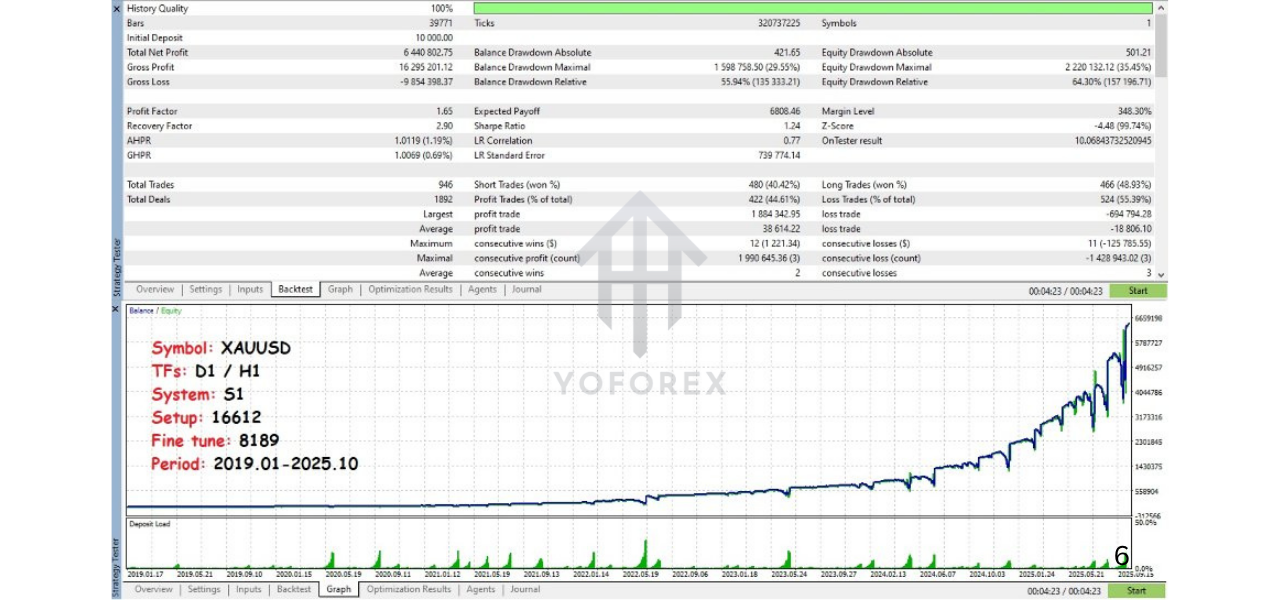

Performance Expectations

It is important to note that no EA guarantees profits. Results depend on broker conditions, spreads, VPS quality, and market volatility. However, Xaurus Pro100 EA V8.0 MT5 has been designed to seek stable long-term performance rather than rapid risky gains.

Traders may observe:

- Controlled frequency of trades

- Higher accuracy during trending markets

- Lower exposure during volatile times

- Consistent risk-to-reward logic

Long-term performance is more stable when the EA is used with disciplined risk management.

Risk Management Features

One of the biggest improvements in version 8.0 is better risk control. Key components include:

- Maximum drawdown limit

- Maximum open trades

- Safe lot scaling

- Hard stop loss integration

- Risk percentage control

These features help traders prevent excessive losses and protect account equity.

Pros and Cons

Pros

- Strong filtering and structured entries

- Flexible configuration options

- Works on multiple currency pairs

- Suitable for beginners and semi-professional traders

- Lightweight and fast execution

Cons

- Requires stable VPS for best performance

- Needs proper settings to avoid overtrading

- Performance varies based on market conditions

Who Should Use This EA

Xaurus Pro100 EA V8.0 MT5 is ideal for:

- Traders who prefer automated systems

- Beginners seeking structured entries

- Users testing strategies on demo or funded accounts

- Traders who want stable risk-controlled performance

Final Verdict

Xaurus Pro100 EA V8.0 MT5 offers a balanced automated trading solution built for traders who want steady performance with reduced emotional involvement. Its improved filtering, dynamic entries, and adaptable risk settings make it a strong option for those looking to automate their MetaTrader 5 trading. While no EA is perfect, this system is built for long-term sustainability rather than aggressive high-risk results.

For traders seeking structure, stability, and multi-pair adaptability, Xaurus Pro100 EA V8.0 MT5 can be a valuable tool in their trading portfolio.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment