Waynes Pivots Bulls BT Indicator V1.0 (MT4/MQ4): A Practical Guide for Pivot-Level, Bull-Bias Trades

Introduction: Why another pivot tool?

If you’ve ever marked daily pivots by hand, missed a clean New-York session bounce, or got chopped in mid-range coz the bias wasn’t clear—this indicator is aimed right at that pain. Waynes Pivots Bulls BT Indicator V1.0 for MT4 builds a structured map of Floor pivots around price (S1/S2/S3, R1/R2/R3, and the central pivot), then overlays a Bulls BT (Bullish Trend/Trigger) module to help you filter for long-side opportunities only—no second-guessing. It’s lightweight, readable, and designed for intraday and swing traders who want quick, visual, rules-based context without bloated dashboards.

In this guide, you’ll learn what it does, how to use it step-by-step, the best time frames and markets, plus risk tips. Keep things simple, keep it consistent… and let the levels do the talking.

What exactly is Waynes Pivots Bulls BT?

At its core, it’s a pivot-mapping indicator with a built-in bullish bias filter:

- Pivot engine: Plots the daily (and optional weekly) pivot ladder—Central Pivot (PP), R1–R3, S1–S3—derived from the prior session’s H/L/C.

- Bulls BT module: Highlights price context when the bullish side is favored (e.g., above PP with constructive structure, or momentum confirmation).

- Signal discipline: Rather than firing constant arrows, it focuses on context: “Are we in a valid long zone, yes or no?”—so you can pair it with your own trigger (pin bar, engulfing candle, or a momentum close).

Why it works: Pivots are watched by a lot of traders and algos. Price frequently reacts at PP, R1/S1, etc.—either as a bounce, a fade, or a breakout. The Bulls BT overlay nudges you to align with bullish flows instead of randomly counter-trading at resistance.

Who is it for?

- Intraday traders who love structure (M5/M15): Looking for pullbacks to PP/S1 in an up-day.

- Swing traders (H1/H4): Seeking trend-continuation buys near daily/weekly PP after a strong close.

- News-aware scalpers: You want clear “levels to lean on” when spreads settle.

- Beginners: You want a clean map that reduces analysis time and over-trading.

Key Features (at a glance)

- • Clean pivot ladder: PP, R1–R3, S1–S3, with optional mid-levels.

- • Bulls BT context: Visual cue when market state supports long-only setups.

- • Session-friendly: Levels hold intraday meaning for London/NY sessions.

- • Multi-timeframe clarity: Works on M5 through H4 (recommended M15–H1).

- • Asset-agnostic: Designed for EURUSD, GBPUSD, XAUUSD, also fine on major FX.

- • Lightweight code: Snappy on low-spec VPS or older PCs.

- • Customizable colors/labels: Style the chart your way.

- • Alerts (if enabled): Get pinged when price tags PP/S1/R1 and Bulls BT is valid.

- • No repainting pivots: Levels are fixed once a day; structure is stable.

- • Risk-first design: Encourages buys at support with tight invalidation.

How to trade it (simple blueprint)

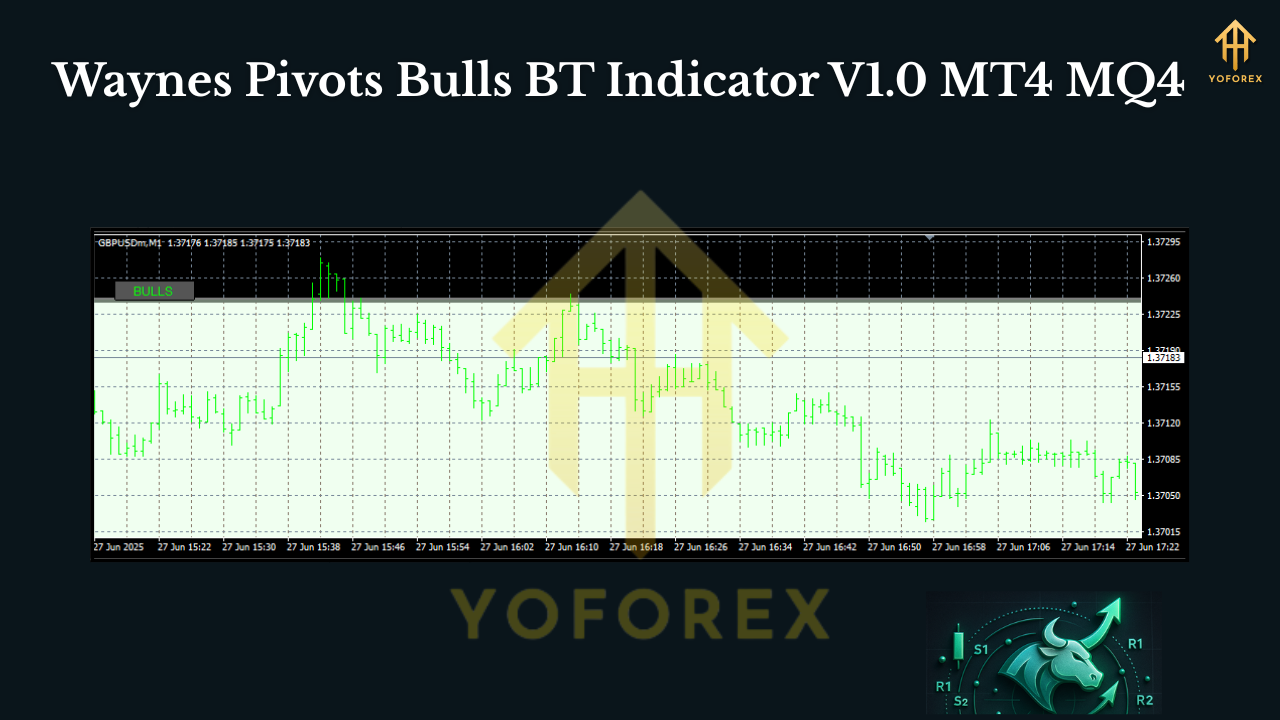

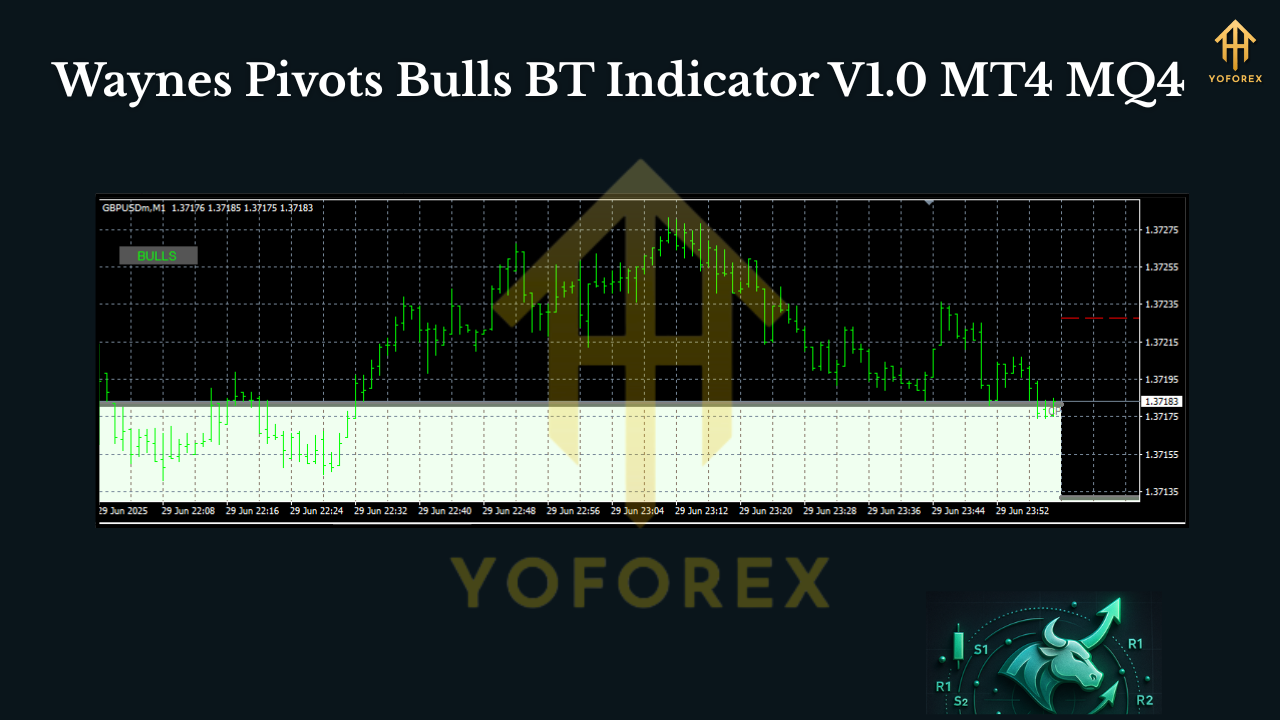

Bias: Only look for longs when the Bulls BT overlay is active and price is above PP (or reclaiming PP after a brief dip).

Zones to watch:

- Pullback to PP after a bullish open → buy the first strong bullish candle close that respects PP.

- Shallow dip to S1 in an up-day → look for a wick rejection + close back above PP or the intraday VWAP/MA you trust.

- Breakout continuation: If price drives above R1 and consolidates, buy a retest of R1 (now support) with Bulls BT still on.

Stops & targets (example):

- Stop: Below the swing low that forms at/near PP or S1 (keep it logical, not arbitrary).

- TP1: The next pivot (e.g., R1 or R2).

- TP2 (runner): Trail behind higher lows or a small ATR-based stop until structure breaks.

Pro tip: If the day opens under PP and stays capped beneath it, skip longs—your BT overlay should help keep you disciplined.

Best time frames & pairs

- Time frames: M15 is a sweet spot for intraday clarity; H1 for cleaner swings; M5 if you’re experienced and disciplined.

- Pairs: EURUSD, GBPUSD are clean with pivots. XAUUSD (Gold) reacts beautifully to PP/R1/S1 but can be volatile—position size smaller. The indicator works on most majors; steer clear of illiquid exotics.

Inputs & settings (suggested starters)

- Pivot type: Standard (Floor).

- Daily pivots: ON (primary).

- Weekly pivots: Optional (turn on if you want higher-timeframe confluence).

- Bulls BT filter: ON.

- Mid-levels: OFF initially (add later if you want more granularity).

- Alerts: Tag-Pivot + Bulls BT Valid (helps you avoid chart-staring).

- Visuals: Keep PP bold and bright; R/S levels slightly muted.

Risk management (yes, even for indicators)

This is not an EA—entries are discretionary—so risk control matters.

- Capital: If you’re new, start with $100 on a cent/micro account (or demo) to test.

- Per-trade risk: 0.25–0.5% until you have at least 30–50 tracked trades.

- Spread & slippage: Avoid chasing at illiquid hours; pivots behave best during London/NY overlap.

- News: Big data releases can smash through pivots—trade smaller, wider stops, or stand aside.

Example play: PP bounce → R1 tag

- London open pushes above PP; Bulls BT lights up.

- Price pulls back to kiss PP; prints a long-wick rejection and closes bullish.

- Enter on the close (or on a small limit near PP if you’re nimble).

- Stop goes a few pips below the PP swing low.

- TP1 at R1; scale partial. Trail the rest to structure for a potential R2 run.

- If price loses PP with a strong close, exit runners—bias invalid.

Installation (MT4 quick start)

- Download the Waynes Pivots Bulls BT Indicator V1.0 MQ4 file.

- Open MT4 → File → Open Data Folder → MQL4 → Indicators and paste the MQ4.

- Restart MT4 (or right-click Indicators → Refresh).

- Navigator → Indicators, drag Waynes Pivots Bulls BT onto your chart.

- In Inputs, enable Bulls BT, keep daily pivots ON, hit OK.

- Save as a template so you can apply it in one click next time.

Common mistakes to avoid

- Counter-trend buying when price is capped under PP (no Bulls BT).

- Buying right into R1 without room for RR>1—wait for a retest or a clean pullback.

- Treating it like a signal bot: It’s a context tool; pair it with your trigger rules.

- Over-optimizing: Keep settings simple for a month; then tweak gradually.

Final thoughts

There’s beauty in objective levels: PP, R1/S1, R2/S2… They’re not magic, but they’re consistent reference points. Waynes Pivots Bulls BT Indicator V1.0 keeps the screen clean, the bias honest, and your playbook repeatable. Start on demo, log the results, and only scale once you can show yourself 30–50 trades where you followed your plan. That’s the game.

Trade well—and let the pivots do the heavy lifting.

Comments

Leave a Comment