Automated forex trading has come a long way, and traders today demand more than just signals or random algorithmic entries. They want intelligence, adaptability, and safety — all packed in a single system. WallStreet Recovery PRO EA V1.7 for MetaTrader 4 stands as one such innovation, designed to not only trade profitably but also recover smartly from temporary losses. This Expert Advisor (EA) takes a structured approach to capital protection while maintaining consistent growth in volatile markets.

This blog explores how WallStreet Recovery PRO works, why it has become a favourite among serious traders, and how you can use it effectively to improve your overall trading performance.

Understanding WallStreet Recovery PRO EA V1.7 MT4

WallStreet Recovery PRO EA is an automated trading system built to execute trades on the MT4 platform without manual intervention. It is part of the WallStreet series of EAs known for their discipline, recovery intelligence, and low-risk performance.

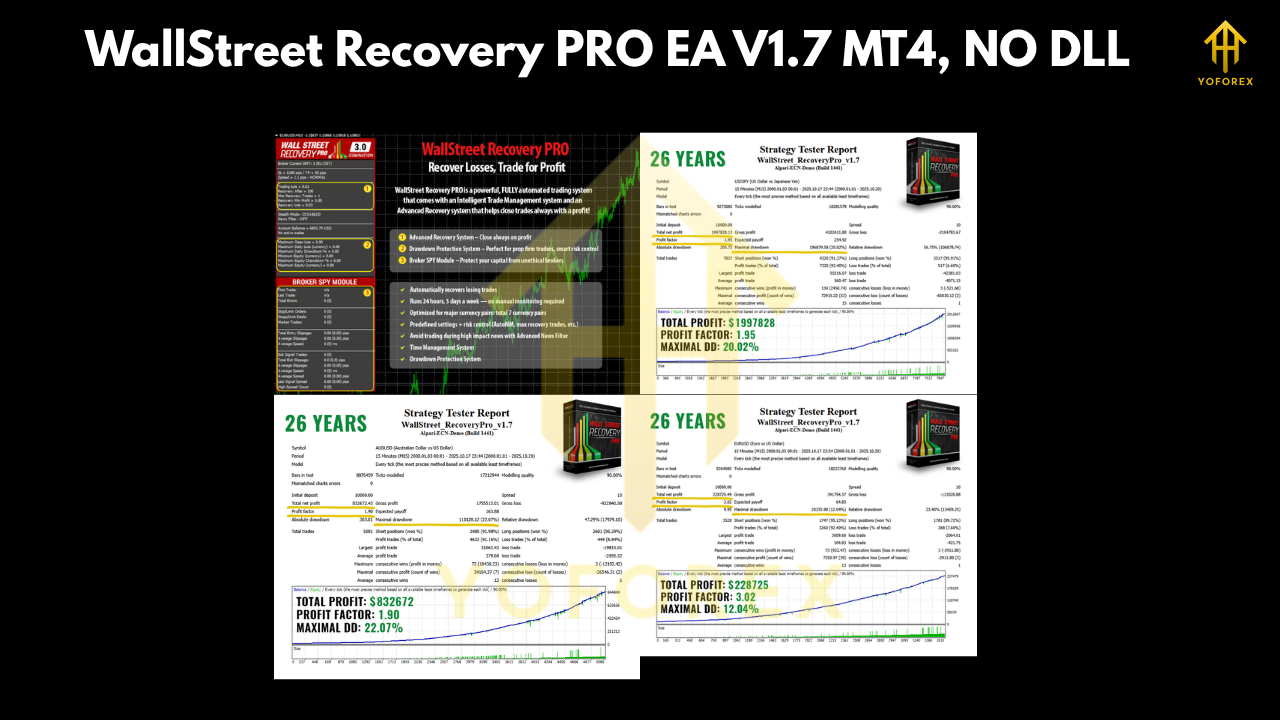

The V1.7 update enhances execution precision, strengthens drawdown control, and improves adaptability in volatile sessions. It uses mathematical logic to recover from losing trades while maintaining balance protection. Instead of relying on high-risk strategies like martingale or grid averaging, this EA focuses on calculated position adjustments that prioritise safety and longevity.

The ultimate goal of this EA is capital recovery with profit optimisation — ensuring traders can sustain longer, trade smarter, and keep risk within manageable limits.

Core Trading Concept

At its heart, WallStreet Recovery PRO EA uses a trend–retracement hybrid approach. It identifies potential reversals or exhaustion points after a strong directional move, entering trades during controlled retracements. If the price moves temporarily against the position, the EA’s recovery logic activates.

This recovery process is not blind averaging; instead, it analyses volatility, spread, and timing to determine the next trade placement. Each layer of recovery aims to minimise overall exposure while bringing the floating loss back to profit.

Key principles include:

- Controlled recovery trades — no random grids or infinite doubling.

- Fixed and dynamic lot sizing, depending on risk mode.

- Trade filters based on volatility and liquidity conditions.

- Built-in time control to avoid low-volume market hours.

The result is a disciplined system that attempts to recover drawdowns methodically, keeping equity growth steady.

Why WallStreet Recovery PRO Stands Out

Many EAs promise profits, but few can manage losses effectively. WallStreet Recovery PRO EA is designed precisely for that — to protect your trading capital while maintaining profitability.

1. Risk Control First

The EA integrates a multi-layer protection system including stop-loss logic, volatility filters, and slippage detection. It avoids trading during high-impact news releases and automatically adjusts to current spread conditions.

2. Smart Recovery Algorithm

Instead of using a typical martingale multiplier, the EA employs a mathematical progression that controls exposure. Each recovery trade has a purpose, aiming to bring the average entry closer to breakeven while maintaining proper money management.

3. Drawdown Limiter

It has a built-in drawdown cap that stops trading once losses reach a certain percentage of the account, preventing account wipeouts.

4. Auto Money Management

WallStreet Recovery PRO adjusts the lot size automatically based on balance, maintaining consistent risk per trade.

5. Plug-and-Play Simplicity

Traders do not need to load external settings. Default parameters are optimized for popular pairs, making setup easy even for beginners.

Recommended Trading Environment

To achieve the best results, use WallStreet Recovery PRO EA under the following conditions:

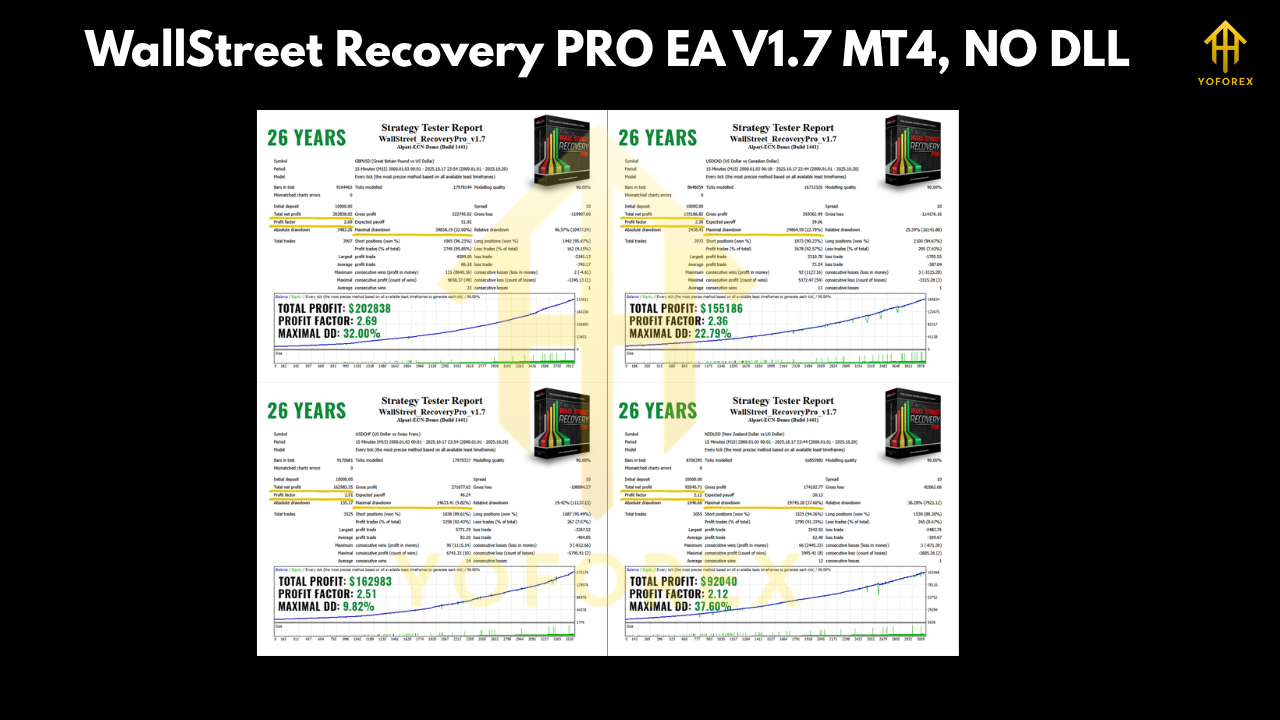

- Platform: MetaTrader 4

- Timeframe: M15

- Currency Pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, USDCAD, NZDUSD, and USDCHF

- Minimum Deposit: $200 or more (recommended $500+)

- Broker Type: ECN or STP with low spread and fast execution

- Leverage: 1:100 or higher

- Hosting: VPS with 24/7 uptime for uninterrupted performance

These conditions allow the EA to execute orders precisely and avoid missed opportunities due to latency or downtime.

Best Practices for Using WallStreet Recovery PRO

- Monitor Account Equity – Even with automation, periodically review drawdowns and open trades.

- Avoid Interference – Don’t manually close trades unless necessary; the system is designed to self-manage positions.

- Use VPS Hosting – Keep the EA running without interruptions, especially during active sessions.

- Update Regularly – Always use the latest version to benefit from performance optimisations.

By following these guidelines, traders can maximise the stability and performance of this recovery-based system.

Advantages of WallStreet Recovery PRO EA

- Fully automated operation with minimal supervision.

- Compatible with major brokers and prop firm accounts.

- Adaptive recovery logic for controlled risk management.

- Avoids trading during high volatility news events.

- Built-in features to counter spread widening and slippage.

- Flexible configuration suitable for both beginners and professionals.

- Long-term sustainability due to a non-aggressive trading style.

Limitations to Keep in Mind

- The EA performs best under stable market conditions; extreme volatility may still cause drawdowns.

- Requires consistent VPS uptime for uninterrupted execution.

- Recovery logic needs sufficient margin and leverage; underfunded accounts may experience slower recovery.

- As with any EA, profitability depends on broker quality and market liquidity.

While these limitations exist, they can be managed through disciplined usage and proper configuration.

Why It’s a Great Choice for Beginners

For new traders, WallStreet Recovery PRO EA offers an excellent learning curve. It doesn’t require advanced trading knowledge, complex settings, or manual intervention. The default setup is optimised, and users can observe how algorithmic recovery strategies work in real conditions.

This makes it ideal for traders who are exploring automation but still want a reliable, low-risk environment.

Long-Term Profit Strategy

The EA’s strength lies not in quick profits but in sustained capital growth. Traders who keep it running across multiple pairs benefit from diversification and smoother equity curves.

Combining WallStreet Recovery PRO with sound risk management — like limiting exposure per pair — can help achieve consistent, long-term returns. Patience is key: letting the algorithm operate continuously often yields better recovery and smoother performance over months rather than days.

Final Thoughts

WallStreet Recovery PRO EA V1.7 MT4 is more than just a forex robot — it’s a capital preservation system that thinks ahead. Its recovery engine, risk-control modules, and flexibility make it one of the most balanced EAs available today.

While no automated system can guarantee profits, this EA provides traders with an edge by focusing on protection first, profit second. When used correctly on suitable brokers with disciplined risk parameters, it can be a valuable addition to any trading portfolio.

If you’re looking for a beginner-friendly, fully automated system that balances recovery and growth, WallStreet Recovery PRO EA V1.7 is a strong contender.

Comments

Leave a Comment