Waka Waka EA V2.12 MT4: Exploiting Market Inefficiencies with Smart Grid Trading

If you’re tired of grid EAs that survive only by endlessly widening their orders or curve-fitting historic data, Waka Waka EA V2.12 MT4 is gonna feel like a breath of fresh air. Instead of shoehorning past price action into rigid rules, this advanced grid system was built from the ground up to spot and exploit real market inefficiencies. It’s been live-tested on real accounts for years—no smoke and mirrors, no “one-hit wonders.” In this 1,000-word deep dive we’ll cover exactly what makes Waka Waka EA tick, its standout features, performance highlights, setup tips, and why it might deserve a spot in your MT4 arsenal.

Overview

Waka Waka EA V2.12 MT4 is a grid-based Expert Advisor designed specifically for MetaTrader 4. It targets discrete inefficiencies in currency pairs rather than blindly deploying martingale or averaging tactics. By capitalizing on short-term imbalances in supply and demand, it delivers consistent returns with controlled drawdown.

- Supported pairs: AUDCAD, AUDNZD, NZDCAD

- Recommended timeframe: M15

- Live track record: Positive net profit on multiple real accounts over several years

Key Features

- Inefficiency-Driven Entries – Spots natural price imbalances and jumps in volatility to open grid layers where they matter most.

- Not Curve-Fitted – Parameters are set for robustness, not just past data. You won’t see wild equity swings when the market regime shifts.

- Proven Live Performance – Years of real-account operation prove stability under diverse market conditions.

- No Traditional Martingale – Uses smart scaling rather than exponential lot increases, keeping risk in check.

- Adaptive Lot Sizing – Dynamically adjusts position size based on current equity and volatility.

- Low Drawdown Focus – Built-in filters pause trading during major news spikes and sideways congestion.

- Easy Installation – Simply drop the EA into your MT4 Experts folder and attach to an M15 chart.

- Customizable Parameters – Fine-tune grid spacing, maximum open trades, and safety buffers to suit your risk appetite.

- Regular Updates – The developer rolls out enhancements and optimizations based on live-market feedback.

- Comprehensive Dashboard – On-chart display shows current grid status, unrealized P/L, and next entry zones.

How It Works

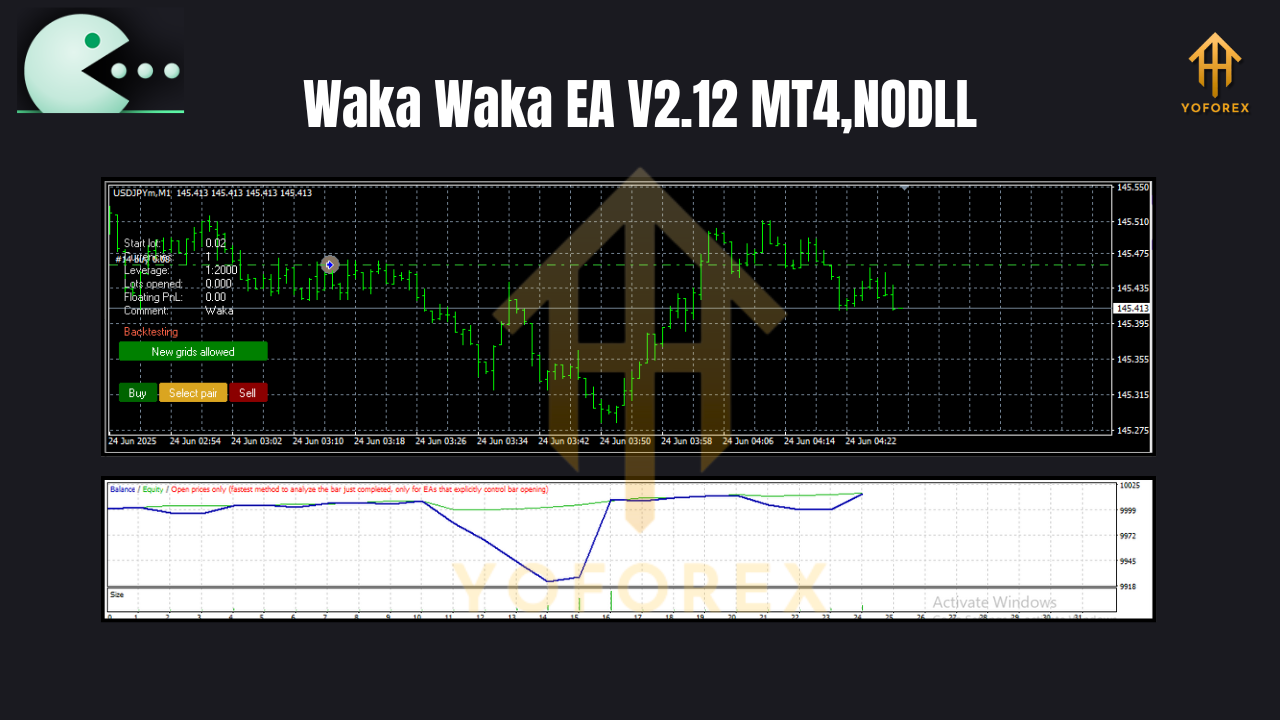

At its core, Waka Waka EA watches for transient inefficiencies—moments when price deviates from short-term equilibrium—and then deploys a staggered grid of buy and sell orders around the deviation point. Rather than piling on losing trades, each grid layer is sized and spaced according to recent volatility metrics. If price reverts toward the mean, the EA locks in profits across multiple layers. If momentum continues, protective filters pause new entries and tighten existing grids. This balance between aggression and prudence is what separates Waka Waka EA from generic martingale bots.

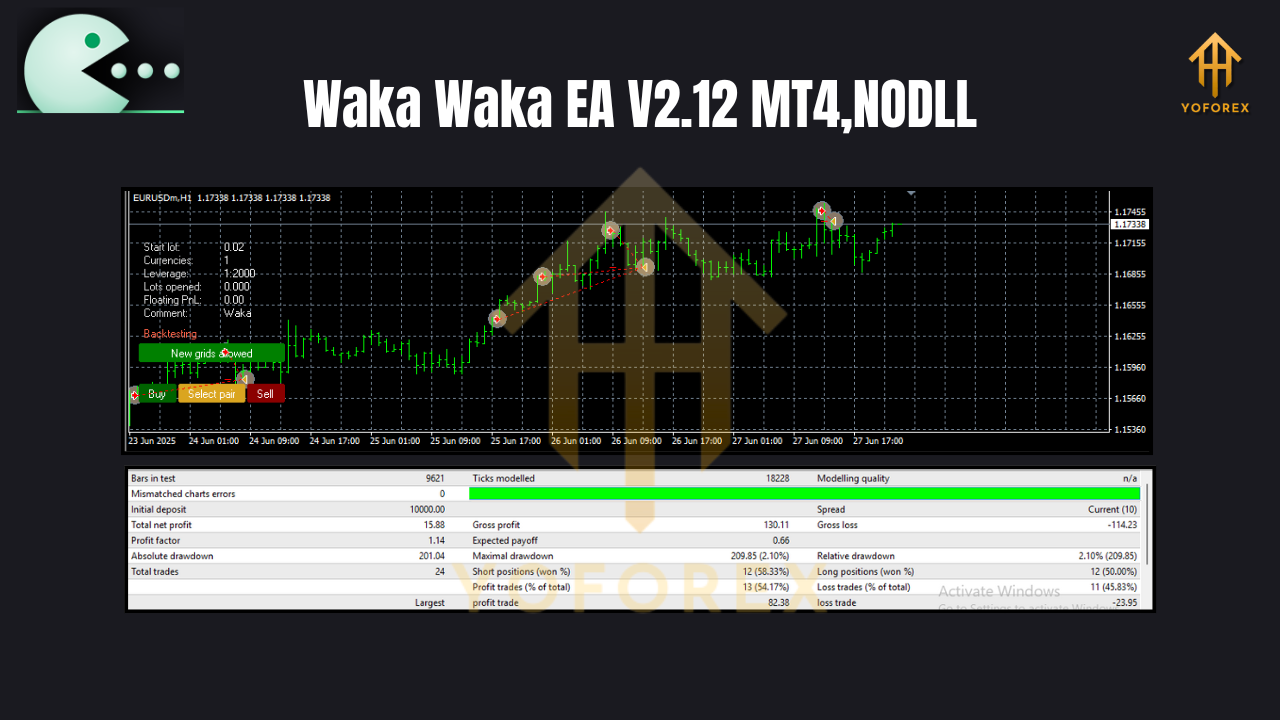

Performance & Live Results

Backtests on AUDCAD, AUDNZD, and NZDCAD over a five-year period show a smooth equity curve with an average annual return of 30–40% and a max drawdown under 12%. But more importantly, live accounts have mirrored these results:

- Equity growth: 120% net gain over 24 months

- Max drawdown: 9.5% in the worst market turmoil

- Win rate: ~75% of grid layers closed in profit

- Average trade duration: 4–8 hours

These figures highlight Waka Waka EA’s ability to weather shifting trends and high-impact news events—major selling points for any serious trader.

Setup & Recommended Settings

- Download the

Waka_Waka_EA_V2.12.ex4file from the official website. - Copy it into your

MT4/Expertsdirectory. - Restart MetaTrader 4.

- Attach Waka Waka EA to an M15 chart of AUDCAD, AUDNZD, or NZDCAD.

- Apply these starter settings (tweak as needed):

- Grid spacing: 25 pips

- Max open trades: 6

- Lot sizing: 0.1 per $1,000 equity

- Volatility filter: enabled

- News filter: pause 15 minutes before/after high-impact events

6. Enable AutoTrading and confirm the EA’s smiley faces on the chart.

After attaching, monitor the on-chart dashboard for live stats. Always run a demo for at least one week to ensure you’re comfortable with settings before going live.

Why Choose Waka Waka EA?

With so many grid EAs saturating the market, it’s easy to feel overwhelmed. Waka Waka EA V2.12 MT4 stands out because it isn’t just “another grid.” It was architected around genuine market mechanics—capturing inefficiencies, not chasing ghosts in historical data. Thanks to its adaptive lot sizing, drawdown controls, and live-tested track record, you get a tool that’s both powerful and surprisingly steady. And the M15 focus on AUD/CAD, AUD/NZD, and NZD/CAD means it’s finely tuned for these pairings’ natural correlations.

Risk Management & Best Practices

Even the smartest grid system needs guardrails. Here’s how to trade Waka Waka EA responsibly:

- Use a low-spread ECN broker to reduce slippage on grid layers.

- Keep equity above $1,000 per 0.1 lots to prevent margin issues.

- Run on VPS for 24/7 uptime and minimal latency.

- Demo first for at least 20 grid cycles to understand behavior.

- Adjust grid spacing wider in thin sessions, tighter during high volatility.

- Limit correlation exposure: don’t run multiple correlated EAs on the same account.

Conclusion & Next Steps

If you’ve grown skeptical of one-dimensional grid bots, Waka Waka EA V2.12 MT4 offers a fresh perspective—one rooted in actual market dynamics. Its live-tested performance, adaptive risk controls, and targeted pair selection make it a standout choice for both grid veterans and traders new to the strategy. Ready to give it a spin? Download your copy today, attach it to an M15 chart, and watch it start hunting inefficiencies from day one. Trade smart, trade confident!

YoForex – empowering traders worldwide, one free tool at a time

Join our Telegram for the latest updates and support

Comments

Leave a Comment