VolumeCandlesticks Indicator V1.08 MT5 — The Practical Guide (with settings, pairs & time frames)

If you’ve ever stared at regular candles and thought, “meh… where’s the pressure behind those moves?”, VolumeCandlesticks is kinda the upgrade you were waiting for. It overlays true market intent—via tick volume—on top of your candlesticks so you don’t just see what price did, you see how hard it had to work to get there. That little twist turns bland charts into storyboards: exhaustion before a reversal, stealth accumulation before a breakout, fake spikes with no fuel… all the good stuff.

Below is a simple, field-tested walkthrough to get you productive fast, whether you scalp the London open or swing trade majors. No fluff, promise.

What is VolumeCandlesticks V1.08 (MT5)?

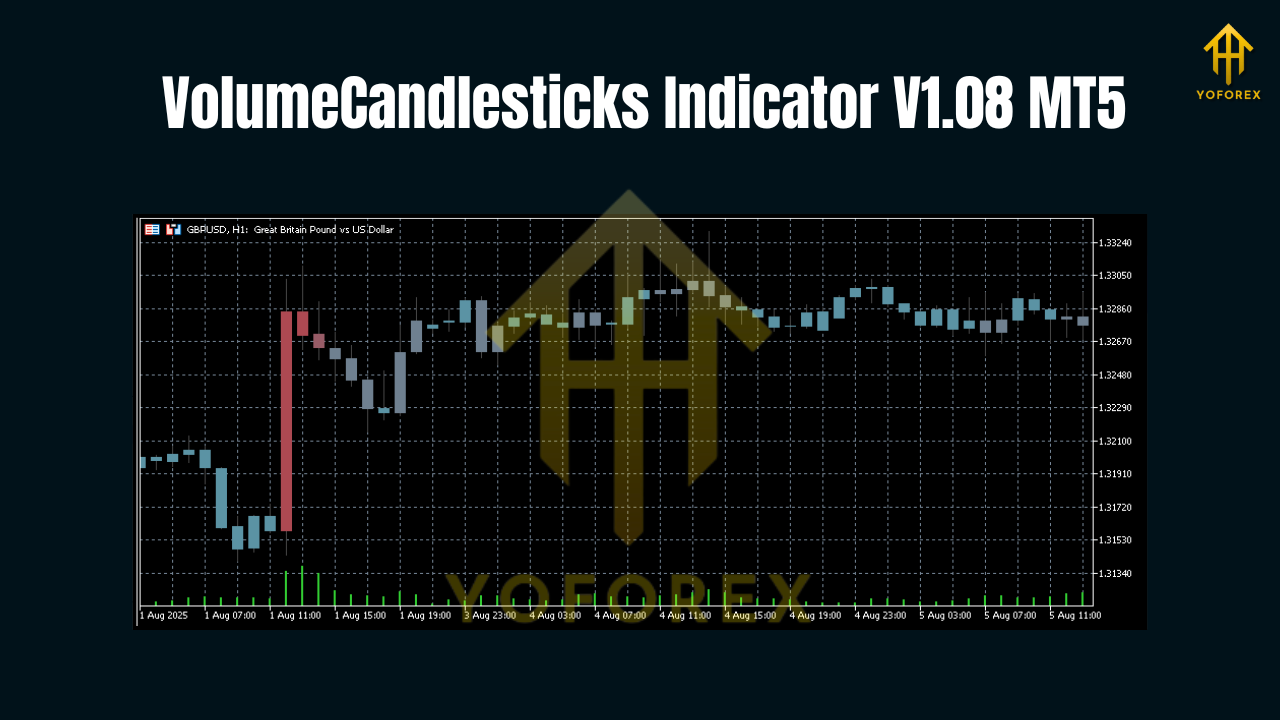

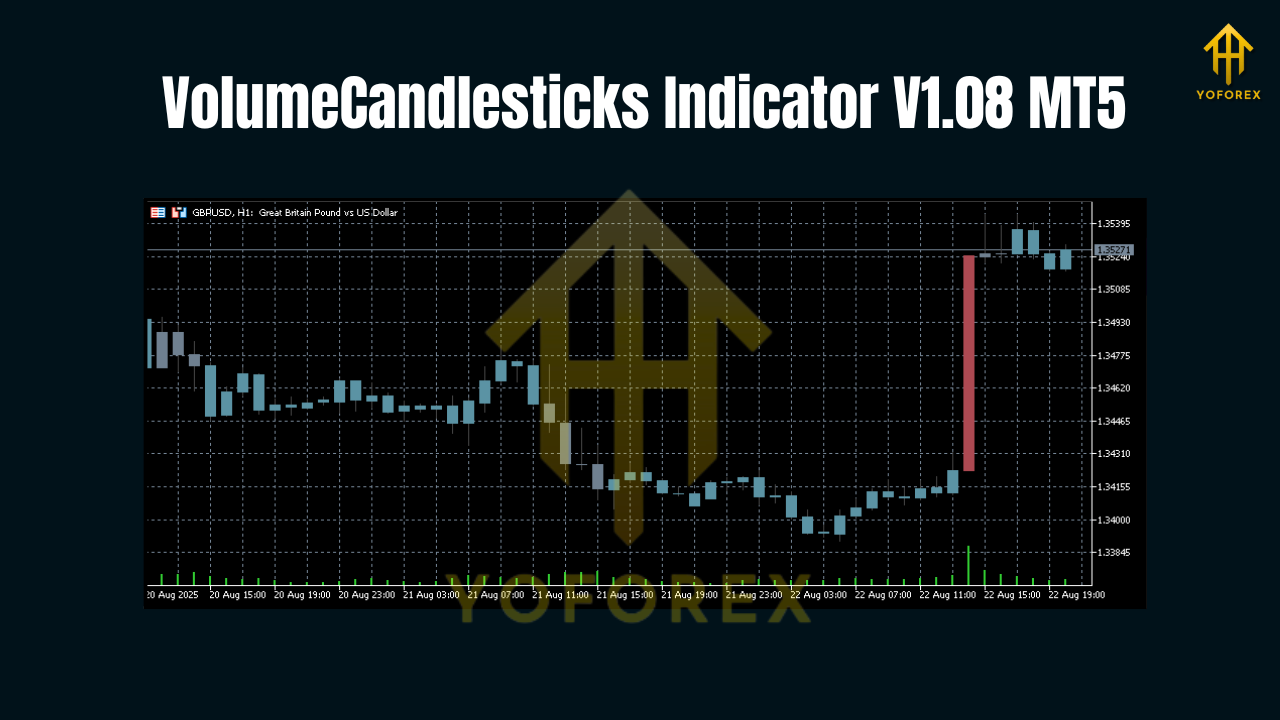

VolumeCandlesticks Indicator V1.08 replaces your standard candle colors or overlays an extra layer that reflects volume pressure per bar. Higher relative volume? Instantly visible. Low-participation pop? Sticks out like a sore thumb. On MT5, we typically use tick volume (number of price changes), which—contrary to myths—is strongly correlated with real volume on liquid FX symbols.

Why it matters: Price can move on air (thin participation) or on conviction (heavy participation). The former often fades; the latter can run. The indicator helps you weigh every candle’s “quality,” not just its shape.

Recommended Pairs & Time Frames

Pairs: Works on any symbol that provides tick volume in MT5. Best results where liquidity is high or where volume rhythm is obvious.

- Major FX: EURUSD, GBPUSD, USDJPY, AUDUSD

- Metals: XAUUSD (Gold), XAGUSD (Silver)

- Indices/CFDs: NAS100, US30, DE40 (if your broker provides robust tick data)

Time Frames:

- Scalping/Intraday: M5, M15, M30

- Swing/Position: H1, H4, D1

- It runs on any TF, but these are the sweet spots most traders prefer.

TL;DR: Start with EURUSD or XAUUSD on M15/H1 if you’re new—clean, instructive signals without being too noisy.

How VolumeCandlesticks Helps

- Confirm breakouts: When price pushes through a level with elevated volume, odds of continuation improve; weak volume breakouts are more likely to fake out.

- Spot exhaustion: Big candle + tiny volume? Often a trap or end-of-move sneeze. Big candle + big volume? That’s real intent.

- Validate pullbacks: Healthy trend pullbacks usually show receding volume, then increasing volume on resumption.

- Filter signals: Combine with your favorite tool (RSI, structure, FVG, S&D). Only act when volume agrees.

Key Features

- • Real-time volume tinting on candlesticks (no guessing)

- • Adaptive thresholds (compares current bar vs recent history)

- • Color-coded intensity for quick read at a glance

- • Works on any MT5 symbol with tick volume

- • Scalp to swing friendly (M5 to D1)

- • No repainting of closed bars (what you saw is what happened)

- • Customizable palette (make it match your theme)

- • Lightweight & fast (keeps charts snappy)

- • Alerts (optional) when volume crosses your set threshold

- • Multi-chart use (attach to several symbols/time frames)

Settings That Actually Matter

- Lookback Period (e.g., 20–50 bars):

Defines what “normal” volume is.

- Shorter lookback (20–30): more sensitive, more signals (good for scalpers).

- Longer lookback (40–50): smoother, fewer false pops (good for swing).

- High/Low Volume Multipliers (e.g., 1.3 / 0.7):

Set the cutoffs for coloring heavy vs light volume bars.

- Aggressive traders might go 1.2 / 0.8 to catch more nuance.

- Conservative traders try 1.5 / 0.6 to only flag the extremes.

- Color Scheme:

Keep contrast strong. For example:

- High-volume up bars: brighter green

- High-volume down bars: brighter red

- Low-volume bars: muted grey/blue

- Alerts:

Consider one basic rule to start: Ping me when volume > 1.5× average during key sessions (London/NY).

Three Simple Strategies You Can Try

1) Breakout + Volume Confirmation (trend-friendly)

- Mark a clean range or previous day’s high/low.

- Wait for a candle to close outside with above-average volume (e.g., >1.3×).

- Enter on the next bar’s micro pullback or use a stop order beyond the breakout bar.

- Stop goes back in the range; target 1.5–2R or trail behind structure.

2) Pullback Validation (follow the strong side)

- Identify the primary trend (higher highs/lows or lower highs/lows).

- On pullback, volume should contract; on resumption bar, you want expanding volume.

- Enter with the trend when the first strong-volume continuation candle closes.

- Keep stops behind the pullback low/high; scale out at prior swing.

3) Fakeout Filter (save yourself some pain)

- Price pokes beyond support/resistance on low volume → likely a trap.

- If the next candle flips back inside the range with rising volume, fade the fakeout.

- Tight stop just beyond the fakeout wick; first target is the range mid, then opposite edge.

Pro tip: Don’t over-optimise settings day one. Trade a week on demo to see your market’s “personality,” then tweak multipliers.

Installation (MT5) & Quick Setup

- Copy the file into MQL5 → Indicators.

- Restart MetaTrader 5 (or right-click Indicators → Refresh).

- Drag VolumeCandlesticks v1.08 onto your chart.

- Set Lookback = 30, High Multiplier = 1.3, Low Multiplier = 0.8 to start.

- Pick a contrasting color theme; save as a template (you’ll thank yourself later).

Practical Tips

- Session matters: Volume “personality” changes across Asia, London, NY. Expect more reliable signals when liquidity is highest.

- News risk: Spikes can show nutty volume—great if planned, deadly if random. Check your calendar.

- Multi-timeframe read: If H1 shows rising volume into a level and M15 confirms, that’s stronger confluence.

- Don’t force it: Flat markets with uniformly low volume? Sit on hands. Capital’s a position.

- Combine with structure: Supply/Demand, S/R, or fair value gaps + volume confirmation = chef’s kiss.

Common Mistakes

- Chasing every high-volume bar: Sometimes it’s just a liquidation wick. Always anchor to context (level, trend, session).

- Over-fitting multipliers: More sensitivity ≠ better trades. Calibrate, then leave it alone for a while.

- Ignoring the pullback story: Great moves often “inhale” (lower volume pullback) before “exhaling” (higher volume continuation).

Final Word

VolumeCandlesticks v1.08 doesn’t “predict” the future—nothing does—but it does show you when the crowd is actually stepping on the gas (or not). Use it to confirm your read of structure, refine entries, and avoid the low-participation head fakes. Start simple, keep notes, and iterate; your eye will get sharper fast, coz context + volume is a deadly combo.

Join our Telegram for the latest updates and support

Comments

Leave a Comment