Virtual Grid Mart Dual Sides EA V1.0 MT5 — Parallel Grids, Virtual Entries, Total Control

Platform: MetaTrader 5 (MT5)

Style: Dual-side grid (long & short), optional martingale, volatility-aware steps, equity protection

Markets: Any asset / any timeframe / any account type (Standard, ECN, etc.)

Virtual Grid Mart Dual Sides EA V1.0 is a power user’s toolkit for systematic grid trading. It can run BUY and SELL grids in parallel, simulate entries with Virtual Trade Technology (VTT) before placing real orders, and adapt step spacing with fixed pips or ATR-based dynamic steps. You get full account protection via equity stops, hard stop-loss behavior, and an auto-redeploy option for aggressive growth profiles after a hard SL. It’s flexible, transparent, and built for operators who want fine-grained scheduling, sizing, and risk governance.

What Makes It Different

Dual-Side Grid Strategy

- Run independent BUY and SELL grids simultaneously.

- Separate configs per direction (steps, take-profits, multipliers, caps).

Virtual Trade Technology (VTT)

- Places virtual orders first to preview strategy behavior under live conditions.

- Reduce immediate capital exposure while testing reaction to volatility, ranges, and spikes.

Fixed or Adaptive Step Entries

- Fixed spacing (pips/points) for classic grid rhythm.

- ATR-adaptive spacing that widens/tightens with volatility → fewer fills during storms, more fills in calm seas.

Advanced Martingale Options (Use With Care)

- Multiplier or additive progression.

- Hard caps on max lot (absolute) or proportional to balance.

- Can be disabled entirely to run a non-martingale grid with fixed lots.

Full Account Protection

- Equity stop (in % or currency) with real-time monitoring.

- Flatten all when the threshold hits.

- Optional daily/weekly PAUSE after an equity event.

Flexible Trading Hours

- Define active windows per weekday.

- Align grids to London/NY sessions or avoid rollover and illiquid hours.

Automatic Redeploy After Hard SL

- Optionally restart the strategy with a simulated deposit or scaled params after a catastrophic SL.

- Designed for aggressive growth profiles; leave OFF for conservative approaches.

Compatibility & Configuration

- Works on forex, metals, indices, oil, crypto; any timeframe.

- Optimized set files available per asset—request via MQL5 messages.

Recommended First-Run Profiles (Pick One)

1) Conservative (Non-Martingale)

- Pairs: EURUSD, USDJPY, XAUUSD (only if spreads are tight)

- Timeframe: M15–H1

- Step: ATR-based (ATR(14) × 0.5–0.8)

- Lot: Fixed 0.01 per $1k (or risk-% sizing)

- Take-Profit: 0.5–0.8× step

- Martingale: OFF

- Equity Stop: –5% day / –10% overall

- Hours: Avoid rollover; run London→NY overlap

2) Balanced (Light Progression)

- Step: ATR(14) × 0.7

- Lot: Start 0.01–0.03 per $1k

- Progression: Additive small increment (e.g., +0.01) with strict max lot

- Equity Stop: –6% day / –12% overall

- VTT: ON for the first week to observe fills

3) Aggressive (High Risk)

- Step: Smaller fixed steps (tighter grid)

- Progression: Multiplier (e.g., ×1.2–1.3) with hard max lot

- Equity Stop: –8% day / –15% overall

- Auto Redeploy: ON (sim deposit)

- Warning: Expect deep drawdowns in trends; intended for high-risk capital only

Setup (MT5)

- Install: MT5 → File → Open Data Folder →

MQL5/Experts→ paste EA → restart MT5. - Chart: Open target symbol & timeframe.

- Attach EA: Enable Algo Trading.

- Configure:

- Directionals: BUY grid ON/OFF, SELL grid ON/OFF

- Step mode: Fixed pips or ATR (length & multiplier)

- Lot mode: Fixed lot or balance-%

- Progression: OFF / additive / multiplier + max lot cap

- TP/Close: per-level TP or basket TP

- Protections: Equity stop %, currency, pause behavior

- Hours: Set trading windows per day

- VTT: ON for observation week, then decide

- Auto Redeploy: OFF by default (toggle only if you accept the risk)

- Logs: Monitor Experts/Journal—placement, virtual vs real, equity triggers, schedule gating.

Operating Playbook

- Phase 1 (Demo Week): VTT ON, martingale OFF, ATR steps, equity stop enabled.

- Phase 2 (Small Live): Same config; verify spreads, slippage, and rollover behavior.

- Phase 3 (Scale Slowly): If stable, nudge lots or add a second symbol—never both at once.

- Trend Weeks: Widen ATR steps, reduce max positions, or disable one side of the grid.

- Range Weeks: Narrow steps slightly and consider enabling both sides with modest lots.

Risk Notes (Read Twice)

- Grid exposure stacks—mind total margin & correlated symbols.

- Martingale compounds losses in strong one-way trends; a hard max lot and equity stop are non-negotiable.

- Session filters help avoid thin-liquidity spikes and funding costs at rollover.

- Do not run aggressive mode on accounts you cannot afford to risk.

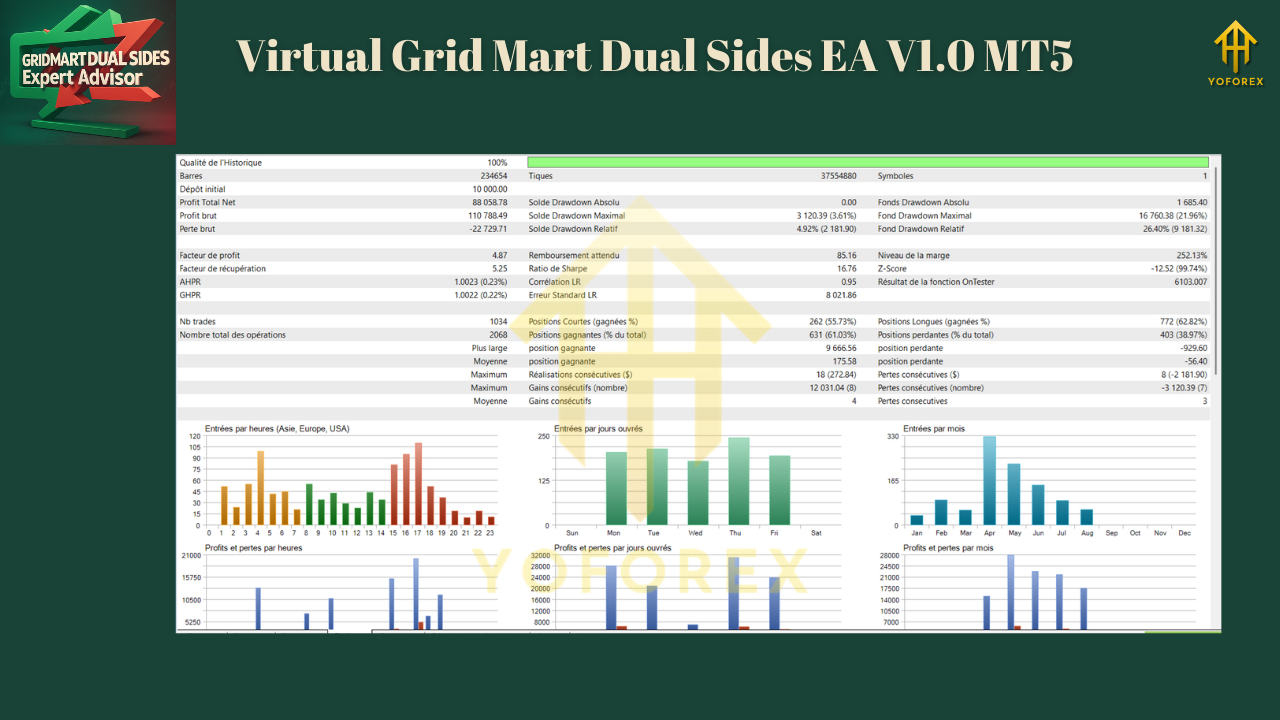

Backtesting & Validation

- Use Every tick based on real ticks where possible.

- Test calm vs. volatile months (CPI, FOMC, NFP).

- Track: max DD, time in DD, margin usage, basket recovery time, PF, avg win/avg loss.

- Forward-test on demo 2–4 weeks before live.

FAQ

Does it require hedging accounts?

Hedging is recommended for parallel long/short grids; most ECN/STP brokers support it.

Is it prop-firm friendly?

Depends on firm rules. Many disallow martingale and have strict daily DD caps. Use non-martingale mode with tight equity stops.

Which assets work best?

Liquid majors (EURUSD, USDJPY) and stable indices. Gold and crypto can work with wider ATR steps and smaller lots.

Can I run multiple symbols?

Yes, but cap total exposure and watch correlation (e.g., USD pairs).

Where do I get set files?

Request optimized set files via the integrated MQL5 messaging (as provided by the author).

Final Word

Virtual Grid Mart Dual Sides EA V1.0 MT5 gives you the levers grid traders actually need: parallel long/short control, VTT preview, ATR-adaptive spacing, strict equity killswitches, schedules, and optional redeploy logic for high-octane profiles. Start conservative, prove stability, then scale—one variable at a time.

Risk Disclaimer: Trading involves risk. Grid and martingale techniques can incur rapid losses in trending markets. Always demo-test first and use firm equity protections.

Join our Telegram for the latest updates and support

Comments

Leave a Comment