Valkyrie AI EA V1.1 is a modern MetaTrader 4 Expert Advisor built for traders who want structure, risk control and intelligent automation instead of guesswork. Rather than relying on aggressive grid or martingale tricks, this EA combines AI-optimised logic with classic market filters like ADX and ATR to hunt for clean trends and manage volatility in a controlled way. Published in November 2025 as a premium MT4 robot, it is designed to run either fully automatic or as a semi-automatic assistant, depending on how much control you want over entries and exits.

In this detailed YoForexEA review, we break down how Valkyrie AI EA works, which pairs and timeframes it prefers, how its risk controls are structured, and what kind of trader is most likely to benefit from it. The goal is simple: to help you decide whether this EA deserves a place in your trading toolbox and how to integrate it into a serious trading plan.

INTRODUCING VALKYRIE AI EA V1.1 MT4

Valkyrie AI EA is built around one big idea: let the robot trade only when the market is structured and trending, and stay away when conditions are flat or noisy. To do that, it uses a mix of artificial intelligence and indicator logic. The AI side is responsible for tuning parameters and behaviour across many market conditions, while the indicator side uses ADX (Average Directional Index) and ATR (Average True Range) to read trend strength and volatility in real time.

This hybrid design makes Valkyrie AI very different from random “plug-and-play” bots. Instead of firing trades all day, it focuses on situations where the trend is clear, volatility is healthy, and the reward-to-risk profile makes sense. The result is a style that feels closer to how a professional discretionary trader thinks, but implemented in fully coded rules.

HOW THE STRATEGY THINKS ABOUT THE MARKET

The trading logic inside Valkyrie AI EA can be summarised in three main layers:

First, the EA checks the overall environment. ADX and its related directional components are used to confirm that the market is actually trending and not just drifting sideways. A phase filter based on ADX and ATR slope helps the system ignore flat periods where most strategies get chopped up.

Second, the EA evaluates volatility conditions. ATR is used to understand how “wide” the market is currently moving. That matters because a 20-pip stop in a 10-pip daily range is completely different from a 20-pip stop in a 100-pip range. Valkyrie AI uses this volatility information when planning its stop-loss and take-profit distances so that trades have room to breathe without being oversized.

Third, AI-optimised rules decide how strict entries, exits and risk parameters should be in the current regime. The developer mentions that hundreds of optimisation cycles were used to refine how Valkyrie AI reacts in quiet vs. chaotic markets, with a focus on keeping behaviour stable over many years of data rather than “curve-fitting” a short period.

The result is a trend-following and breakout-style system that aims to enter in the direction of the dominant move, manage trades dynamically and avoid overtrading.

KEY FEATURES THAT MAKE VALKYRIE AI STAND OUT

The official description highlights a long list of features, but the most important ones for a trader are:

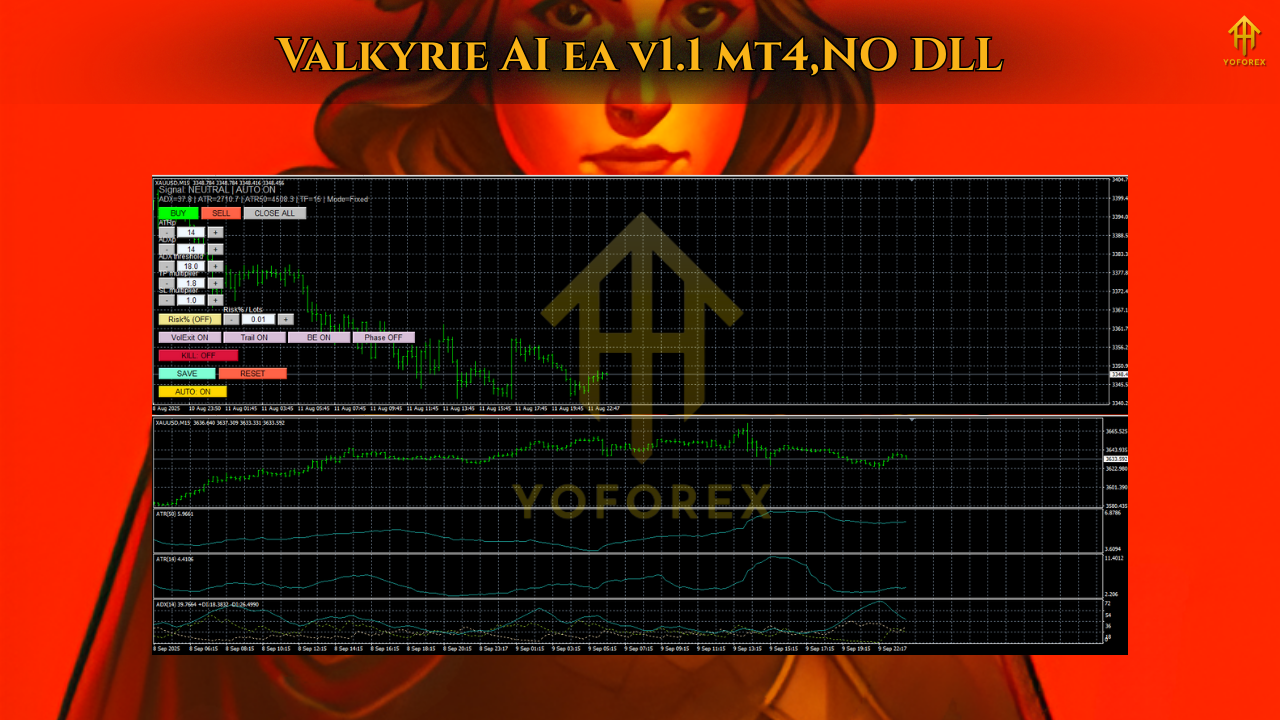

Valkyrie AI uses AI-enhanced ADX and ATR filters for its entries, which means trades are triggered only when trend strength and volatility hit specific thresholds rather than on every small move. It also offers a choice between dynamic risk-percentage position sizing and fixed lot trading, allowing you to set risk in the way that best fits your account size and comfort level.

The EA uses ATR-based stops and targets along with a Smart Volatility Exit system that adapts to changing conditions. That gives it the ability to cut trades that no longer make sense and to lock in profits when volatility spikes against the position. Break-even and trailing-stop functions are available and can be fine-tuned, so you can decide whether you want a tighter or looser style of risk locking.

Partial take-profit and runner management is another core feature. Valkyrie AI can close part of a winning trade while leaving a smaller position open to ride the trend if the move continues. For traders who like to scale out, this behaviour feels very natural and helps reduce emotional decision-making.

On top of that, there is a built-in session filter and daily drawdown guard. You can limit the trading to specific sessions, such as London and New York, and stop the robot from opening new trades once a certain loss threshold is reached for the day. This is especially important for traders running prop firm challenges or funded accounts where daily drawdown rules are strict.

Finally, Valkyrie AI includes a visual on-chart control panel with real-time toggles and buttons. That means you do not have to dig through deep MT4 menus every time you want to make a quick change; basic management is available directly on the chart.

RECOMMENDED PAIRS, TIMEFRAMES AND RISK SETTINGS

According to the recommended usage guidelines, Valkyrie AI EA is primarily tuned for major currency pairs such as EURUSD, GBPUSD, NZDUSD and USDJPY. It can also be applied to other majors after testing, but these four are the core focus in the default configuration.

In terms of timeframe, the EA can run from M5 to H1, but the developer suggests that M15 offers the best balance between signal frequency and control. On this timeframe, trade setups are frequent enough to keep the account active while still leaving enough time for the EA to analyse trends and volatility properly.

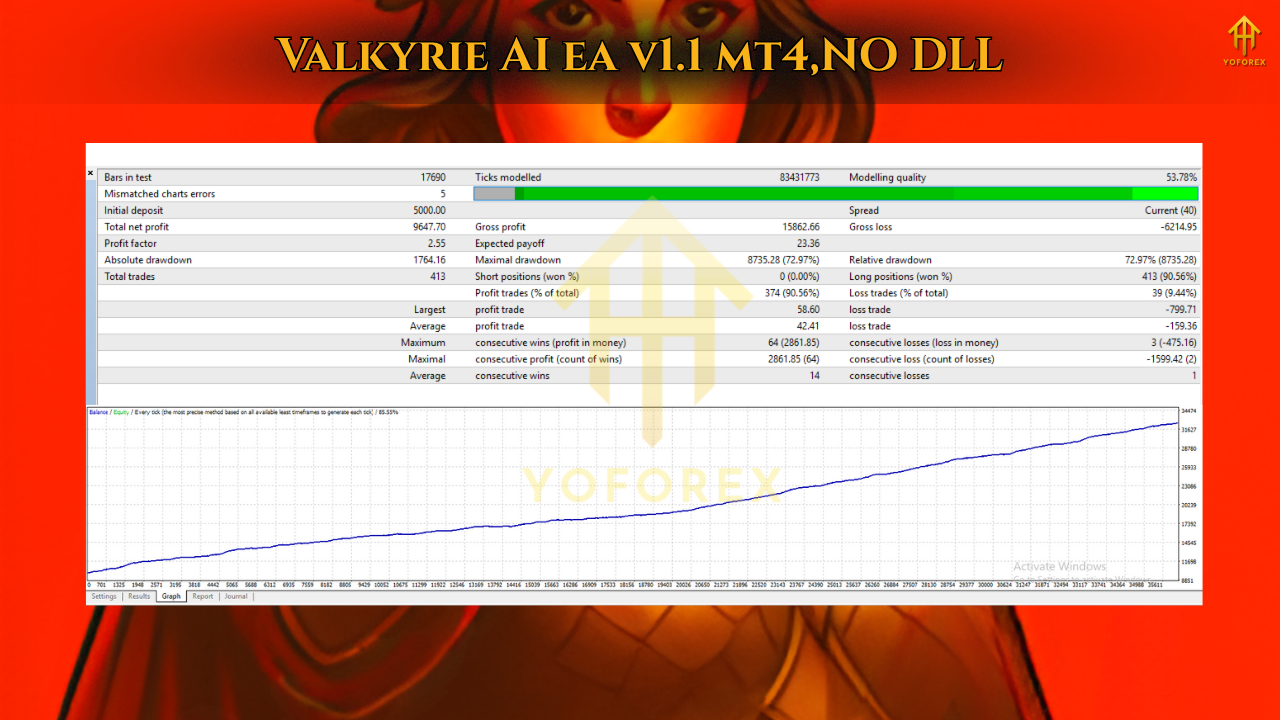

Risk management guidelines are quite conservative, which is a positive sign. The suggested starting point is around 0.5–1.0% account risk per trade when using the percentage-based mode. For traders who prefer fixed lots, small sizes such as 0.01–0.05 are recommended until you are fully familiar with the EA’s behaviour. The system has been tested across the 2022–2025 period, covering multiple volatility cycles and market environments.

RISK MANAGEMENT PHILOSOPHY

One of the strongest aspects of Valkyrie AI EA is its approach to risk. The developer clearly positions it as a disciplined tool, not a high-risk gambling robot. The strategy does not use martingale or classic grid escalation. There are no hidden lot multipliers that explode the exposure when a trade goes against you. Instead, it focuses on single, controlled positions that are sized according to your chosen risk rules.

The daily drawdown guard can shut down new trading if the EA hits a predefined loss for the day, helping you protect capital during difficult sessions. Combined with ATR-based stops and volatility-aware exits, the EA is built to respect the reality that capital preservation is more important than squeezing out a few extra trades.

If you are used to aggressive systems that double lots after every loss, Valkyrie AI will feel slower and more controlled. That is exactly the point. It is designed for sustainable trading, not for chasing lottery-style returns.

WHO SHOULD CONSIDER VALKYRIE AI EA?

Based on the design, Valkyrie AI EA fits best with traders who value process and rules:

It is a good fit for beginners who understand the basics of MT4 but do not yet have a fully developed manual strategy. The logic is transparent, and the risk controls are clear, so you can learn a lot simply by watching how the robot behaves. It is also suitable for intermediate traders who want to automate a chunk of their trading while still staying in control through semi-automatic mode.

Prop firm and funded account traders may find the daily drawdown and structured risk features particularly attractive. Finally, more advanced traders who already understand how ADX and ATR work might appreciate seeing those tools integrated into a complete AI-driven system, which can save months of personal coding and testing.

If you are looking for a robot that opens dozens of trades per hour and aims to grow small accounts in a few days, Valkyrie AI is not that type of EA. It is designed more for steady, planned growth with a focus on avoiding catastrophic drawdown.

PRACTICAL SETUP TIPS FOR LIVE AND DEMO

Before putting Valkyrie AI EA on a live account, it is wise to follow a structured setup process.

Start by running the EA on a demo account with one or two recommended pairs on the M15 timeframe. Keep risk very low and let the system trade through different sessions so you can see how often it opens trades, how it handles winning and losing streaks, and how the equity curve behaves. Use the built-in parameters, but note down any changes you make so you can track their impact.

Next, consider running the EA on a VPS with low latency to your broker. Because Valkyrie AI uses real-time analysis and needs stable connectivity, a good VPS helps reduce slippage and unexpected disconnects. When you are satisfied with the demo results and comfortable with the behaviour, you can move to a small live account, still using conservative risk. Only after several months of stable performance should you think about scaling up position size or adding additional pairs.

HOW TO INTEGRATE VALKYRIE AI INTO A TRADING PLAN

An Expert Advisor should never be viewed as a complete replacement for a trading plan. Instead, Valkyrie AI EA should be treated as one powerful component in a larger structure.

Decide first how much of your capital you want to allocate to automated trend trading and how much you want to keep for manual strategies or other systems. Set clear rules for maximum daily and weekly drawdown, profit targets for withdrawals, and what conditions would make you pause the EA (for example, breaking news periods or major macro announcements).

It is also sensible to keep a simple performance log. Track metrics such as win rate, average reward-to-risk ratio, maximum drawdown and which sessions produce the best results. Over time, this data will help you fine-tune the session filter, adjust risk mode and decide whether to expand to more pairs or timeframes.

LEGAL AND RISK NOTICE

The developer is very clear that Valkyrie AI EA, despite its AI optimisation and high technical standard, cannot guarantee profits. Trading Forex and CFDs always involves risk, and results will vary from account to account. By using the EA, you accept full responsibility for your trading decisions and outcomes.

Understanding this upfront is part of being a serious trader. A well-built robot can be a big advantage, but it still needs to be handled with respect for risk.

CONCLUSION: IS VALKYRIE AI EA V1.1 MT4 WORTH YOUR TIME?

Valkyrie AI EA V1.1 MT4 brings a professional blend of AI optimisation, ADX/ATR market analysis and robust risk control to the MetaTrader 4 platform. With its focus on trend strength, volatility awareness and non-martingale money management, it stands out from the crowded field of high-risk robots that depend on luck more than logic.

For YoForexEA readers who value discipline and want a rules-based way to participate in trending markets, Valkyrie AI is definitely worth testing. Approach it with the same seriousness you would give any trading system: demo first, respect risk guidelines, monitor real-world performance and integrate it into a clear plan instead of chasing quick wins.

Used in that way, Valkyrie AI EA can become a strong, structured ally in your long-term trading journey.

Comments

Leave a Comment