Introduction

If you’ve ever tried scalping the US30 index manually, you already know the pain – the chart moves like lightning, spreads widen without warning, and a single slippage spike can ruin a full day’s work. Most traders either blow their accounts or get so stressed they stop trading altogether. Honestly, US30 can feel brutal.

That’s exactly why more traders are shifting toward automated trading systems designed specifically for high-volatility indices instead of trying to catch every move by hand.

Enter US30 Scalper EA v1.0 MT5, a fast-execution, ultra-optimized Expert Advisor built for one mission:

Scalp the US30 index with precision, speed, and risk-adjusted consistency.

This EA doesn’t promise fairy-tale profits; instead, it focuses on smart execution, controlled risk, and a clean scalping framework that adapts to ever-changing index volatility. Whether you’re aiming for daily pips, smooth equity growth, or prop-firm-friendly consistency, the US30 Scalper EA v1.0 MT5 might be the tool you were quietly searching for.

In this blog, we’ll break everything down – how it works, why it stands out, performance behaviour, key features, recommended settings, and a step-by-step installation guide. Let’s dive in.

What Is US30 Scalper EA v1.0 MT5?

US30 Scalper EA v1.0 MT5 is an automated trading robot developed exclusively for trading the US30 (Dow Jones) index on the MetaTrader 5 platform. Unlike multi-pair robots that try to cover everything at once, this EA is laser-focused on one asset – and that focus is what gives it an edge.

Its core logic combines:

- Volatility-based entry triggers

- Micro-scalping logic for small, precise take-profits

- Dynamic stop-loss adjustment

- Spread and slippage filtering

- Session-based timing during high-liquidity periods

The US30 Scalper EA v1.0 MT5 runs on fast execution logic, making it ideal for scalping the rapid movements of US30. It does not rely on dangerous martingale, heavy grid, or hedge-stacking recovery systems. Instead, it focuses on single-shot entries and clean exits.

This EA is best suited for:

- Active scalpers

- Day traders

- Prop-firm challenge traders

- US30 and index-focused traders

- Traders who want structured, rule-based automation

Because it’s built for MT5, you also benefit from improved order handling, faster execution, and better index support compared to MT4, especially on ECN or zero-spread accounts.

Key Features of US30 Scalper EA v1.0 MT5

Let’s break down the core features that make the US30 Scalper EA more practical for real-world traders and not just a “backtest hero.”

- Ultra-Fast Entry Execution: The EA uses a tick-sensitive execution engine to respond quickly during strong movements. This is crucial for the US30, where candles can move dozens of points in seconds. Fast in, fast out – that’s the core idea.

- Non-Martingale, Safer Trading Logic: US30 Scalper EA v1.0 MT5 does not use any martingale or reckless lot-doubling strategies. No insane grids that can blow your account in one bad session. It focuses on controlled entries with predefined risk.

- Dynamic Stop-Loss & Take-Profit: Instead of fixed SL/TP values, the EA adjusts stops and targets based on recent volatility. In quieter periods it can aim for smaller TP with tighter stops; during explosive moves it gives trades a bit more breathing room while keeping risk in check.

- Spread & Slippage Protection: The robot constantly monitors spread and execution quality. If spread becomes too wide or conditions are unstable (common during news or rollovers), it will avoid opening trades. This helps prevent entries at the worst possible time.

- High-Probability Scalping Algorithm: The strategy is built around volatility pulses and micro-trend direction. The US30 Scalper EA looks for short bursts of movement that often follow a liquidity grab or breakout. It enters, catches a clean move, and gets out instead of holding for hours unnecessarily.

- Optimized for NY Session: US30 typically delivers its most reliable volatility during the New York session and the London–New York overlap. The EA is designed to operate best during these periods, when liquidity and movement are both high.

- Low-Drawdown Design: Trade frequency is balanced with capital protection in mind. The US30 Scalper EA v1.0 MT5 doesn’t fire trades every minute just to look “busy.” Instead, it focuses on cleaner set-ups to keep drawdown controlled and growth steadier.

- Prop-Firm Friendly Structure: Because it avoids martingale and other risky behaviour, this EA can be configured in a way that aligns with most prop-firm rules. With proper risk per trade, it’s possible to maintain challenge accounts within maximum drawdown and daily loss limits.

- Beginner-Friendly Setup: The configuration isn’t overly complicated. Attach it to your US30 chart, choose your risk or fixed lot, and you’re basically ready to go. Perfect if you don’t want to spend days tuning parameters.

- VPS Recommended: For best results, running the EA on a VPS ensures stable connectivity and minimal downtime, especially important for high-speed scalping strategies on indices like US30.

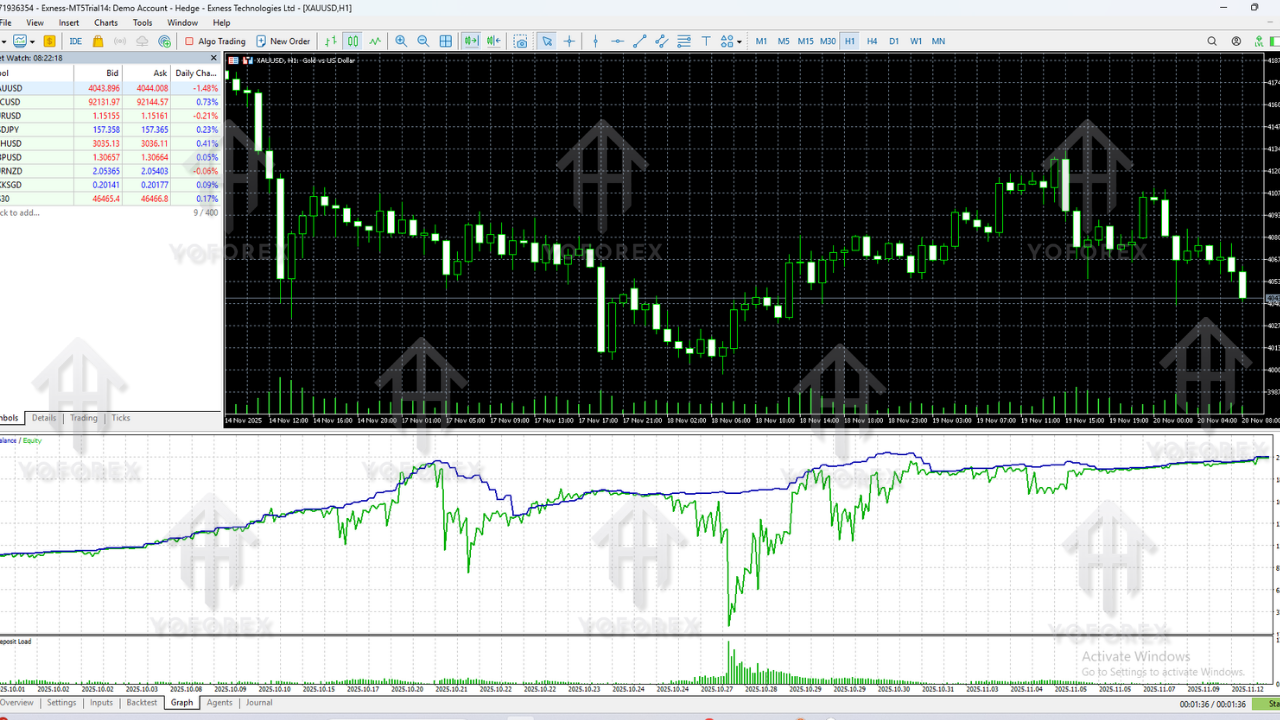

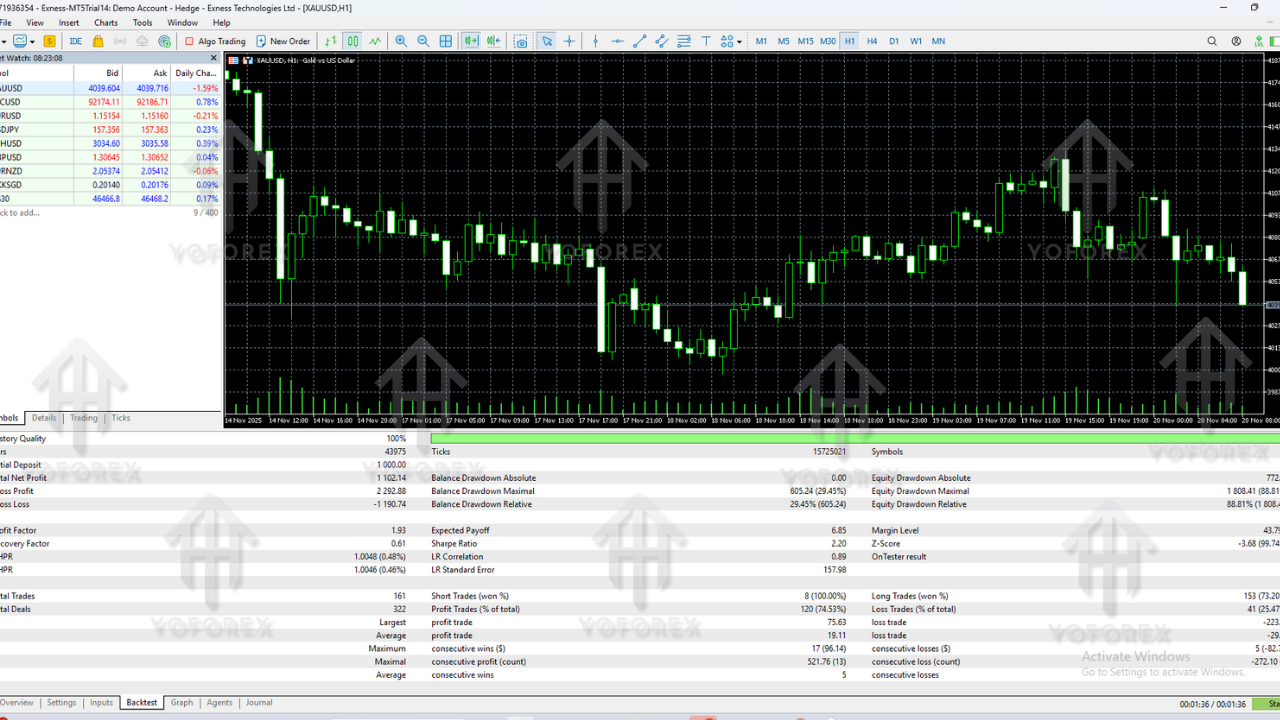

Performance Behaviour – How US30 Scalper EA v1.0 MT5 Handles the Market

Instead of throwing random numbers, let’s talk about behaviour – how the EA reacts in different types of market conditions.

- Trending Market Conditions: When US30 forms a strong directional move, the EA tends to perform very well. Its micro-scalping logic catches short bursts aligned with the main trend, often stacking small wins through the session. Pullbacks are kept controlled by dynamic stops.

- Ranging or Choppy Markets: In sideways or choppy conditions, the built-in volatility filter reduces the number of entries. Trade count may drop, but this is actually a good thing – it avoids random whipsaws that kill many manual traders in consolidation phases.

- High-Impact News & Spikes: During major news events, spreads can spike, and US30 can become wild. Here, the spread and execution filters are crucial. If conditions are too extreme, the EA simply stands aside and waits for the market to calm down before resuming normal trading.

- Win-Rate and Risk Profile: With sensible settings and a reasonable broker, the win-rate generally sits around the moderate range – think roughly 60–70% depending on risk, spread, and execution. It targets frequent, smaller wins rather than “home run” trades.

- Drawdown Behaviour: Because it doesn’t use martingale or aggressive grids, drawdown is more linear and controlled. With conservative lot sizes, traders can typically keep drawdown within a zone like 10–15%, though of course that also depends on user risk preferences.

- Risk-to-Reward Structure: The risk-to-reward ratio usually sits around 1:1 to 1:1.5, which is common and acceptable for pure scalping systems. The idea is: many smaller, consistent wins while trying to keep losing trades limited and controlled.

- Execution Advantage: On a good VPS with a low-latency connection and ECN account, execution speed becomes a real edge, especially on an index as fast as US30. The EA is designed to take advantage of that.

How to Install & Configure US30 Scalper EA v1.0 MT5

Setup is pretty simple, even if you’re not extremely technical. Follow these steps carefully.

Step 1 – Download the EA File

Download the US30 Scalper EA v1.0 MT5 file (.ex5) from your trusted source or your YoForex EA download page and save it somewhere easy to find on your computer.

Step 2 – Open MetaTrader 5

Launch your MT5 platform and log in to the trading account where you want to run the EA.

Step 3 – Open the Data Folder

In MT5, click on File > Open Data Folder. This opens the main directory where all your MT5 files are stored.

Step 4 – Copy the EA into the Experts Folder

Inside the data folder, navigate to:

MQL5 > Experts

Paste the .ex5 file of the US30 Scalper EA into this Experts folder.

Step 5 – Refresh or Restart MT5

Close and reopen MT5, or in the Navigator window, right-click on Expert Advisors and select Refresh. The EA should now appear in your list.

Step 6 – Attach EA to US30 Chart

Open the US30 (Dow Jones) chart on MT5. Recommended timeframes: M5 or M1 for pure scalping. Then drag and drop US30 Scalper EA v1.0 MT5 onto the chart.

Step 7 – Enable Algo Trading & Inputs

Make sure the Algo Trading button on your MT5 toolbar is enabled. In the EA settings window, configure:

- Lot Size: For smaller accounts, 0.01 per $200–$300 equity can be a conservative starting point.

- Risk Mode: Fixed lot or percentage-based, depending on your comfort.

- Trading Session: Keep focus on NY and overlap hours if possible.

- Spread Filters: Ensure the maximum spread allowed is not too high for US30.

Step 8 – Recommended Account Conditions

- Account Type: ECN, Raw, or Low-Spread account

- Leverage: 1:200 or higher (handle with responsibility)

- VPS: Strongly recommended for 24/5 operation

Once everything is set, click OK and the EA will start monitoring and trading the US30 automatically according to its logic.

Why Choose a Dedicated US30 Scalper EA?

US30 is one of the most aggressive, opportunity-rich instruments in the market – but it’s also one of the most unforgiving. Manually chasing entries, reacting late to spikes, or over-trading from emotions can destroy an account fast.

A dedicated tool like US30 Scalper EA v1.0 MT5 gives you:

- Emotion-free, rule-based execution

- Consistent reaction speed to volatility

- Pre-defined risk parameters

- Protection from random, impulsive trades

- A scalping framework designed around how US30 actually moves

Instead of trying to “catch everything,” the EA enforces discipline – take only qualified setups, cut risk fast, let the system handle the heavy lifting.

Risk Disclaimer

Trading US30 or any leveraged product is inherently risky. Even with the best Expert Advisor, there is no guarantee of profits or a risk-free experience. Market conditions change, spreads vary, execution can differ across brokers, and human decisions like over-leveraging can still cause losses.

Always:

- Test the US30 Scalper EA v1.0 MT5 on a demo account first

- Use risk you can genuinely afford to lose

- Avoid over-sizing your lot just to “speed up” profits

- Monitor performance regularly and adjust settings if needed

Past performance, backtests, or shared results are not guarantees of future returns. Trade responsibly.

Conclusion – Is US30 Scalper EA v1.0 MT5 Worth Using?

If you’re serious about trading the US30 but tired of emotional entries, late reactions, and inconsistent manual results, then US30 Scalper EA v1.0 MT5 offers a structured alternative.

It brings:

- Fast execution for high-speed index moves

- Non-martingale safety and controlled risk

- Volatility-aware entries and exits

- Prop-firm friendly behaviour with the right configuration

It won’t magically turn every losing trader into a millionaire, but it can give you a serious edge if you respect risk, choose a good broker, and let the system work as designed.

Looking for a disciplined, high-speed way to trade US30 without sitting glued to the screen all day? Then US30 Scalper EA v1.0 MT5 is definitely worth having in your trading toolkit.

Comments

Leave a Comment