Introduction of Trend Direction Indicator MT4 :

If you’ve ever felt lost between a dozen oscillators and squiggly lines, take a breath. The Trend Direction Indicator for MT4 boils the chart down to what you actually need: bullish, bearish, or stand-aside—with a strength read that helps you pick your spots. It’s designed to be clean, lightweight, and non-repainting on closed bars, so you can build a repeatable plan around it (entries, exits, or simply “no trade” filters).

Below you’ll find how it works, the signals it prints, suggested settings for FX majors and gold, installation, practical playbooks, and FAQs—plus ready-to-paste SEO meta data for your blog/CMS.

What Is the Trend Direction Indicator?

- A baseline trend (composite of fast/slow moving averages),

- A slope & alignment score (how convincingly price is moving),

- An optional volatility sanity check (ATR band),

- Optional Higher-TF confirmation (keeps you with the big picture).

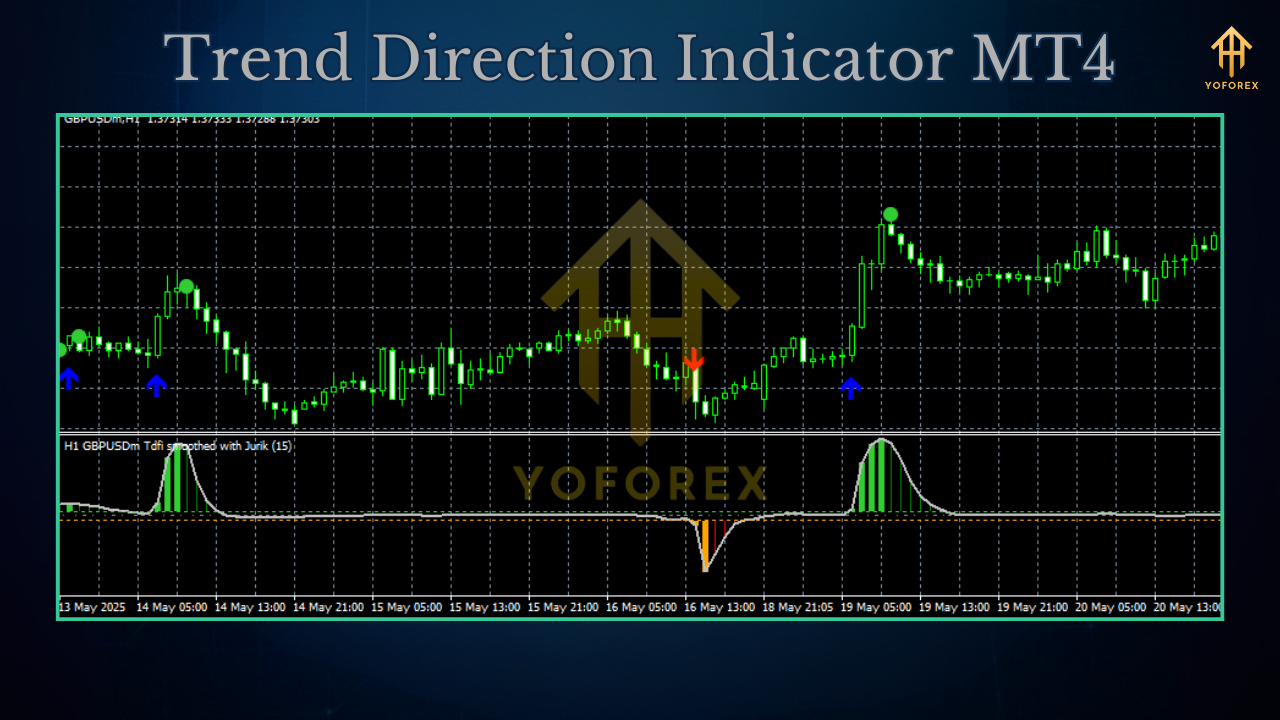

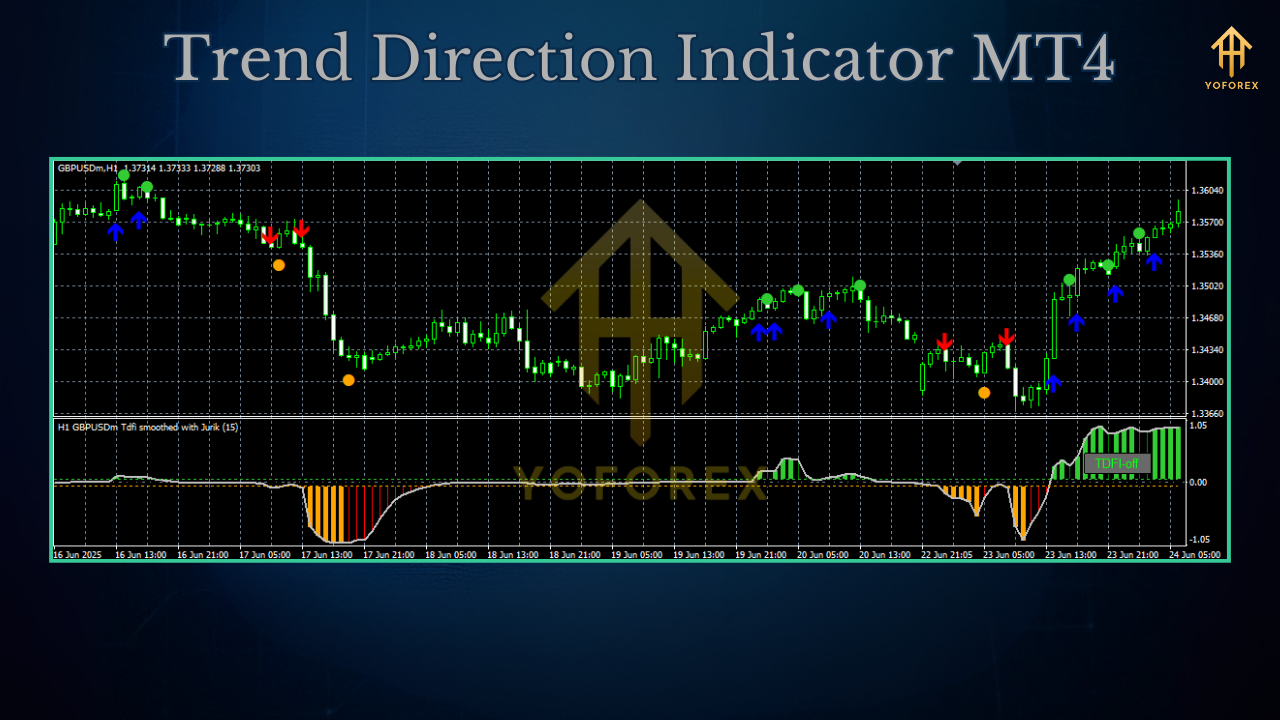

It paints the chart and/or a compact dashboard with a color state:

- Green → Bullish bias (prefer longs)

- Red → Bearish bias (prefer shorts)

- Amber/Gray → Neutral/compression (probable chop; filter trades)

Best use cases

- Define your with-trend direction before pulling the trigger

- Time pullback entries into a trending move

- Filter systems: trade only when bias is strong

- Trail exits on color flip or weakening strength

Assets/TFs

- EURUSD, GBPUSD, USDJPY → M15–H4

- XAUUSD (Gold) → M30–H4 (cost-aware)

- Works on indices/CFDs (check broker specs).

What’s Inside (V1.x Feature Set)

- Composite Baseline: Weighted MA ribbon (EMA/SMA/SMMA options) compressed into a single bias.

- Strength Meter (0–100): Combines slope, alignment, and fan-out into a confidence score.

- ATR Guard (optional): Mutes “strong trend” labels if volatility is abnormally low/high.

- MTF Confirmation (optional): Require agreement with a higher timeframe (uses closed bars).

- Pullback Zone Bands: Shaded area between fast & mid baselines for re-entries.

Alerts:

- Bias flip (green ↔ red),

- Pullback touch within a strong trend,

- Strength rises/falls past thresholds.

- Lightweight Code: Built for multi-chart setups, no laggy gimmicks.

- Non-Repainting on Closed Bars: What you see at bar close is what the logic generated.

How to Read the Signals (Fast)

- Green + Strength ≥ 35–40: With-trend long bias. Favor pullbacks into the shaded band.

- Red + Strength ≥ 35–40: With-trend short bias. Favor rallies into the band for sells.

- Amber/Gray or Strength < 25: Stand aside; system expects chop or low-quality action.

- Rising strength + widening band: Trend gaining traction (breakouts more likely to hold).

- Falling strength + narrowing band: Momentum fading; consider scaling out or tightening trails.

Recommended Settings (Starter Templates)

- MA set: EMA 9/21/50/100/200

- Strength threshold: 30

- ATR filter: ON (ATR(14), min 0.3×, max 3.0× pair-dependent)

- MTF confirm: ON (H1 confirmed by H4)

- Alerts: Flip + Pullback touch

Intraday (M15/M30) — FX Majors

- MA set: EMA 8/13/21/34/89

- Strength threshold: 25

- ATR filter: ON (min 0.2×, max 2.5×)

- MTF confirm: Optional (M15 confirmed by H1)

- Alerts: Pullback touch; Strength > 40

Gold (XAUUSD, M30/H1)

- MA set: EMA 10/20/50/100/200

- Strength threshold: 35

- ATR filter: ON (min 0.5×, max 3.5×)

- MTF confirm: ON (H1 confirmed by H4)

- Alerts: Flip + Pullback touch (cooldown widened)

Three Playbooks You Can Use Today

1) Trend-Pullback Re-entry

- Context: Green (or Red) state with Strength ≥ threshold; band fanning out.

- Trigger: Price pulls into the shaded band and prints a rejection candle or micro break-retest in trend direction.

- Stop: Beyond the slow baseline or last swing.

- Targets: 1.5R–2.0R. Consider partial at +1R and trail under the slow line.

2) Breakout Confirmation

- Context: Recent flip (red→green or green→red) and Strength rising.

- Trigger: Close beyond range high/low with acceptable spread; no instant snap-back.

- Stop: The other side of the range or beyond slow baseline.

- Management: Trail once Strength > 50 or after +1R.

3) Do-Nothing Filter (the underrated edge)

- Context: Amber/Gray, Strength < 25, ATR outside band (too dead or too wild).

- Action: Skip. The best money you make is often the money you don’t lose.

Installation (MT4)

- Copy

Trend_Direction_Indicator.ex4toMQL4/Indicators/. - Restart MT4 → Navigator → Indicators → drag onto chart.

- Choose MA type/periods, enable ATR filter & MTF (if desired), set strength thresholds, and configure alerts.

- Save a Template to re-use across symbols.

Best Practices

- Decide on closed-bar logic. Trade decisions at candle close reduce noise (and stress).

- One timeframe per plan. Don’t time-hop to justify a trade.

- Costs matter. If spreads widen (esp. on gold), move up a timeframe.

- Journal screenshots. Mark bias, strength, and your entry/exit. Patterns appear fast.

- Don’t over-optimize. The power here is clarity + consistency.

FAQs

Does the indicator repaint?

On the current TF, it finalizes on bar close (no repaint). With MTF, the higher-TF state locks on its bar close.

Can I use SMA or SMMA instead of EMA?

Yes—pick what suits your tempo. EMAs react faster; SMA/SMMA are smoother.

Good for scalping?

Yes on M5/M15—raise the strength threshold and keep a tighter ATR band. Remember, execution costs are king on low TFs.

How do alerts work?

Enable pop-up/push/email in MT4 (Options → Notifications/Email), then toggle Flip, Pullback, or Strength alerts in inputs.

Can this drive an EA?

It’s an indicator (not an EA). You can read its buffer values in a custom EA if you code it.

Disclaimer

Indicators guide decisions; they don’t guarantee profits. Trading Forex/CFDs involves risk. Test on demo first, size positions responsibly, and never trade money you can’t afford to lose.

Call to Action

Want an uncluttered way to see bias and trade with the flow? Install Trend Direction Indicator for MT4, load the Swing or Intraday template above, and journal a week of trades. The clarity boost—knowing when to trade and when not to—can be a game-changer.

Comments

Leave a Comment