In 2025, automated forex trading continues to dominate the global markets. Traders are shifting from manual systems to intelligent Expert Advisors that can analyze trends, control risk, and execute trades with unmatched accuracy. Among these modern solutions, Titany X Pro EA V3.0 for MetaTrader 4 (MT4) stands out as a professional-grade robot designed to bring precision and reliability into every trade.

Built for both retail traders and prop-firm challengers, this EA is engineered to manage volatility, minimize drawdowns, and optimize entry points with disciplined logic. In this in-depth review, we’ll explore how Titany X Pro EA V3.0 works, its key features, risk control system, and whether it’s truly worth adding to your trading setup.

What Makes Titany X Pro EA V3.0 Special

The Titany X Pro EA V3.0 is a next-generation algorithmic trading robot tailored for MetaTrader 4 users who value consistency over hype. It focuses on scalping and intraday trading within controlled conditions — aiming to capture small yet repeatable profits across major currency pairs.

This version has been re-optimized for build 1441+, ensuring full compatibility with modern MT4 terminals and broker updates. It operates primarily on the M15 timeframe, balancing responsiveness with stability to suit both short-term and medium-term traders.

Trading Logic and Strategy

At its core, Titany X Pro EA relies on a data-driven trading framework. It identifies low-risk entry points using a blend of volatility measurement and micro-trend confirmation.

Unlike aggressive grid or martingale systems, this EA maintains a controlled position limit — usually a maximum of two open trades per currency pair.

Its underlying strategy includes:

- Momentum confirmation based on short-term price velocity

- Adaptive stop-loss calculation according to market volatility

- Equity-based protection that halts trading if total drawdown exceeds predefined limits

- Smart exit logic that scales profits when volatility spikes

By following these structured rules, the EA minimizes over-trading and avoids sudden reversals that destroy many high-frequency robots.

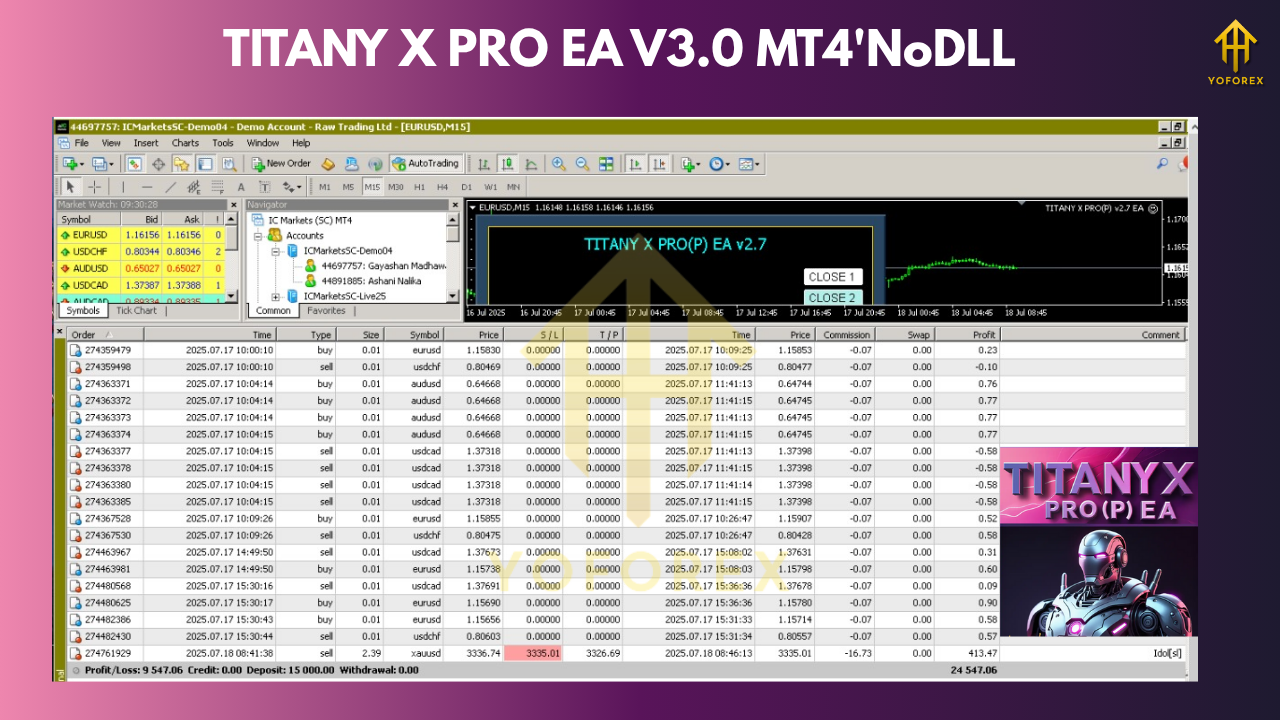

Currency Pairs and Timeframes

Titany X Pro EA performs best on stable and liquid pairs such as:

- EURUSD

- AUDUSD

- USDCHF

- AUDCAD

- EURAUD

The M15 timeframe is recommended for optimized signal quality. Traders can also experiment with M30 for broader swings or M5 for faster entries, depending on broker execution and spread levels.

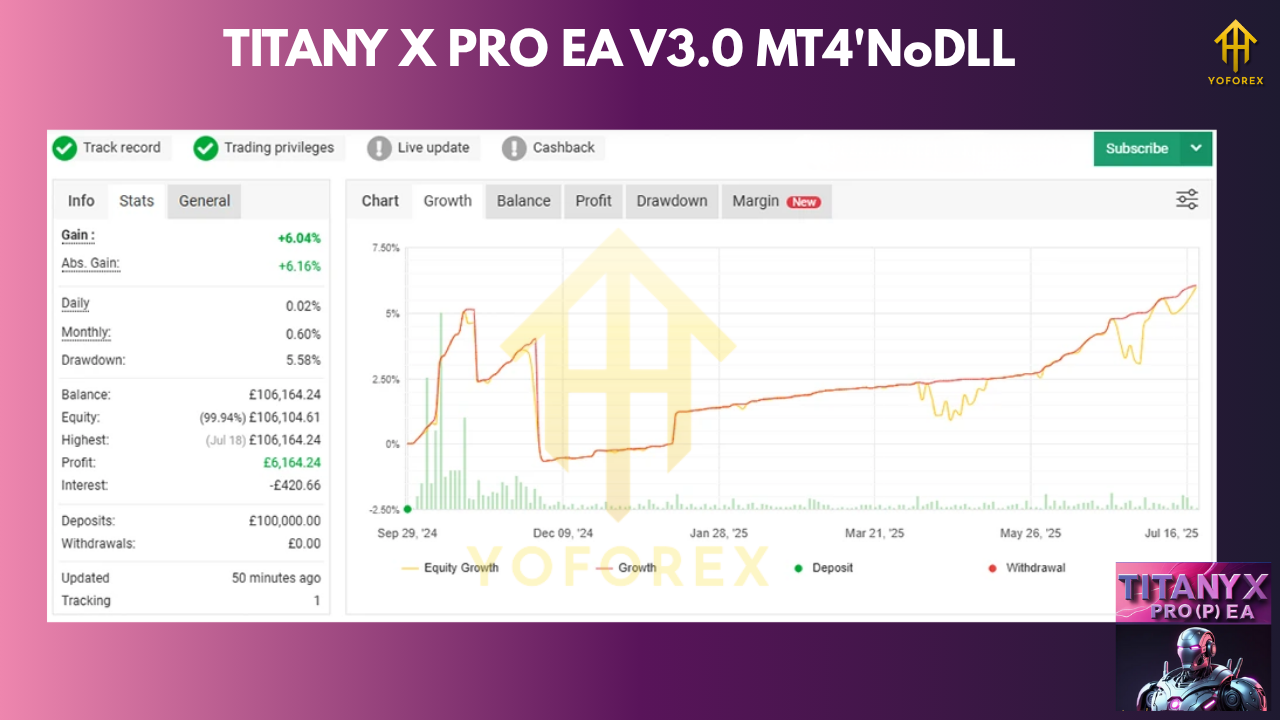

Performance Potential

While no automated system guarantees profit, multiple backtests and demo trials show that Titany X Pro EA V3.0 can maintain consistent profitability when used under optimal conditions.

Average reported monthly growth ranges between 6% and 15%, depending on broker execution speed and market volatility.

What makes this robot impressive is its ability to stay disciplined during unstable market sessions. Instead of chasing losses or doubling lots, it cuts risk quickly and waits for the next confirmed setup — a vital characteristic for traders targeting long-term survival over short bursts of luck.

Prop-Firm Ready Configuration

One of the strongest selling points of Titany X Pro EA V3.0 is its prop-firm-friendly configuration.

It complies with strict trading parameters like:

- Daily drawdown limits (under 9%)

- Equity stop protection

- Controlled lot exposure

- Avoidance of overnight or news-based spikes

This makes it suitable for traders preparing for challenges under firms like FTMO, MyFundedFX, Funding Pips, and similar evaluation programs.

The EA’s algorithm automatically stops trading after reaching a predefined equity target or drawdown, helping traders stay compliant and avoid disqualification during the testing phase.

Risk Management System

Titany X Pro EA is built with a clear philosophy — capital preservation first, profit second.

Its risk module limits losses per trade and per account, ensuring traders never face unexpected wipeouts.

Key protection mechanisms include:

- Global equity stop: Halts trading when total drawdown exceeds safe limits.

- Trade-specific stop-loss: Each position carries a calculated SL based on ATR (Average True Range).

- Lot size control: Adjusts exposure automatically relative to account balance.

- Profit lock: Gradually secures gains as trades move in the favorable direction.

This balance between aggression and restraint makes it a valuable tool for both beginners and professional money managers.

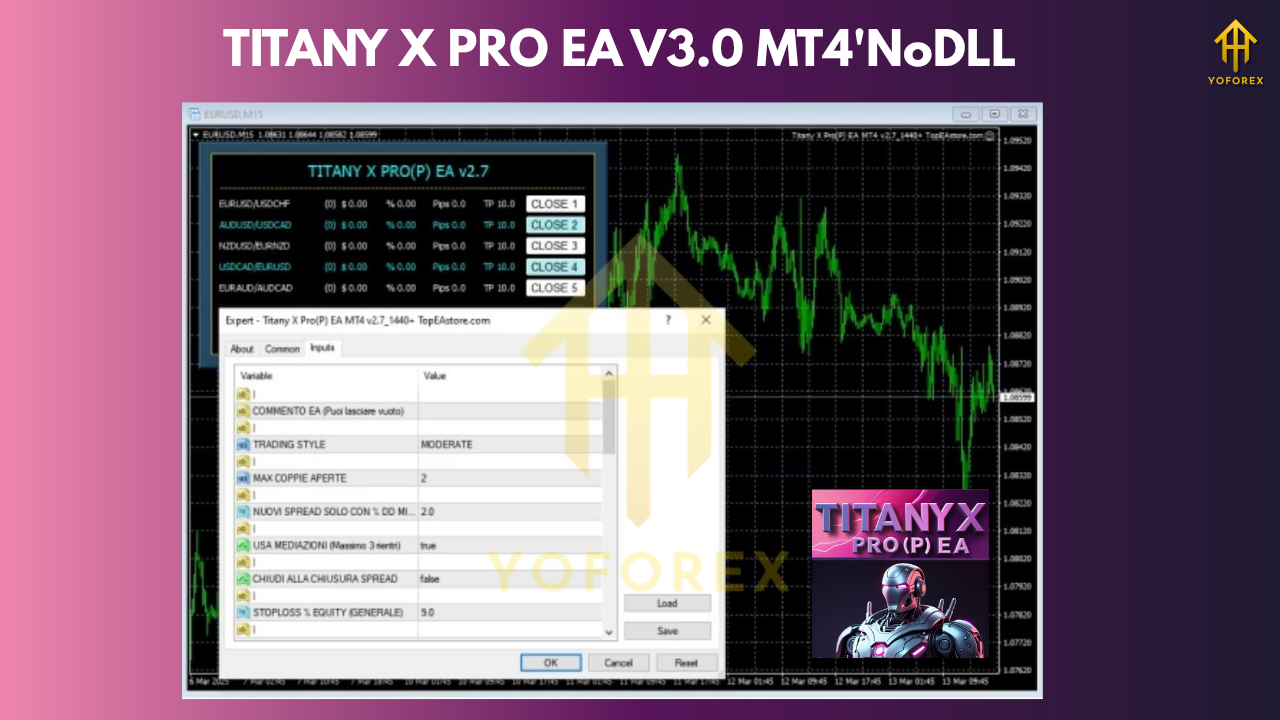

Recommended Settings

To extract the best performance from Titany X Pro EA V3.0, traders should use optimized settings tailored to their broker and risk profile:

- Account Type: ECN / Raw Spread

- Minimum Deposit: $500

- Leverage: 1:200 or above

- Spread: Below 20 points

- Timeframe: M15

- Recommended VPS: Low-latency VPS under 100ms

A stable internet connection and VPS hosting are crucial for maintaining continuous trade execution and avoiding missed opportunities during market sessions.

Advantages

- Works on multiple pairs and brokers

- Compatible with all MT4 terminals (build 1441+)

- Strong equity protection and disciplined drawdown control

- Ideal for prop-firm trading and risk-restricted environments

- No external DLLs or activation codes required

- Plug-and-play configuration with optional customization

Limitations

- No public MyfxBook or verified live performance data

- Performance may vary across brokers due to execution delay

- Requires fine-tuning for specific account types

- Unrealistic performance claims by resellers should be ignored

- Still needs periodic monitoring during major economic events

Installation and Setup Process

- Download the EA file and place it in the Experts folder of your MT4 directory.

- Restart the MetaTrader 4 platform.

- Open your chosen chart (preferably M15).

- Attach the EA to the chart and enable AutoTrading.

- Adjust parameters such as lot size, risk percentage, and equity protection level.

- Start monitoring trades using the built-in dashboard.

Even beginners can set it up within minutes. For advanced users, further optimization can be done through backtesting with broker-specific spreads and execution speeds.

Why Traders Choose Titany X Pro EA

The main reason behind its growing popularity is stability. In a market flooded with unreliable EAs that over-optimize backtests, Titany X Pro V3.0 takes a more disciplined route. It trades only when the probability of success is statistically high — reducing the emotional pressure of constant manual decision-making.

Its combination of simple risk logic, clear structure, and sustainable consistency makes it a practical choice for traders aiming for realistic, compounding results instead of overnight miracles.

Best Practices for Real Results

- Start with demo trading: Test for at least 2–3 weeks to understand behavior across pairs.

- Use reputable ECN brokers: Slippage and spreads heavily influence EA results.

- Avoid manual interference: Let the algorithm execute based on its logic without emotion.

- Monitor VPS uptime: Any disconnection may cause missed signals or partial closures.

- Diversify assets: Run the EA on at least 3–4 pairs to balance volatility exposure.

Following these steps ensures consistent performance and risk-controlled returns over time.

Final Verdict

The Titany X Pro EA V3.0 MT4 is a professional-grade trading robot that merges intelligent algorithmic precision with practical risk control. It isn’t designed for gamblers or high-risk thrill seekers — it’s meant for traders who value long-term, compounding success with structured decision-making.

Its prop-firm compliance, low-drawdown design, and smart trade management make it a powerful ally for both aspiring and seasoned traders.

While it’s essential to verify settings and test performance independently, Titany X Pro EA’s balanced strategy, stability, and compatibility justify its growing reputation as one of the smarter EAs for 2025.

Comments

Leave a Comment