The forex market has always been a battleground of strategies, systems, and innovations. Every year, new Expert Advisors (EAs) enter the scene, promising traders an easier way to capture consistent profits. Among these tools, Theranto V3 EA V1.2 MT4 has been drawing attention for its unique approach to market pullbacks. Unlike generic robots that attempt to handle every market condition, this EA has been designed with a sharper focus, giving traders a more disciplined pathway to harness price momentum.

This detailed guide explores everything you need to know about Theranto V3 EA: how it works, what makes it different, its strengths and weaknesses, and whether it can fit into your trading plan in 2025 and beyond.

Introduction to Theranto V3 EA V1.2 MT4

Theranto V3 EA is an automated forex trading robot for MetaTrader 4. Its key principle revolves around trading pullbacks—moments when price retraces after a strong move. This retracement often signals a continuation of the larger trend, and the EA uses algorithmic logic to identify these entry points.

The version under review, V1.2, builds upon earlier releases with improvements in signal accuracy, execution, and money management. While it is primarily optimized for the AUD/CAD currency pair, traders may experiment with other pairs. However, its real strength lies in focusing on a narrow market, reducing the risks of over-optimization across multiple assets.

Why Pullback Trading?

Pullback trading is a time-tested approach used by both professional traders and automated systems. The logic is simple:

- Prices rarely move in straight lines.

- Strong trends usually pause before continuing.

- A pullback provides a chance to enter at a better price.

Theranto V3 EA takes this logic and converts it into a mechanical trading process. Instead of manually waiting and watching for opportunities, the EA runs continuously, scans the charts, and executes trades when its conditions are met.

Features of Theranto V3 EA

- Automated Pullback Entries

Identifies retracements after strong market impulses and places entries in line with the dominant trend. - Optimized for AUD/CAD

While many EAs claim to work across dozens of pairs, Theranto V3 EA keeps its focus on AUD/CAD, where it has been tested extensively. - Improved Version 1.2 Updates

The latest update refines entry signals, adds better exit management, and enhances compatibility with modern MT4 builds. - Risk Control Tools

Includes stop-loss levels, adjustable lot sizing, and trade management rules to limit downside exposure. - Hands-Free Trading

Once installed, the EA requires minimal supervision, allowing traders to automate strategies without constant screen time.

How the Strategy Works

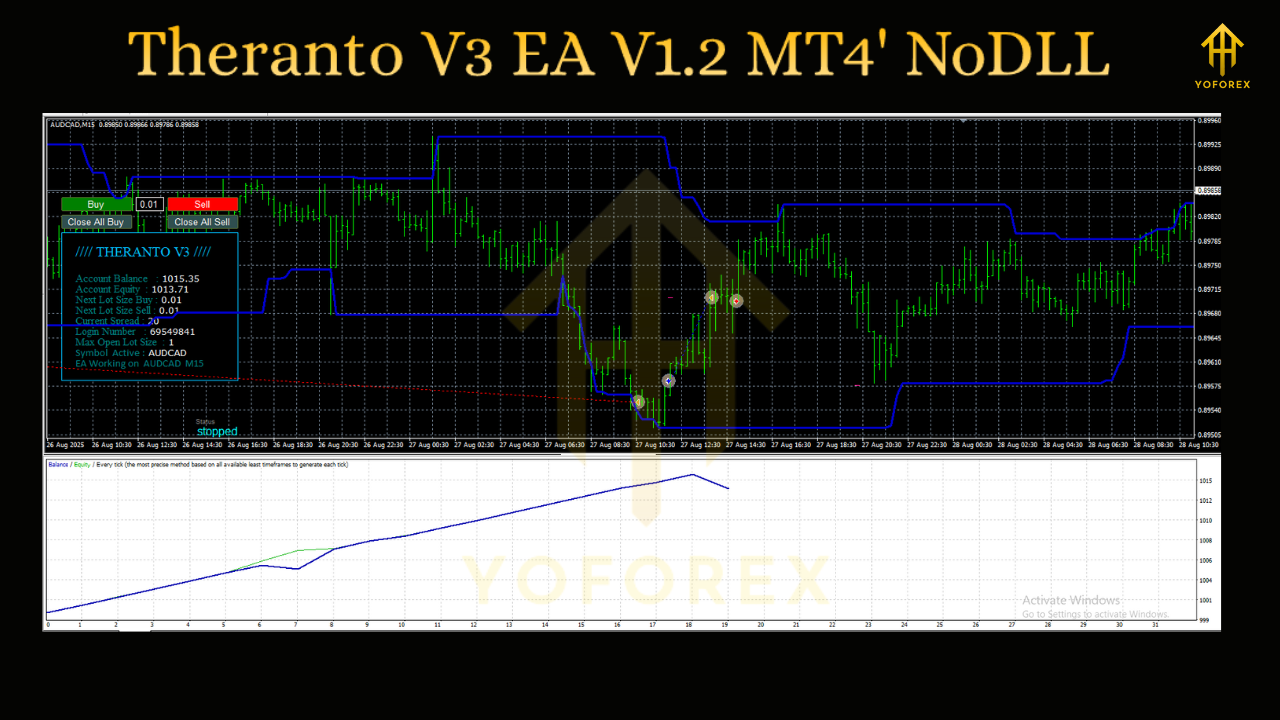

The EA’s logic can be broken down into stages:

- Detects when AUD/CAD experiences a sharp move.

- Waits for a price retracement, signaling a temporary pause.

- Confirms whether momentum supports a continuation.

- Places an order aligned with the initial trend.

- Applies exit conditions through take-profit or stop-loss.

This disciplined approach helps avoid emotional mistakes and reactive trading. However, like all pullback strategies, it can face challenges during sideways or news-driven volatility.

Strengths of Theranto V3 EA

- Focused Design: Concentrates on one major pair, avoiding over-complexity.

- Automated Logic: Reduces manual guesswork and emotional trading errors.

- Adjustable Settings: Traders can tailor risk parameters based on account size.

- Backtested Framework: Performance tested across multiple years of historical data.

- Continuous Updates: Ongoing refinements have improved version stability.

Limitations to Keep in Mind

- Limited Pair Diversity: Performance is strongest on AUD/CAD; results on other pairs may be inconsistent.

- Market Dependency: Works better in trending conditions than in sideways markets.

- Performance Claims: Profit percentages highlighted in promotions should be reviewed carefully and tested independently.

- No Guaranteed Results: Like all EAs, outcomes vary based on broker conditions, spreads, and risk settings.

Recommended Usage

For traders considering Theranto V3 EA, here are practical tips:

- Test it first on a demo account before moving to live capital.

- Run the EA on a VPS to avoid interruptions.

- Stick to moderate risk—ideally risking only 1–2% per trade.

- Monitor performance during high-impact news events, as volatility can disrupt pullback patterns.

- Withdraw profits regularly to safeguard against drawdowns.

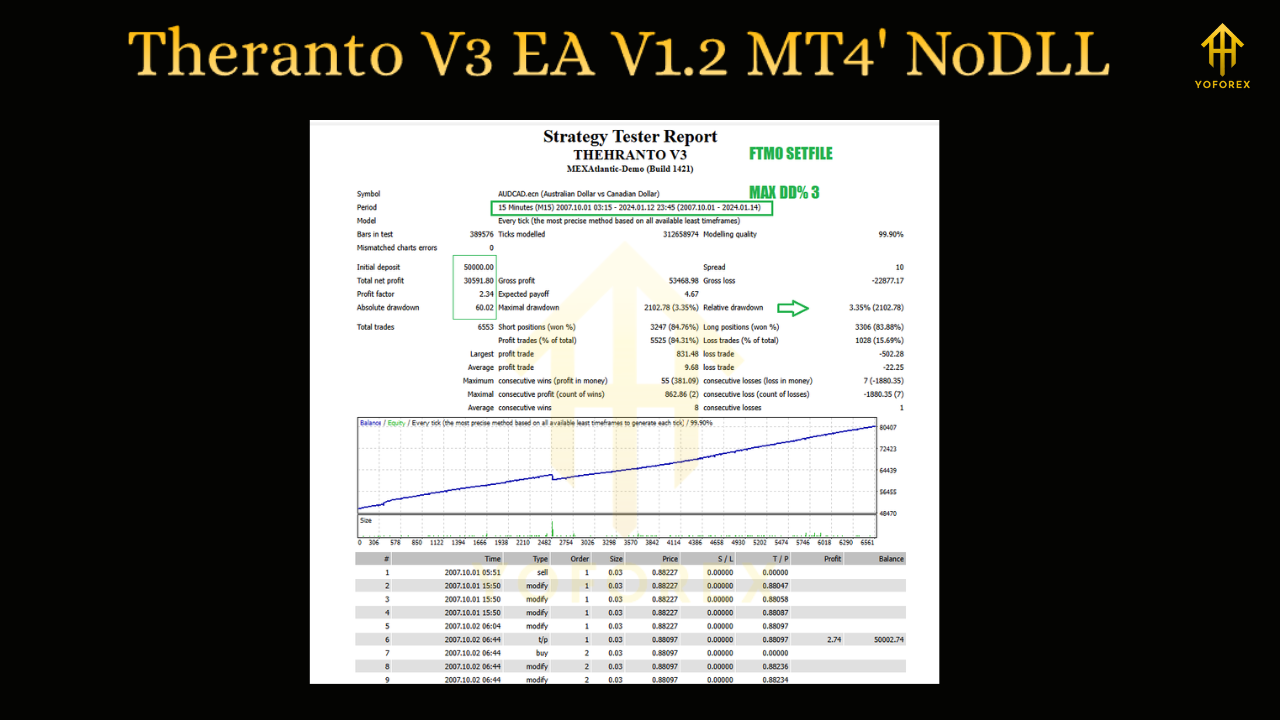

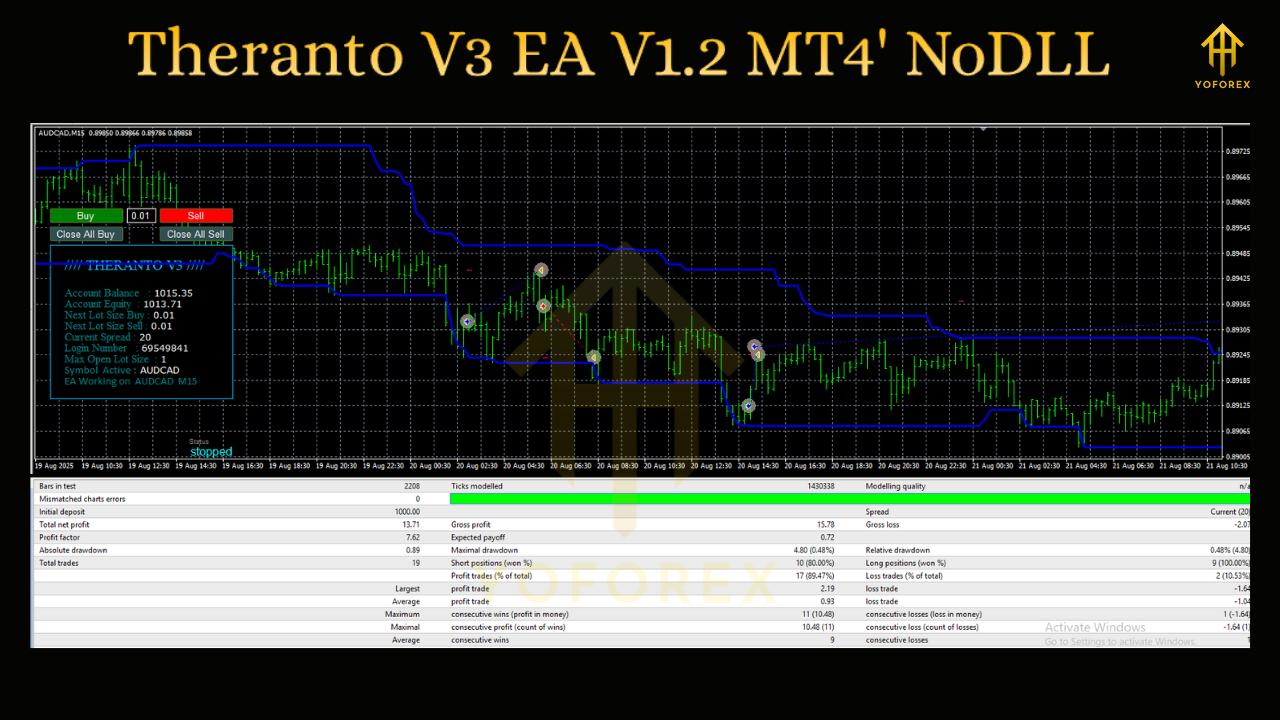

Backtest and Live Performance

Independent backtests suggest that Theranto V3 EA has achieved steady returns on AUD/CAD over multiple years, with average monthly gains between 5% and 10%. Drawdowns vary depending on risk settings but are generally reported in the 20–30% range.

However, live verified performance data remains limited. Traders should not assume backtest success guarantees future results. The EA should be seen as a tool within a diversified trading plan rather than a single solution for all market conditions.

Why Consider Theranto V3 EA in 2025?

As markets evolve, traders increasingly rely on automation to stay competitive. Theranto V3 EA provides:

- A structured approach for those who prefer trend-based strategies.

- Simplified management compared to complex multi-strategy robots.

- Hands-free operation that suits traders balancing other responsibilities.

It is not a system for everyone, but for traders who understand pullback logic and want a dedicated EA to apply it, Theranto V3 EA can be a strong candidate.

Final Thoughts

The Theranto V3 EA V1.2 MT4 is a well-defined automated system built on the concept of trend pullbacks. Its strengths lie in focus, automation, and risk control features. Its limitations revolve around market dependency and the lack of diversified application.

Traders should approach with realistic expectations, conduct personal testing, and use proper risk management. For those who do, Theranto V3 EA could serve as a reliable trading companion in 2025.

Comments

Leave a Comment