The ORB Master EA V1.1 MT5 — Precision Index Trading with Prop-Safe Logic

Platform: MetaTrader 5 (MT5)

Version: 1.1

Optimized Assets: US30, SP500, NASDAQ, DAX

Timeframe: M15

Chart Setup: EURUSD (EA manages all index symbols automatically)

Minimum Balance: $500 (adjust depending on broker lot size)

Broker Type: Low-spread ECN broker recommended

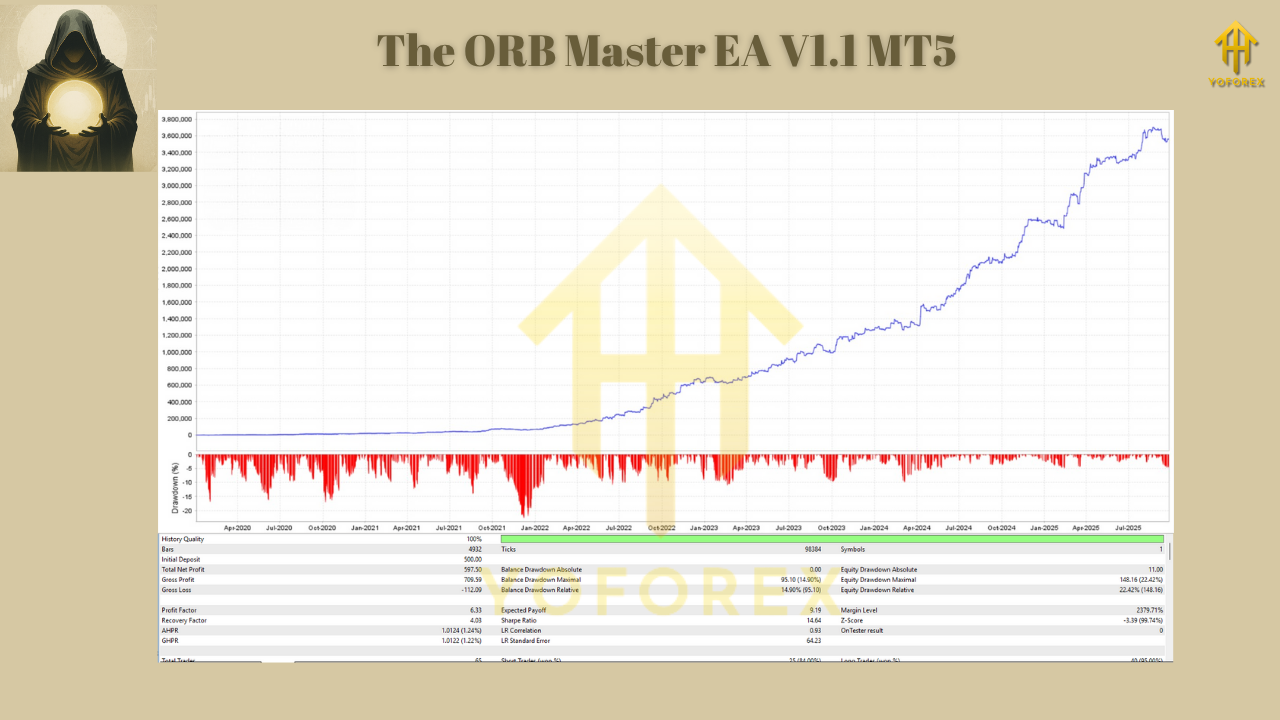

The ORB Master EA V1.1 MT5 is a next-generation index-trading Expert Advisor designed around the Opening Range Breakout (ORB) principle. It’s a clean, non-martingale system that deploys 12 uncorrelated strategy variations to capture intraday volatility across multiple indices — including US30, SP500, NASDAQ, and DAX. Built for professional traders and prop-firm compatibility, this EA balances consistency, precision, and capital protection.

Risk Management Philosophy

ORB Master is a non-grid, non-martingale system — every position comes with a fixed stop-loss and take-profit. There’s no averaging, doubling, or hidden exposure. Its strategy core focuses on controlled risk per trade, ensuring long-term sustainability and compliance with funded-account rules.

Each position is independently managed and risk-adjusted. You decide your capital allocation, and the EA does the rest — safely.

Core Strengths and Trading Logic

1. Opening Range Breakout (ORB) Engine

The EA identifies the first major market move during a session (the “opening range”) and takes trades in the direction of momentum once a confirmed breakout occurs.

2. 12 Independent Strategy Variations

Instead of one rigid rule set, ORB Master runs 12 algorithmic sub-strategies simultaneously. Each uses different entry logic, volatility filters, and timing windows — creating a diversified performance profile that minimizes drawdowns and smooths equity growth.

3. Multi-Asset Index Execution

Although it runs on EURUSD, the EA seamlessly executes on US30, SP500, NASDAQ, and DAX internally. This unified setup reduces platform load and simplifies multi-index automation.

4. Prop-Firm Ready

The EA is fully compliant with the strictest prop firm conditions — no martingale, no grid, no overnight risk escalation, and controlled daily exposure.

5. Capital Safety Features

- Fixed SL/TP logic per trade

- Position sizing tied to balance or fixed lots

- Risk caps to limit exposure per index

- Daily drawdown protection (optional)

Recommended Usage

- Attach the EA to an EURUSD chart on M15 timeframe — it automatically trades US30, SP500, NASDAQ, and DAX.

- Minimum capital: $500 (use higher for smoother scaling).

- Leverage: 1:100 or more for efficient margin use.

- Broker: ECN or Raw Spread brokers with low commission and fast execution (IC Markets, Pepperstone, Exness, etc.).

- VPS: Strongly recommended for uninterrupted 24/5 uptime and low latency.

How It Trades

Once loaded, ORB Master analyzes session volatility and builds an opening range for each index. When price breaks out above or below that range with volume confirmation, the EA executes trades in the direction of momentum.

By running 12 strategy variants, it filters out false breakouts and creates balanced exposure across multiple market conditions. The result is smoother equity progression — no high-risk pyramiding, no emotional entries, just logic-driven execution.

Advantages

• No grid, no martingale, no dangerous multipliers

• 12 independent systems for natural diversification

• Works across four major indices simultaneously

• Simple one-chart setup for ease of use

• Prop firm–safe and verified for funded accounts

• Fixed, predictable drawdown limits

• Clean trade visualization and reporting

Limitations

• Works only on indices (US30, SP500, NASDAQ, DAX)

• Requires VPS and low-spread ECN broker for best results

• Best suited to traders who prefer slow, consistent growth rather than high-frequency action

Final Thoughts

The ORB Master EA V1.1 MT5 is an institutional-grade, risk-controlled index trading system that blends mechanical precision with diversification intelligence. With 12 uncorrelated strategies running across US30, SP500, NASDAQ, and DAX, it delivers consistency without the pitfalls of grid or martingale trading.

Ideal for funded account traders, long-term portfolio builders, or anyone who wants safe exposure to index volatility, ORB Master sets a new standard in clean, intelligent automation.

Risk Disclaimer: Trading indices involves significant risk. Always use tested settings, start on demo, and trade responsibly.

Join our Telegram for the latest updates and support

Comments

No Comments ˆ(

Leave a Comment