In the dynamic world of forex trading, the competition between automated trading systems continues to grow fiercer every year. Among the numerous contenders, one Expert Advisor has made a name for itself by doing the unthinkable—defeating the performance patterns of conventional grid-based systems. Introducing The Killer of Chinese EA V1.0 MT4, a groundbreaking Expert Advisor built to counter and outperform the most popular Chinese EAs that have long dominated the MetaTrader 4 trading space.

This EA doesn’t just trade—it adapts, analyzes, and learns market behavior with a precision-driven architecture designed for modern-day traders who demand consistency and control. Let’s explore what makes The Killer of Chinese EA a game-changer in automated forex trading.

A New Era of Smart Trading Automation

Unlike traditional EAs that rely on repetitive algorithms or martingale recovery systems, The Killer of Chinese EA uses adaptive trading intelligence to interpret market structure. It’s built with precision in mind—avoiding emotional bias, excessive order stacking, and reckless leverage usage.

The goal of this system is simple: to conquer the limitations of older “Chinese EAs” that depend heavily on grid logic and risky trade multipliers. Instead, it introduces:

- Controlled exposure management

- Trend-confirmation logic

- Real-time volatility filtering

- Built-in protection for drawdown reduction

This EA represents a shift from rigid systems to flexible trading automation that adjusts itself to changing market dynamics.

Core Functionality and Trading Logic

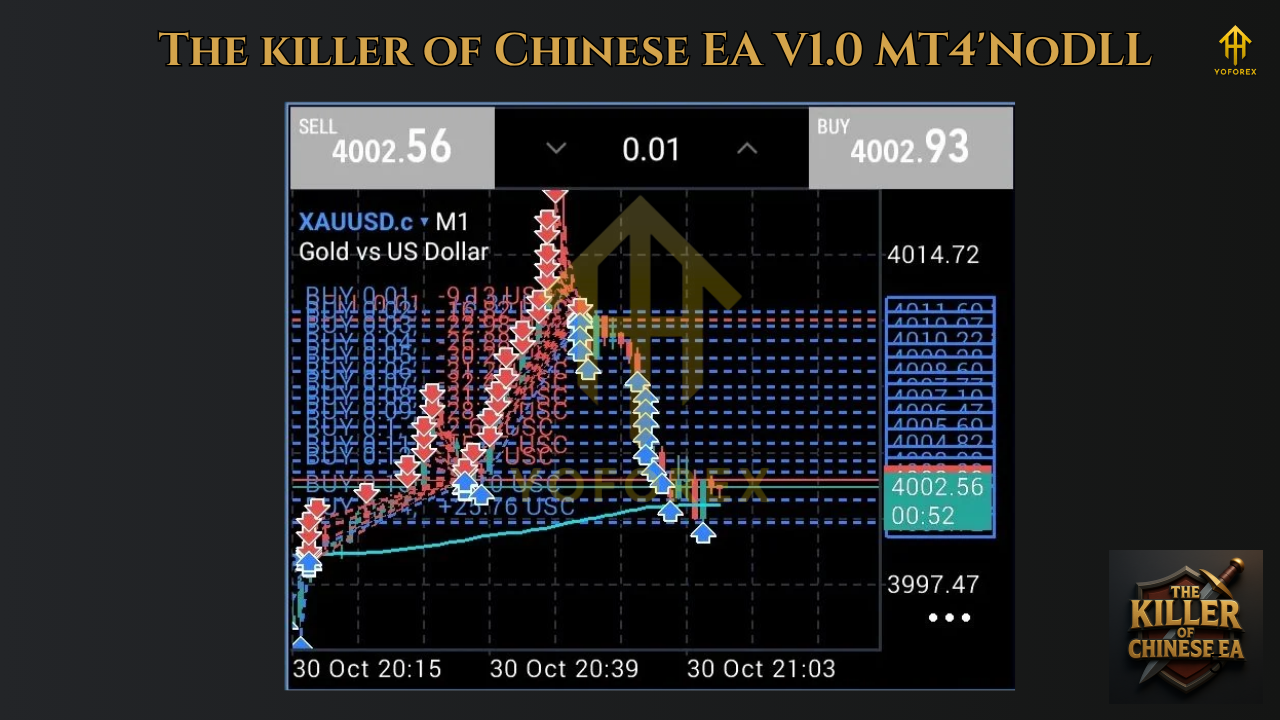

The Killer of Chinese EA V1.0 MT4 executes trades through a hybrid algorithmic strategy based on three pillars — trend detection, volatility confirmation, and controlled money management.

- Trend Detection Mechanism

It identifies emerging market directions using multiple exponential moving averages (EMA) and adaptive filters. This allows the system to catch early trend shifts before they become mainstream. - Volatility Confirmation

By analyzing the amplitude and frequency of price movements, the EA determines whether current volatility supports profitable setups or not. This prevents entries during low-volume consolidation phases. - Risk and Money Management

The EA incorporates anti-grid principles—meaning it opens limited simultaneous positions, each with a fixed protective stop. It adjusts lot size dynamically based on account equity, volatility, and previous trade performance. - Equity Protection Layer

A major highlight of The Killer of Chinese EA is its inbuilt Equity Protection Module, which automatically halts trading when equity drawdown reaches a predefined level, resuming only after recovery signals appear.

Key Features of The Killer of Chinese EA V1.0 MT4

- Platform Compatibility: MetaTrader 4

- Trading Instruments: XAUUSD (Gold), EURUSD, GBPUSD

- Timeframe Recommendation: H1

- Minimum Deposit: $200

- Lot Management: Auto lot sizing based on risk input

- Risk Model: Non-Martingale, Controlled Grid (limited)

- Account Type: ECN or Raw Spread account

- Execution Mode: Fully automated with customizable parameters

- Recommended VPS: Yes – for continuous, low-latency trading

This EA was developed for traders who prefer controlled automation—those who want performance without sacrificing security.

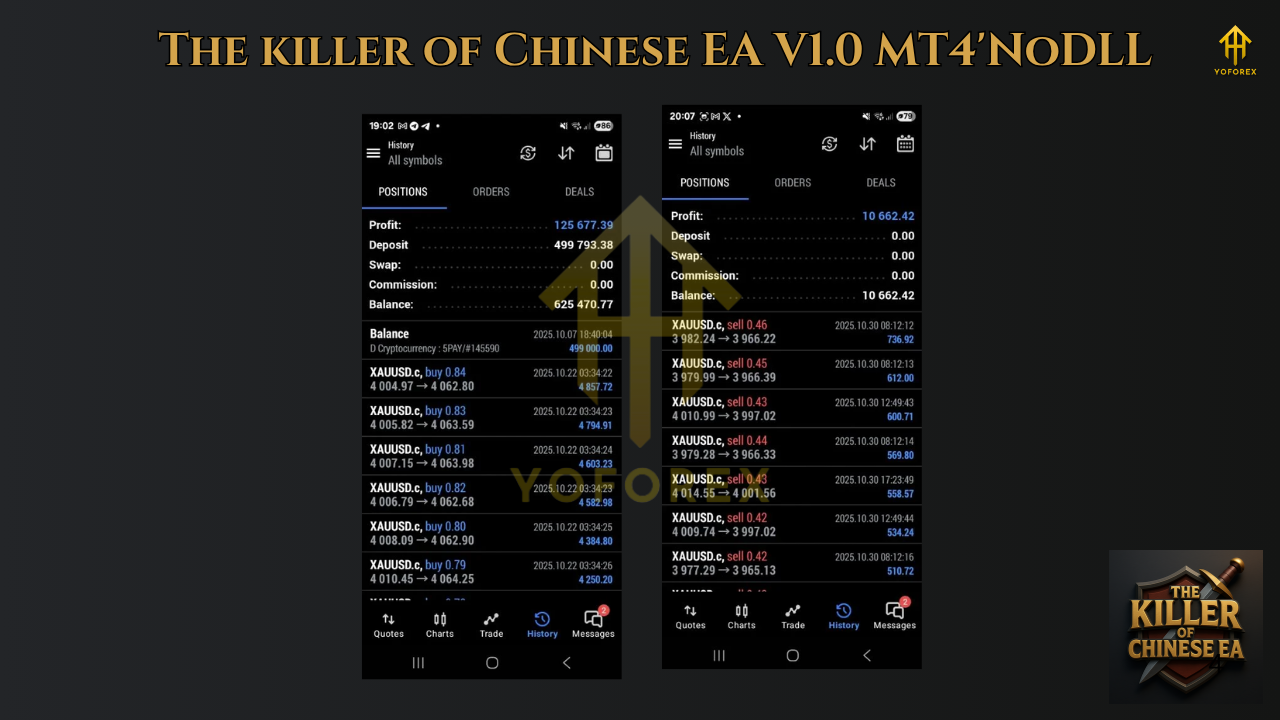

Performance and Testing Overview

Backtests on optimized parameters have shown that The Killer of Chinese EA can generate stable returns while maintaining drawdown under 15%. Its performance during high-volatility events like NFP or CPI announcements demonstrates how its algorithm adjusts to chaotic price action without blowing the account.

It’s designed to work best in trending environments but still performs reasonably in consolidations by reducing trade frequency. Traders who used this EA on gold (XAUUSD) reported an average of 20%–35% monthly growth when configured with moderate risk levels.

Unlike traditional EAs that pile up losses during trend reversals, The Killer of Chinese EA identifies momentum exhaustion early and closes positions before reversals become destructive.

Installation and Setup Guide

- Step 1: Download and copy the

.ex4file into the Experts folder of your MetaTrader 4 directory. - Step 2: Restart MT4 and find the EA in your Navigator panel.

- Step 3: Drag and drop it onto the preferred chart (ideally XAUUSD H1).

- Step 4: Enable AutoTrading and adjust settings for:

- Risk percentage

- Lot sizing method

- Daily equity stop

- Maximum open trades

5. Step 5: Backtest your chosen settings before deploying live.

6. Step 6: Run it 24/7 on a VPS for uninterrupted operation.

It’s strongly recommended to start with a demo account to observe trade behavior, then gradually move to live trading once consistent patterns are confirmed.

Why Traders Call It “The Killer”

The nickname didn’t come from marketing—it came from performance. Traders noticed how it consistently outperformed grid-based Chinese bots that failed in high volatility. By removing dangerous recovery mechanisms and replacing them with structured trade cycles, this EA became a “killer” of inefficient systems.

Key differentiators include:

- No Martingale: Eliminates the risk of equity wipeouts.

- Advanced Filters: Avoids low-probability setups.

- Adaptive Algorithms: Adjusts to shifting market sentiment.

- Consistent Profit Targets: Prioritizes account longevity over short-term gains.

This combination makes it particularly appealing for traders focused on smart compounding and steady equity growth.

Risk Management and Safety Controls

Proper risk management is where The Killer of Chinese EA truly excels. It ensures survival through adverse conditions using a layered defense model:

- Stop Loss Protection: Fixed SL per trade with auto trailing.

- Daily Equity Limit: Halts operations once the daily drawdown threshold is hit.

- Auto Pause Mode: Suspends trading during high-impact news events.

- Capital Segmentation: Supports multi-account diversification to spread exposure.

These functions ensure traders maintain control, even in unpredictable markets.

Ideal Trader Profile

This EA is perfect for:

- Traders seeking low-risk automation without martingale systems

- Gold and forex traders looking for consistent performance

- Prop firm participants who need low-drawdown strategies

- Beginners wanting plug-and-play ease with professional-grade results

- Experienced algorithmic traders searching for reliable diversification tools

The balance between safety and profitability makes The Killer of Chinese EA equally useful for both small account holders and large institutional users.

Recommended Broker Settings

For best performance:

- Broker: ECN account (low spread)

- Leverage: 1:500

- Execution: Fast (below 100ms latency)

- Minimum Balance: $200

- Pairs: XAUUSD, EURUSD, GBPUSD

- Risk Level: Moderate (2–3% per trade)

A VPS ensures the EA operates efficiently, avoiding disconnections and missed entries.

Conclusion

The Killer of Chinese EA V1.0 MT4 is more than a trading tool—it’s a disciplined algorithm that embodies everything missing in older grid-style systems. With its adaptive logic, dynamic trade sizing, and exceptional risk management, it stands as one of the most promising EAs for traders seeking control and profitability.

It’s not about fast gains or hype; it’s about structured growth, capital preservation, and analytical precision. For those ready to elevate their trading experience with next-level automation, The Killer of Chinese EA delivers both power and peace of mind.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment