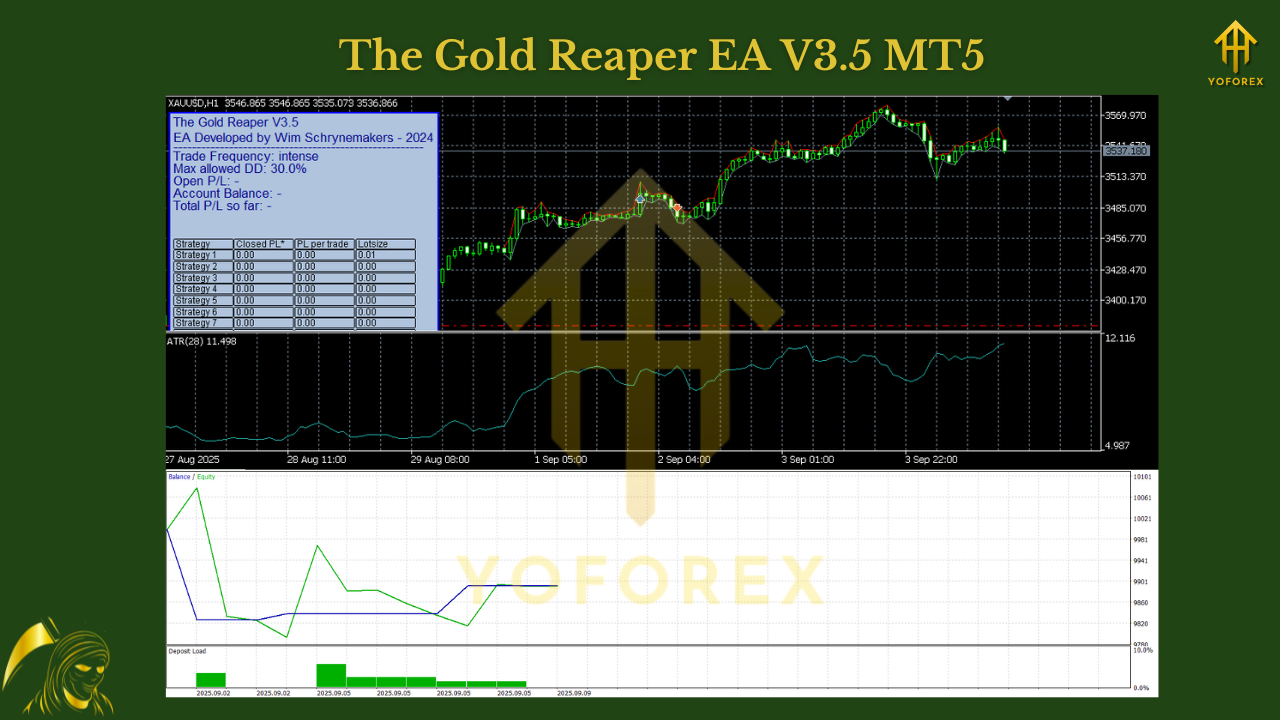

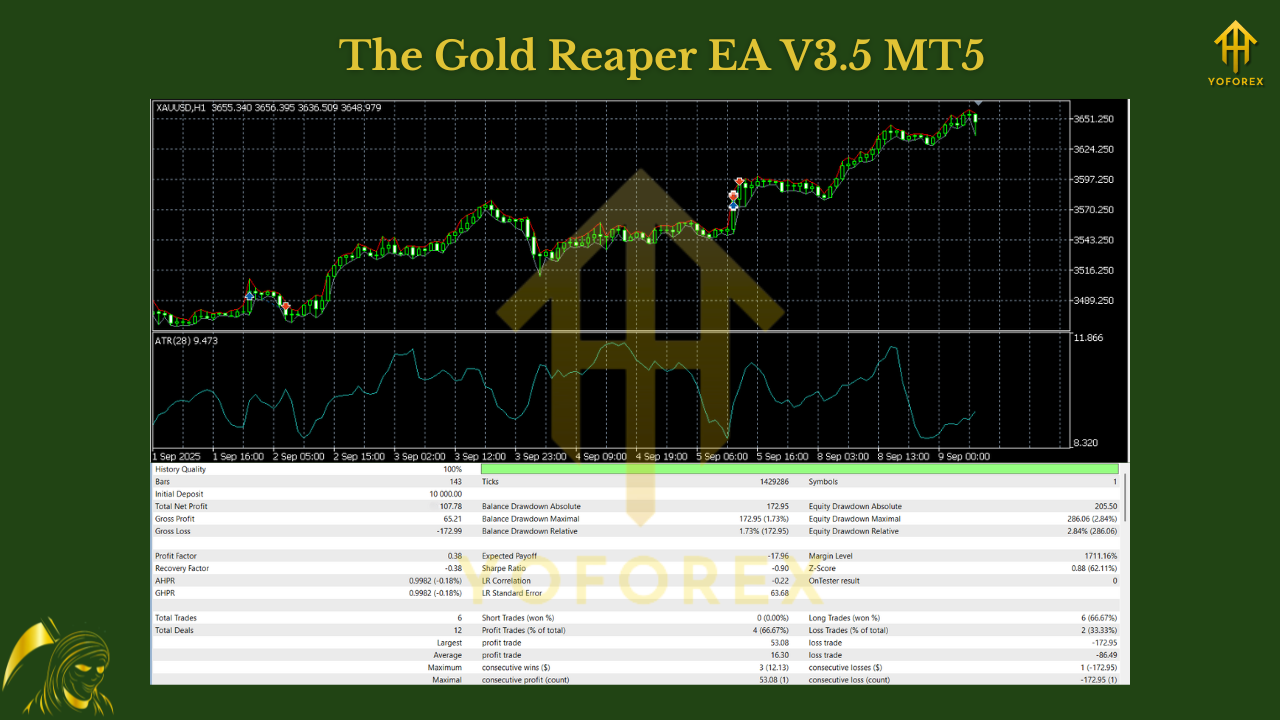

The Gold Reaper EA V3.5 MT5 — A Clean, Drawdown-First Bot for Serious XAUUSD Traders

Gold (XAUUSD) can be a beast. Big moves, wicked whipsaws, spreads that widen right when you least expect it… and if your EA gets fancy with risk, your account can go from calm to chaos fast. The Gold Reaper EA V3.5 (MT5) takes the opposite path. It’s built to be easy to use, risk-first, and prop-firm friendly, with a simple promise: you set a maximum allowed drawdown, and the EA adapts trade frequency and lot size automatically. No grid. No martingale. No “trust me bro” risk management.

If you want a gold robot that keeps things transparent and manageable, while still letting you capture the precious metal’s intraday momentum, this EA hits a sweet spot—especially for traders who prefer clarity over complexity.

What Exactly Is The Gold Reaper EA?

The Gold Reaper EA V3.5 is an MT5 expert advisor that runs on XAUUSD and focuses on controlled risk with automated scaling. You don’t have to juggle complicated money-management trees or tweak dozens of inputs. Set your maximum allowed drawdown, attach it to your gold chart, and let the EA do the heavy lifting—it automatically adjusts both trade frequency and lot size within your risk boundary.

- Instrument: XAUUSD (Gold)

- Platform: MetaTrader 5 (MT5)

- Risk Model: Drawdown-capped, no grid, no martingale

- Ease of Use: Install → set max DD → run

- Minimum Account Balance: $300

The guiding idea is simple: protect your downside first, then let the system look for opportunities that fit your risk profile.

Key Features (At a Glance)

- Set-and-Go Simplicity: Install on chart, choose your max allowed drawdown, and start. The EA auto-manages entries per its logic without needing constant babysitting.

- Automatic Trade Frequency & Lot Size: It adapts trade count and position sizing depending on your risk cap—keeping exposure aligned with your limits.

- No Grid / No Martingale: No averaging down, no multiplying lots after losses. Your risk stays transparent.

- Clean Risk Guardrails: Hard stop-loss discipline embedded; the EA does not rely on “hope” to exit.

- Good Historical Behavior on XAUUSD: Built and tuned for gold’s volatility profile with strong historical performance traits (remember: past performance ≠ future results).

- Prop-Firm Friendly: Straightforward risk handling makes it easier to align with typical daily/max drawdown rules.

- Lightweight Configuration: Minimal inputs and human-readable parameters.

- Robust Logging: Clear journal outputs to understand why a trade was taken or skipped.

- VPS-Ready: Works well on a low-latency VPS for consistency during volatile sessions.

How It Manages Risk (The Drawdown-First Approach)

The standout is the max drawdown control you set. Once you define your risk ceiling, the EA calibrates how aggressively or conservatively it trades. Two things change automatically:

- Trade Frequency – If market conditions get noisy or your drawdown limit is near, the bot slows down. If volatility becomes favorable and you’re comfortably inside your risk budget, it can engage more.

- Lot Size – Position sizing responds to your drawdown guardrail so that no single trade (or sequence) overexposes the account.

This means the EA’s pace and size are never divorced from your risk preference—your drawdown cap is the boss. Traders who hate micromanaging or over-optimizing will love this: set the line in the sand and let the EA respect it.

Strategy Notes (Without the Hype)

This is a gold-specialized EA with rules designed around gold’s typical behaviors—momentum bursts, trend follow-through, and occasional range expansions. The logic avoids pyramiding or grids that stack risk; instead, it opts for defined entries with hard stops, and manages winners/losers within your DD envelope.

A few practical implications:

- Fewer catastrophic sequences (thanks to no martingale/grid).

- More consistent risk per attempt, which makes statistics like win-rate/R-multiple easier to track.

- Smoother prop-firm compliance, since daily equity swings are actively contained by your DD cap and the EA’s adaptive throttle.

Installation (MT5) — Quick Start

- Copy the EA File

Open MT5 → File → Open Data Folder → MQL5 → Experts, and paste the EA file. - Restart MT5

Close and reopen MT5 so it recognizes the new Expert Advisor. - Attach to XAUUSD Chart

Open a Gold (XAUUSD) chart → Navigator → Experts → drag The Gold Reaper EA V3.5 onto the chart. - Allow Algo Trading

Make sure Algo Trading is enabled (toolbar button is green). - Set Your Max Drawdown

In the Inputs tab, set your preferred maximum allowed drawdown (e.g., 5%–10% to start cautiously).

Tip: Begin conservative; you can loosen later after forward results. - Confirm Journal/Experts Logs

Check the Experts and Journal tabs to ensure the EA initialized correctly.

Recommended Starting Settings

- Account Size: Minimum $300 (use micro lots and keep risk low until you learn its rhythm).

- Max Drawdown: Start around 5%–8%; scale only after a few weeks of positive forward observation.

- Time to Run: 24/5 is fine; consider pausing just before major red-flag news if you prefer a calmer profile.

- VPS: Highly recommended for stability and lower latency on gold.

- Broker Conditions: Tight spreads and fast execution improve fill quality on XAUUSD

Why It’s Prop-Firm Friendly

Prop rules typically revolve around max daily loss, overall drawdown, and news-time pitfalls. The Gold Reaper’s architecture helps here because:

- You define the drawdown ceiling, so the EA won’t “accidentally” run hot beyond your plan.

- No grid/martingale means no progressive risk blow-ups when markets turn.

- Optional news discipline (manual or via schedule) makes it easier to avoid the wildest spikes.

Always cross-check your firm’s rules (daily trailing rules can be tricky). Start on demo, then a small live/personal account, then your funded challenge once you’re fully confident.

Best Practices for Real-World Use

- Run a 2–4 week demo to understand behavior across sessions (Asia/London/NY).

- Measure drawdown vs. return—not just win-rate. Consistent downside control is the edge.

- Avoid parameter tinkering mid-week unless something is obviously broken.

- Scale risk slowly. Double only after a statistically meaningful sample (30–50 trades).

- Keep expectations grounded. Even a robust EA can hit losing streaks during regime shifts.

Final Take

The Gold Reaper EA V3.5 (MT5) is for traders who want clean risk, zero gimmicks, and an easier path to consistency on gold. You set the maximum drawdown. The EA keeps itself honest by auto-adjusting trade frequency and lot sizing to respect that line—no grid, no martingale, no hidden surprises. Start small, be patient, and let your data—not emotions—drive the next tweak.

Join our Telegram for the latest updates and support

Comments

Leave a Comment