SupraAI 2025 EA V1.50 MT4 – Smart, Fast, and Built for 2025’s Market Pace

The forex market never sleeps—and honestly, neither do the opportunities. Between global headlines, inflation prints, and surprise central-bank pivots, prices can rip from level to level before most traders even finish drawing a zone. If you’re aiming for consistency without babysitting every candle, automated trading can be the difference between “almost” and actual execution. Enter SupraAI 2025 EA V1.50 for MT4—a next-gen Expert Advisor that leans on machine-assisted logic, regime filters, and pragmatic risk controls to help you trade with discipline, not adrenaline. Let’s break down what it does, why it matters, and how to set it up the right way.

What is SupraAI 2025 EA V1.50 (MT4)?

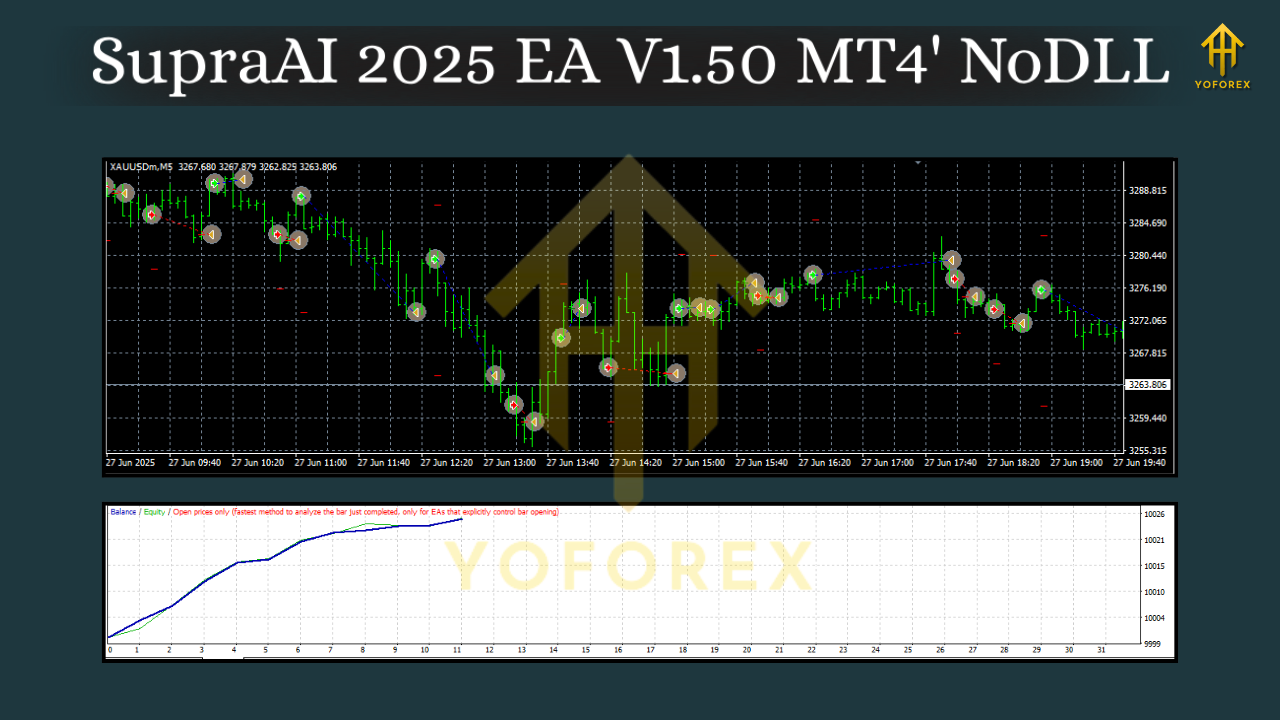

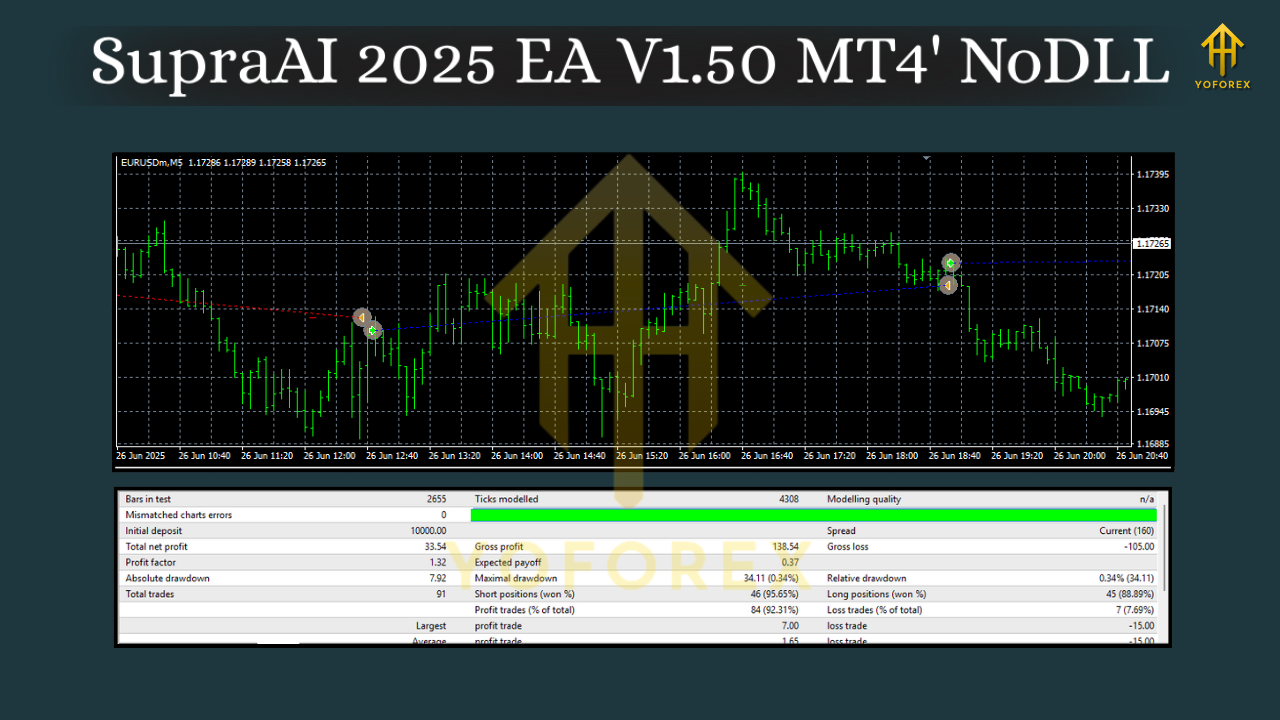

SupraAI 2025 EA is an MT4 expert advisor that blends technical signals with AI-assisted scoring to decide when to trade and—equally important—when to sit tight. Rather than chasing every minor pullback, the system looks for high-quality setups aligned with broader market context (trend, volatility state, session dynamics). The “2025” in its name isn’t just a year—it reflects a design philosophy: faster markets, noisier data, stricter risk, and the need for smarter filters.

The V1.50 release focuses on stability and execution hygiene. Think: fewer impulsive entries, more patience around news and session opens, and more consistent position sizing. You still control risk, lot sizes, and pairs, of course. But the EA’s job is to keep your strategy’s edge intact even when emotions say “click buy now!”

Core Strategy, Simplified

SupraAI 2025 runs a rule-based core with an AI-assisted layer that scores potential trades before they’re allowed in. The goal isn’t to make “magic” decisions; it’s to enforce discipline:

- Market regime detection: Is volatility expanding or compressing? Are we trending or ranging? The EA adapts triggers accordingly.

- Directional bias: Trend filters (e.g., MTF moving average alignment or structure breaks) keep trades on the right side of momentum.

- Volatility gates: ATR-style thresholds reduce entries during chaotic spikes or “dead” sessions.

- Entry confirmation: Only when preconditions meet (direction + regime + volatility) does the EA look for a precise trigger (breakout, pullback, or reversal cue—depending on your mode).

- Exit logic with guardrails: Trailing, partials (if enabled), and time-based exits help lock progress, especially before major session flips or events.

This layered approach aims to avoid the two classic killers: over-trading in chop and late chasing after parabolic moves.

Key Features You’ll Actually Use

- AI-assisted trade scoring to filter low-quality setups and reduce noise-trades.

- Regime-aware logic (trend vs. range) so triggers feel “smart,” not generic.

- Volatility and spread filters to dodge bad fills during spikes or thin liquidity.

- Session controls (Asia/London/NY) to focus on the hours that fit your style.

- Risk-first management with max daily loss, per-trade risk %, and equity protection.

- Adaptive trailing for momentum days and time-outs when momentum fades.

- Multi-pair support (majors, minors, metals if your broker allows)—configure lists per account.

- News avoidance window (optional) to pause around high-impact releases.

- Prop-friendly behavior (conservative mode) to help stay within typical rules.*

- Clean alerts & logs so you understand why a trade was or wasn’t taken.

*Always check your specific prop firm’s rules—no EA can guarantee compliance everywhere.

Who Is It For?

- Busy traders who want rule-driven execution while they handle work or study.

- System traders who value consistency over drama.

- Newer traders who understand risk and want guardrails against impulse clicks.

- Experienced quants who like to tweak filters and build pair-specific profiles.

If you’re looking for a lottery ticket or an “always-on grid until margin call,” this isn’t it. SupraAI 2025 aims for quality over quantity.

Recommended Setup (Start Safe, Scale Later)

Account type: ECN/RAW or a reputable standard account with tight spreads and reliable execution.

Pairs to begin with: EURUSD, GBPUSD, USDJPY, XAUUSD (if you know gold’s temperament).

Timeframes: H1 for directional stability; M15 for more signals once you’re comfortable.

Risk per trade: 0.25%–0.75% to start; let data (not feelings) justify increases.

Max daily loss: 2%–3% hard stop; the day you don’t lose is the day you can come back stronger.

VPS: Strongly recommended for 24/5 uptime and low latency.

Broker time alignment: Match session windows to your server time and personal schedule.

Pro tip: Run it demo for 2–3 weeks, log outcomes, then go live with conservative risk. Iterate settings based on your pairs and goals.

Configuration Walk-Through (MT4)

- Copy files: Place the EA in

MQL4/Expertsand any indicators (if required) inMQL4/Indicators. - Restart MT4: Or hit Refresh in the Navigator panel.

- Enable AutoTrading: Top toolbar should glow green when active.

- Load on chart: Pick your pair/timeframe and drag the EA onto it.

- Inputs to check first:

- Risk model: fixed lot vs. % risk per trade.

- Max daily loss / Equity guard: set your hard limits.

- Session filter: on/off and hours per your schedule.

- Volatility gate: ensure ATR/spread thresholds make sense for the pair.

- News pause: enable if you don’t want trades near red-flag releases.

6. Save as preset: Once dialed, save a .set file so you can reuse quickly across charts.

7. Run multiple charts: One chart per pair/timeframe; don’t stack multiple EAs on one chart.

Best Practices (From Traders Who’ve Been There)

- Less is more: A tight watchlist often outperforms a bloated one. Curate your top 2–4 symbols.

- Sessions matter: If you trade London, focus on instruments that move then; don’t force NY logic into Asia.

- When in doubt, reduce: Uncertain market? Cut risk in half rather than guess.

- Don’t tweak mid-trade: Let rules run—then review post-session.

- Journal the why: Track settings, sessions, and news context. In two weeks, you’ll see patterns.

Strengths vs. Limitations

Strengths

- Disciplined filters reduce emotional over-trading.

- Solid risk controls help protect equity on bad days.

- Flexible enough for both swing bias (H1) and more active modes (M15).

- Transparent logs—great for learning and auditing.

Limitations

- Not a “set and forget forever”; markets evolve, you should review weekly.

- News spikes, slippage, and spread widening affect all EAs—SupraAI included.

- Past performance (backtests, demos) ≠ future results; treat data as guidance, not gospel.

Example Profiles (Starting Points)

- Conservative: 0.25% risk/trade, H1 only, session filter ON (London), news pause ON, trailing modest.

- Balanced: 0.5% risk/trade, H1 + selective M15 on majors, session filter ON (London/NY overlap), news pause ON for red events, adaptive trailing.

- Active: 0.75% risk/trade, M15 focus, hand-picked pairs, volatility gate stricter to avoid chop, partial exits ON. (Use only after you’ve gathered data.)

Final Word

If 2025 is the year you commit to process over impulse, SupraAI 2025 EA V1.50 MT4 fits that mindset. It’s not hypey, it’s not a grid dressed up as “AI,” and it won’t promise what the market can’t deliver. Instead, you get structured entries, regime-aware logic, and practical risk management—exactly what most traders say they want… but rarely execute consistently on their own. Use it with respect for risk, give it a clean environment (low spreads, stable VPS), and let data guide your tweaks. Consistency isn’t flashy, but it compounds.

Comments

Leave a Comment