In the world of automated trading, finding a balance between responsiveness and reliability is key. Too many Expert Advisors chase signals without structure, causing inconsistent performance and unpredictable results. SuperTrend EA Pro V1.0 for MT4 changes that narrative by focusing on trend strength, confirmation, and controlled risk.

This EA isn’t built for guesswork. It uses one of the most respected technical indicators in trading — the SuperTrend — to guide entries and exits based on real market direction. Whether you're a beginner or a more advanced trader looking for a clean, rule-based solution, this EA offers a flexible toolset to help you ride trends rather than fight them.

Let’s break down how it works, what makes it unique, and how you can integrate it into your trading strategy.

What Is SuperTrend EA Pro V1.0?

SuperTrend EA Pro is a MetaTrader 4 Expert Advisor that automates trend-based trading decisions. At its core, it uses the SuperTrend indicator — a dynamic tool based on price and volatility — to determine market direction and filter entries.

Rather than relying on price breakouts or lagging oscillators, SuperTrend identifies clear zones where price shows sustained movement. This EA builds on that by combining multiple SuperTrend levels, dynamic stop loss logic, and position management systems that give you full control over how trades are executed and managed.

You can run this EA on forex, indices, metals, or even crypto pairs, as long as your broker supports the asset on MT4. It's adaptable across all timeframes, letting traders pick their comfort zone — whether that’s high-speed scalping or longer-term swing positions.

How SuperTrend EA Pro Operates

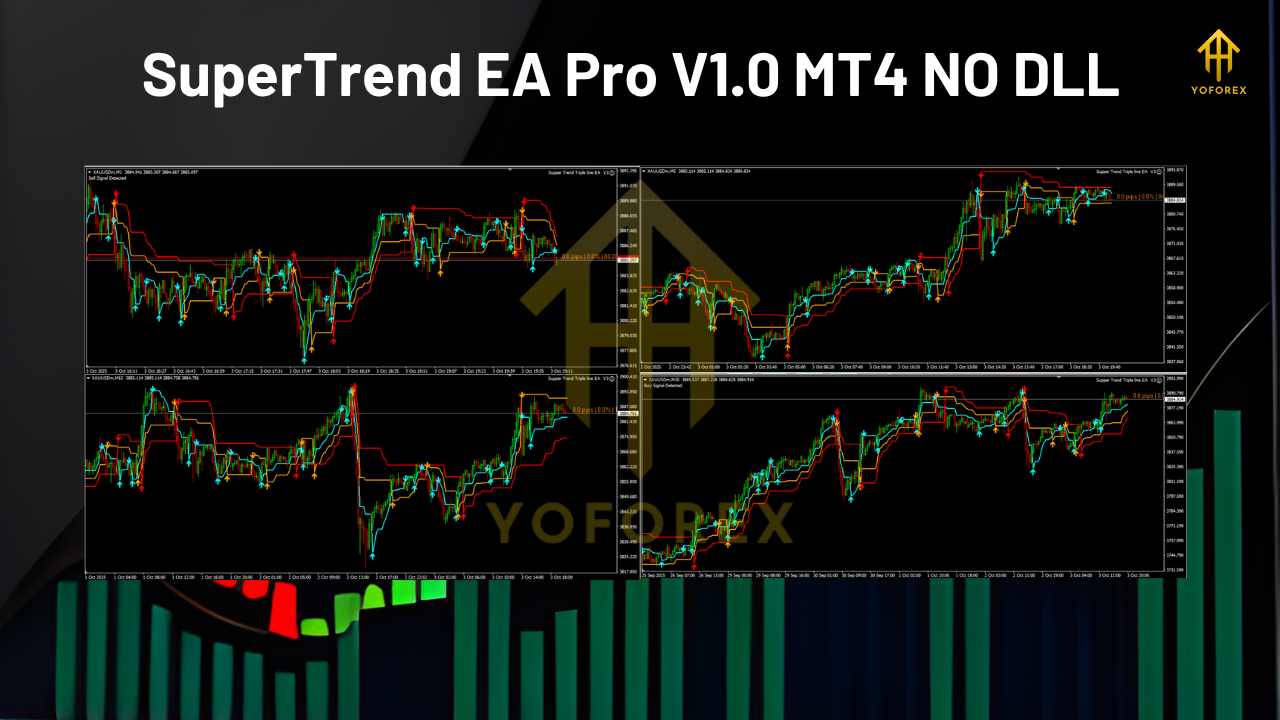

SuperTrend EA Pro works by analysing multiple SuperTrend signals on the chart. The indicator creates a trend bias by changing direction based on ATR and price action. In the EA’s case, three SuperTrend signals are used to add confirmation before placing a trade.

This multi-layer logic ensures that entries aren't triggered by one minor move but rather by a consistent pattern of price pushing through key zones. It reduces noise and keeps trades aligned with momentum.

Key Mechanics Include:

- Entry Logic: A trade is opened only when all SuperTrend levels align in the same direction. This filter reduces false entries and improves accuracy.

- Dynamic Stop Loss: The stop loss isn’t fixed but adjusts based on the volatility of the instrument being traded. This is calculated using ATR and changes in price behaviour.

- Trailing Stop: Once a trade is in profit, the EA trails it. This means profits are protected as the price continues in your favour.

- Exit Conditions: Positions close based on trailing logic, opposite trend signals, or a stop-loss trigger.

- Lot Sizing: You can trade using a fixed lot or risk percentage per trade. It adjusts to account balance, giving you more flexibility depending on your style.

- Equity Control: The EA supports equity-based controls so you can protect your capital during large drawdowns or when the market becomes unstable.

Benefits of Using SuperTrend EA Pro

Designed for Clear Market Trends

Unlike scalpers that enter dozens of trades a day or mean-reverting systems that struggle in trends, this EA thrives in directional markets. Once the trend is confirmed, it enters with calculated precision.

Reduces Emotional Trading

Because the entries and exits are handled by the EA, there’s no hesitation or panic-based decision-making. This is particularly valuable for beginners who often close trades too early or too late.

Fully Customizable

Everything from stop-loss multipliers, SuperTrend settings, risk management rules, and trailing logic can be tailored to your strategy. Whether you're risk-averse or aggressive, the EA can be adjusted accordingly.

Runs Across Assets

The logic isn’t limited to currency pairs. You can test it on gold, SPX500, BTCUSD, or any other instrument offered by your broker. Just make sure to optimise for volatility and pip value.

Timeframe Flexibility

It works just as well on M15 as it does on H1 or H4. You decide how often you want it to trade and adjust the parameters accordingly.

What Makes This EA Stand Out?

There are many EAs out there that claim to follow trends, but few use the SuperTrend indicator as the backbone of their logic. What makes this EA different is its multi-layered approach. It doesn’t enter just because one trend line is crossed. It waits for multiple confirmations — filtering out weak signals.

It also gives you more risk control than the average bot. Instead of rigid SL/TP settings, it adapts to current market conditions, making it more versatile in both fast and slow markets.

Things to Watch Out For

As with any automated trading system, there are a few considerations to keep in mind before deploying SuperTrend EA Pro live:

- Works Best in Trending Markets: During ranging or sideways markets, the EA might enter trades that don’t follow through. Use filters or avoid deploying it during such conditions.

- Parameter Optimisation Required: While default settings work, it’s highly recommended to test and optimize the EA for the asset and timeframe you're trading.

- Not a Set-and-Forget Forever: The market changes over time. Just because a strategy worked last month doesn’t mean it will work next quarter. Review and adjust periodically.

- VPS is Recommended: To avoid downtime, a Virtual Private Server is ideal — especially if you want the EA running 24/5 without interruptions.

Best Use Cases

Here are a few ways you might consider using SuperTrend EA Pro:

- Swing Trading on H1 Timeframe: Use the EA on H1 charts for EURUSD or GBPUSD with a higher ATR multiplier and conservative trailing stop.

- Crypto Trend Riding: Try the EA on BTCUSD or ETHUSD on the H4 timeframe. Crypto assets often trend strongly, making them ideal for SuperTrend logic.

- Diversified Portfolio: Run the EA on five to seven pairs with slightly different settings. This spreads your exposure and balances risk across markets.

- Manual Monitoring: Use the EA for entries but manage trades manually during high-impact news events or unusual price activity.

Tips for Optimisation

- Use ATR Filters: Adjust the ATR multiplier to fine-tune when signals trigger.

- Optimise for Spread: On low-spread accounts, you can be more aggressive with trailing stops and entry frequency.

- Avoid Overfitting: Don’t over-optimise based on backtesting alone. Ensure forward testing is part of your setup process.

Final Verdict

SuperTrend EA Pro V1.0 MT4 offers a solid, logic-driven approach to trading with the trend. Its use of multiple SuperTrend signals, dynamic stop systems, and full customisation makes it a useful tool for any trader serious about riding market momentum while managing risk.

It’s not for traders looking for hundreds of trades per week, but it is for those who want calculated entries, clear exits, and a hands-off system that reflects real technical discipline.

Used correctly, this EA can be part of a strong long-term trading plan — especially for those who prefer structure over speculation.

Comments

Leave a Comment