If you’ve been drowning in charts stuffed with a dozen indicators and still second‑guessing every click, you’re not alone. Traders crave simple, timely, and trustworthy signals… without repaint drama or lag that kills your R:R. That’s exactly where Super Indicator v1.0 MT4 steps in. It’s built to keep charts clean while giving you the one thing you really want: actionable entries and exits you can spot in a heartbeat.

Whether you’re scalping London open, day trading NY session, or holding H4 swings, this indicator adapts. It blends trend mapping, dynamic support/resistance, and smart alerts so you’ll know what to trade, when to react, and where your risk sits. No gimmicks. No grid or martingale nonsense—just clean confluence and practical signals you can actually execute.

What Is Super Indicator v1.0 MT4?

Super Indicator v1.0 is a lightweight, multi‑purpose indicator for MetaTrader 4 that produces buy/sell signals, trend bias, and levels. It’s designed to reduce screen noise while preserving the signals that matter. The result? A cleaner chart, less hesitation, and better timing—especially if you pair it with disciplined risk management.

Platform: MetaTrader 4 (MT4)

Pairs: Majors (EURUSD, GBPUSD, USDJPY, XAUUSD), works fine on most liquid pairs and gold

Timeframes: M5–H4 (M1 possible for advanced scalpers)

Trading Styles: Scalping, day trading, swing trading

Skill Level: Beginner‑friendly, pro‑approved

Key Features (Why Traders Like It)

- Crisp Buy/Sell Signals: Easy arrow prompts so you don’t squint at candles or second‑guess the move.

- Trend Filter Built‑In: Aligns signals with the prevailing direction to avoid countertrend traps.

- Dynamic Support/Resistance: Auto‑plots zones that actually react to price—great for take‑profit and stop placement.

- Alert System (Push/Email/Popup): Get notified instantly; no more chart babysitting.

- Non‑Repainting Core Logic: Signals don’t vanish after the fact—what you see is what you traded.

- Multi‑Timeframe Friendly: From M5 scalps to H4 swings, keep the same logic across styles.

- Works on Gold & Majors: Especially handy on XAUUSD volatility; still behaves on EURUSD/GBPUSD.

- Clean Visuals: Minimal overlays, no spaghetti lines—focus stays on price + levels.

- Risk Cue Points: Levels help you set logical SL/TP with attractive R:R.

- Low CPU Load: Smooth on VPS and standard desktops; won’t freeze MT4 during busy hours.

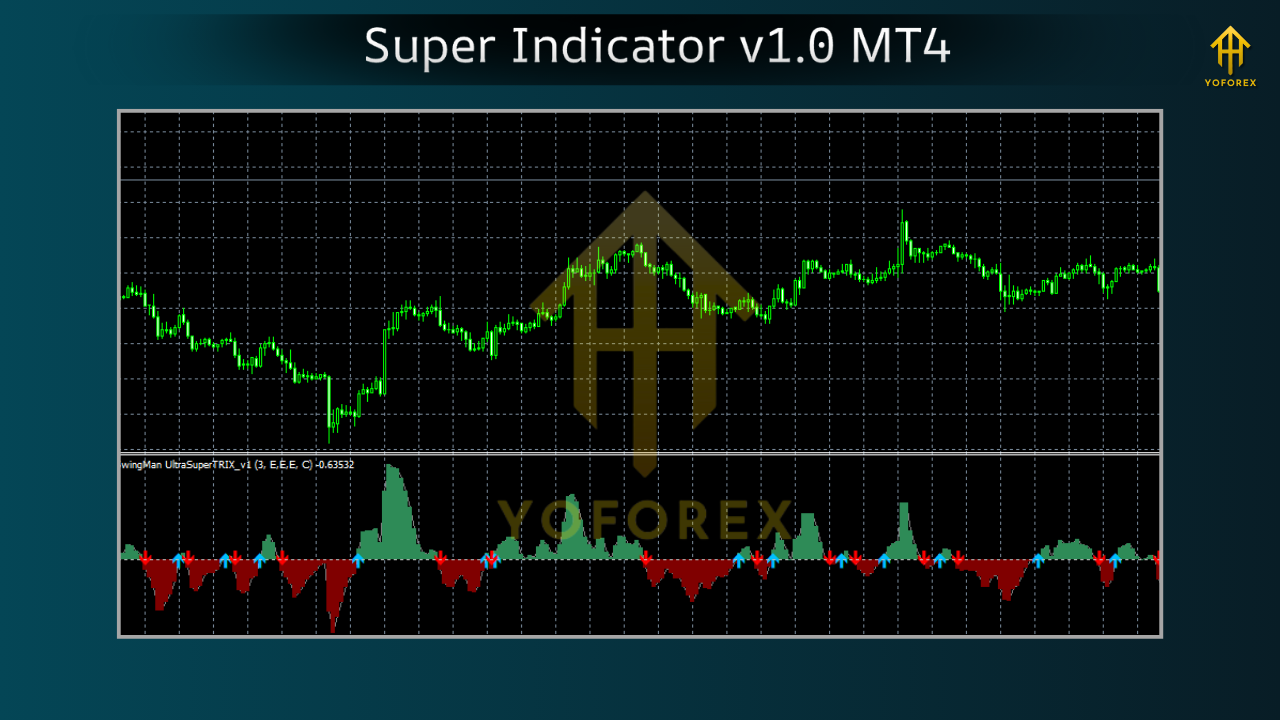

How It Works (In Plain English)

Super Indicator v1.0 reads market structure and momentum to mark spots where probability tilts in your favor. You’ll typically see:

Trend Bias – A subtle visual cue (e.g., line/colour shift) that tells you the dominant direction.

Signals – Buy/sell arrows when momentum and structure align, filtered to cut out a lot of chop.

Zones – Dynamic S/R that price respects often enough to plan trades around them.

Your job becomes straightforward: trade in the direction of the trend cue, only take signals near supportive zones, and set SL beyond structure with 2R or better targets. That’s it. Consistency, not cleverness, wins here.

Best Practices & Suggested Settings

For Scalpers (M5–M15):

- Signal Sensitivity: Medium‑High (captures more moves, expect more noise)

- Alert Mode: Popup + push

- SL/TP: 1.2–1.8R per trade, partials at nearest opposing zone

- Session: London open to NY mid for liquidity

For Day Traders (M15–H1):

Signal Sensitivity: Medium

Alert Mode: Popup + email (in case you step away)

SL/TP: 1.5–2.5R, trail behind fresh HL/LH structure

Confluence: 200 EMA or daily pivot can help filter

For Swing Traders (H1–H4):

Signal Sensitivity: Low‑Medium (fewer, cleaner signals)

SL/TP: 2–4R; consider scaling in at retests of the zone

Add‑Ons: Mark weekly highs/lows; avoid Friday late entries

Risk Tip: Keep risk per trade ≤1%. If you’re new, 0.5% is fine—coz staying in the game beats hero mode every time.

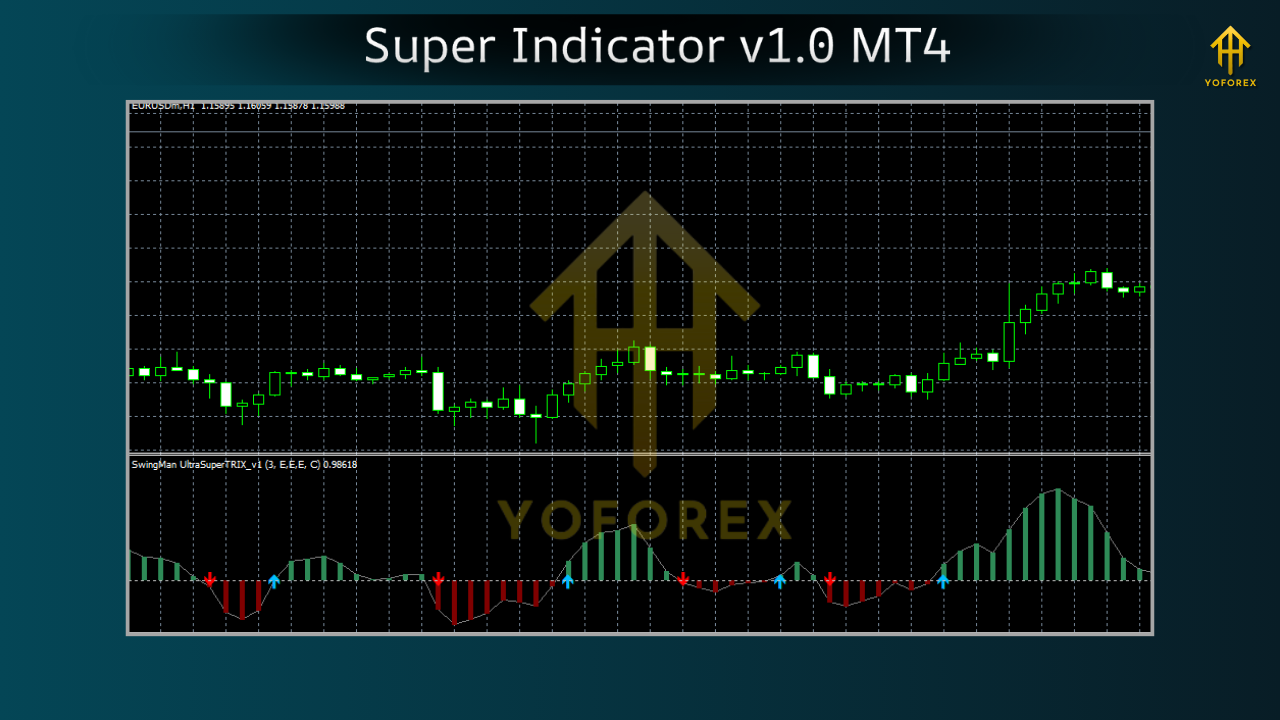

Example Trade Idea (EURUSD M15)

Trend Cue Up: Indicator shows bullish bias after higher low forms.

Pullback Into Support: Price tags a fresh dynamic support zone.

Buy Arrow Prints: Entry triggers on the candle close.

Stop Loss: 2–3 pips below zone low (plus spread buffer).

Take Profit: First target at prior swing high (1R–1.5R), runner toward next resistance (2R+).

Management: Move SL to breakeven once 1R hits; partial close to lock equity.

Installation & Setup (MT4)

- Download the Super Indicator v1.0 MT4 file (

.ex4or.mq4). - In MT4, click File → Open Data Folder.

- Go to MQL4 → Indicators and paste the file.

- Restart MT4 (or right‑click Indicators → Refresh).

- Drag Super Indicator v1.0 onto your chart.

- On the Inputs tab, leave defaults or adjust:

- SignalSensitivity (Low/Med/High)

- AlertsEnabled (true/false)

- Email/Push (set in MT4 Options → Notifications/Email)

Click OK. Save a Template so you can load it in one click on new charts.

Where It Shines (Markets & Timeframes)

XAUUSD (Gold): Great volatility—watch for pullbacks into zones; don’t chase.

EURUSD & GBPUSD: Clean structure, reliable S/R hits.

USDJPY: Momentum bursts; consider slightly wider stops.

Indices (if broker supports on MT4): Use lower sensitivity; target structure breaks.

Timeframes:

M5/M15 for scalps, M15/H1 for day trades, H1/H4 for swings.

Pick one style and master it before hopping around—seriously, consistency > variety.

Strategy Tips for Better Results

Trade With Trend First: Countertrend can work, but win rate drops; keep it advanced‑only.

Wait for Closes: Enter on candle close after signal; reduces fakeouts.

Don’t Trade News Spikes: Spread + slippage can ruin perfect charts.

Journal Religiously: Tag setup type, R:R, session, emotion—review weekly.

One Change at a Time: If you tweak sensitivity or TP logic, test it for a week before another change.

Backtest → Demo → Live: Don’t rush. Build confidence first—no one gets a trophy for speed.

Pros & Cons

Pros

Clear signals with trend + S/R confluence

Non‑repainting core logic

Works on majors and gold

Friendly for scalpers and swing traders alike

Low visual clutter, easy to read

Cons

Over‑sensitivity can create noise in low liquidity

Not a “set and forget” robot—you manage trades

Still needs risk discipline; it’s a tool, not a guarantee

Frequently Asked Questions

Q1: Does Super Indicator v1.0 repaint?

No. Signals remain after the bar closes. Always enter on bar close to avoid intra‑bar noise.

Q2: Can I use it on multiple charts?

Yes. It’s lightweight. Just keep alerts sensible so your phone doesn’t melt.

Q3: Will it work on crypto or indices on MT4?

If your broker provides symbols on MT4, it can work. Use lower sensitivity and test first—volatility profiles differ.

Q4: What’s the best timeframe?

M15/H1 strike a nice balance for most traders. Scalpers can go M5; swing traders can live on H1/H4.

Q5: Can beginners use it?

Absolutely. The signals are straightforward. Just keep risk per trade small and practice on demo first.

Final Thoughts

Super Indicator v1.0 MT4 is about clarity and timing. It strips away the mess, surfaces the confluence that matters, and lets you execute quickly—without turning your chart into a Christmas tree. If you’re tired of over‑complication and lag, this is a solid, no‑fluff upgrade to your playbook.

Ready to try it? Download Super Indicator v1.0 for MT4, load it, and run a week of demo trades. Track every entry, SL, and TP… you’ll see where it clicks for your style. Start simple, risk small, and let the data nudge your tweaks—not vibes.

Risk disclaimer: Trading involves risk. Past performance doesn’t guarantee future results. Use proper money management and test before going live.

Comments

Leave a Comment