Grid trading has long been a favorite among forex traders seeking consistent profits in ranging markets. The traditional grid approach places orders at fixed intervals above and below a base price, capturing small gains as price oscillates. However, static grids can struggle during sudden volatility spikes or trending moves. Squid Grid AI EA V1.0 MT4 reinvents this concept by integrating artificial intelligence (AI) to dynamically adapt grid spacing, lot sizing, and portfolio weighting—helping you ride both calm and choppy market conditions effectively.

What Sets Squid Grid AI EA Apart

AI-Enhanced Parameter Adjustment

Rather than relying on pre-set grid levels, the EA’s AI engine analyzes real-time volatility, trend strength, and correlation across instruments. It then recalibrates grid intervals and position sizing to optimize risk-reward.

Multi-Instrument Diversification

Squid Grid AI EA can trade up to six uncorrelated symbols simultaneously—spreading risk across major forex pairs, commodities, and indices. This portfolio approach reduces drawdown during instrument-specific shocks.

Automated Stop Conditions

Traditional grid systems can accumulate large losing positions during strong trends. The AI layer monitors equity curves and volatility thresholds, closing all open orders when drawdown limits or extreme volatility are detected.

How Squid Grid AI EA Works

Signal Generation

The EA continuously ingests market data (price action, ATR, correlation metrics).

AI algorithms generate entry signals when price deviates from a calculated “fair value” envelope.

Grid Placement

A base order is placed at the signal price.

Subsequent grid orders are spaced dynamically: tighter when volatility is low, wider when volatility increases.

Position Management

Partial grid closures occur as price retraces toward the mean.

The AI engine adjusts lot multipliers based on recent win-loss ratios and drawdown statistics.

Exit Strategy

Orders close when cumulative profit targets are met or when price reverts through the base level.

All open positions are forcibly closed if a stop-loss threshold is breached.

Recommended Settings

Risk Profile:

Balanced (default for most accounts)

Conservative: 50% lot sizing, 1.5× ATR grid intervals

Aggressive: 150% lot sizing, 0.75× ATR grid intervals

Minimum Deposit: $1,000

Timeframes: M15 or H1 for optimal balance between trade frequency and signal reliability

Max Drawdown Limit: 8%–10% (adjustable via the EA’s input parameters)

Pro Tip: Begin with a demo account for 2–4 weeks to observe how the AI adapts to different volatility regimes before committing real capital.

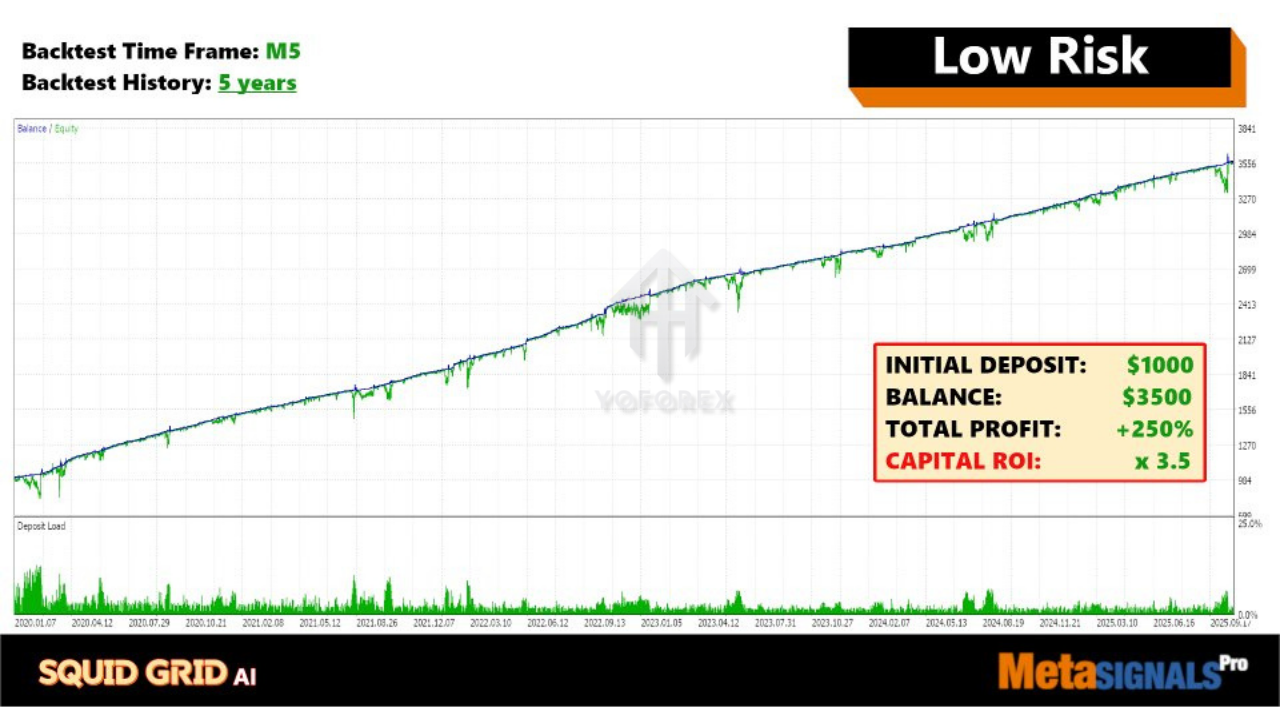

Backtesting & Live Performance

Although vendor-published backtests can vary in quality, early adopters report:

Average Monthly Return: 4%–7% in balanced mode

Max Drawdown: 6%–9%

Win Rate: 65%–78% across diversified instruments

For the most reliable insights, download the EA’s built-in performance report and review your broker-specific backtest logs. Always calibrate your account size and risk settings to match these historical metrics.

Installation Guide

Download the EA File

Obtain

Squid_Grid_AI_EA.ex4from your MQL5 Market purchase page or from YoForexEA’s download portal.

Place in Indicators Folder

Copy the

.ex4file intoMQL4/Expertsunder your MT4 data directory.

Restart MetaTrader 4

Close and reopen MT4 to load the new EA.

Attach to Charts

Drag “Squid Grid AI EA V1.0” onto each chart of your chosen instruments.

Enter License Key & API Endpoint

Input the license key provided via email.

Enter the API URL if prompted (for live AI updates).

Configure Inputs

Select your risk profile, symbols list, and max drawdown limit.

Enable alerts and set your notification preferences.

Advantages & Disadvantages

Advantages

AI-driven adaptations to changing market conditions

Diversified grid exposure across multiple assets

Automated drawdown protection and stop conditions

User-friendly presets for different risk appetites

Disadvantages

Requires an active internet connection for AI data feeds

Slightly higher CPU usage due to AI computations

Learning curve for users new to grid strategies

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment