SPYDER USDJPY M5 EA V6.1 MT5 — Precision Scalping Built For Speed

Tired of chasing setups and babysitting charts all day? Same. That’s exactly why SPYDER USDJPY M5 EA V6.1 MT5 exists—to automate the boring-but-critical parts of trading so you can focus on strategy, review, and scaling. Built for MetaTrader 5 and optimized for the M5 (5-minute) timeframe, this Expert Advisor zeroes in on USDJPY (with optional support for GBPJPY) to deliver a fast, rules-driven approach to scalping and short-term trend trades. It hunts for high-probability entries, executes with minimal delay, and manages risk with discipline—coz consistency beats excitement in the long run. Whether you’re new or already seasoned, SPYDER EA aims to remove the constant screen-watching while keeping your trading logic tight and measurable.

What Is SPYDER USDJPY M5 EA V6.1 MT5?

SPYDER USDJPY M5 EA V6.1 is an automated trading system tailored for USDJPY on M5, designed to exploit micro-trends, momentum bursts, and volatility windows typical of the Asian, London, and NY overlap sessions. The logic blends scalping + trend following, and avoids reckless behaviors like heavy martingale. It focuses on:

- Fast detection of momentum shifts

- Tight stop placement and adaptive trailing

- Capital preservation during chop

- Smart session-aware filters to reduce noise

While the EA’s sweet spot is USDJPY, advanced users can optionally deploy it on GBPJPY (still on M5) once they’ve validated broker conditions and spread behavior.

Key Features (Why Traders Pick SPYDER)

- Pair-Focused Logic: Tuned for USDJPY M5; optional GBPJPY support.

- No Martingale, No Grid Overload: Risk stays measurable and sane.

- Adaptive Risk Management: Position sizing based on balance or equity; fixed lot mode for prop-style rules.

- Session Filters: Option to trade only during selected sessions (Asia/London/NY) to fit your routine.

- Spread & Slippage Guards: Skips new orders when market conditions get hostile.

- Pullback + Breakout Combo: Combines momentum confirmation with micro-pullback logic for cleaner entries.

- Trailing & Breakeven: Move SL to BE at configurable RR; trail in steps or ATR-based logic.

- News Pause (Manual Toggle): Quickly disable trading when high-impact events are scheduled.

- Equity Drawdown Shield: Daily loss cap and max open risk controls for account protection.

- Clean Journal Notes: Every action is labeled for easy post-trade review and optimization.

How It Works (Under The Hood—In Plain English)

SPYDER watches USDJPY ticks on M5, waiting for the right blend of:

- Directional Bias: Short-term trend filter decides if longs/shorts are even allowed.

- Momentum Confirmation: Price impulse + volatility check (to avoid fake breaks).

- Pullback Quality: Entry prefers micro-retracements into structure instead of chasing.

- Risk-First Placement: Stop is always defined first; TP scales from conservative 1:1 to extended 1:1.5/1:2 depending on volatility.

- Active Management: Once price moves your way, SPYDER can lock partials, shift to breakeven, and trail.

Result? Fewer random nibbles, more targeted “wait-then-strike” behavior. It’s still trading—nothing is guaranteed—but the mechanics are designed to keep outcomes bounded and reviewable.

Recommended Settings (A Practical Starting Point)

Always forward-test on demo first and verify with your broker’s spreads/commissions.

- Timeframe: M5

- Pairs: USDJPY (primary), GBPJPY (optional after testing)

- Risk Per Trade: Start modest, e.g., 0.5%–1% (or use fixed lots like 0.01 per $1k for prop rules)

- Max Concurrent Trades: 1–2 (avoid over-exposure)

- Session Filter: Enable London + NY overlap for tighter spreads, or tailor to your schedule

- Spread Filter: On; set the max spread slightly above your broker’s typical peak during your chosen session

- Breakeven: Consider BE at +8 to +12 pips on USDJPY M5 (tune for your broker’s costs)

- Trailing: ATR-based or step trail after BE; avoid over-tight trailing in early move

- Daily Loss Cap: 2%–3% recommended; auto-disable trading when reached

Installation & Setup (MT5)

- Copy Files: Place the EA file into

MQL5/Expertsinside your MetaTrader 5 data folder. - Restart MT5: Or refresh the Navigator pane.

- Attach To Chart: Open USDJPY, set M5, drag SPYDER USDJPY M5 EA V6.1 onto the chart.

- Allow Algo Trading: Check the “Algo Trading” button is green and inputs permitted.

- Load/Save Presets: Start with conservative defaults; save your own once stable.

- Run On VPS: If possible, use a reliable, low-latency VPS for consistent execution.

Backtesting & Optimization Tips

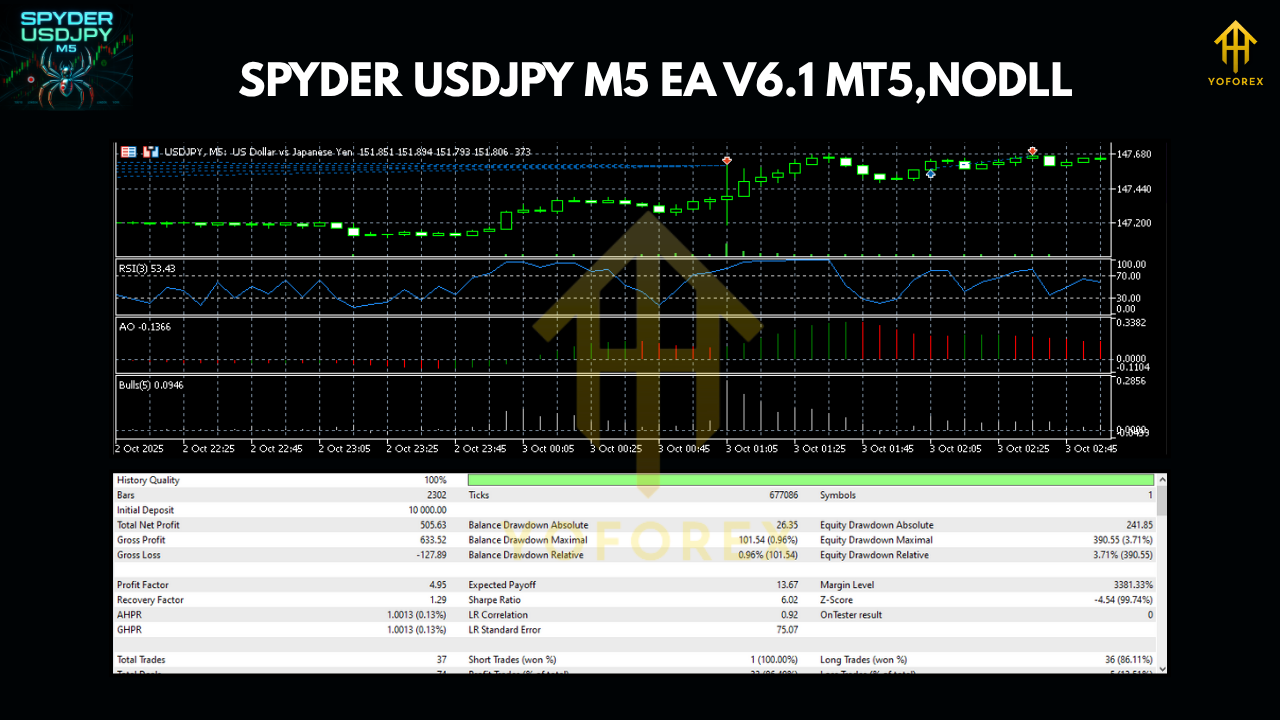

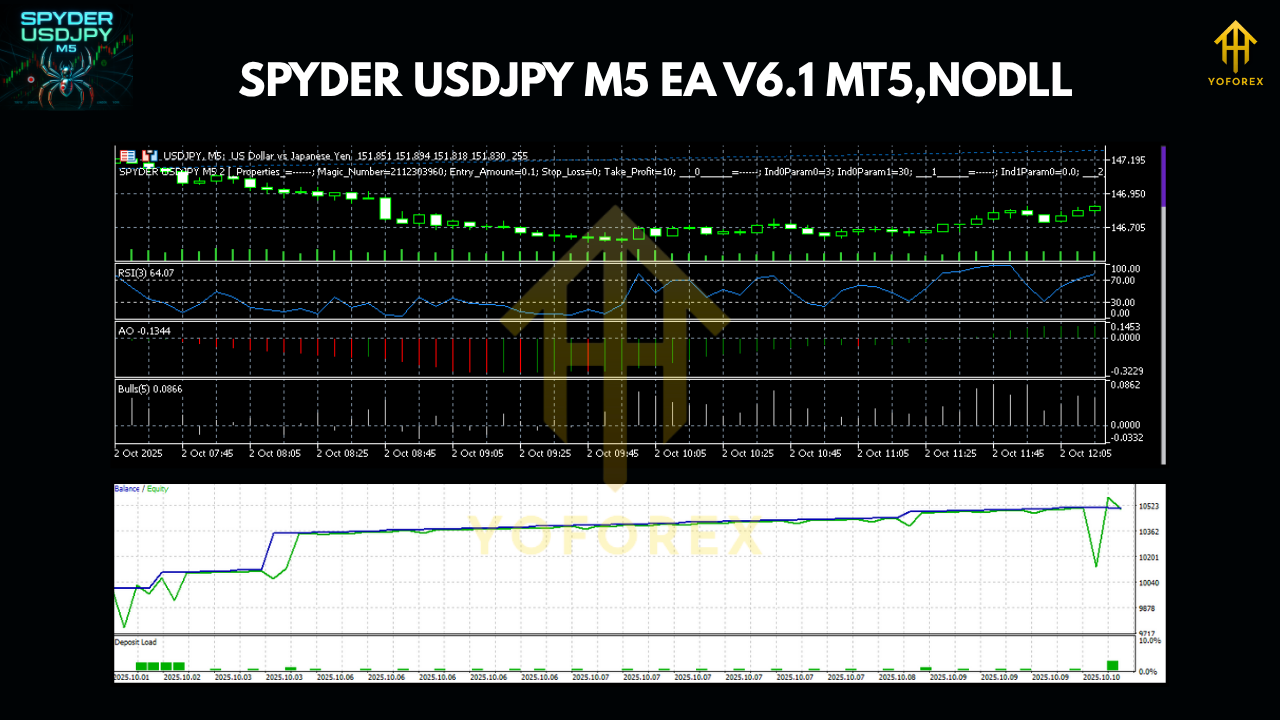

Backtests aren’t reality, but they’re good for directional validation and parameter sanity checks. For SPYDER:

- Use Quality Data: 99% tick modeling if available; at least realistic spreads and commissions.

- Focus Windows: Test over multiple years, but validate the last 12–18 months more heavily (market regimes change).

- Walk-Forward Validation: Optimize on one period, validate on a later unseen period.

- Outlier Handling: Check worst daily/weekly drawdowns; ensure they fit your rules.

- Prop-Style Constraints: If you’re targeting prop firms, simulate daily loss and max trailing drawdown triggers.

What you’re looking for: a smooth equity slope, tolerable max drawdown, and a positive profit factor that survives volatile cycles. If the curve only works in one tiny window, dial back the complexity and re-test.

Risk Management (Non-Negotiable)

- Fixed Daily Loss Limit: Stops you from “revenge” loops.

- Position Sizing Rules: Decide a fixed % per trade or fixed lot; don’t mix mid-week.

- Trade Count Cap: If you hit 3–5 trades in chop, step away—your future self will thank you.

- News Awareness: Big events = step aside or reduce risk.

- Weekly Review: Journal key stats (win rate, avg RR, PF, max adverse excursion). Improve, don’t guess.

Who Is SPYDER Best For?

- Intraday scalpers who want structure and speed on USDJPY M5.

- Desk-bound traders who can watch London/NY overlap but hate micromanaging entries.

- Methodical optimizers who’ll test, journal, and refine (not set-and-forget forever).

- Prop aspirants needing consistent, rule-driven execution without martingale drama.

Final Thoughts

The SPYDER USDJPY M5 EA V6.1 MT5 is all about timing + precision on a fast chart. It won’t fix bad discipline—but it will remove a ton of mechanical friction so you can trade a rules-based plan with fewer distractions. Start slow, keep risk small, collect data, and scale logically. Tho it’s tempting to crank the risk when it wins a few in a row… don’t.

Call To Action

Ready to try it? Spin it up on USDJPY M5 with conservative risk and a simple trailing plan. Run a demo forward test for 2–4 weeks, review the stats, then consider going live only if the numbers align with your risk rules. Your edge is in the process, not just the bot.

Comments

Leave a Comment