The world of forex trading is rapidly shifting toward automation powered by artificial intelligence. Among the latest innovations, Soluna AI EA V6.28 MT4 stands out as a game-changer for traders who aim to combine intelligent analytics with mechanical precision. This Expert Advisor (EA) is designed to trade with minimal human intervention while adapting to evolving market conditions using AI-driven algorithms.

Unlike traditional EAs that follow static rules, Soluna AI EA leverages advanced learning models to read market sentiment, filter high-probability setups, and execute trades with precision. The result is a fully autonomous trading engine that blends logic, adaptability, and risk management — all integrated seamlessly into the MT4 platform.

What Makes Soluna AI EA V6.28 MT4 Different?

Soluna AI EA isn’t just another trading robot built on fixed indicators. Its main distinction lies in how it analyses and adapts dynamically. It utilises real-time data interpretation and pattern recognition to detect emerging opportunities before typical algorithms can.

Some of its defining attributes include:

- AI-Driven Decision Making: The EA processes live market data and continuously recalibrates its entry and exit rules.

- Dynamic Adaptation: When volatility spikes or market structure shifts, the EA automatically adjusts risk exposure and trade frequency.

- News Protection Filters: Built-in mechanisms can identify high-impact economic events and pause trading to avoid unpredictable price swings.

- Self-Learning Engine: Over time, the EA refines its logic by analysing past trades, improving its overall accuracy.

These features make Soluna AI EA a unique blend of technology and strategy, providing a smarter edge for traders seeking long-term stability.

Key Functionalities

1. Intelligent Trade Execution

The EA constantly monitors multiple pairs to identify trades that meet its probabilistic model. It evaluates conditions such as volume pressure, volatility, trend strength, and candle formations to confirm signals. Once a setup is validated, the EA triggers an entry and manages stop-loss and take-profit automatically.

2. Real-Time Market Analysis

Soluna AI EA operates like a human analyst — studying price behavior, comparing it with historical patterns, and forecasting probable outcomes. It doesn’t rely solely on lagging indicators; instead, it combines short-term momentum analysis with AI pattern modeling to find high-accuracy trades.

3. Adaptive Money Management

One of the EA’s strongest points is its adaptive money management system. Depending on equity, drawdown, and recent performance, it adjusts the lot size automatically. For traders, this feature helps maintain account safety while maximising profit potential during favourable conditions.

4. Multi-Currency Compatibility

Soluna AI EA can trade across major and minor forex pairs, as well as metals like Gold (XAUUSD). Its structure allows you to diversify exposure while maintaining a unified risk model.

5. Built-In Capital Protection

Capital preservation is at the core of its architecture. The EA includes:

- Equity guard system

- Spread control mechanism

- Auto-close positions during abnormal market spikes

This makes it reliable even during volatile sessions.

Recommended Timeframes and Pairs

While Soluna AI EA V6.28 can technically operate on all timeframes, the developer’s recommended use cases focus on:

- Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD

- Timeframes: M15, M30, and H1

These setups balance responsiveness and stability, offering smooth performance during both trending and ranging markets.

Installation and Setup Guide

- Download the EA file and place it in the “Experts” folder inside your MT4 directory.

- Restart MetaTrader 4 and locate Soluna AI EA under the “Expert Advisors” tab.

- Drag it onto your selected chart.

- Enable auto-trading and ensure algorithmic trading permissions are active.

- Customise your inputs — risk per trade, equity guard level, news filter, and lot size multiplier.

For best results, it’s advisable to test configurations on a demo account before moving to live trading.

Trading Philosophy Behind Soluna AI

The system is built on a belief that markets are not random — they follow behavioural patterns that can be decoded. Soluna AI EA focuses on identifying repetitive sequences that historically lead to predictable price actions.

Unlike grid or martingale systems that depend on position stacking, Soluna AI uses precision targeting — one trade at a time, based on confluence factors. Its AI continuously evaluates whether the probability of success outweighs the potential risk.

By reducing emotional bias and replacing guesswork with adaptive logic, the EA provides traders with mechanical discipline.

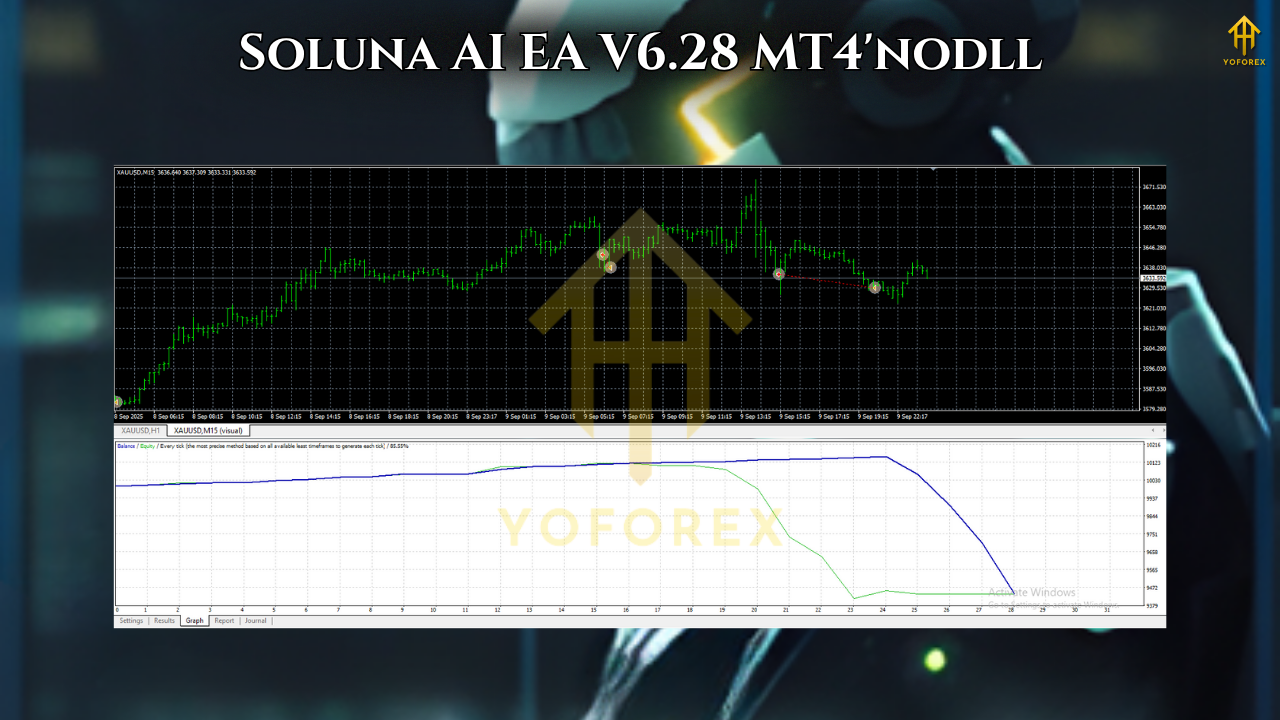

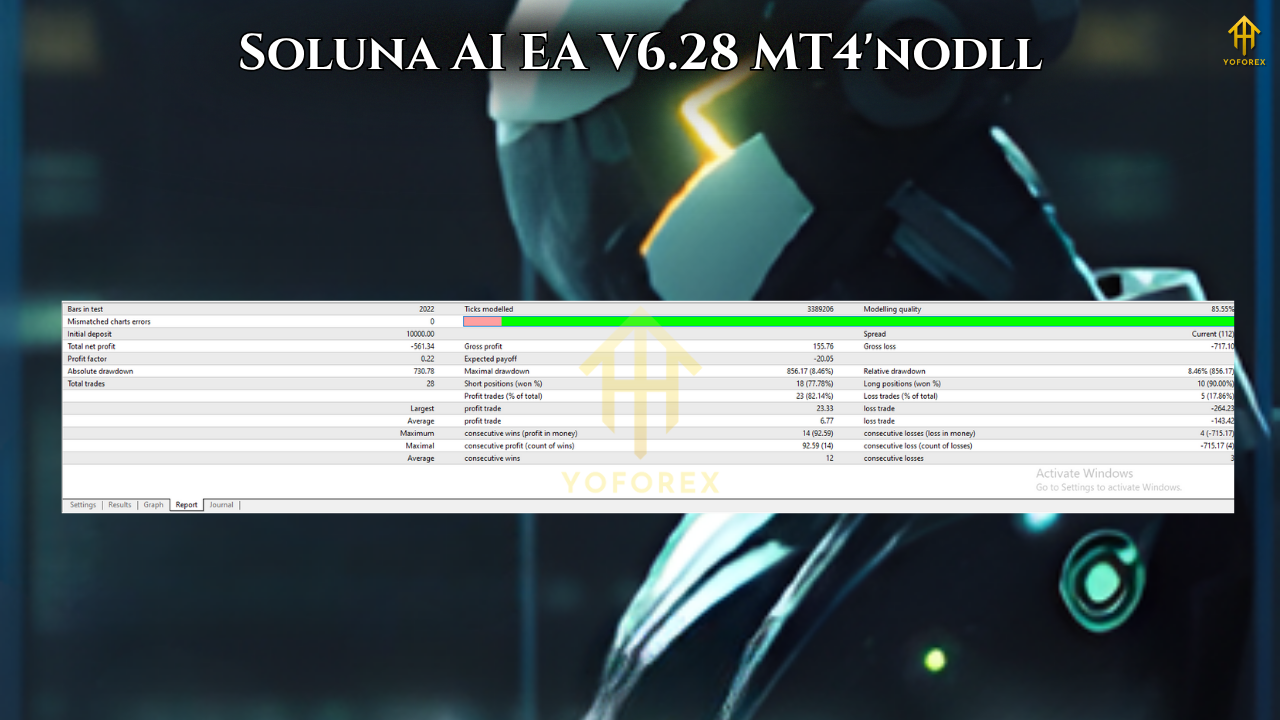

Performance Overview

Although performance depends on market conditions, backtests and live monitoring have demonstrated consistent profitability under controlled risk settings. Traders have reported smoother equity curves and smaller drawdowns compared to older generation bots.

Key performance highlights include:

- Low drawdown and steady equity growth

- No aggressive martingale strategy

- Consistent trade logic across major pairs

- Smooth adaptability during news volatility

The EA is especially suitable for traders who prefer low-risk compounding strategies rather than high-frequency gambling.

Risk Management and Safety

A significant part of Soluna AI’s intelligence lies in its defensive trading architecture. It can automatically halt trading during economic announcements or market shocks, preserving the account from unnecessary losses.

Additionally, the EA monitors internal account metrics:

- Maximum floating drawdown

- Equity deviation from balance

- Slippage and spread threshold

If any of these exceed safe limits, it immediately cuts exposure and pauses activity until conditions normalise.

Why Traders Choose Soluna AI EA

- Hands-Free Automation: Once configured, it runs 24/7 without manual supervision.

- Smart Market Filtering: Avoids overtrading by analysing trend quality and volatility levels.

- Built for Longevity: Constant updates ensure compatibility with modern brokers and liquidity conditions.

- Works for Beginners and Experts: Beginners enjoy its plug-and-play simplicity, while advanced traders can tweak parameters for optimisation.

Best Practices for Users

- Use a Reliable Broker: Choose a broker with tight spreads and fast execution.

- Start on Demo: Observe performance before live deployment.

- Deploy on VPS: Keep the EA running 24/7 to avoid interruptions.

- Stay Conservative: Use low risk (0.5%–1% per trade) until you’re familiar with its behaviour.

- Monitor Weekly: Even though it’s automated, periodic monitoring ensures smooth operation.

Following these guidelines can help you extract the maximum benefit from Soluna AI EA while maintaining safe trading standards.

Who Should Use Soluna AI EA?

Soluna AI EA is ideal for:

- Traders seeking consistent, low-risk growth

- Investors looking for AI-based automation

- Beginners wanting to start with an intelligent yet easy-to-use bot

- Experienced traders who value flexibility and analytical transparency

It bridges the gap between data-driven logic and human trading intuition, making it suitable for anyone who wants reliable automation with strategic control.

Final Verdict

Soluna AI EA V6.28 MT4 represents a significant step forward in algorithmic trading. By integrating artificial intelligence with advanced money management and real-time adaptability, it stands out as a premium tool for traders who demand both automation and control.

While no EA can guarantee profits, Soluna’s unique structure — blending AI-driven decisions, safety filters, and continuous learning — makes it a solid choice for traders aiming to enhance consistency. When used with proper risk management, it can serve as a dependable partner in navigating the forex market’s unpredictability.

For those seeking to modernise their trading approach, Soluna AI EA V6.28 MT4 offers a glimpse of the future — where machine learning meets human ambition.

Comments

Leave a Comment