Sogili 7100 Full Auto EA V1.0 MT4 — In-Depth Review for Real-World Traders

In the dynamic world of forex trading, automation has gone from “nice to have” to mission-critical. You want execution that never blinks, discipline that never wavers, and entries that follow rules to the letter. That’s the promise behind Sogili 7100 Full Auto EA V1.0 for MetaTrader 4 (MT4). This Expert Advisor aims to streamline the routine stuff so you can focus on what matters—risk, portfolio balance, and the big picture.

If you’re eyeing a bot that works on EURUSD, GBPUSD, and USDJPY across M15 or H1 timeframes and you’ve got $500 minimum to start, this comprehensive review breaks down the strategy idea, setup steps, risk controls, pros/cons, and who this EA actually suits. No fluff… just what you need to know before you click “Attach to Chart.”

What Sogili 7100 Tries to Do (and Why That Matters)

At its core, Sogili 7100 Full Auto EA is a rules-driven algorithm designed to capture repeatable intraday edges on major pairs. It blends momentum and mean-reversion micro-signals, then pairs them with session-aware filters to avoid chop as much as possible. Sounds fancy, but the big idea is simple: consistent execution.

Human traders often lose consistency under stress; an EA doesn’t. Sogili 7100 seeks to:

- Identify high-probability zones where price either continues or snaps back quickly.

- Place trades with pre-defined risk and a clear exit plan.

- Limit screen time… coz staring at candles for 10 hours straight isn’t a flex.

It’s built for traders who want a hands-off assistant that follows rules exactly—no revenge trades, no second-guessing. You’ll still steer risk and choose when to pause during news, but the EA does the clicking.

Tradable Markets, Timeframes & Minimum Capital

- Pairs: EURUSD, GBPUSD, USDJPY

- Timeframes: M15 or H1 (choose one per chart; M15 for more frequency, H1 for cleaner signals)

- Minimum Deposit: $500 (that’s the floor—more headroom helps absorb variance)

- Account Type: Standard or Raw/ECN with tight spreads works best

- Leverage: Sensible, not maxed; your risk per trade matters more than leverage bragging rights

If you’re brand new, start on demo for at least 2–4 weeks. Then go live small. The market will test your patience; your job is to protect capital while the EA collects data.

How the Strategy Generally Operates

While proprietary logic remains under the hood, the behavior you’ll observe looks like this:

- Trend + Pullback Logic

The EA prefers trading with the session bias on majors, then times pullbacks for entries. On M15, you may see tighter stops and quicker exits; on H1, fewer but cleaner signals. - Session Awareness

London and early NY carry the most juice. Asian session trades may be fewer and often smaller. This isn’t a hard rule in code, but fills/slippage and spreads suggest focusing on active hours. - Risk-First Execution

Each position uses a fixed stop loss with optional break-even moves after partial progress. You’ll control lot size using either fixed lots or risk % per trade. - News Caution

High-impact news can throw spreads and slippage out of whack. Best practice: pause before major releases and resume after conditions normalize.

Key Features at a Glance

- • Plug-and-play on MT4: Drop into the Experts folder and attach—done.

- • Multi-pair flexibility: Optimized for EURUSD, GBPUSD, USDJPY.

- • Timeframe choice: M15 (more trades) or H1 (cleaner rotations).

- • Fixed SL/TP framework: Keeps risk quantifiable; no martingale by default.

- • Optional break-even/partial: Lock in and de-risk once price moves your way.

- • Spread & slippage filters: Helps avoid low-quality fills during spikes.

- • Session filters: Focus where liquidity is strongest.

- • Magic Number control: Safe multi-chart deployment.

- • News-safe workflow: Quick toggle to pause during high-impact events.

- • VPS-friendly: 24/5 uptime with low latency execution.

Recommended Settings (Simple, Battle-Tested Starting Points)

Lot Sizing

- Conservative: 0.01 lots per $500–$700 balance

- Moderate: 0.02 lots per $700–$1,000

- Advanced: switch to risk % per trade (0.5%–1%) once comfy with the EA’s rhythm.

Stops & Targets

- M15: SL 15–25 pips, TP 20–40 pips, optional break-even after +12 to +18 pips

- H1: SL 25–40 pips, TP 35–70 pips, optional break-even after +20 to +30 pips

Filters

- Max spread: 1.5–2.0 pips on majors (tighter is better)

- Active sessions: London into NY; reduce size or pause during late-NY/rollover

- News handling: pause 15–30 minutes before major red-flag releases, resume 15–30 minutes after

These are starting templates, not gospel. Every broker/latency combo behaves a bit differently. Tweak in demo before committing real funds.

Installation & First-Run Checklist (MT4)

- Copy Files

Open MT4 → File → Open Data Folder →MQL4/Experts/→ paste the EA file. - Restart MT4

Or right-click Expert Advisors and hit Refresh. - Enable AutoTrading

Top toolbar: make sure the green “AutoTrading” button is ON. - Attach to Chart

Open EURUSD M15 (for example). Drag Sogili 7100 Full Auto EA onto the chart. - Input Settings

Set lot strategy, SL/TP, and filters. Keep defaults if unsure. - Allow Live Trading

In the EA’s Common tab, tick “Allow live trading.” - Test First

Run Strategy Tester for a quick sanity check (model quality, spread). Move to demo for forward-testing in live conditions. - Go Live Carefully

Start small. Scale only after you see consistent execution for a few weeks.

Who Will Like Sogili 7100 (and Who Won’t)

Great Fit If You:

- Prefer rules and consistency over gut feel.

- Want an EA that trades major pairs with practical SL/TP logic.

- Are OK with small, repeated edges instead of lottery-ticket wins.

- Can pause for news and respect risk caps.

Probably Not For You If You:

- Expect daily moonshots or “guaranteed profit.”

- Push max leverage and ignore drawdowns.

- Hate optimization and won’t forward test.

- Need one EA to “trade everything” all day, every session. (Real talk: nothing does.)

Risk Management: The Part Most Traders Skip (Don’t)

- Daily Loss Cap: 2%–3% of account balance. Hit it? Pause for the day.

- Max Exposure: Don’t run big lots across all three pairs at once unless your risk model accounts for correlation (especially EURUSD/GBPUSD).

- VPS & Latency: Lower latency means better fills and less partials missed.

- Withdrawals: If you scale up and get consistent returns, pull profits on a schedule. Banking wins > compounding ego.

- Drawdown Plan: Pre-decide the point you’ll cut risk by half. Following that plan is what keeps you in the game.

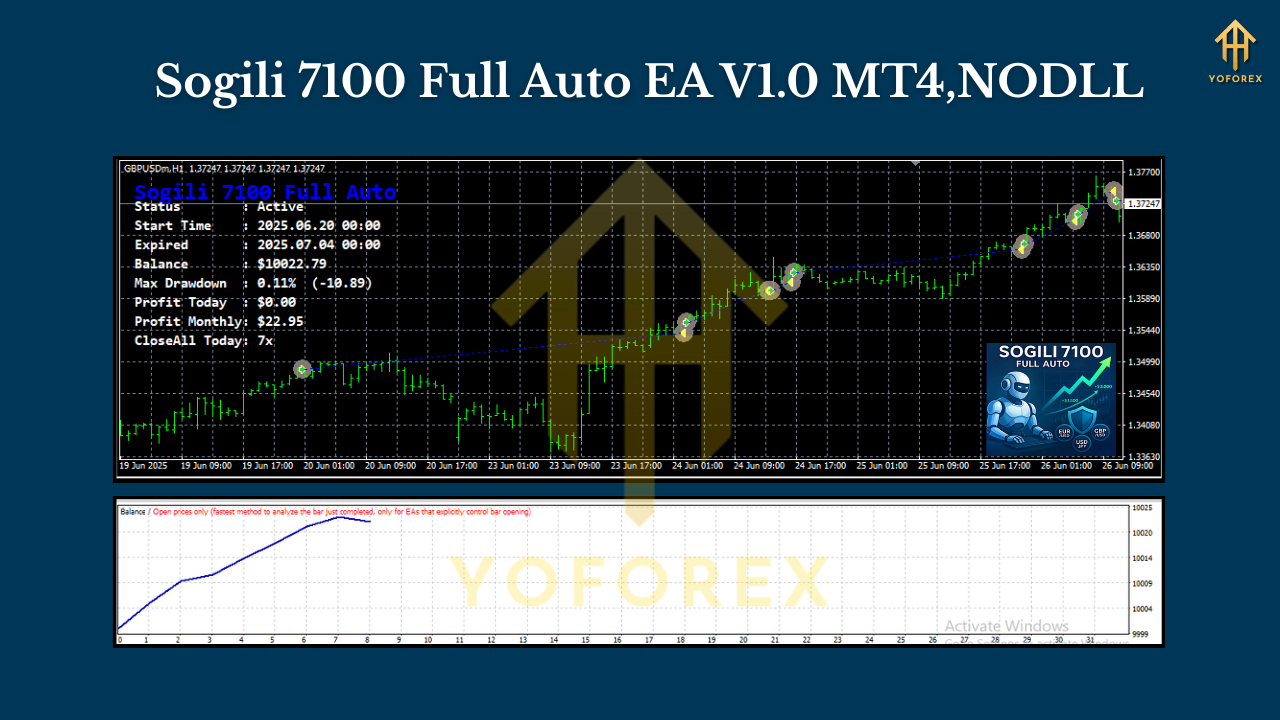

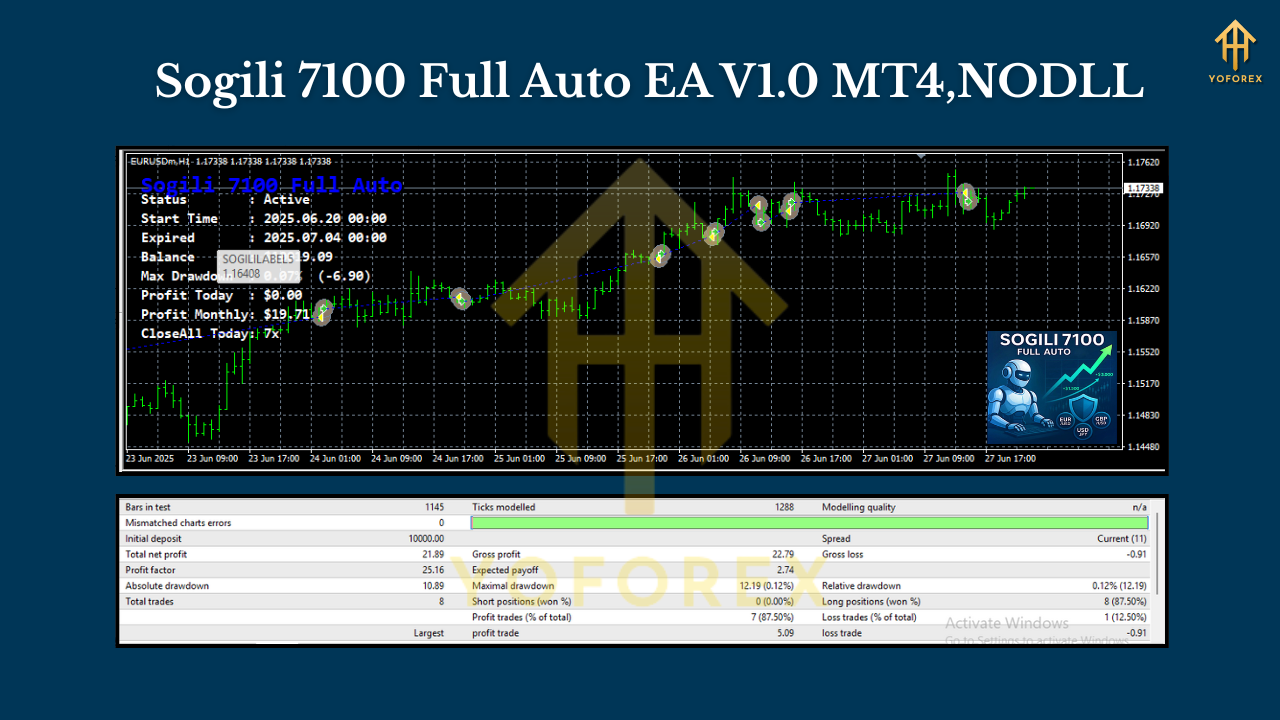

Backtesting vs. Forward Testing: What to Expect

Backtests are useful for sanity checks—does the logic make sense across multiple months? Do SL/TP rules behave under spread stress? Still, forward demo is where you catch real-world friction: slippage, news gaps, broker quirks, session microstructure.

On M15 you’ll see more trades and a faster sample. On H1 you’ll likely see fewer whipsaws and a steadier equity curve, tho patience is required. Expect flat spots; that’s normal. The edge shows up over many trades, not a handful.

Pros & Cons

Pros

- Clean, rules-based execution on major pairs

- Flexible between M15/H1 depending on your style

- No martingale by default; risk stays predictable

- Practical filters for spread, session, and slippage

- Easy setup; beginner-friendly yet robust enough for veterans

Cons

- Results hinge on broker conditions (spreads/latency matter)

- Needs human supervision around big news

- Not a set-and-forget cash machine (no EA is)

- Correlated exposure risk if you run all pairs at once with big size

Final Verdict

Sogili 7100 Full Auto EA V1.0 MT4 is a sensible, no-drama assistant for traders who value consistency over hype. Use EURUSD, GBPUSD, USDJPY on M15 or H1, stick to a clear risk plan, and give the EA enough sample size to show its edge. If you’re expecting instant riches, this isn’t it. If you want disciplined execution that can compound small edges over time, it’s worth a serious demo run.

Join our Telegram for the latest updates and support

Comments

Leave a Comment