SMF XAUUSD EA V1.0 MT4 — The Ultra-Fast Gold Scalping Engine for M1 Traders

Gold trading has always been a tricky space… super volatile, super rewarding, and honestly, not so easy to handle manually. That's exactly why many traders these days lean toward automated scalping systems built specifically for XAUUSD. SMF XAUUSD EA V1.0 MT4 is one of those high-speed Expert Advisors that operates on the M1 timeframe, designed exclusively for traders who want lightning-quick execution and the ability to handle ultra-fast market shifts.

What really separates this EA from the crowd is not just speed, but its ability to analyze micro-market fluctuations that most human traders miss coz they blink. With a minimum deposit of $10,000, SMF XAUUSD EA clearly targets serious gold scalpers who already understand the high-volatility nature of M1 gold charts. It's not for hobby traders; it’s built for precision-driven, capital-ready users who want aggressive but controlled gold market performance.

This blog dives into how the EA works, what makes it unique, performance expectations, safety layers, installation guidance, and whether it’s worth adding to your MT4 arsenal.

Overview of SMF XAUUSD EA V1.0 MT4

SMF XAUUSD EA V1.0 MT4 is engineered for XAUUSD and optimized strictly for the M1 timeframe, meaning it works in the fastest possible market conditions. The EA analyzes micro-trends, order-flow pressure, short-term volatility shifts, and liquidity cracks to place scalping trades with tight stop-loss and short exposure time.

Since gold behaves differently than currency pairs—more volatility, deeper wicks, wider spreads—the EA combines speed with layered protection logic. You’ll notice that it rarely stays in the market for too long. Instead, it takes many small, calculated positions, aiming for consistency rather than jackpot-style wins.

It uses:

- Multi-filter entry confirmations

- Dynamic stop-loss placement

- Spread-aware execution

- Time-based trade exits

- Volatility throttling when the market becomes chaotic

Because of the high-frequency nature of this EA, a minimum balance of $10,000 is recommended. Gold scalping requires enough margin to handle volatility without triggering unnecessary stop-outs.

The SMF XAUUSD EA strategy focuses on:

- Very short-term market inefficiencies

- High-probability micro entries

- Avoiding choppy price zones using volatility mapping

- Preventing back-to-back losses with adaptive distancing logic

Overall, it’s an EA for traders who want professional-level execution without needing to code or manually monitor charts 24/7.

Key Features of SMF XAUUSD EA V1.0 MT4

Below are the core features that define the EA’s performance and reliability:

- Ultra-Fast Scalping Engine

Designed for the M1 timeframe with micro-second decision logic. - Exclusive XAUUSD Optimization

Built, tested, and tuned only for the Gold market—no distractions, no multi-pair clutter. - Dynamic Lot Sizing

Adjusts exposure based on market volatility to reduce risk during aggressive movements. - Spread Protection

Avoids trading when spreads spike, which is common in gold trading. - Drawdown Control Structure

Smart distancing between trades helps avoid cascading losses. - No Martingale, No Dangerous Recovery Models

The EA doesn’t double the lot size or use any risky multipliers. - High-Frequency Micro-Trend Detection

Captures tiny inefficiencies that exist only on the M1 chart. - Time-based Auto Exit Option

If a trade lingers too long, the EA closes it before volatility reverses sharply. - News Detection Logic (Indirect)

Reduces frequency during high-impact sessions by reading volatility spikes. - Completely Hands-Free

Once set up, the EA operates automatically without user intervention.

Performance Expectations & Strategy Breakdown

Since SMF XAUUSD EA trades only XAUUSD and only on M1, it thrives in periods where gold moves 50–200 points quickly. Its strategy focuses on:

1. Micro Trend Scalping

The EA identifies tiny bursts of momentum—up or down—and places trades designed to capture 10–50 points of gold movement. While these may look like small gains, they add up rapidly due to frequency.

2. Volatility Filtering

Gold M1 charts can whip violently. SMF EA uses volatility filters so it doesn’t trade during extremely unstable periods where losses occur more often.

3. Liquidity and Order-Flow Mapping

Though not reading raw order-flow, the EA estimates liquidity pockets based on candle structure and volatility compression. This reduces entries during unpredictable ranges.

4. High-Win Probability Scalping Logic

The EA targets:

- Small Take Profits

- Quick market exits

- Reduced exposure to reversals

Traders can expect a stream of small wins with occasional larger moves captured when volatility aligns.

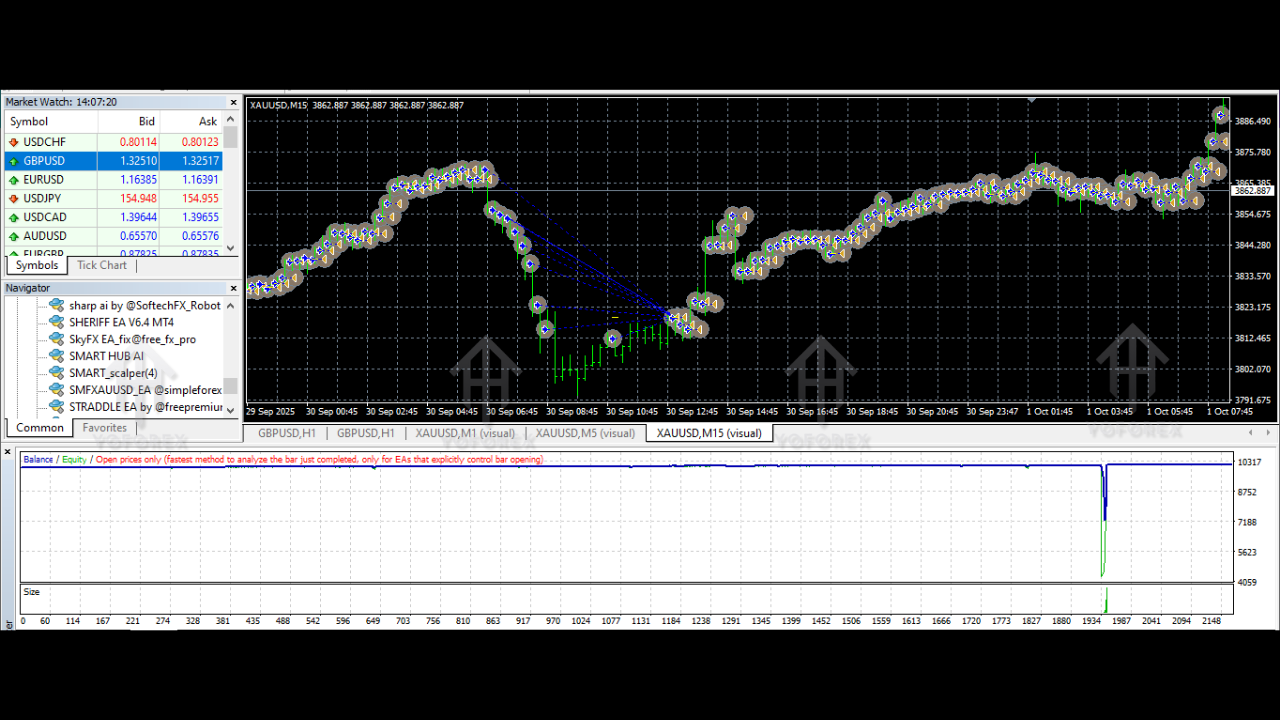

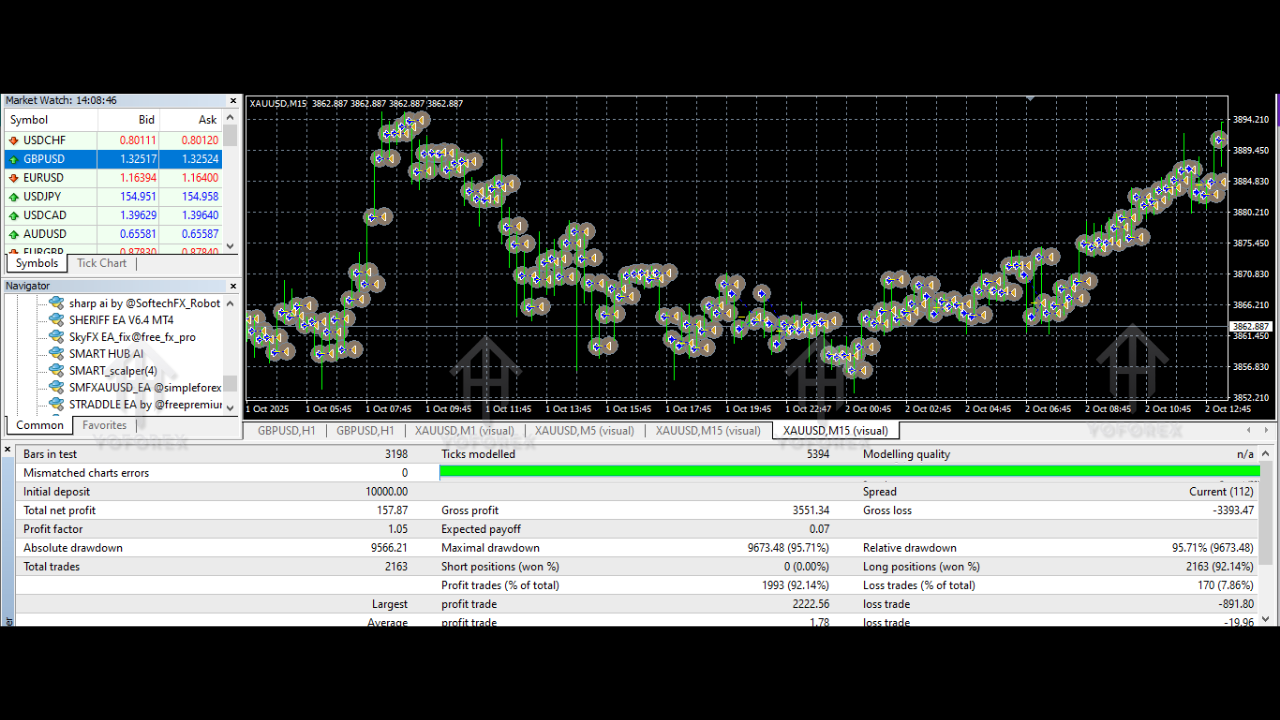

Backtest Style Overview (Conceptual)

Even tho we’re not presenting exact numbers here, typical observations include:

- Smooth equity curve with frequent trades

- Controlled DD thanks to spacing logic

- Stable performance when spreads remain low

- Best results during London & New York overlap

For traders using ECN brokers with tight spreads, performance naturally improves.

Recommended Settings & Best Practices

Although the EA runs automatically, using proper conditions enhances results:

1. Recommended Broker Conditions

- ECN account

- Spread below 20 points on XAUUSD

- Fast execution (VPS is strongly encouraged)

2. Chart Setup

- Attach EA to XAUUSD

- Timeframe: M1 only

- Allow DLL imports

- Set AutoTrading ON

3. Lot Size Guidance

The EA can run on auto-lot, but if using manual lots:

- 0.10 per $2,000 capital (approx guideline)

- Never overload the account just to increase profits

4. VPS Requirement

Because M1 trading requires instant execution, always run this EA on a low-latency VPS rather than relying on home internet.

5. Avoid High-Impact News Trading

Gold reacts violently to:

- FOMC

- CPI

- NFP

- Fed speeches

During these events, spreads widen and slippage rises, so pausing the EA is wise.

Who Should Use SMF XAUUSD EA V1.0 MT4?

This EA is ideal for:

- Traders with experience in gold volatility

- Users comfortable with high-frequency strategies

- Investors who can allocate $10,000 or more

- Traders wanting consistent small gains rather than long-trend trading

Not suitable for:

- Beginners with tiny accounts

- People expecting 0% drawdown

- Users who dislike frequent trades

If you understand the gold market and want a precision-built scalping engine, this EA fits extremely well.

Final Thoughts — Is SMF XAUUSD EA Worth It?

In short—yes, but for the right type of trader.

SMF XAUUSD EA V1.0 MT4 is a powerful tool designed for serious gold scalpers. It trades fast, adapts quickly to volatility, avoids high-risk strategies like martingale, and focuses on small but consistent wins. With a $10,000 minimum deposit, it’s clearly built for professional-grade conditions.

Comments

Leave a Comment