SMC Strategy EA V10.0 MT5 is an advanced, professional-grade Expert Advisor (EA) designed for traders seeking precise and institutional-style automated trading. Built on the foundation of Smart Money Concepts (SMC), the EA analyzes market structure, liquidity shifts, and Fair Value Gaps (FVG) to determine optimal entry points. As the popularity of SMC strategies rises among professional traders, the SMC Strategy EA V10.0 MT5 stands out due to its clear logic, non-aggressive trading style, and robust risk management framework.

In this detailed guide, we will explore the core features of the SMC Strategy EA, its performance expectations, risk management techniques, and who should consider using it. By the end of this review, you will have a thorough understanding of this EA’s strengths and whether it is the right fit for your trading goals.

What is SMC Strategy EA V10.0 MT5?

SMC Strategy EA V10.0 MT5 is a cutting-edge Expert Advisor designed for MetaTrader 5. Unlike traditional EAs that rely on indicators and historical price data, the SMC Strategy EA uses institutional-grade logic to identify market trends, liquidity zones, and price imbalances. Based on the principles of Smart Money Concepts (SMC), this EA focuses on following institutional flows rather than traditional retail strategies.

By using Fair Value Gap (FVG) logic, the EA waits for price to revisit imbalanced zones created by large institutional orders. Once these zones are identified, the EA enters trades aligned with the dominant market trend. This precision in trade execution is key to the EA’s success in highly dynamic market conditions.

Core Features of SMC Strategy EA V10.0 MT5

1. No Martingale or Grid Trading

One of the major advantages of SMC Strategy EA V10.0 MT5 is that it avoids high-risk money management techniques such as martingale or grid trading. Every trade placed by the EA is independent, with its own stop loss, and follows a strict risk-to-reward ratio. This ensures that the EA avoids the pitfalls of runaway losses often associated with grid or martingale strategies.

2. Price Action-Based Strategy

The EA uses Smart Money Concepts to determine the best entry points by analyzing market structure, liquidity zones, and price action. This methodology is much more aligned with institutional trading strategies, focusing on price imbalances rather than relying on lagging indicators.

3. Fair Value Gap (FVG) Detection

FVGs are created when price moves rapidly in one direction, leaving an imbalance in the market. These gaps are often revisited by institutional traders looking to rebalance. The EA identifies these imbalances and waits for price to retrace back to them before executing a trade. This ensures that trades are made at optimal price levels, reducing risk and increasing the probability of success.

4. Trend Filtering with EMA

An adaptive Exponential Moving Average (EMA) filter is used to determine the direction of the trend. The EA trades only in the direction of the trend, as confirmed by the EMA, ensuring that trades are aligned with the broader market momentum. This further reduces the chance of false signals and increases the probability of successful trades.

5. Low Drawdown & Fixed Stop Loss

The EA is designed to keep drawdown under control. Each trade is accompanied by a fixed stop loss, which means that the risk per trade is always predefined. This fixed risk ensures that losses are capped and the overall account equity remains protected.

6. Daily Equity Protection

The EA includes a daily equity protection feature, which allows you to limit daily losses. This is particularly useful for traders who want to avoid large drawdowns in volatile market conditions. If the EA hits the predefined daily loss limit, it will automatically stop trading for the day, preventing further losses.

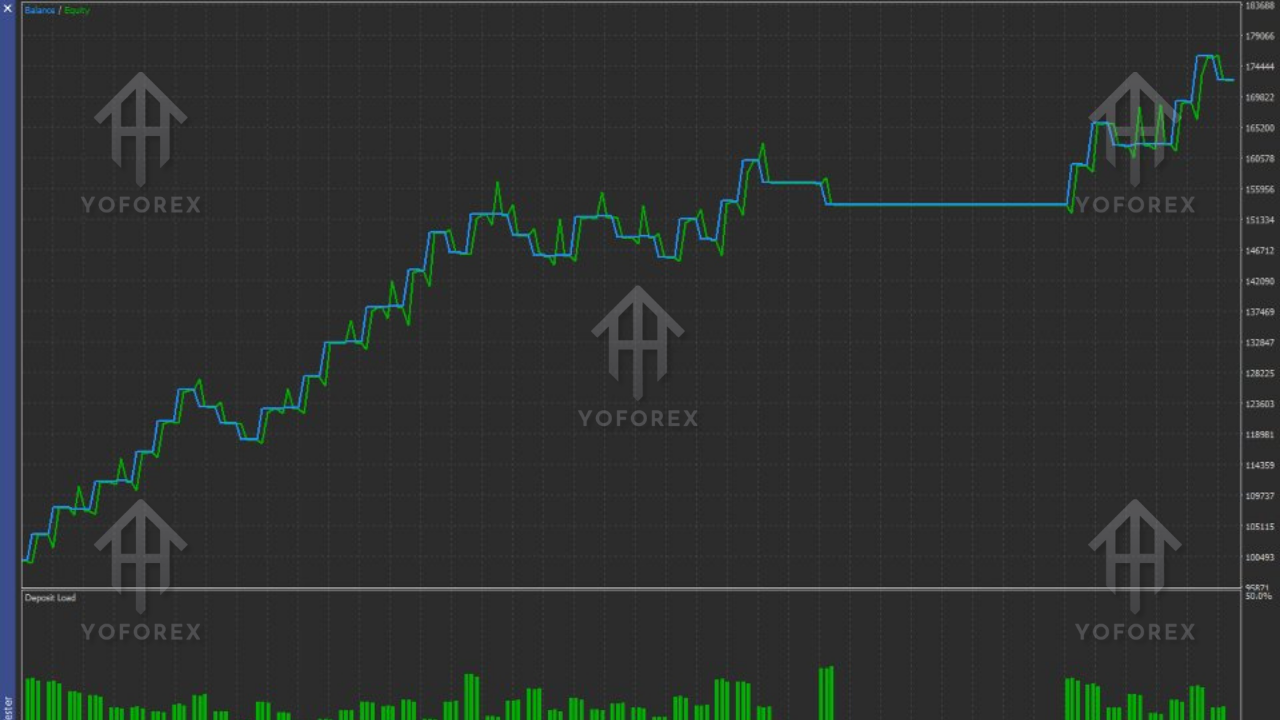

Performance Expectations

Performance results for any Expert Advisor depend on several factors, including broker conditions, market volatility, and the risk parameters you set. However, based on the EA's design and its core strategy, you can expect the following:

1. High-Precision Entries

SMC Strategy EA V10.0 MT5 does not trade frequently but focuses on high-quality setups. The strategy is designed to wait for price to return to Fair Value Gaps before entering trades, ensuring that each entry has a high probability of success.

2. Selective Trading Style

Unlike many high-frequency trading EAs, SMC Strategy EA only trades when the conditions align with its strategy. This typically results in 2–8 trades per week, depending on market conditions. The fewer but higher-quality trades ensure that the account is not overexposed, which can happen with more aggressive EAs.

3. Consistent Risk-to-Reward

The EA is designed to target high risk-to-reward ratios, generally aiming for 1:2 or higher. By maintaining a favorable R:R ratio, even with a moderate win rate, the EA can achieve consistent profitability over time.

4. Low Drawdown

Due to its selective trading and precise entries, the EA typically experiences lower drawdowns compared to many other automated trading systems. The use of a fixed stop loss on every trade further protects the account from substantial losses.

Who Should Use SMC Strategy EA V10.0 MT5?

SMC Strategy EA V10.0 MT5 is designed for a specific type of trader who is looking for disciplined, high-quality automated trading. This EA is suitable for:

1. Professional Traders Who Understand Price Action

Traders who already understand price action and Smart Money Concepts will appreciate the institutional-grade logic behind the SMC Strategy EA. The EA uses advanced price analysis techniques to determine optimal entry points, making it ideal for those who want to automate their trading based on these principles.

2. Beginners Looking for Safe Automation

Despite its advanced logic, SMC Strategy EA V10.0 MT5 is user-friendly and can be deployed with minimal setup. Its non-aggressive risk management makes it suitable for beginner traders who are just starting with automated trading.

3. Prop Firm Traders

The EA’s disciplined approach, with fixed stop losses and controlled risk exposure, makes it an excellent choice for traders looking to pass prop firm challenges. The EA does not rely on high-risk methods like martingale, which are typically not allowed in proprietary trading firm evaluations.

4. Traders Who Prefer Long-Term, Steady Growth

The EA is ideal for traders who are focused on long-term, consistent growth rather than short-term gains. The selective trade execution ensures that trades are aligned with institutional liquidity and market structure, creating sustainable returns over time.

Pros and Cons of SMC Strategy EA V10.0 MT5

Pros

- Uses institutional-grade price action strategies

- No martingale or grid-based risk management

- Fixed stop loss and low drawdown

- Fair Value Gap detection for precise entries

- Daily equity protection for risk control

- Suitable for prop firm challenges

- Compatible with EURUSD and GBPUSD

- Professional, non-aggressive trading strategy

Cons

- Limited pair support (mainly EURUSD and GBPUSD)

- Does not trade as frequently as high-frequency systems

- Performance may vary during extreme news-driven volatility

- Requires careful risk management to align with settings

Final Thoughts

SMC Strategy EA V10.0 MT5 is a well-structured and professional-grade Expert Advisor, offering advanced price-action-based trading strategies with institutional-level risk management. By focusing on market structure, liquidity zones, and Fair Value Gaps, this EA offers traders a reliable way to automate trading while maintaining control over drawdown and risk.

Whether you are a professional trader familiar with Smart Money Concepts or a beginner looking for a disciplined, low-risk automated system, the SMC Strategy EA V10.0 MT5 provides a solid foundation for achieving consistent, long-term results.

Contact Links

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment