In the competitive forex market, automated trading is increasingly becoming an essential tool for both novice and seasoned traders. As the market becomes more volatile and fast-paced, leveraging advanced Expert Advisors (EAs) is crucial to staying ahead. SmartDayMultiStrat EA V1.0 MT4 offers a comprehensive solution by utilising a multi-strategy approach to trading, designed to make the most of diverse market conditions.

In this blog post, we will provide a deep dive into what SmartDayMultiStrat EA is, its features, strengths, weaknesses, and whether it’s the right choice for your forex trading needs.

What is SmartDayMultiStrat EA V1.0 MT4?

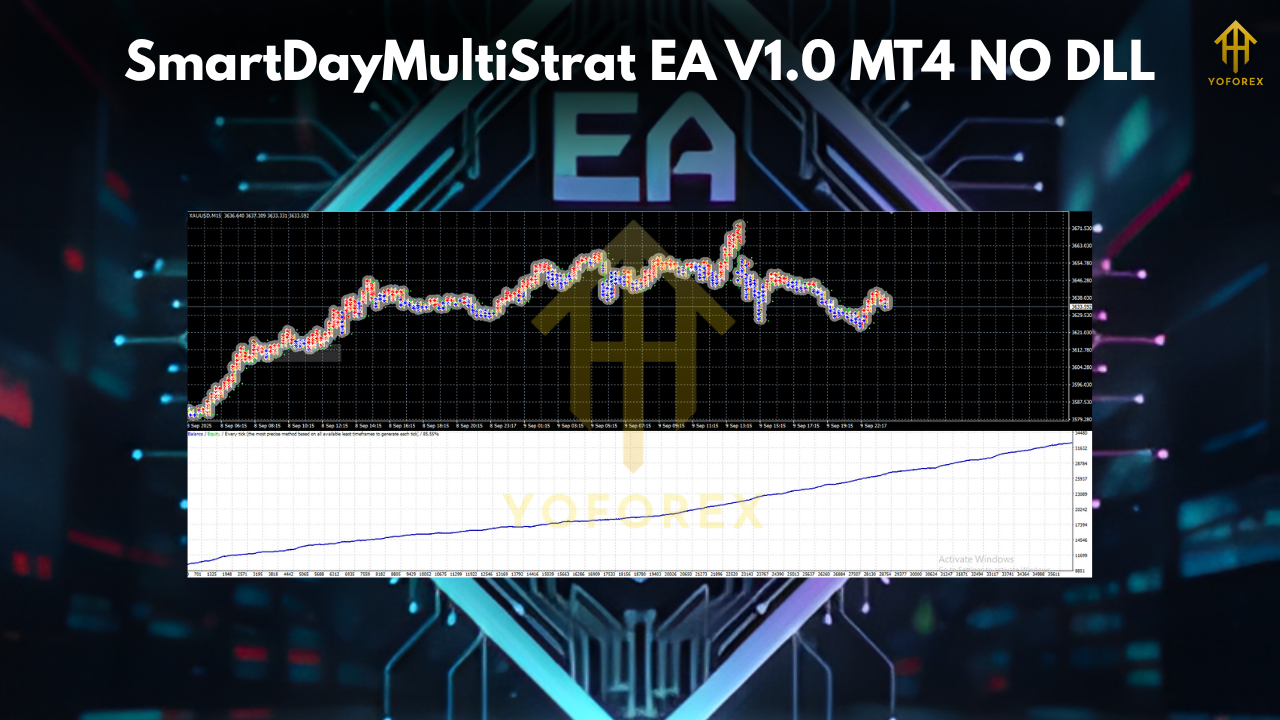

SmartDayMultiStrat EA V1.0 is an automated trading system for MetaTrader 4 (MT4). This EA is designed to execute trades based on six different trading strategies, allowing traders to customise the EA's behaviour according to their preferences and the prevailing market conditions.

The main appeal of this EA lies in its versatility. Unlike standard single-strategy EAs, SmartDayMultiStrat EA is capable of switching between different strategies, optimising itself to adjust to the changing forex market. Traders can mix and match strategies like gap trading, engulfing patterns, and high-low breakouts to fine-tune their trading approach.

Each strategy operates independently, and traders have the flexibility to activate or deactivate them at will. This modular structure gives traders greater control over their automated trading activities, making it an ideal tool for both beginner and experienced traders.

Key Features of SmartDayMultiStrat EA V1.0

Multiple Trading Strategies: The EA comes with six built-in strategies:

- Gap Trading: Identifies price gaps and takes trades when the gap occurs.

- Engulfing Candlestick Pattern: Trades on bullish or bearish engulfing patterns for trend reversals.

- Harami Reversal: Looks for Harami candlestick patterns that signal potential reversals.

- Continuation Strategy: Identifies market trends and rides them until a reversal signal occurs.

- Reversal Strategy: Detects price exhaustion and enters the market in the opposite direction.

- Yesterday's High/Low Breakout: Trades when price breaks above or below the previous day's range.

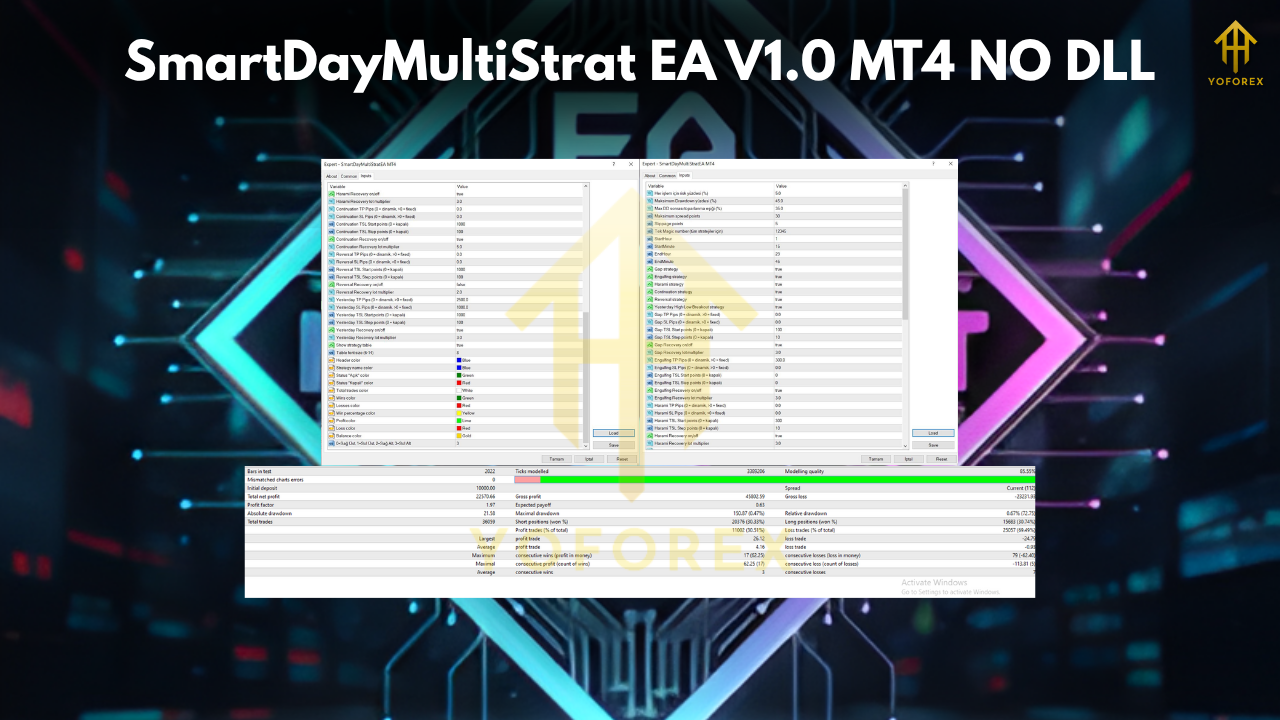

2. Money Management & Risk Controls: SmartDayMultiStrat EA is equipped with sophisticated money management tools. These include:

- Risk per trade: Traders can set a specific percentage of the balance to risk per trade.

- Max drawdown protection: Prevents excessive losses by automatically pausing trading if a specific drawdown threshold is reached.

- Recovery Mode: Enables the EA to trade with larger lot sizes to recover from previous losses, ensuring that the account doesn’t stay in a losing streak.

Time Filter & Spread Control:

The EA allows users to trade during specific hours, avoiding market hours with low liquidity that could lead to higher slippage. Furthermore, it limits trades to when spreads are below a specified maximum, ensuring fair execution.

3. On-Chart Performance Dashboard:

An intuitive dashboard is available on the MT4 chart, which shows key metrics such as:

- Number of trades executed

- Win/loss ratio

- Account balance and equity

- Active strategies and their performance

This feature provides complete transparency, allowing users to monitor the effectiveness of each strategy in real time.

Error Handling & Logging:

The EA includes robust error handling, which logs all trade operations, helping traders track performance and identify issues in the system for easy troubleshooting.

Benefits of Using SmartDayMultiStrat EA V1.0 MT4

1. Diversification Across Multiple Strategies

By integrating six distinct strategies, this EA reduces the risk associated with relying on one type of market condition. While one strategy might underperform in a range-bound market, another might excel. This diversification helps smooth returns over time.

2. Customizable Trading Settings

The modular nature of this EA makes it highly customizable. Traders can adjust settings based on their risk tolerance, preferred market conditions, and trading goals. They can choose which strategies to activate, change risk parameters, and fine-tune the overall trading approach.

3. Automated Risk Management

With features like adjustable risk per trade, drawdown protection, and recovery modes, SmartDayMultiStrat EA ensures that traders don’t take on excessive risk. These safeguards are essential for long-term success in automated trading.

4. Transparency & Monitoring

The real-time performance dashboard makes it easy to see how the EA is performing. Traders can view the live status of each strategy, helping them make quick adjustments or stop trading altogether if the results aren’t up to par.

5. Reliable Execution

The EA's use of time filters and spread control ensures that trades are executed in favorable conditions, reducing the risk of slippage and poor fills.

Is SmartDayMultiStrat EA Right for You?

While SmartDayMultiStrat EA offers several advantages, it’s not a one-size-fits-all solution. Here’s a summary of who may benefit most from using it:

1. Experienced Traders

SmartDayMultiStrat EA is best suited for experienced traders who understand various trading strategies and their market implications. Its flexibility in enabling or disabling strategies makes it ideal for those who prefer to tailor their automated trading setups.

2. Traders Seeking Diversification

For those who want to diversify their approach, SmartDayMultiStrat EA offers six different strategies that can help spread risk and increase the chances of successful trades in varying market conditions.

3. Risk-averse Traders

The built-in money management features, such as risk percentage per trade and drawdown protection, make this EA a good choice for those who prefer automated systems with strong risk control.

4. Traders Who Want Transparency

The on-chart dashboard and detailed logging provide traders with full transparency, which is important for those who want to track their trading performance and adjust settings for optimal results.

Potential Drawbacks

Despite its advanced features, SmartDayMultiStrat EA is not without its drawbacks:

1. Complexity

The variety of strategies available means that this EA may be overwhelming for beginner traders who are just starting to learn automated trading. It requires careful configuration and regular monitoring.

2. Higher Initial Cost

At USD 1,200, SmartDayMultiStrat EA comes at a premium price. This may not be affordable for all traders, particularly those just starting out with automated trading.

3. Market Conditions Dependency

While the EA is versatile, it still depends on specific market conditions for the strategies to perform well. The EA may not work effectively in low volatility or illiquid periods, which may lead to suboptimal results.

Conclusion

SmartDayMultiStrat EA V1.0 for MT4 is a powerful and flexible tool designed for traders who want to harness the power of multi-strategy trading in a fully automated way. Its diverse range of strategies, coupled with robust risk management features, makes it a strong contender for traders who value flexibility and control.

However, as with any trading system, SmartDayMultiStrat EA should be used with caution. Traders should start with small amounts and conduct thorough testing before deploying it on a live account. Its premium cost and complexity may not make it suitable for beginners, but for seasoned traders, it could be a valuable addition to their trading toolkit.

Comments

Leave a Comment