Silicon Ex EA V2.3 MT4 – Smart, Consistent Gold Trading on M5

If you’re hunting for an MT4 Expert Advisor that treats XAUUSD like its home turf, Silicon Ex EA V2.3 MT4 deserves a serious look. Built around smart execution logic and disciplined risk management, this EA is designed to scan live market data, react fast on the M5 timeframe, and prioritize capital protection while seeking consistent gains. In other words: less guesswork, more structure.

What Is Silicon Ex EA V2.3 MT4?

Silicon Ex is a MetaTrader 4 Expert Advisor focused on gold (XAUUSD) and optimized for the M5 chart. It aims to deliver automated, reliable trade decisions using smart algorithms that read momentum shifts, short-term volatility, and micro-trend behavior. The “Ex” in the name is about execution—getting in and out with rules that keep risk in check, even when gold spikes or whipsaws.

Unlike one-size-fits-all bots, Silicon Ex V2.3 is purpose-built: it’s trained for gold’s speed and personality on lower timeframes. That singular focus lets it be nimble during London/New York overlaps, filter noise better than generic scalpers, and apply position sizing that adapts to volatility.

Who Is It For?

- Busy traders who want consistent, rules-based entries/exits without babysitting charts.

- Gold scalpers who appreciate disciplined risk and quick, repeatable setups.

- Prop-firm aspirants aiming to keep drawdown controlled while meeting profit targets.

- Newer MT4 users who want clear settings, straightforward deployment, and a learnable workflow.

Core Strategy in Plain English

Silicon Ex EA V2.3 watches M5 candles and live tick flow for changes in momentum, micro trend alignment, and volatility compression or expansion. It prefers trading with the short-term trend but can stand aside when the tape gets messy. The logic uses:

- Momentum filters to avoid countertrend traps.

- Volatility gates (e.g., ATR-like logic) to scale risk in high/low volatility pockets.

- Session awareness so entries aren’t forced into illiquid hours.

- Protective exits (hard stop + rule-based trailing) to cap losses and lock gains.

No martingale, no dangerous multipliers. The “smart” part is less about fancy buzzwords and more about consistent execution rules that stack probabilities over many trades.

Timeframe & Pair

- Timeframe: M5 (5-minute chart)

- Instrument: XAUUSD (Gold)

Yes, you could load it on other charts—but Silicon Ex V2.3 is explicitly tuned for gold on M5. That’s where it shines.

Key Features

- Purpose-built for XAUUSD M5: Tight logic for a fast market.

- Risk-first design: Fixed stop-loss on every trade, with optional trailing logic.

- No martingale/grid: Clean, linear risk so your equity curve isn’t one big coin toss.

- Session filters: Focus on liquid windows; avoid dead zones.

- Spread & slippage checks: Helps dodge poor fills during spikes.

- Adaptive lot sizing: Calibrate to your account risk (e.g., risk % per trade).

- News awareness (manual option): Pause during high-impact releases if you prefer.

- Clear logs & alerts: Understand what the EA is doing and why.

- Friendly presets: Sensible defaults so you’re not lost in inputs.

- VPS-ready: Lightweight operation for 24/5 uptime.

Setup: Getting Started in Minutes

- Broker & Account: Choose an ECN/RAW-type account with tight XAUUSD spreads and stable execution.

- VPS (recommended): For near-constant uptime and lower latency.

- Install the EA:

- In MT4, go to File → Open Data Folder.

- Drop the EA file into MQL4/Experts.

- Restart MT4, then find Silicon Ex under Navigator → Expert Advisors.

4. Load on Chart: Open XAUUSD, M5, drag the EA onto the chart.

5. Enable AutoTrading: Make sure the top toolbar button is green; check smiley in the chart corner.

6. Configure Risk:

- Set your risk percent per trade or fixed lot.

- Confirm max spread and slippage limits.

- Decide whether to pause around news (manual habit or using a trade pause window).

7. Forward Test First: Always run it on a demo for a couple of weeks to make sure fills and behavior match your expectations.

Risk Management You Can Live With

Silicon Ex V2.3 is built around capital preservation. That means:

- Hard stop-loss on every trade.

- Optional trailing when momentum follows through.

- Daily loss cap (if you choose) to cut the day short and avoid tilt.

- Max open positions to prevent over-exposure in fast markets.

- Session windows so you aren’t trading into thin liquidity.

You can start with a conservative risk—say 0.5%–1% per trade—then slowly scale once you’re comfortable with the live behavior. Gold moves fast; restraint helps longevity.

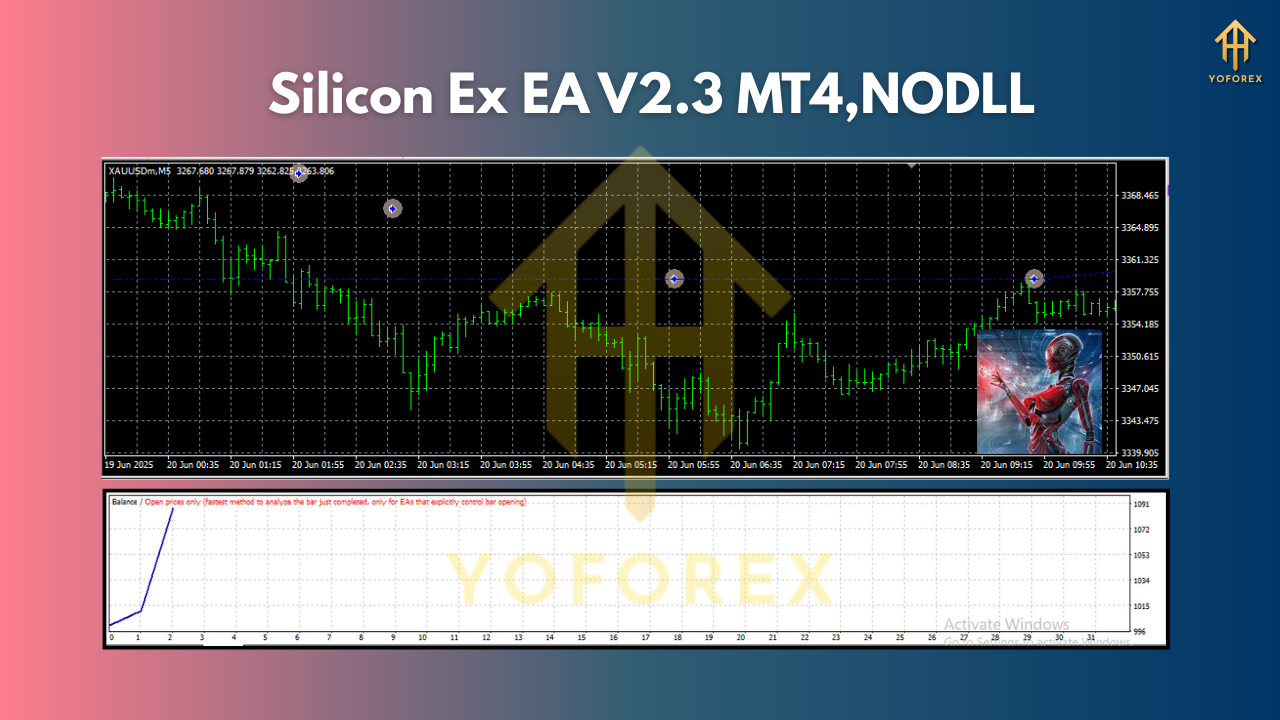

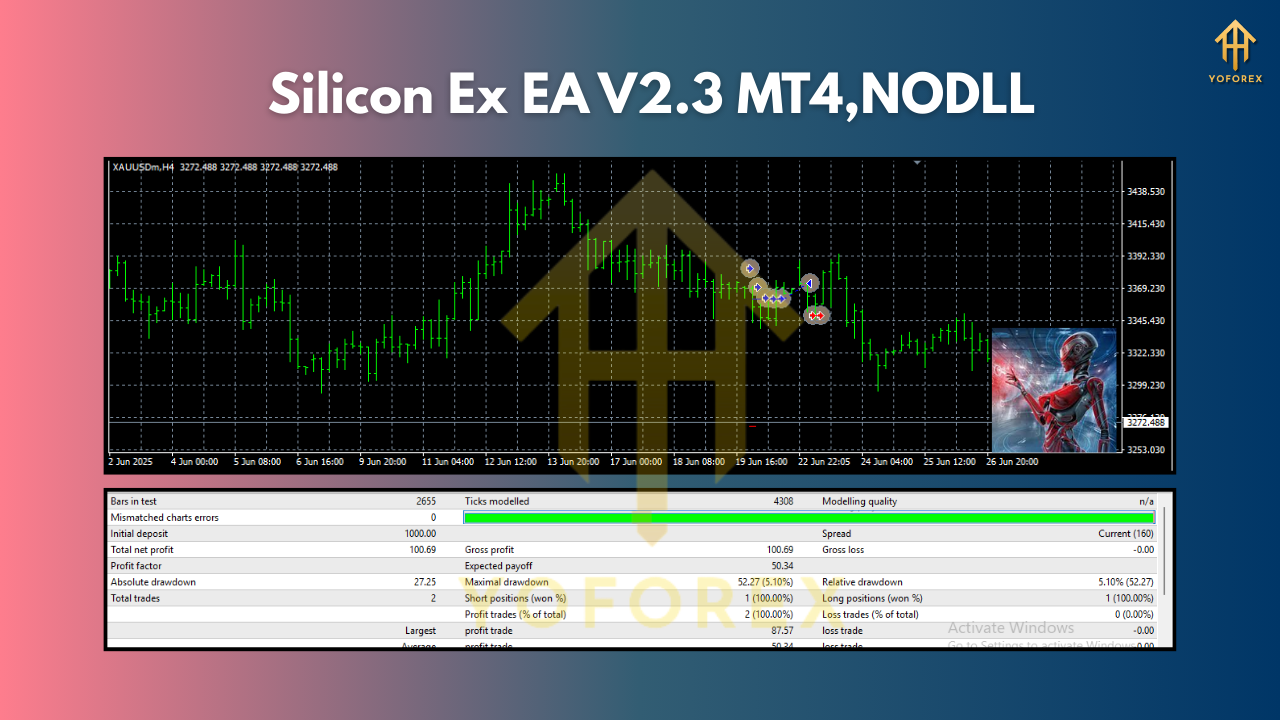

Performance Mindset (Backtests & Live)

Backtests help you validate logic, but they’re not the finish line. For Silicon Ex:

- Backtest scope: Run 5+ years on XAUUSD M5 with variable spreads and realistic slippage.

- Walk-forward or split-sample: Optimize on one period, validate on another to avoid curve-fit comfort.

- Monte Carlo: Shake up order, slippage, and spreads to see if the edge holds under stress.

- Forward test (demo → small live): This is where execution quality and broker conditions prove themselves.

The goal isn’t a perfect equity curve; it’s stability—a system that continues to find high-probability micro-moves and manages drawdowns without drama.

Best Practices for Gold Scalping on M5

- Avoid red-flag news spikes: NFP, CPI, FOMC—consider pausing.

- Respect spreads: If your broker widens to the moon, sit out.

- Use a VPS: Less downtime, fewer missed signals.

- Keep risk steady: Don’t over-tweak lots after a winner or loser.

- Audit weekly: Check logs, slippage, and spreads. Small tweaks → big differences.

Example Input Settings (Guidance)

These are illustrative starting points. Always validate on demo before going live.

- Risk Percent per Trade: 0.5%–1%

- Max Spread (points): Sized to your broker’s typical XAUUSD spread + buffer

- Slippage: 2–5 points (adjust to your fills)

- Trading Sessions: London + NY overlap; disable illiquid hours

- News Pause: On (manually, 15–30 mins before/after major events)

- Max Simultaneous Trades: 1–2

Prop-Firm Friendly?

Prop rules vary, but Silicon Ex’s linear risk, hard stops, and optional daily loss cap can be aligned with many evaluations. Keep risk modest, watch max daily loss rules, and don’t trade through blockbuster news unless rules allow.

Final Thoughts

Silicon Ex EA V2.3 MT4 isn’t trying to be everything; it’s built to be good at one thing—scalping gold on M5—while treating risk with the seriousness it deserves. If you value clean logic, linear risk, and a workflow that respects gold’s speed, this EA lines up well. Do your homework, start small, and let the edge show up across many trades—not just a single day.

Comments

Leave a Comment