In today’s fast‑moving forex market, automation is not just an advantage—it’s a requirement for traders who want consistency and precision. With hundreds of expert advisors available, the challenge lies in finding one that truly understands market structure, filters false signals, and executes trades based on strong confirmations.

That’s where SignalFXPro Consensus EA V3.4 MT4 comes in. Designed for MetaTrader 4, this expert advisor doesn’t rely on a single indicator or signal source. Instead, it uses a consensus approach—waiting for multiple technical indicators to agree before it enters or exits a position.

This unique mechanism aims to minimise false signals and ensure that trades are placed only when the probability of success is high. Let’s break down how it works, its major features, and how it can be a useful addition to a professional trader’s toolkit.

What Is SignalFXPro Consensus EA?

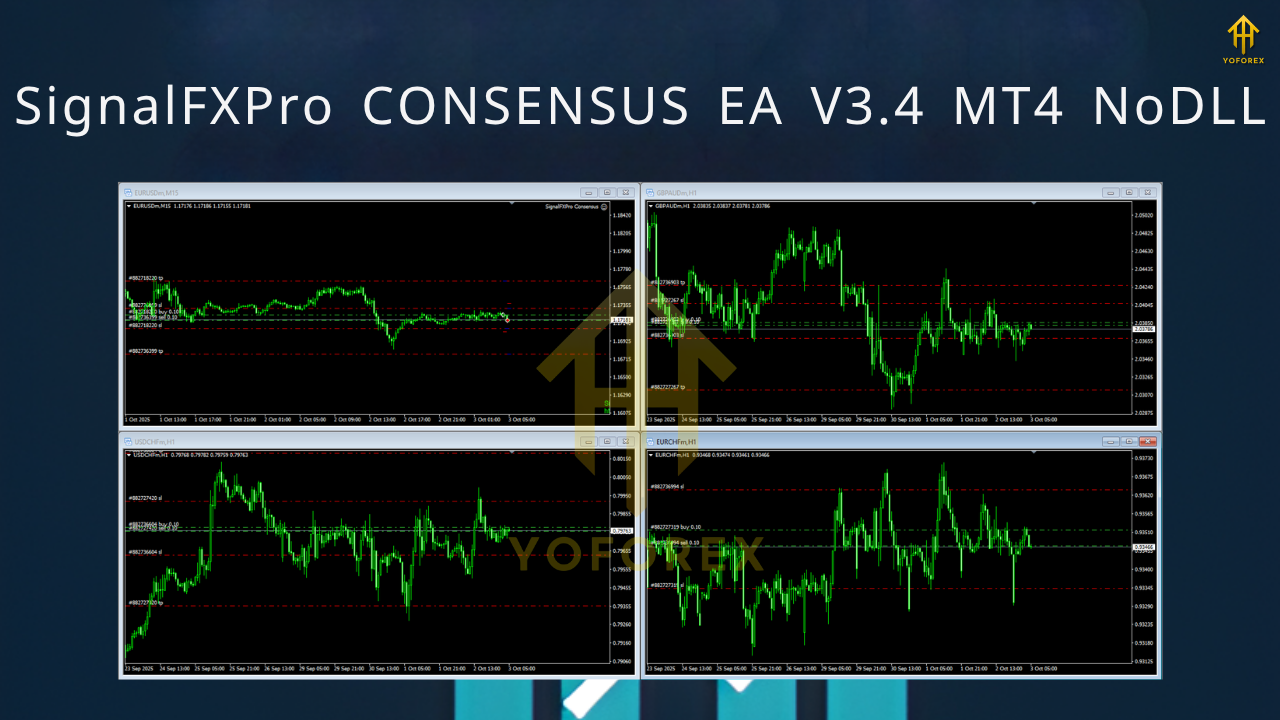

SignalFXPro Consensus EA V3.4 is an intelligent automated trading system built to operate across multiple forex pairs directly from one chart. It’s structured to scan several markets at once, analyse signals from multiple indicators, and open trades when all criteria align.

This EA is not a scalper or a martingale system—it’s a well‑structured, risk‑controlled algorithm designed to prioritise accuracy over trade frequency. Its decision‑making engine uses a blend of classical technical indicators to confirm a trend before taking action.

It’s compatible with MetaTrader 4, one of the most widely used trading platforms globally, and can be adapted to different trading styles such as swing, day, or intraday trading.

Core Concept: Consensus Logic

At the heart of this EA lies its consensus trading model. Instead of relying on a single indicator—which can often give misleading entries—the EA uses several well‑known technical tools in combination.

Before placing a trade, the system checks multiple indicators, including trend‑based and momentum‑based filters. A position is opened only if all the selected conditions confirm the same direction—bullish or bearish.

This “agreement filter” drastically reduces noise and false entries, which are common causes of drawdowns in ordinary bots.

How SignalFXPro Consensus EA Works

1. Market Scanning and Analysis

Once installed, the EA continuously scans symbols from your Market Watch window. You don’t need to attach it to every chart; one instance can handle multiple instruments simultaneously.

It evaluates market conditions across several timeframes and pairs, identifying where trend and momentum align. This allows it to react to opportunities in real time without trader intervention.

2. Multi‑Indicator Confirmation

The EA utilizes several key technical indicators (such as trend averages, oscillators, and volatility filters). When the majority of these indicators agree, the EA sees it as a valid signal.

This process filters out sideways market phases, letting the system focus on stronger, directional moves—something many single‑indicator EAs fail to achieve.

3. Risk and Trade Management

After entering a position, the EA uses well‑defined rules for managing open trades:

- Fixed or dynamic lot sizing based on account equity

- Customizable Stop Loss and Take Profit per timeframe

- Break‑even and trailing‑stop systems to lock profits

- A built‑in “no‑loss close” function that avoids closing trades in negative territory when opposite signals appear

All of this gives traders greater control while maintaining disciplined trade exits.

4. Multi‑Timeframe Logic

Each timeframe can have its own risk settings. For instance, you can configure smaller SL/TP levels for short‑term charts and broader ones for higher timeframes.

This flexibility allows the EA to adapt to changing volatility patterns throughout the trading week.

Key Features

- Multi‑Indicator Consensus: Waits for strong confirmation from multiple technical sources before taking a trade.

- Multi‑Symbol Functionality: Operates across all pairs in the Market Watch window from a single chart.

- Dynamic Trailing Stop: Moves stop levels automatically based on price movement.

- Configurable Risk Settings: Choose between fixed lot sizes or risk‑percentage‑based trading.

- Automatic Trade Closure: Detects opposite conditions and manages exits intelligently.

- Optimised for MetaTrader 4: Lightweight, stable, and easy to configure.

- No Martingale, No Grid: Pure analytical trading logic with full transparency.

Why the Consensus Approach Works

Most EAs fail because they rely on one or two technical filters that can produce false signals in volatile or sideways markets. The consensus method used in SignalFXPro filters out uncertainty by waiting for alignment across multiple indicators.

This increases the probability of successful trades while reducing exposure to random fluctuations.

In essence, the EA acts as a risk‑filtering system—prioritizing quality over quantity of trades. It won’t trade constantly, but when it does, it’s backed by a high‑confidence signal.

Suggested Settings and Usage Tips

Timeframes:

M15 to H1 tend to work best for balanced performance.

Currency Pairs:

EURUSD, GBPUSD, USDJPY, AUDUSD, and other major pairs are recommended for stable execution.

Risk Management:

- Keep risk per trade under 2% of account balance.

- Avoid increasing lot sizes to recover losses.

- Use default parameters as a baseline, then adjust after demo testing.

- Execution Conditions:

Run the EA on a VPS for 24/5 uptime and smoother execution during high‑volatility periods.

Advantages of SignalFXPro Consensus EA

- Stronger Signal Accuracy: By requiring multiple confirmations, false signals are filtered out.

- Lower Emotional Involvement: The system follows rules without bias or hesitation.

- Adaptability: Works across different timeframes and pairs, reducing dependency on one setup.

- Safety First Design: “No‑loss close” logic prevents trades from being closed in unnecessary drawdown.

- Multi‑Market Support: Capable of managing several pairs simultaneously for portfolio diversification.

Limitations to Keep in Mind

No EA can guarantee constant profits. While SignalFXPro Consensus EA is designed for stability, traders should be aware of potential limitations:

- In low‑volatility or ranging markets, signals may take longer to appear.

- The system may enter slightly late since it waits for consensus confirmation.

- Requires stable network connectivity and good execution speed for optimal results.

- Not suitable for traders who want high trade frequency or scalping strategies.

To maximise success, combine it with proper money management and realistic expectations.

Who Should Use It

SignalFXPro Consensus EA V3.4 MT4 is ideal for traders who:

- Prefer structured, rule‑based automation.

- Want consistent, high‑probability entries rather than rapid trades.

- Are comfortable running EAs on multiple symbols at once.

- Value capital protection and controlled risk exposure.

If you’re seeking a professional‑grade EA that uses logic and statistical confirmation instead of hype or blind signals, this one fits the bill.

Getting Started

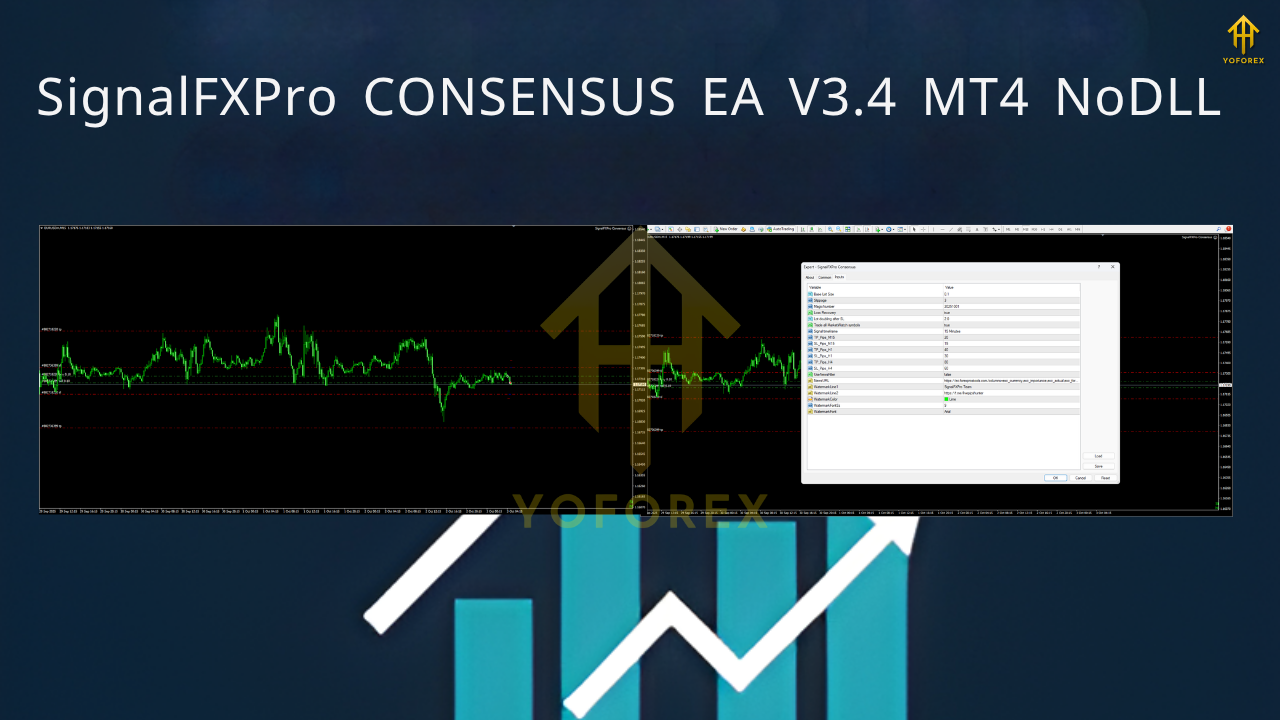

- Install MT4 and place the EA in the Experts folder.

- Load the EA on any chart—no need to attach to every pair.

- Configure symbol list, risk percentage, SL/TP, and trailing stop.

- Enable AutoTrading and ensure your broker’s server connection is stable.

- Let the EA monitor and trade based on its consensus logic.

Always start with a demo account to get familiar with how it behaves under different market conditions.

Final Thoughts

SignalFXPro Consensus EA V3.4 MT4 is an advanced trading system that relies on smart confirmation logic rather than speed or luck. It filters weak signals, manages risk intelligently, and adapts to multiple symbols—all from one interface.

While it won’t produce dozens of trades per day, the trades it does take are typically well‑filtered and high in probability. For traders who prefer precision, control, and a disciplined trading framework, this EA can be an effective ally in long‑term portfolio growth.

Comments

Leave a Comment