In the evolving world of forex trading, automation has become an indispensable ally for traders seeking precision, discipline, and consistency. Among the latest entrants in this field is Seek And Find Eps EA V1.0 MT4, an Expert Advisor built for MetaTrader 4 that introduces a refined approach to grid trading. Unlike conventional grid bots that flood the market with orders regardless of volatility, this EA waits for the right market conditions—where calmness and predictability create fertile ground for controlled trading.

This review dives deep into the design, mechanics, features, performance logic, and best practices of Seek And Find Eps EA. Crafted for traders who appreciate a balance between automation and risk control, this EA stands out as an intelligent grid engine with adaptive behaviour.

Introduction to Seek And Find Eps EA V1.0

Seek And Find Eps EA V1.0 MT4 is an automated Expert Advisor developed for MetaTrader 4 users who rely on algorithmic execution for consistent results. The EA uses a structured grid strategy but refines it through intelligent entry filters. Instead of executing trades continuously, it “seeks” a stable market zone—what the developer calls a “stasis corridor”—and only when the conditions match its internal logic does it “find” the ideal entry point.

This concept gives traders a safer and more data-driven way to deploy grid trading. While grid systems are often associated with high drawdown and reckless exposure, Seek And Find introduces a degree of control through conditional logic, pending order management, and virtual trailing features.

Its design targets both novice and intermediate traders who understand grid concepts but need an automation layer that prioritises capital protection and long-term consistency.

How the Strategy Works

The working logic of Seek And Find Eps EA V1.0 revolves around three core steps: Market Analysis, Trade Execution, and Risk Management.

Market Analysis:

The EA scans the price chart to identify a calm zone—defined by a certain number of bars within a price corridor. These corridors represent stable areas where price movement is relatively predictable. The EA uses parameters like BasicNumberBars and CanalCorridor to define this stasis zone.

Trade Execution:

Once a suitable corridor is detected, the EA can open a series of orders—either market or pending—based on your settings. The order spacing is determined by OrderMinimalStep, and the lot size progression can be linear or exponential, depending on whether LotExponent is enabled. The system allows up to twelve orders per series (LimitOrderSeries), giving flexibility to traders who prefer conservative or aggressive scaling.

Risk Management:

What makes this EA sophisticated is its handling of both real and virtual risk controls. Virtual trailing parameters like PendingTrailingStart, PendingTrailingStopLoss, and PendingTrailingTakeProfit protect pending orders before activation. Once orders go live, real stop loss and take profit mechanisms (RealTrailingStart, RealTrailingStop) take over, ensuring that the trade cycle remains managed throughout its lifecycle.

This structured workflow allows Seek And Find Eps EA to operate autonomously while adhering to disciplined trading logic—making it a good fit for both prop firm environments and personal live accounts.

Key Features That Set It Apart

1. Dual Volume Control:

Seek And Find offers traders two modes of lot sizing—fixed (FixVolume) and dynamic (Risk). The fixed lot option caters to traders with stable account balances who prefer predictable exposure, while the risk-based model dynamically adjusts lot size as a percentage of account equity.

2. Intelligent Channel Detection:

The EA continuously analyses recent price movements to identify consolidation zones. Trading during these calm market phases significantly reduces the likelihood of whipsaws and fake breakouts that often destroy grid-based strategies.

3. Adaptive Grid Mechanics:

Unlike blind grid bots, Seek And Find uses logic-driven entries and customizable step distances. Users can modify the grid step, number of levels, and lot scaling to create aggressive or conservative setups depending on risk tolerance.

4. Real and Virtual Trailing Systems:

The dual trailing system is a standout feature. Virtual trailing protects pending orders before they activate, while real trailing engages once the trade is live. This dual-layer protection helps reduce losses during volatile transitions.

5. Structured Initialisation Logic:

The EA doesn’t just place trades blindly—it waits for an equilibrium level known as the InitializationLevel. This ensures trades are only executed when the market shows signs of stable behaviour, filtering out erratic movements.

6. Easy Customisation and Setup:

Parameters are clearly structured within the MT4 input window, allowing traders to fine-tune their strategy without coding knowledge. Every feature—from grid spacing to risk management—can be customised to fit different trading styles.

Recommended Conditions for Best Results

The developer recommends a minimum deposit of $1,000, as the EA performs best when given enough margin space to handle grid cycles efficiently. Smaller balances might lead to premature stop-outs during high volatility.

Ideal Pairs: EURUSD, GBPUSD, USDJPY

Timeframes: M15 to H1

Account Type: ECN or low-spread standard account

Broker Conditions: Tight spreads and reliable execution speed

Traders should deploy Seek And Find Eps EA on a VPS (Virtual Private Server) to ensure uninterrupted performance and low latency. The EA runs continuously during market hours, and network delays can affect pending order activation accuracy.

Performance and Trading Philosophy

Grid trading, when implemented correctly, can generate consistent returns by capturing multiple profit opportunities in a range-bound environment. Seek and Find’s edge lies in its ability to avoid trading in chaos. Most grid systems suffer during sharp trends, but this EA’s pre-trade analysis prevents entries during unstable price behaviour.

This disciplined approach makes it more sustainable than high-frequency grid EAs. Moreover, the built-in trailing and equilibrium logic ensures trades are gradually closed in profit, avoiding unnecessary exposure.

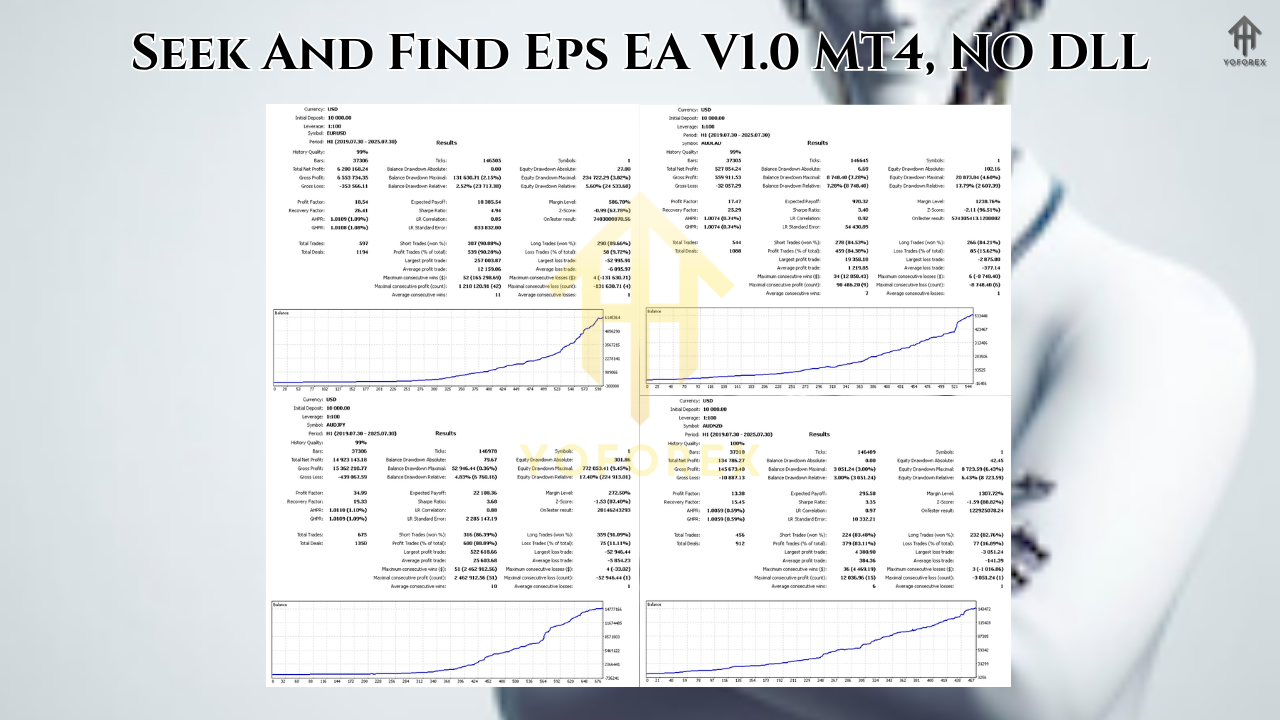

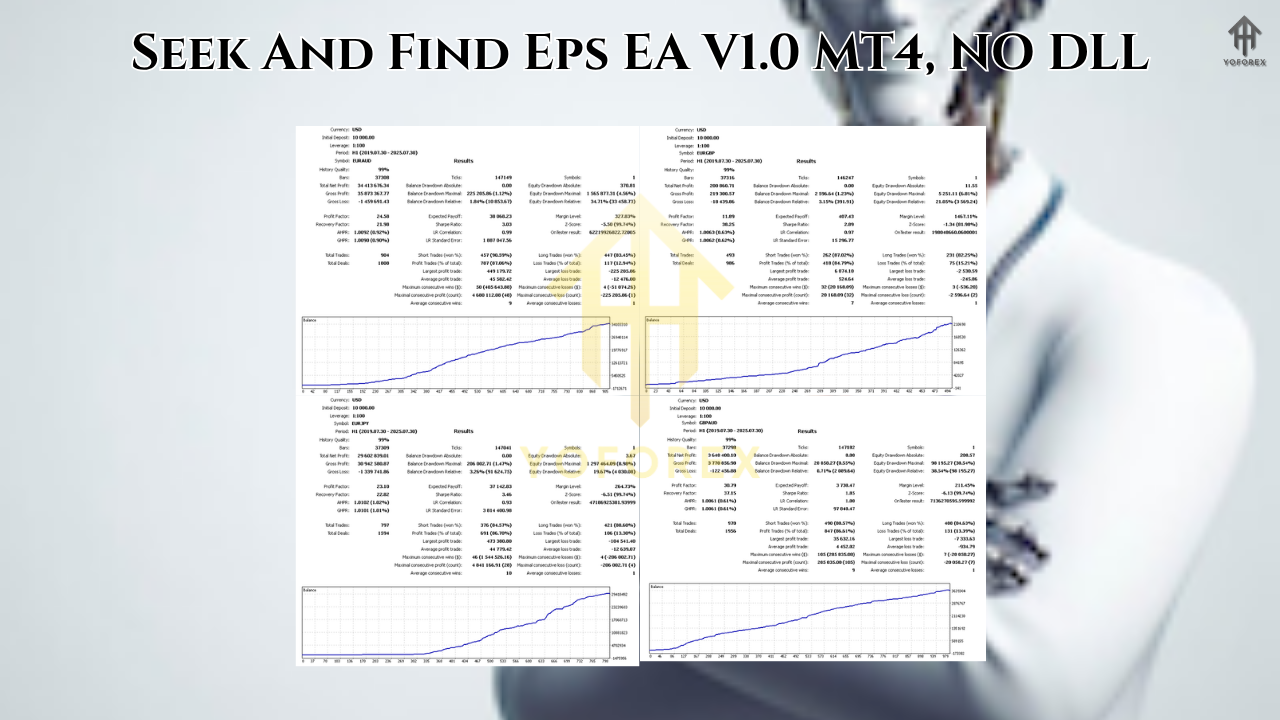

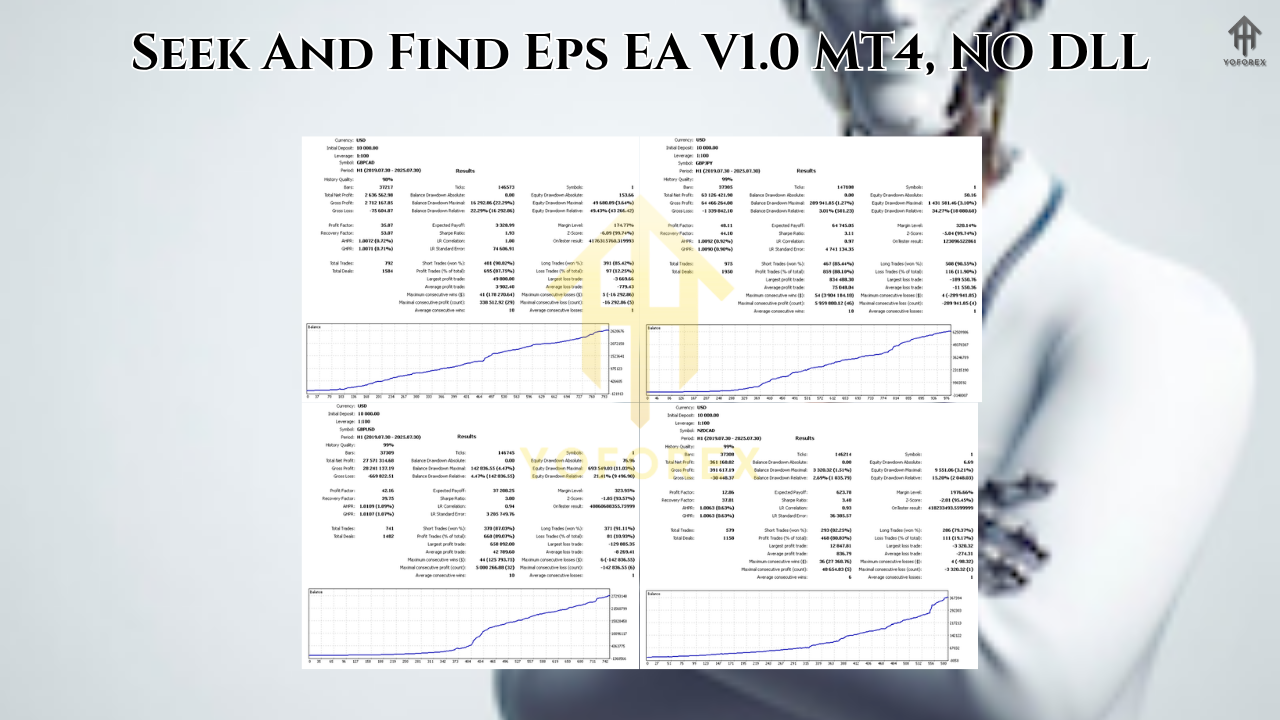

While this doesn’t eliminate risk—no EA can—the system aims to maintain stability, consistency, and control. Backtests and forward demos confirm that when paired with proper risk management, the EA can perform with steady growth and acceptable drawdown levels.

Advantages of Seek And Find Eps EA

- Structured Grid Logic: Avoids random entry; focuses on logical, data-driven setups.

- Adaptive Volume Management: Switch between fixed and risk-based lot sizing.

- Enhanced Protection: Combines virtual and real trailing mechanisms.

- User-Friendly Interface: No programming knowledge needed.

- Broad Compatibility: Works on major pairs and medium timeframes.

- Prop Firm Friendly: Designed with sustainable exposure limits suitable for firm challenges.

Limitations to Consider

While Seek And Find Eps EA brings innovation to grid trading, it’s important to recognise its boundaries:

- Grid Exposure Risk: As with any grid system, extended trends can result in large drawdowns if parameters are too aggressive.

- Broker Dependency: High spreads or slow execution can distort pending order accuracy.

- Learning Curve: Although user-friendly, understanding grid dynamics is essential before going live.

- Capital Requirement: A $1,000 minimum deposit is recommended for safe operation.

The key to success is balancing expectation with discipline—traders must respect money management and avoid using excessive leverage.

Best Practices for Using Seek And Find Eps EA

- Use a VPS: Ensure uninterrupted connectivity to keep trade cycles consistent.

- Monitor Equity Drawdown: Set a maximum drawdown threshold to control losses.

- Optimise Settings Quarterly: Market volatility shifts over time; occasional parameter adjustments can maintain an edge.

- Diversify Across Pairs: Deploy the EA on 2–3 major pairs with independent risk profiles.

- Avoid News Volatility: Temporarily disable the EA during major economic releases if you notice slippage or excessive spread widening.

These practices help traders maintain stability while benefiting from the EA’s intelligent grid management.

Why It Fits the Modern Trader

The Seek And Find Eps EA aligns with what most modern forex traders demand—automation that adapts, not reacts. Instead of entering trades every minute, it waits for structured conditions. For prop traders, it’s a valuable companion since it avoids breaching drawdown rules common in challenge accounts.

Retail traders will appreciate how the EA operates transparently, with clearly defined parameters rather than obscure “black box” logic. This transparency builds confidence and allows traders to tweak and learn simultaneously.

In a market crowded with quick-profit promises, Seek And Find stands as a professional-grade solution that emphasizes risk discipline over short-term gains.

Conclusion

Seek And Find Eps EA V1.0 MT4 offers a compelling blend of intelligence, structure, and flexibility. By detecting market calm before launching its grid, it reduces unnecessary exposure while capitalising on repeatable market patterns. Its dual-layer trailing, equilibrium entry logic, and adaptive volume management make it stand out among similar systems.

For traders looking for a professional and consistent Expert Advisor, this EA provides the foundation for long-term, disciplined trading. As always, success will depend on the user’s understanding, testing, and ability to manage expectations.

Before going live, traders should thoroughly backtest and demo the EA, ensuring settings align with their risk profile. Once properly configured, Seek And Find Eps EA V1.0 MT4 can become a cornerstone of a sustainable automated trading strategy.

Comments

Leave a Comment