In the competitive world of forex and CFD trading, effective money management is just as crucial as accurate market analysis. The Rocket Money Indicator MT5 is a powerful tool designed to automate and optimize your position sizing, risk control, and profit-taking strategies. By integrating dynamic money management algorithms directly into the MetaTrader 5 platform, Rocket Money helps traders of all skill levels preserve capital, maximize gains, and maintain consistent risk profiles across every trade.

This comprehensive guide explores the Rocket Money Indicator MT5’s features, configuration options, strategic applications, and best practices. Whether you’re a novice seeking structured risk controls or an experienced trader aiming for systematic position sizing, Rocket Money can elevate your trading discipline and performance.

What Is the Rocket Money Indicator MT5?

The Rocket Money Indicator MT5 is a custom money management plugin for MetaTrader 5 that calculates optimal lot sizes, stop-loss and take-profit levels, and dynamic risk limits based on user-defined parameters. Unlike generic fixed-lot approaches, Rocket Money adapts position sizing to account volatility, account equity fluctuations, and individual trade risk preferences. Key benefits include:

Automated Position Sizing: Computes lot sizes based on percentage-of-equity, fixed-risk per trade, or volatility-adjusted inputs.

Dynamic Stop-Loss & Take-Profit: Suggests stop and target levels using ATR (Average True Range) or historic support/resistance zones.

Equity Protection: Can enforce daily drawdown limits and disable new trades after hitting predetermined equity thresholds.

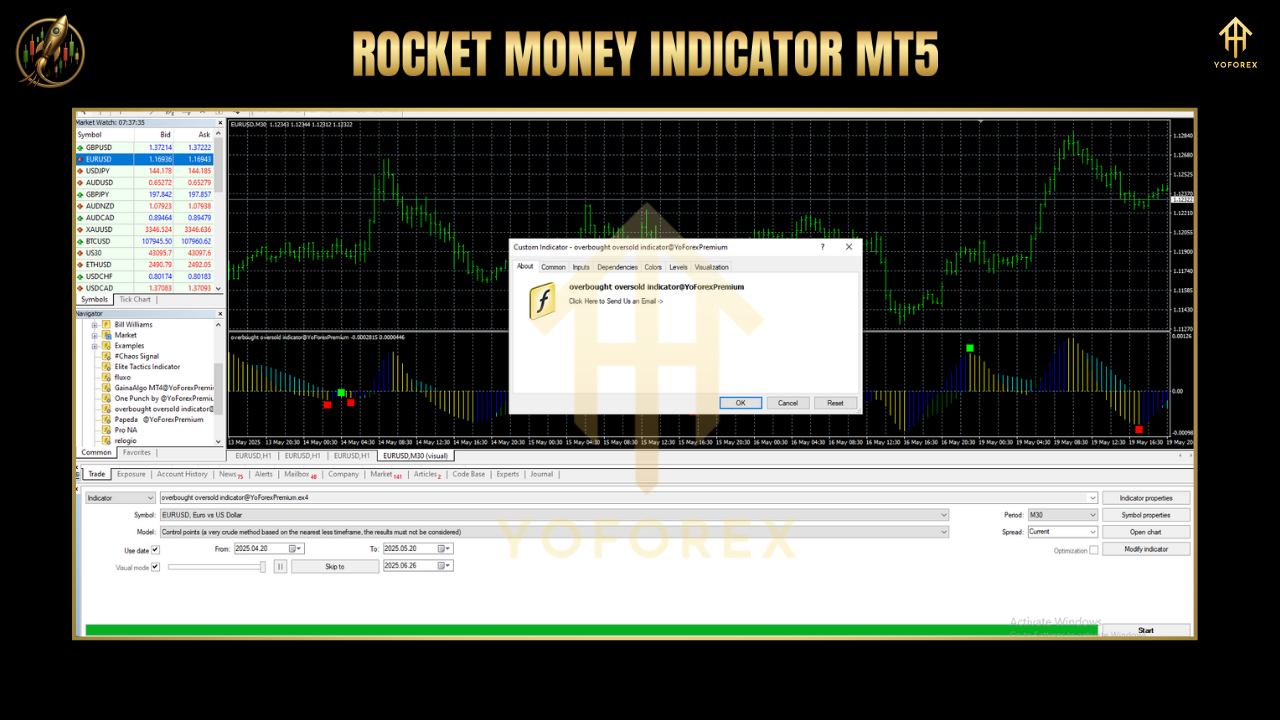

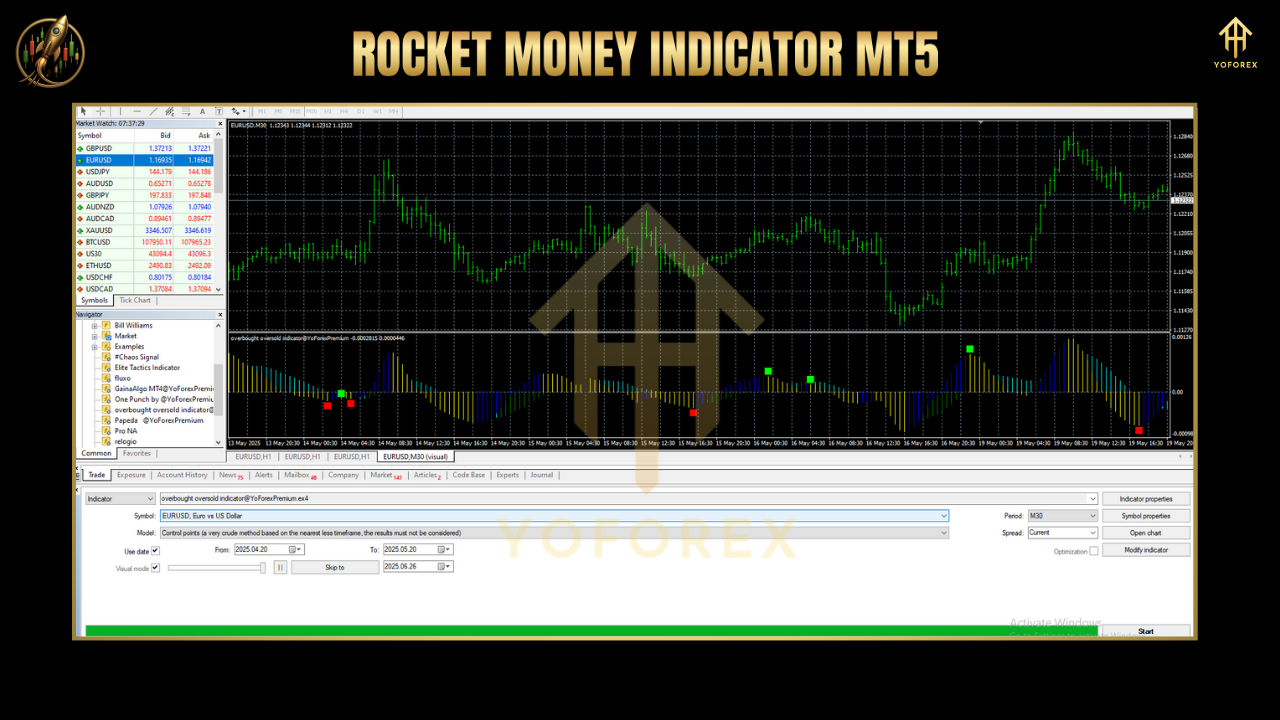

Visual Dashboard: Displays real-time risk metrics and recommended trade parameters directly on your chart.

By consolidating these functions into one intuitive indicator, Rocket Money empowers you to follow a disciplined, rules-based trading plan without manual calculations.

Core Features & Settings

Risk-Per-Trade Percentage:

Define the maximum percentage of equity you’re willing to risk on each trade (e.g., 1 %). Rocket Money computes the lot size so that a stop-loss breach will not exceed this threshold.

ATR-Based Stop-Loss & Take-Profit:

Choose an ATR multiple (e.g., 1.5 × ATR(14)) to set distance-based stop-loss and take-profit levels that adapt to current volatility.

Fixed Point Targets:

Alternatively, specify fixed pip or point distances for your stop and target if you prefer static levels.

Equity & Drawdown Limits:

Set a daily or overall drawdown cap (e.g., 3 % of starting equity). Rocket Money will alert you or block new entries upon reaching this limit.

Risk-Reward Ratio Enforcement:

Require that any potential trade meets a minimum R : R threshold (e.g., 1 : 2). The indicator will warn if the ratio is insufficient.

Visual Overlay & Alerts:

A clean chart-overlay panel shows real-time equity, risk-per-trade, lot size, stop-loss & take-profit levels, and projected drawdown.

Alerts (pop-up, email, or push) notify you when any parameter falls outside your risk criteria.

How It Works

Input Parameters: You enter your preferred risk percentage, ATR multiplier, minimum R : R, and drawdown limits into the indicator’s settings panel.

Volatility Analysis: Rocket Money calculates the current ATR(14) value to gauge recent market volatility.

Lot Calculation: Based on your equity and chosen risk, the indicator computes the exact lot size that would risk only the specified percentage if the ATR-based stop-loss is hit.

Order Suggestion: It then plots the proposed stop-loss and take-profit levels on the chart, ensuring they align with ATR multiples and your R : R constraints.

Trade Execution: You can manually place orders using these plotted levels or integrate Rocket Money with an EAs to automate execution.

Equity Monitoring: The indicator continuously monitors equity changes and stops new trade suggestions if drawdown limits are breached.

This systematic process removes guesswork from risk management, helping you maintain consistency and emotional discipline.

Strategic Applications

1. Volatility-Adjusted Breakout Entries

Setup: Identify a breakout zone from a consolidation pattern (e.g., triangle, range).

Rocket Money Role: Use ATR-based stop-loss to automatically place protective stops just beyond recent volatility spikes and calculate lot size to risk ≤ 1 % equity.

Benefit: You join breakouts confidently, knowing your position size adapts to market turbulence.

2. Trend-Following Position Scaling

Setup: Trade in the direction of a confirmed trend on higher timeframes (H4/Daily).

Rocket Money Role: After initial entry, use the indicator to scale in with smaller positions on successive pullbacks, each risking a fixed percentage of the remaining equity.

Benefit: You compound winners while strictly controlling total account risk across multiple entries.

3. Mean-Reversion with Fixed Risk-Reward

Setup: Trade reversals from overextended moves back to mean (e.g., Bollinger Band touches).

Rocket Money Role: Enforce a minimum R : R (e.g., 1 : 3) by only accepting trades where ATR-based targets exceed 3 × risk distance.

Benefit: You filter out low-reward opportunities and avoid “YOLO” mean-reversion traps.

4. Equity Protection During High-Impact News

Setup: Want to avoid trading around unpredictable economic releases.

Rocket Money Role: Temporarily disable new trade signals or enforce tighter stop-losses in your settings panel during specified times (e.g., before NFP).

Benefit: Prevents emotional or reckless trades during high-volatility news events.

Best Practices & Tips

Calibrate Risk to Your Profile: Conservative traders may choose 0.5 % risk per trade, while more aggressive traders can push to 2 %. Always backtest to find your comfort zone.

Combine with Price-Action Filters: Use Rocket Money’s calculated levels alongside candlestick confirmation (e.g., pin bars, engulfing patterns) for higher-probability setups.

Multi-Instrument Management: Apply the indicator to multiple correlated pairs with caution—ensure total combined risk across positions stays within your overall drawdown limit.

Review & Adjust Regularly: Market volatility changes; periodically recalibrate your ATR multipliers and risk percentages based on recent performance.

Maintain a Trade Log: Record each Rocket Money–guided trade—entry, exit, risk, reward, and outcome. Analyze monthly to identify areas for parameter tuning.

Conclusion

Effective money management is the cornerstone of long-term trading success. The Rocket Money Indicator MT5 streamlines risk control, position sizing, and equity preservation directly within your trading platform. By automating these critical processes, you can focus on high-quality trade setups, maintain emotional discipline, and protect your capital through all market conditions. Integrate Rocket Money into your MT5 workflow today, and watch your trading strategy take off—like a perfectly launched rocket.

Thanks for the visit ...

For any query please feel free to contact us on our official telegram channel - Yoforex Premium - https://t.me/+V6Nr5sRZVr4xYzdl

Comments

Leave a Comment