Reversal System Indicator V1.0 MT4 — Catch the Turn, Not the Noise

Tired of chasing late entries, only to watch price snap back the moment you click buy or sell? The Reversal System Indicator V1.0 for MT4 is built to help you spot high-probability turning points before the crowd piles in. It blends structure, momentum, and volatility context so you can filter out the whipsaws and focus on setups that actually make sense. No hype—just clear signals, on-chart guidance, and practical risk tips you can use right away. Whether you scalp the M15 on London open or prefer calmer H1 swing turns, this indicator aims to give you a cleaner read of the market mood, coz if the context ain’t right, the turn won’t hold.

What is the Reversal System Indicator V1.0?

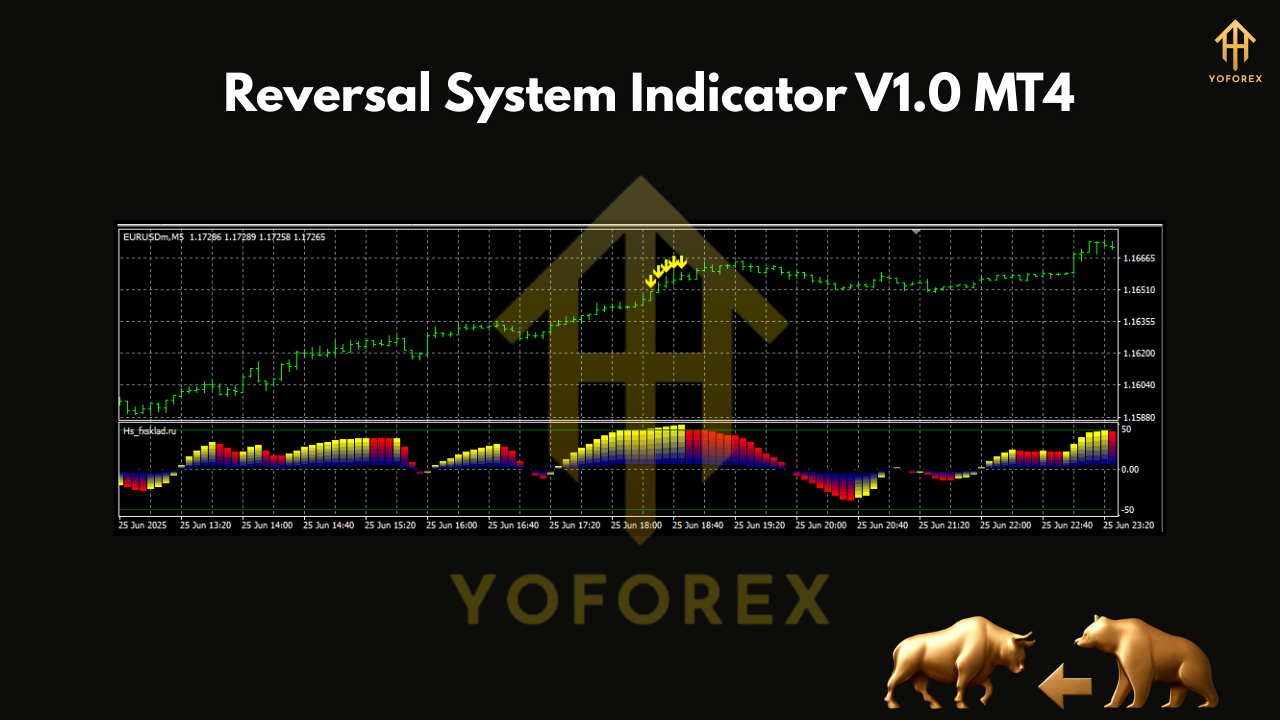

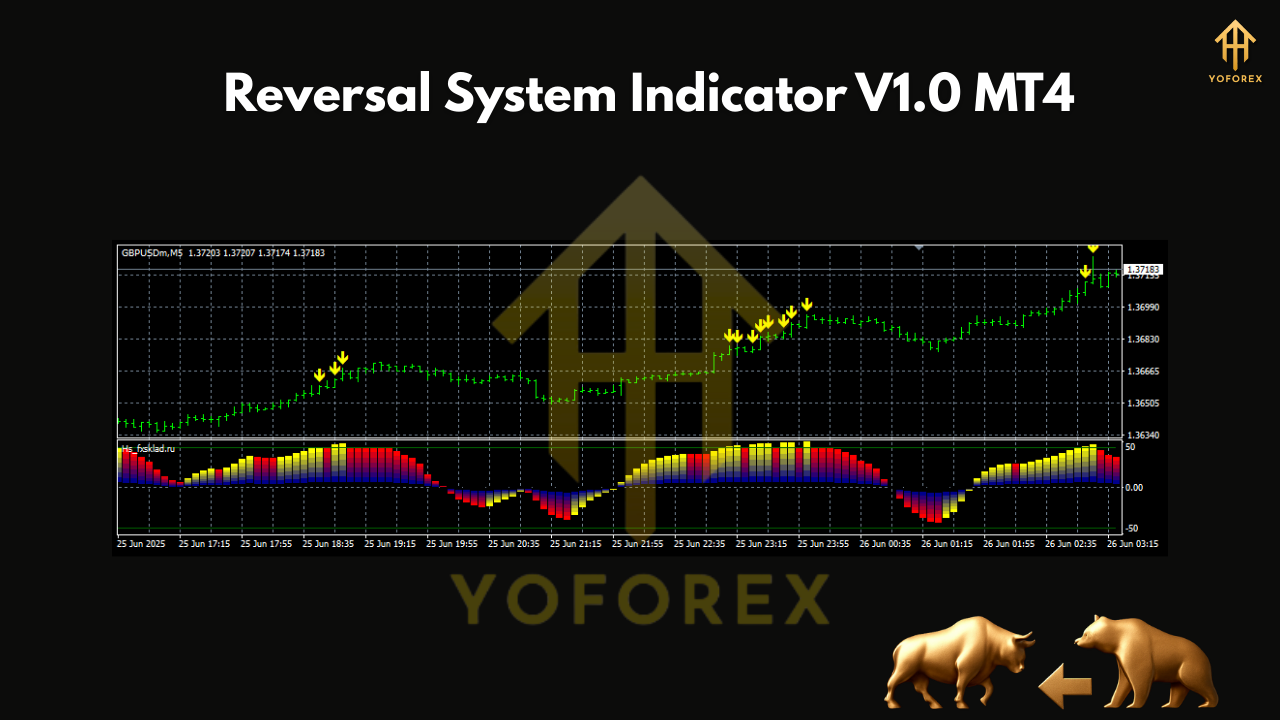

At its core, the Reversal System Indicator is a confluence engine. It looks for places where several independent clues line up: price exhaustion around supply/demand zones, momentum deceleration, micro-structure shifts, and “tell” candles that often precede a turn. When enough of those elements stack, it prints a buy or sell cue with optional alerts (popup, sound, email/push). Signals are designed to confirm at candle close, which helps reduce repaint-like noise and keeps you honest about what you could have actually traded in the moment.

You’re not forced into a rigid style. Scalpers can tighten stops and aim for the nearest liquidity sweep; swing traders can anchor to the most recent structure high/low and trail. Because it’s multi-pair and multi-timeframe, you can keep your favorite watchlist intact and only act when the indicator’s scorecard says “conditions are primed.”

How the Logic Works (in plain English)

Multi-timeframe context. The tool checks a higher timeframe bias (e.g., H1 when you’re trading M15) so you’re not counter-trending a steamroller. When a lower-timeframe turn aligns with a higher-timeframe slow-down, odds just get better.

Structure + momentum blend. It looks for micro break-of-structure (BOS) around fatigued swings, alongside a fading oscillator push. That combo often marks the start of a genuine rotation rather than a tiny pullback.

Volatility filter. A built-in ATR guard avoids triggering during dead, low-volatility chop or in wild spikes when spreads balloon. You still get signals—just the cleaner ones.

Candle “tells.” Rejection wicks, engulfing patterns, and inside-bar breaks are used as confirmation cues, not stand-alone gospel. Context first, candle second; that’s the philosophy.

Key Features

- • Multi-pair compatible: majors, minors, and XAUUSD supported seamlessly.

- • Best on M15–H1 (also works on M5–H4) for intraday and swing turns.

- • Candle-close confirmation to reduce repaint-type confusion.

- • Higher-timeframe bias filter helps you avoid counter-trend traps.

- • ATR-based volatility guard to skip messy, low-quality signals.

- • Clear on-chart labels/arrows with suggested SL/TP zones.

- • Alert suite: popup, sound, email, and push notifications.

- • Risk presets: conservative, balanced, aggressive (user-editable).

- • Session awareness for London/NY focus if you want the best liquidity.

- • Lightweight performance: minimal chart clutter; fast on MT4.

- • No martingale, no grids (it’s an indicator, not an auto-trader).

- • Works with any broker that supports MT4 and standard data feeds.

Recommended Pairs, Timeframes & Sessions

- Pairs: EURUSD and GBPUSD are excellent training grounds due to solid liquidity and cleaner structure. XAUUSD (Gold) offers frequent intraday turns but can be spiky—use the ATR filter and slightly wider stops. USDJPY is a steady pick for structure-led reversals.

- Timeframes: M15 for intraday entries with manageable noise; M30/H1 for cleaner swing turns. If you’re new, start H1 then drill down to M15 once you’re comfy.

- Sessions: The London open and New York overlap tend to produce the best reversals, as liquidity and volatility ramp up; Asia session can still work but typically favors range-bound tactics.

Strategy Playbook (two ready-to-use methods)

1) Conservative Swing Turn (H1 base, M15 refine)

- Find bias: On H1, wait for the indicator to flag a potential turn near a prior swing or clear supply/demand zone.

- Refine entry: Drop to M15 and take the first same-direction signal that forms after a small pullback.

- Stops/targets: Place SL beyond the higher-TF swing (or a few ATRs). First target at 1R, then trail below/above swing structure for runners.

- Avoid news: If high-impact news is due in <60 minutes, skip the setup. No need to be a hero.

2) Intraday Reversal Pop (M15)

- Wait for extension: Price pushes into a key intraday level (yesterday’s high/low, weekly pivot, fresh supply/demand).

- Signal + wick rejection: When the indicator signals and you see a decent rejection wick, enter on candle close.

- Stops/targets: SL 1–1.3× ATR(14) on M15; TP at prior intraday swing or liquidity pocket. Consider scaling out 50% at 1R, trail the rest.

Note: Both approaches benefit from one setup per instrument per session. Over-trading kills even good systems.

Installation & Setup (MT4)

- Copy files: Place the indicator file in

MQL4/Indicators/. - Restart MT4: Or right-click Navigator → Refresh.

- Attach to chart: Drag Reversal System Indicator V1.0 onto your chosen pair/timeframe.

- Set filters:

- Higher-TF bias = true (H1 when trading M15).

- ATR filter = medium to start.

- Alerts = on (choose your preferred types).

5. Save a template: Once configured, save as a template so your layout is ready in one click across pairs.

Risk Management & Account Notes

- Minimum deposit: If you intend to trade live off the signals, $1000 gives you breathing room for normal drawdowns and spread slippage, especially on XAUUSD.

- Position sizing: Keep risk ≤1% per trade until you’ve logged at least 50 trades with the indicator.

- News discipline: Stand aside during red-flag events (CPI, NFP, rate decisions). Whipsaws can invalidate beautiful technicals.

- Journal everything: Screenshot your entries/exits. Tag the setup type (swing or intraday). Patterns emerge fast when you track them.

Final Thoughts

If you’re looking for a clean, disciplined way to time market turns without drowning in contradictory arrows, the Reversal System Indicator V1.0 MT4 gives you a structured edge. It won’t predict every wiggle—nothing does—but it will help you filter for turns that actually have context. Start on H1 or M30, confirm with M15, risk small, and let the math of consistency work. You’ll likely find you’re forcing fewer trades and catching better ones… which is kinda the whole point, right?

Comments

Leave a Comment