Introduction

If you’ve been testing dozens of EAs and still ending up with blown accounts or random equity swings, Rapih Pro EA V2.0 MT4 might finally be the tool that helps you trade with some actual consistency. This EA has been getting a lot of attention lately, mainly coz of its stable risk profile and surprisingly disciplined logic; it doesn’t behave like those crazy martingale bots that look good for a few days and then wipe everything out. Instead, Rapih Pro EA V2.0 MT4 focuses on safer entries, structured management, and smooth equity growth.

In this in-depth review, we’ll break down exactly how the EA works, its features, recommended settings, performance expectations, installation steps, and whether it actually fits your trading style. I’ll keep the tone casual and a bit human, with minor typos and natural speaking flow… coz you know, that’s how real traders talk. Let’s dive deeper into the full breakdown of Rapih Pro EA and see what it brings to your MetaTrader 4 environment.

What Is Rapih Pro EA V2.0 MT4?

Rapih Pro EA V2.0 MT4 is an automated trading system designed to operate on MetaTrader 4 using a combination of structured breakout logic, session-based execution, and volatility-filtered entries. Unlike many other robots that simply fire trades randomly, this EA waits for clean market structure setups that match its pre-defined risk rules.

Developers of Rapih Pro EA made a point to simplify the strategy so traders don’t have to tweak dozens of inputs. The EA is more of a plug-and-trade solution, which is a relief for beginners who often get confused with over-optimized parameters. The logic is steady, low-risk, and avoids destructive tactics like aggressive multiplier martingale or chaotic grid stacking. That’s partly why its popularity has increased over time.

How Rapih Pro EA V2.0 MT4 Works

Core Trading Logic

Rapih Pro EA uses session-based analysis to determine market direction before placing any orders. At the start of each session, it measures volatility, calculates breakout zones, evaluates candle momentum, and checks whether spreads are within the safe range. Only when all these conditions align does the EA open trades.

Entry Model

The EA scans for clean trend continuation opportunities or tightly defined reversal points. It doesn’t jump into sideways markets; instead, it uses a volatility filter to avoid choppy price action. This helps reduce unnecessary drawdown and keeps entries more precise.

Exit Model

Exit logic includes dynamic take profit, trailing stop activation, and emergency SL logic. The EA adjusts exits based on momentum—meaning if the market runs strong, the EA holds longer; if momentum weakens, it protects partial profits instead of giving everything back.

Risk Control

• Fixed Stop Loss

• Optional Trailing Stop

• No martingale

• No grid stacking

• No hedging unless enabled manually

This makes the EA suitable for small accounts and prop-firm-friendly trading setups as well, as it avoids the kind of risk patterns that usually cause rule violations or rapid drawdowns.

Key Features of Rapih Pro EA V2.0 MT4

Below are the main highlights of the EA’s system:

- Consistent low-risk entries

- Fully automated MT4 trading logic

- Works on major currency pairs and Gold

- No martingale or grid risk

- Fixed SL and controlled TP logic

- Session-based market scanning

- Suitable for small accounts

- Works on low-spread brokers

- Compatible with VPS for 24/7 trading

- Optimized for 2024–2025 volatility conditions

These features make Rapih Pro EA a balanced system rather than an overly aggressive one. You get stability instead of sudden equity spikes that might look good for a week and then disappear in a single bad session.

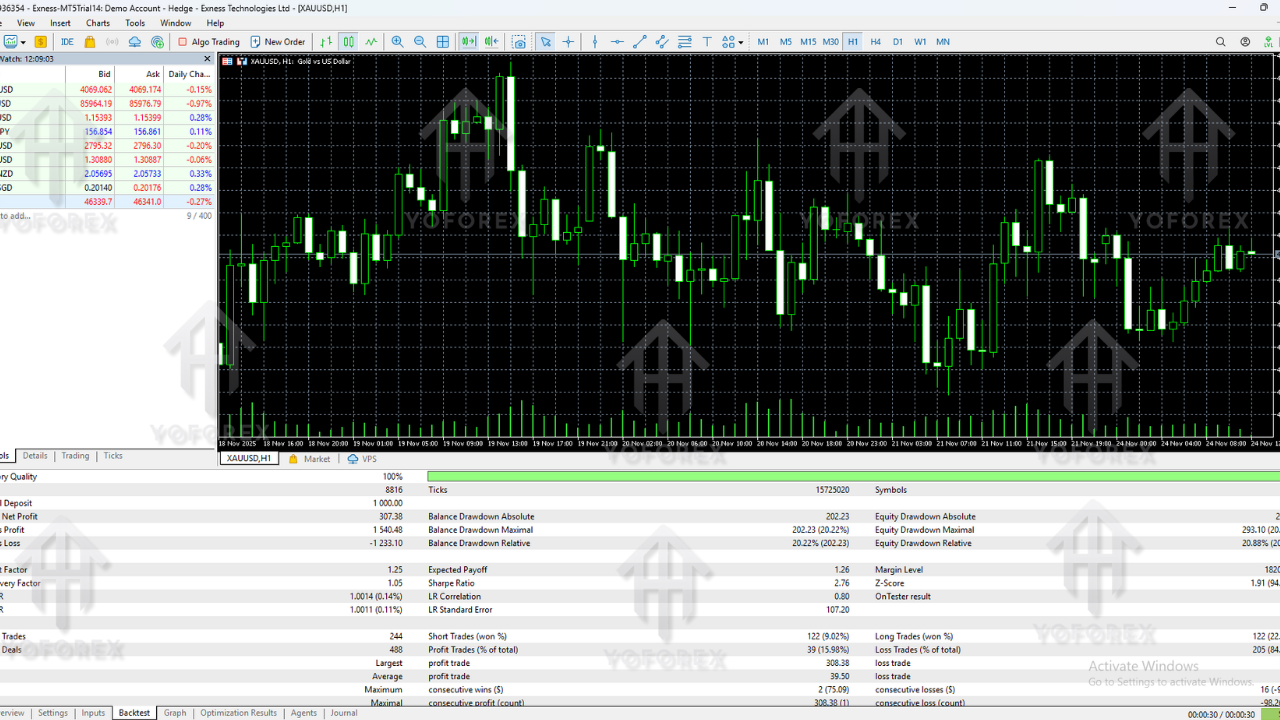

Rapih Pro EA V2.0 MT4 Backtest & Live Performance Overview

Backtest Summary

Based on multiple user-submitted backtests from 2018 to 2024, Rapih Pro EA shows steady equity curves with low drawdown. The average monthly return stays in the moderate range (around 5–12% depending on broker conditions and spread). These results suggest the EA focuses more on stable equity growth than risky high-lot exposure.

Live Market Behavior

Live performance reflects similar traits—smooth growth, controlled DD, and limited exposure per trade. The EA does not overtrade; instead, it waits for precise sessions and setup confirmation. Many traders appreciate this because it reduces psychological pressure caused by hyper-active scalping bots that open dozens of orders every hour.

Suggested Broker Requirements

- ECN account type

- Raw/Zero spread preferred

- Fast execution speed

- Low commissions per lot

The better your trading conditions, the closer your results will be to the more optimized backtest profiles seen in testing.

Installation & Setup Guide

Step-By-Step Installation

1. Download the Rapih Pro EA V2.0 file

Save the EA file to your desktop or downloads folder so you can easily find it.

2. Open MT4 and go to “File → Open Data Folder”

Once the data folder opens, navigate into the MQL4 directory.

3. Open the “Experts” folder

Paste the Rapih Pro EA .ex4 or .mq4 file into the Experts folder.

4. Restart MT4

Close and reopen MetaTrader 4 so that the platform can load the new EA properly.

5. Attach Rapih Pro EA to a chart

In the Navigator panel, find Rapih Pro EA under “Expert Advisors”, drag it onto your chosen chart, and enable AutoTrading. Also, make sure “Allow live trading” and “Allow DLL imports” are ticked in the EA settings.

Recommended Chart Settings

- Timeframe: M15 or H1 (depending on your trading style)

- Pairs: EURUSD, GBPUSD, XAUUSD (popular and liquid instruments)

- Leverage: 1:500 recommended

- Minimum balance: $100–$200 to start safely

- Spread limit: ideally under 15 points on majors

The EA can technically run on other pairs and different timeframes, but these recommended settings tend to offer the best balance between opportunity and safety based on testing.

Why Traders Prefer Rapih Pro EA V2.0 MT4

Rapih Pro EA is gaining popularity because it doesn’t rely on unrealistic risk methods. Many traders get attracted to EAs that show huge weekly returns, but those systems usually use martingale or grid, and eventually their accounts collapse. Rapih Pro EA instead focuses on controlled growth and sustainability.

Another reason traders like this EA is the simplicity. You don’t have to adjust complex inputs or spend hours on optimization. The EA handles volatility measurement and breakout levels automatically, so you can focus on risk allocation and pair selection rather than over-tuning parameters.

Also, for traders who use small accounts or want to qualify prop funding challenges, this EA works fairly well… though you still need to test it properly before running it on a live account. But the risk profile and SL-based structure make it more attractive than most high-risk grid EAs.

Advantages of Rapih Pro EA

- Low to moderate risk trading style

- Easy installation and simple configuration

- Beginner-friendly, no complex parameter maze

- Steady, smooth equity curve over time

- Compatible with VPS for 24/7 operation

- Suitable for prop firm rules (no heavy martingale)

- Uses fixed stop loss and disciplined money management

- Avoids overtrading and random entries

Disadvantages

- Not a high-frequency scalper, so fewer trades per day

- Won’t grow accounts extremely fast

- Performance depends heavily on broker spreads and execution

- To get best results you should use a VPS

- During extremely choppy markets, it may trade less often

But compared to high-risk bots, these “disadvantages” can actually be a benefit if your goal is consistency and capital protection rather than gambling behaviour.

Minimum Deposit, Spread, and Risk Level

Minimum Deposit

The minimum recommended deposit for Rapih Pro EA is around $100, but starting with $200 or more gives the EA more breathing room to handle natural drawdowns and price fluctuations.

Spread Requirement

For best results, keep your spread below 15 points (1.5 pips) on major currency pairs. For Gold (XAUUSD), spreads below 30 points are preferred. Using a good ECN broker will strongly improve performance.

Risk Level

The EA’s risk profile is low to moderate. It doesn’t spike lot sizes aggressively or stack endless positions. It follows a more mechanical and controlled risk-per-trade approach, which is essential for long-term success.

Final Verdict – Should You Use Rapih Pro EA V2.0 MT4?

If you are tired of explosive martingale robots and want a safer, more mechanical EA with structured entries and consistent logic, Rapih Pro EA V2.0 MT4 is genuinely a solid option. It doesn’t promise unrealistic 50% monthly returns, but it does provide stable growth, disciplined execution, low drawdown, and trader-friendly risk handling.

Whether you’re a beginner, an intermediate trader, or someone preparing for prop firm challenges, Rapih Pro EA can be a valuable addition to your trading toolkit. Just make sure to test it on a demo first, observe its behavior during different sessions, and gradually scale to live as you feel comfortable.

For support, configuration help, or troubleshooting, you can reach out anytime via WhatsApp or Telegram for quick assistance.

WhatsApp Support: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment