Quantum ICT Concepts EA V1.19 MT5 is a powerful Expert Advisor built for traders who demand institutional-grade precision, disciplined market structure analysis, and advanced algorithmic execution. Designed around the principles of ICT (Inner Circle Trader) methodology and Smart Money Concepts, this EA brings together liquidity mapping, structure shifts, Fair Value Gap (FVG) detection, and high-confidence confluence models to deliver a fully automated trading engine for MetaTrader 5.

As modern forex markets evolve, traders are shifting away from traditional indicator-based systems and toward models that understand how institutional players move the market. ICT trading emphasizes how liquidity is engineered, how price manipulates before delivery, and how market structure reveals the true direction. Quantum ICT Concepts EA V1.19 MT5 automates these exact principles, making it an essential tool for those who want structured, smart trading without emotional interference.

In this detailed review, you’ll learn how the EA works, the strategy behind it, its major features, installation guidance, and what traders can expect when deploying it in their everyday trading workflow.

Introduction to Quantum ICT Concepts EA V1.19 MT5

Quantum ICT Concepts EA V1.19 MT5 follows the core ICT trading framework but enhances it with algorithmic logic, multi-timeframe filters, and advanced decision modeling. Instead of relying on lagging indicators, it interprets market conditions in real time:

- When liquidity is being targeted

- When displacement indicates institutional presence

- When FVGs form and remain unmitigated

- When BOS or CHOCH signals real structural change

- When the market is in premium or discount zones

These concepts create high-probability trade scenarios used by experienced ICT traders. The EA automates these elements into a clean and systematic approach, ideal for both beginners and advanced traders.

Version 1.19 introduces improvements in structure recognition, faster FVG detection, refined liquidity sweep filters, and enhanced killzone awareness. These updates contribute to better accuracy and fewer false setups.

How the Strategy Works

The EA operates through a multi-layered approach built around the key pillars of ICT and Smart Money Concepts.

1. Market Structure Reading

The EA identifies:

- Swing highs and lows

- Directional bias

- Break of Structure (BOS)

- Change of Character (CHOCH)

This allows the system to understand whether the market is ready for continuation or reversal.

2. Liquidity Mapping

Liquidity drives the market. The EA continuously evaluates:

- Equal highs and equal lows

- External and internal liquidity

- Buy-side and sell-side liquidity pools

- Inducement zones

It enters only after liquidity has been taken, preventing premature trades.

3. Fair Value Gap Evaluation

FVGs are a key part of ICT entry models. The EA checks:

- Strength of displacement

- Cleanliness of the gap

- Proximity to structural levels

- Directional bias alignment

Only FVGs with strong narrative support are used as trade triggers.

4. Order Block Validation

The EA identifies institutional footprints through order blocks:

- Confirmed bullish or bearish blocks

- High-volume or high-impact OBs

- Mitigated vs unmitigated zones

- HTF and LTF alignment

This ensures entries originate from zones where institutional traders may place orders.

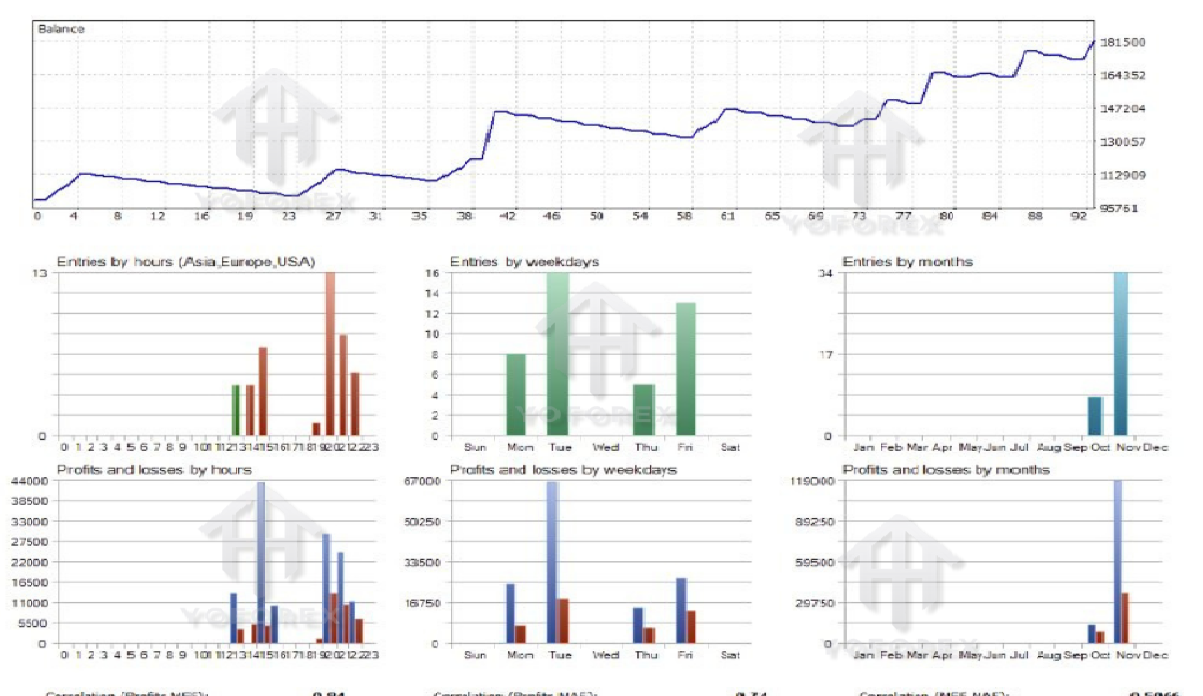

5. Session & Timing Logic

ICT trading emphasizes timing. The EA includes logic for:

- London session setups

- New York session setups

- Reversal windows

- High-volume periods

This avoids low-liquidity times when setups are weaker.

Key Features of Quantum ICT Concepts EA V1.19 MT5

1. Multi-Timeframe Confirmation Engine

The EA checks multiple timeframes to ensure the narrative is aligned. This eliminates many false signals and strengthens entry quality.

2. Smart Confluence Filtering

It requires multiple ICT conditions to align before executing trades. These include liquidity sweep, displacement, market structure break, and premium/discount alignment.

3. Precision Entry and Exit Logic

The EA enters only after liquidity is taken and price rebalances into optimal FVG zones. Exit logic is structured using liquidity targets, imbalance fills, or structure breaks.

4. Adaptive Risk Management

Risk is dynamic and based on:

- Swing structure

- Volatility changes

- Session conditions

Parameters include breakeven protection, partial closes, trailing logic, and risk per trade customization.

5. Enhanced Version 1.19 Upgrades

The latest version includes:

- Faster pattern recognition

- Cleaner order block calculations

- Improved FVG algorithm

- Better rejection of low-probability setups

- More responsive killzone logic

6. Suitable for Beginners and Professionals

Even with advanced internal logic, the EA’s interface is simple. Beginners can use default settings, while advanced traders can adjust:

- Bias models

- Entry criteria

- Session filters

- Risk parameters

7. Fully Automated ICT Trading

All major ICT concepts are automated:

- Liquidity grab confirmation

- Structural shift identification

- FVG entry mapping

- OB interaction

- Session timing

This eliminates emotional trading and produces disciplined execution.

Why ICT-Based Automation Is Effective

1. Structure Over Indicators

Most EAs depend on indicators. ICT trading depends on price behavior and liquidity models, making it more reactive to real movement.

2. High-Probability Setups

The EA focuses on the setups ICT traders manually wait for:

- Clean displacement

- Confirmed structure

- Premium/discount pricing

- Liquidity engineering

3. Avoids Choppy and Uncertain Markets

The EA’s filters automatically skip markets lacking clear structure or liquidity cues.

4. Consistent Risk-Adjusted Returns

While not high frequency, the EA targets:

- High-quality trades

- Controlled drawdown

- Strong R:R outcomes

This leads to more stable long-term performance.

Installation & Setup Guide

- Open MetaTrader 5.

- Navigate to File → Open Data Folder.

- Go to MQL5 → Experts.

- Paste the EA file into the folder.

- Restart MT5.

- Attach the EA to your preferred chart.

- Adjust inputs such as risk, pair selection, and session settings.

- Enable algorithmic trading.

- For best performance, run it on a stable VPS.

Best Trading Conditions

Quantum ICT Concepts EA V1.19 MT5 performs best in:

- Trending or semi-trending markets

- Sessions with strong liquidity

- Pairs with clean structure

- Brokers offering low spreads and fast execution

Killzone periods deliver the strongest setups due to institutional activity.

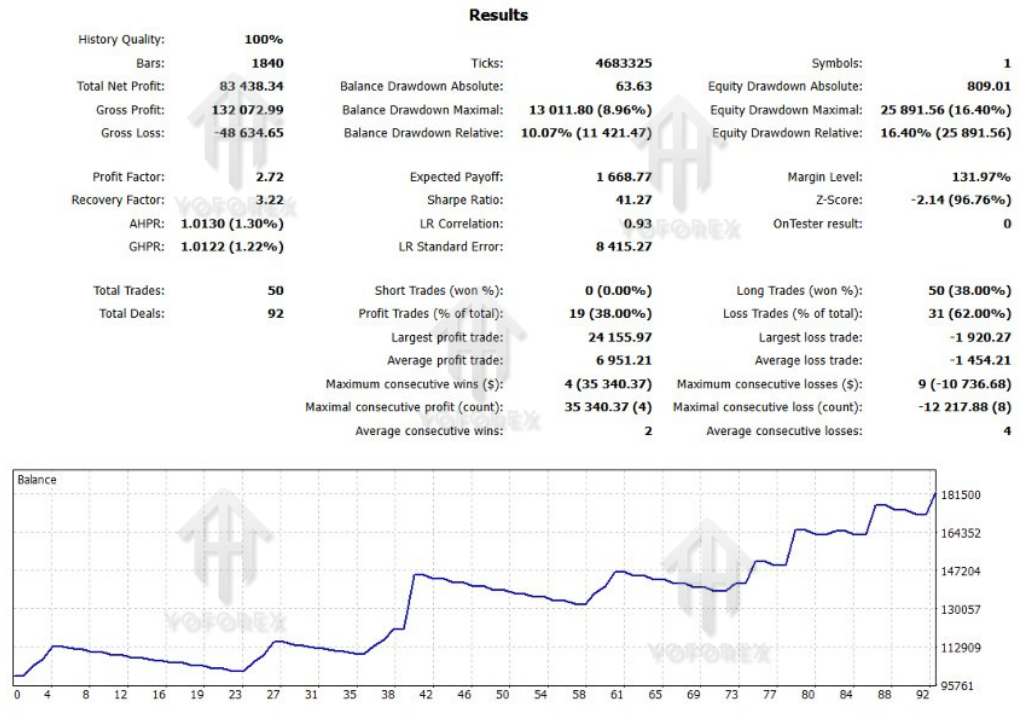

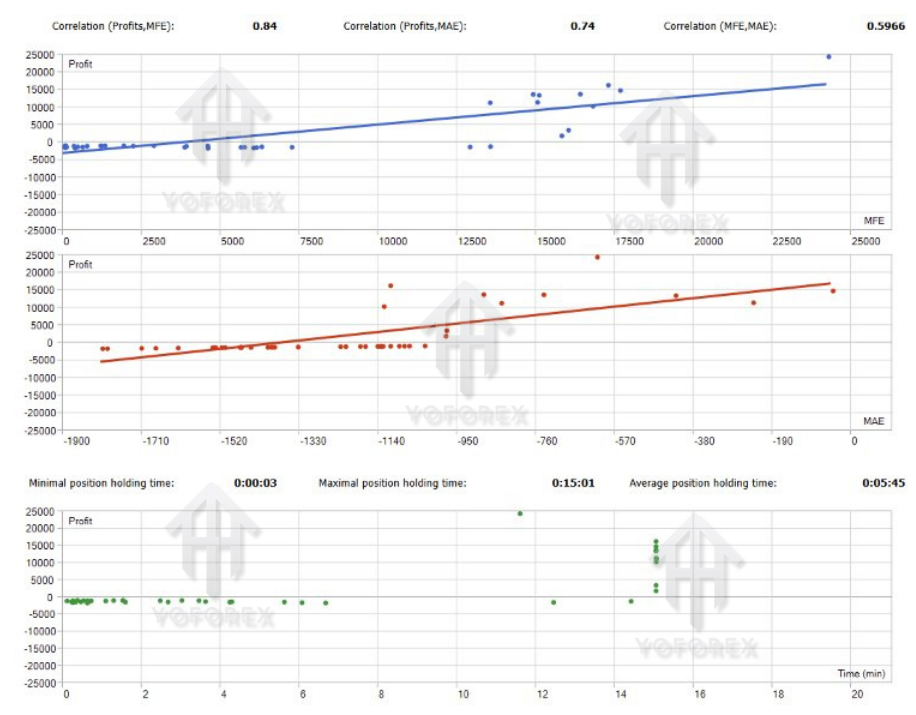

Performance Expectations

ICT-based systems prioritize accuracy, not trade frequency. Users should expect:

- Clean, structured entries

- Strong R:R ratios

- Lower overall drawdown

- Fewer trades but higher consistency

- Professional-level logic with minimal noise

The EA is designed to trade only when the market aligns with institutional behavior.

Who Should Use This EA?

Quantum ICT Concepts EA V1.19 MT5 is ideal for:

- Traders who follow ICT teachings

- Beginners wanting structured automation

- Advanced users building diversified EA portfolios

- Long-term traders seeking consistent logic-driven setups

- Those who value liquidity-based trading principles

Its disciplined design makes it suitable for serious traders aiming for professional execution standards.

Comments

Leave a Comment