In the competitive world of forex trading, automated systems have gained tremendous popularity for their ability to minimize emotional trading, execute trades 24/7, and manage complex strategies. Among the many Expert Advisors (EAs) available, Quantum Empire Grid Pro EA V1.0 MT4 has emerged as a flexible, high-performance tool for traders seeking a grid-based trading system that can deliver profits across a wide range of market conditions.

In this blog post, we will dive deep into the features, advantages, and potential risks of the Quantum Empire Grid Pro EA V1.0 MT4 to help you understand why it could be a valuable addition to your trading arsenal.

Overview of Quantum Empire Grid Pro EA V1.0 MT4

Quantum Empire Grid Pro EA V1.0 MT4 is an automated trading system designed to trade using a grid and averaging methodology on the MetaTrader 4 platform. By using this EA, traders can automate their trading strategies, reducing the need for constant monitoring of the markets. This EA works by opening a series of positions in the market and managing them based on predefined grid levels. The idea behind this strategy is to capitalize on price fluctuations by opening positions at various levels, which can lead to profitable exits even when prices move against the initial position.

One of the key selling points of Quantum Empire Grid Pro is its ability to adapt to different trading conditions. Whether you're trading forex, indices, metals, or even cryptocurrencies, this EA can be configured to handle a range of markets, making it a versatile tool for traders.

Key Features of Quantum Empire Grid Pro EA V1.0 MT4

1. Grid and Averaging Trading Strategy

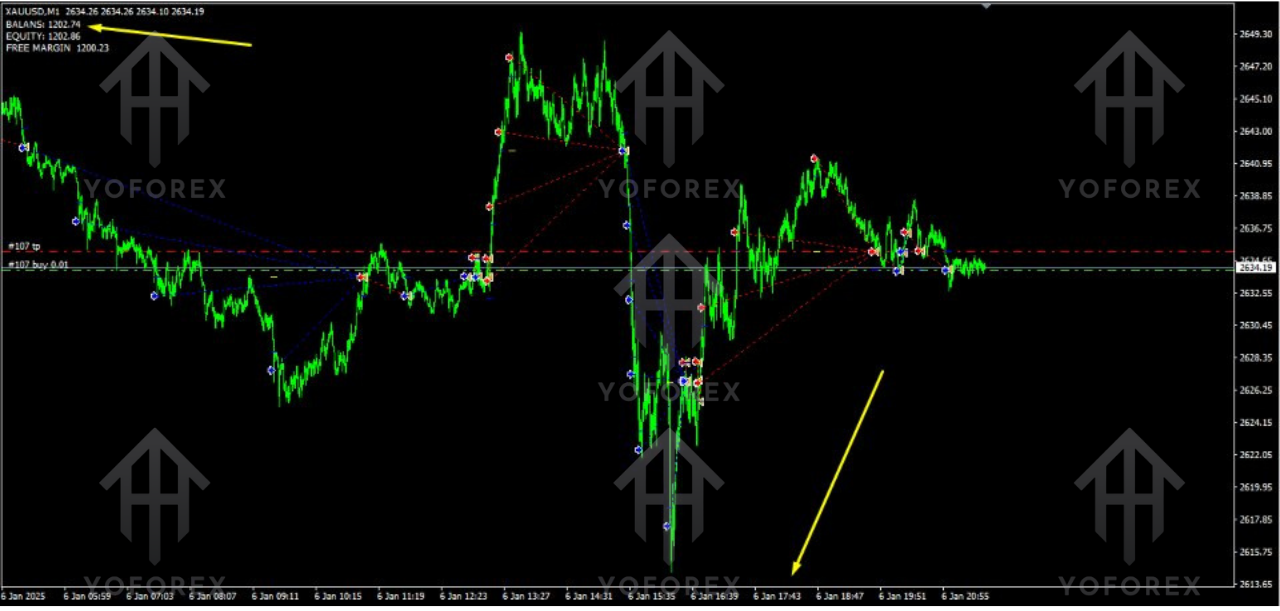

At the heart of Quantum Empire Grid Pro EA is the grid trading strategy, which involves placing buy and sell orders at pre-defined intervals. This strategy is particularly useful when the market exhibits ranging behavior, allowing the EA to open positions at different levels and accumulate profits when prices eventually return to the mean.

The EA also incorporates averaging, meaning that if the price moves against a trade, it will open additional positions in the opposite direction to bring the average entry price closer to the current market price. This strategy aims to recover from drawdowns and secure profits when the market reverses.

2. Multiple Signal Modes for Customization

Quantum Empire Grid Pro offers multiple signal modes to help optimize trade entries. Traders can select from four different modes:

- Chaotic Pulse Mode: Focuses on detecting market momentum and volatility for high-frequency trading.

- SMA Filter Mode: Uses a simple moving average to filter trades, ensuring that the EA trades in the direction of the prevailing market trend.

- Custom Indicator Mode: Allows the integration of custom indicators, such as RSI, MACD, and other custom strategies.

- Combined Filter Mode: Combines both custom indicators and SMA filters to refine trade signals, increasing accuracy and reducing noise.

3. Adjustable Risk Management Parameters

Effective risk management is critical for any trader, and Quantum Empire Grid Pro offers several tools to control risk. You can set:

- Maximum drawdown limits: to protect your account from excessive losses.

- Daily profit targets: to lock in profits at specific times and reduce overtrading.

- Lot size management: to control the amount of risk per trade.

These features help traders ensure that they can trade with peace of mind, knowing that their risk is always within acceptable limits.

4. Multi-Timeframe and Multi-Instrument Support

The EA is designed to work across multiple timeframes, making it adaptable for different types of trading strategies. Whether you prefer short-term scalping on lower timeframes (e.g., M1, M5) or longer-term trading on higher timeframes (e.g., H1, H4), this EA can accommodate your trading style.

Additionally, Quantum Empire Grid Pro supports a wide range of instruments, including forex pairs, indices, metals (such as gold), and even cryptocurrencies. This wide range of asset classes makes it a versatile EA for traders with diverse portfolios.

Advantages of Quantum Empire Grid Pro EA V1.0 MT4

1. Automation Saves Time

One of the primary benefits of using Quantum Empire Grid Pro is the automation of the grid trading strategy. This allows traders to set up their trades and let the EA handle the execution, freeing them from the need to monitor the markets constantly. The EA works 24/7, ensuring that no potential trading opportunity is missed, even when you are away from the screen.

2. Flexibility Across Different Market Conditions

The EA’s ability to adapt to different market conditions—whether trending or ranging—makes it a robust tool. Traders can choose between various signal modes and adjust their strategies based on market volatility and the direction of the trend.

3. Advanced Risk Management

With customizable risk settings, Quantum Empire Grid Pro ensures that you can trade without worrying about excessive drawdowns. The EA offers flexibility in adjusting trade sizes, limiting risk, and setting profit targets. This level of control helps mitigate risks and protects your capital from major losses.

4. Suitable for Traders of All Experience Levels

Whether you are a beginner or a professional, Quantum Empire Grid Pro is designed to be user-friendly, with an intuitive interface and easy-to-understand settings. Beginners can use the default settings and rely on the built-in risk management features, while more experienced traders can fine-tune the EA’s parameters to suit their preferences.

Disadvantages and Risks of Using Quantum Empire Grid Pro EA V1.0 MT4

While Quantum Empire Grid Pro has many advantages, there are some risks associated with its use:

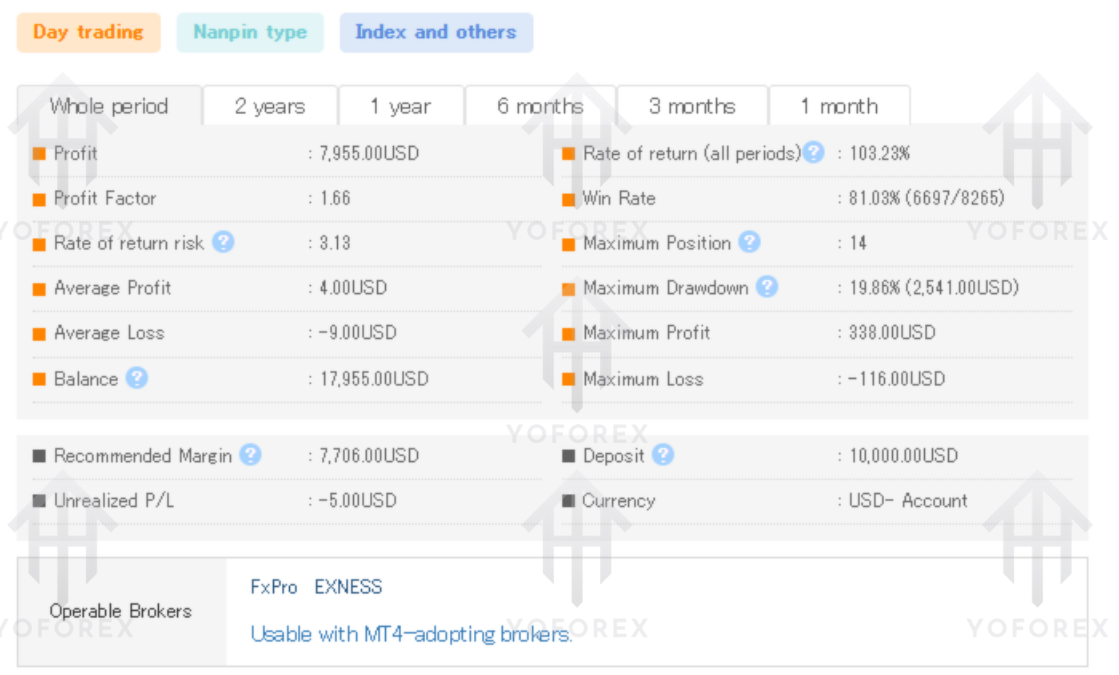

1. Grid Trading Can Lead to Large Drawdowns

One of the major risks of grid trading is the potential for significant drawdowns. If the market moves against the open positions for an extended period, the EA may accumulate a large number of trades, which could lead to substantial losses. Proper risk management and account sizing are essential when using this EA to avoid catastrophic drawdowns.

2. Over-Optimization Risk

As with any automated system, there is a risk of over-optimization. This occurs when the EA is fine-tuned to perform well on historical data but struggles in live market conditions. It is important to test the EA on demo accounts before applying it to live trading.

3. Requires Sufficient Capital

Due to the nature of grid trading, it is recommended to have a sufficient account balance to withstand drawdowns. Traders with smaller accounts may find that grid trading strategies are more risky due to the potential for large position sizes.

Conclusion

Quantum Empire Grid Pro EA V1.0 MT4 is a powerful automated trading tool that offers flexibility, customization, and advanced risk management features. It combines grid trading with signal filtering, allowing traders to capture profits in volatile or trending markets. While the EA provides several advantages, particularly in terms of automation and adaptability, traders should be cautious about the risks of grid trading, such as large drawdowns and over-optimization. Proper risk management, account sizing, and thorough testing are crucial when using this EA.

If you are looking for an automated trading solution that offers flexibility and adaptability across multiple markets and timeframes, Quantum Empire Grid Pro could be the right choice for you. However, always remember to conduct thorough testing before using it in live markets.

Comments

Leave a Comment