Quantitative Apex Prop Firm EA V1.0 MT5 — One Trade a Day, Built for Funded Accounts

Platform: MetaTrader 5 (MT5)

Asset Focus: XAU/USD (Gold)

Design Goal: Prop firm compliance — strict risk, low frequency, high discipline

Style: One structured trade per day, managed end-to-end by the EA

Core Concept

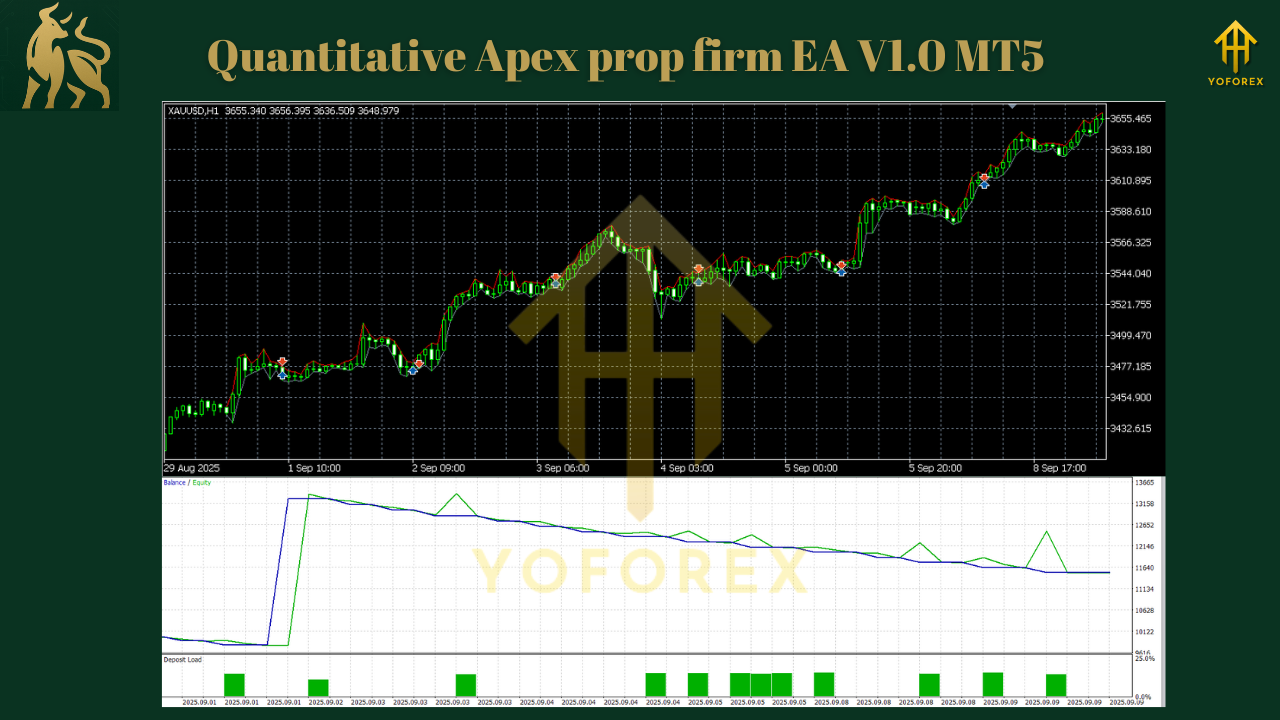

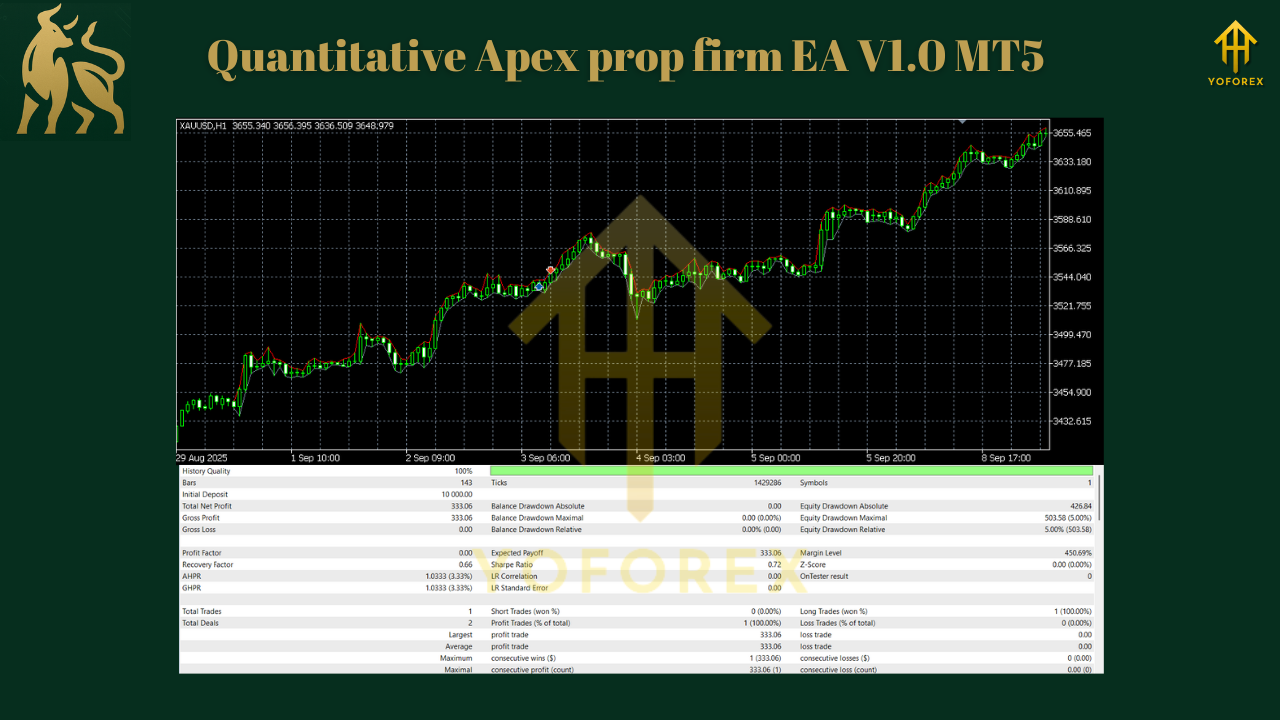

Quantitative Apex Prop Firm EA V1.0 is engineered with one job: help traders pass and maintain prop firm accounts by enforcing discipline, risk limits, and consistency. Unlike typical EAs that spam entries, it takes only one trade per day — aligning with many firms’ strict rules. Optimized for XAU/USD (Gold), the EA captures liquidity-driven moves during EU and US sessions, where volatility and volume align.

This is not a scalper or grid bot — it’s a compliance-first Expert Advisor designed to protect your drawdowns, grow accounts steadily, and keep you from breaking rules.

Key Features

- One Trade per Day Logic

Eliminates overtrading and complies with firm restrictions. - XAU/USD Specialization

Gold is liquid, volatile, and predictable around EU & US sessions — perfect for structured setups. - Smart Money Management

- Fixed Lot Mode: Consistent sizing for simple execution.

- Dynamic Lot Mode: Calculates % of balance (and adapts to account leverage) for smoother scaling.

- Drawdown Protection

Automatic respect for daily, weekly, and monthly drawdown caps. Trades halt if limits are approached. - Fully Automated

No manual interference required. The EA handles entries, stop-loss, take-profit, and trailing if configured. - Prop Firm Ready

- No martingale, no grid

- Strict one-position logic

- Built-in safeguards to prevent rule violations

Recommended Settings

- Symbol: XAU/USD

- Timeframe: M15 or H1 chart (logic is session-driven, not TF-sensitive)

- Account Size: Minimum $5,000 for prop firm accounts (scale risk accordingly)

- Risk per Trade: 0.5%–1% (fixed or % equity)

- Leverage: Works with 1:30 to 1:500, adapt sizing carefully

- Trading Window: EU + US session overlap (default logic optimized here)

- Stop-Loss / Take-Profit: Auto-calculated per volatility; customize if needed

- VPS: Highly recommended for stable execution and low latency

Example Workflow

- Daily Session Scan

EA monitors Gold price behavior at start of London/NY session. - Signal & Entry

Confirms structure breakout or trend alignment before taking the day’s single trade. - Risk Validation

Position sized based on account equity, leverage, and prop drawdown rules. - Trade Management

- Hard stop-loss + take-profit

- Optional trailing stop once in profit

- Auto-breakeven protection available

- Shut Down for the Day

Once the trade is closed, EA stands aside until next session.

Benefits for Prop Traders

- Compliance Built-In: Respects daily/weekly/monthly DD rules.

- Steady Growth Mindset: Focuses on consistent compounding rather than chasing every move.

- Rule-Based Discipline: No emotional interference; EA prevents revenge trading.

- Minimal Monitoring: Just ensure VPS stability — EA handles the rest.

- Universally Accepted: Compatible with most major prop firms (FTMO, MFF, TFT, E8, etc.).

Advantages & Limitations

Advantages:

- One trade/day = reduced stress + prop safety

- Smart lot management with leverage awareness

- Gold-focused, optimized for volatility sessions

- Works across regulated and high-leverage brokers

- No complex optimization required

Limitations:

- Not multi-asset (XAU/USD only)

- Lower trade frequency (patience required)

- Requires VPS for best performance

FAQ

Does it use martingale or grid?

No. Single-entry, fixed-risk logic only.

Why one trade per day?

To comply with prop firm restrictions and avoid overtrading.

Can I run it on other pairs?

It’s optimized for Gold (XAU/USD). Other pairs are not recommended.

What’s the minimum account size?

$5,000+ for prop firm accounts; demo or cent accounts can be smaller for testing.

Is VPS required?

Yes, strongly recommended.

Final Thoughts

Quantitative Apex Prop Firm EA V1.0 MT5 is for traders serious about passing and keeping funded accounts. Its one-trade-per-day, Gold-only, risk-first design makes it one of the safest automated tools for prop firm challenges. By respecting daily/weekly/monthly drawdowns and eliminating emotional trading, it allows you to focus on execution consistency and account growth.

Risk Disclaimer: Trading involves risk. Even prop-firm-friendly EAs cannot guarantee profits. Always demo-test before going live.

Join our Telegram for the latest updates and support

Comments

Leave a Comment