The Forex market never sleeps, and traders are always searching for better tools to improve their performance and decision-making. One product that is increasingly mentioned in trading circles is Quant Analyzer EA V4.9.2 MT4. While some traders see it as an innovative way to track, manage, and optimize trading strategies, others remain skeptical about its reliability. In this article, we will explore what this tool represents, how it is positioned in the trading ecosystem, its potential benefits, and why careful evaluation is necessary before putting it into live use.

Introduction to Quant Analyzer EA V4.9.2 MT4

Quant Analyzer EA V4.9.2 MT4 is described as an Expert Advisor designed to enhance trading insights and provide more structure to strategy evaluation. Unlike traditional indicators that only generate signals, this EA claims to combine analytical capabilities with automated features, allowing traders to track risk, monitor drawdowns, and understand the deeper performance of their trading systems.

The main purpose of this version is to give traders clarity. In Forex, where small mistakes compound quickly, having detailed insights into how a strategy performs under different conditions can make the difference between steady growth and uncontrolled losses.

Why Tools Like Quant Analyzer Matter

Every trader eventually realizes that profit is not the only metric that counts. Stability, drawdown control, and consistency are just as important. Tools like Quant Analyzer EA are built around the idea that traders should focus on sustainable systems rather than short-lived gains.

Without proper analysis, a strategy that looks profitable for a few weeks can collapse in high volatility. By running detailed breakdowns of trades and performance, an analyzer can show you whether the system has the resilience to survive in the long term.

Features Associated With Quant Analyzer EA V4.9.2 MT4

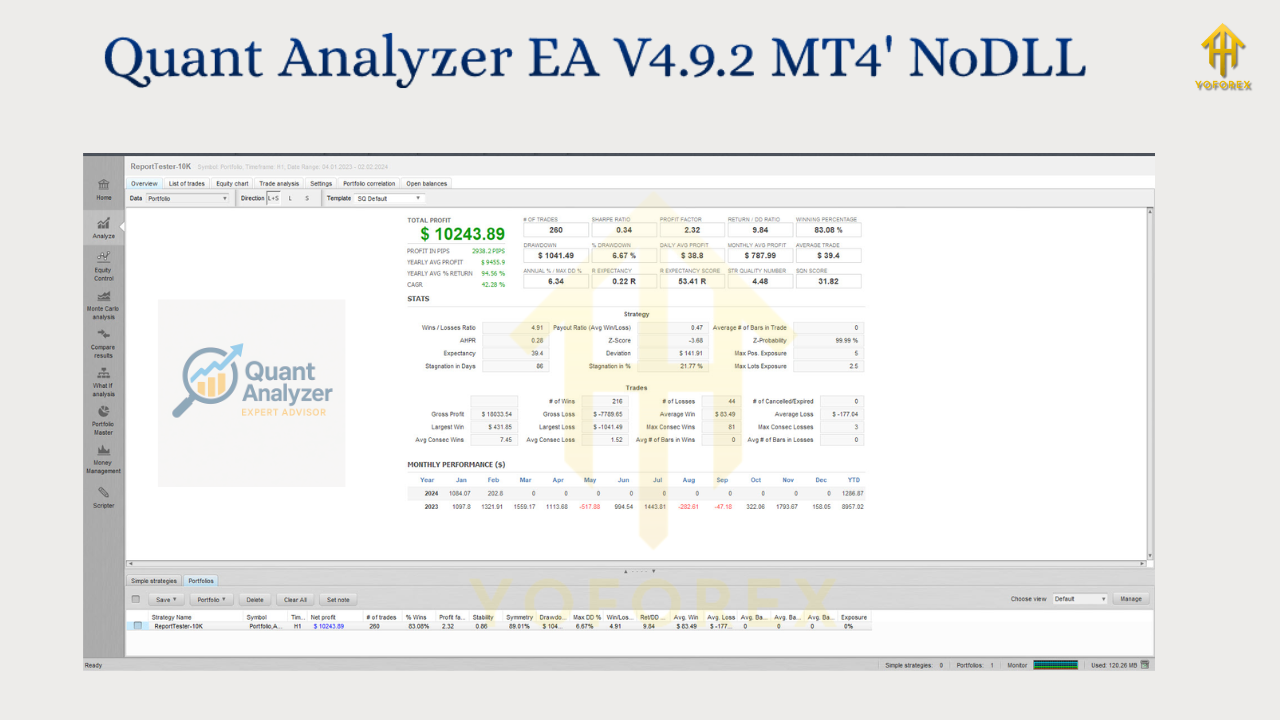

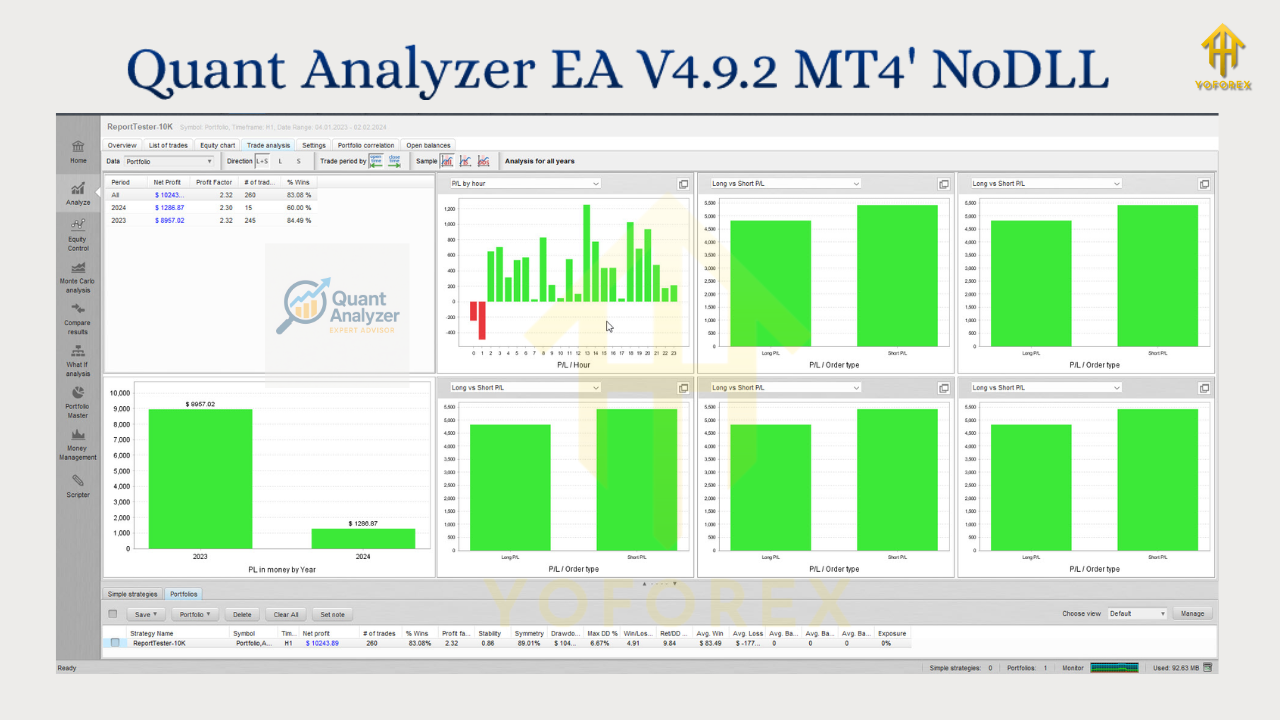

Trade Performance Breakdown

The EA reportedly evaluates every trade, not just by profit and loss but by metrics such as average hold time, peak drawdown, and entry accuracy.

Risk Management Enhancements

Traders often fail not because their strategy is poor but because their risk control is weak. A system like this may help by providing alerts or settings that limit exposure.

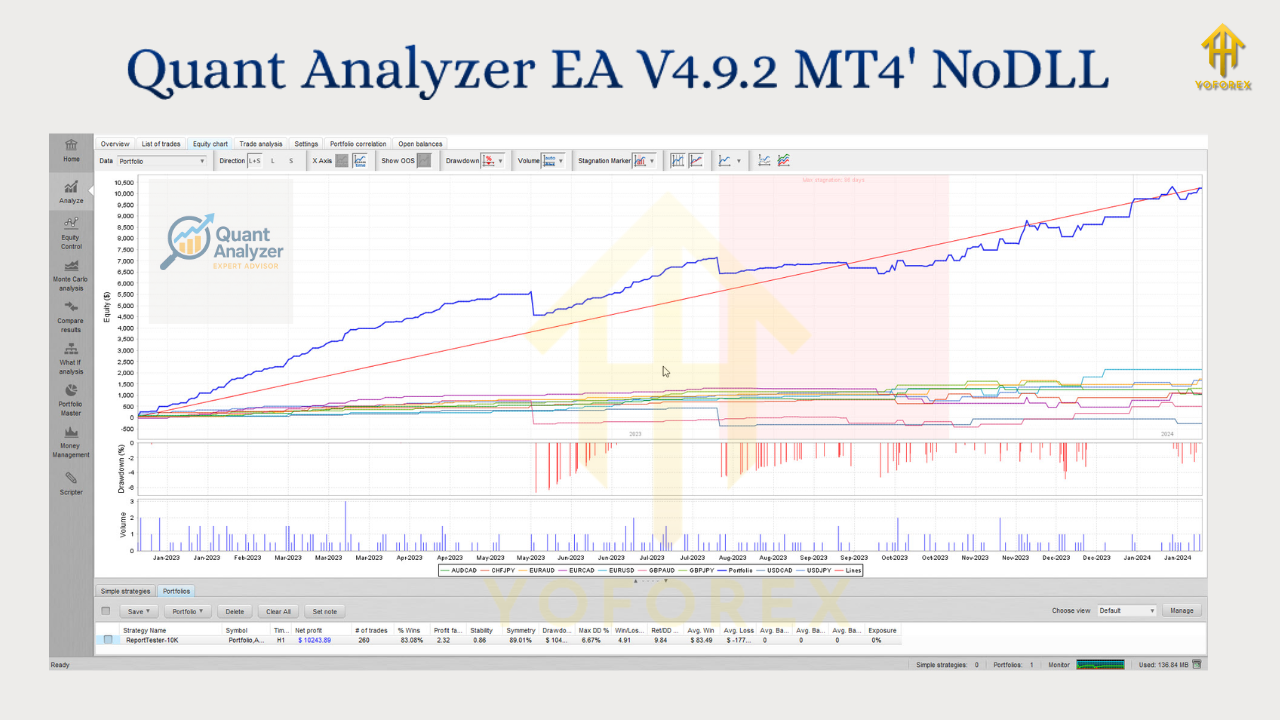

Equity Monitoring

An essential part of trading is knowing when your account balance is at risk. The EA is said to provide ongoing monitoring, helping traders stop trading during unstable conditions.

Scenario Testing

The EA can theoretically simulate how a strategy might perform in different timeframes, spread conditions, or levels of volatility. This gives traders a glimpse of potential weaknesses before real money is at risk.

Portfolio Insight

For traders running multiple EAs or strategies, the analyzer element helps identify which systems complement each other and which overlap in risk, reducing unnecessary exposure.

The Controversy Around This Version

Although the features sound attractive, one of the major issues with Quant Analyzer EA V4.9.2 MT4 is verifying its authenticity. While there are many listings and mentions of this software, very few credible reviews confirm its origin or whether it is officially maintained.

This creates confusion: is it a genuine analyzer that includes EA functionality, or is it a repackaged version created by third parties? For traders, this uncertainty can be risky, as installing unknown software on MT4 could expose accounts to instability or even security threats.

Benefits of Using an Analyzer-Style EA

If the product works as claimed, traders could gain several advantages:

- Improved decision-making through detailed performance metrics.

- Early warnings about high drawdowns or inconsistent trades.

- A structured way to evaluate multiple strategies.

- The chance to learn more about how different market conditions affect results.

- More disciplined trading, as the EA can remove emotion from the equation.

Risks to Be Aware Of

At the same time, traders must be cautious. The risks include:

- Lack of Verification: Without confirmed sources, authenticity is questionable.

- Possible Malfunction: If the EA is not coded well, it may crash, lag, or mismanage trades.

- Overreliance: Traders who completely trust an EA may stop learning the fundamentals, which is dangerous if the software fails.

- Market Conditions: No analyzer or EA can guarantee profitability. Markets evolve, and what works today may fail tomorrow.

Best Practices Before Using Quant Analyzer EA V4.9.2 MT4

- Start in Demo

Always begin with a demo account. This allows you to test the EA without risking real funds. - Check Settings Carefully

Every EA has adjustable parameters. Misconfigured settings may lead to inaccurate results or unnecessary trades. - Monitor Consistently

Even if the EA seems stable, monitor its trades and analysis daily. Never assume full automation equals safety. - Protect Your Account

Use brokers with reliable execution and avoid connecting unknown files to your live trading account until thoroughly tested. - Educate Yourself

Don’t treat the EA as a substitute for learning. Use the insights to sharpen your own understanding of markets and strategies.

Who Should Consider This Tool?

Quant Analyzer EA V4.9.2 MT4 may appeal to:

- Traders who already run multiple EAs and need better portfolio monitoring.

- Beginners who want structured insights into how their trades behave.

- Intermediate traders aiming to refine strategies with deeper analysis.

However, it is not suited for anyone looking for a plug-and-play “get rich quick” solution. It should be used as an analytical assistant, not as a magic formula.

Final Thoughts

Quant Analyzer EA V4.9.2 MT4 sits at an interesting intersection between trading automation and analytical software. On one hand, the idea of combining performance breakdown with automated monitoring is attractive. On the other hand, questions remain about its authenticity and long-term support.

For traders, the best approach is cautious optimism. Use demo testing, strict risk management, and ongoing monitoring to judge whether the EA truly adds value. If treated as a tool rather than a shortcut, it may provide useful insights that strengthen your trading journey.

The most important takeaway is that no software replaces discipline, knowledge, and strategy. Quant Analyzer EA V4.9.2 MT4 might assist you, but success will still depend on your ability to adapt and make informed decisions.

Comments

Leave a Comment