PZ Turtle Trading Indicator V2.0 MT5 – Full Review & Complete Guide

If you’ve ever been curious about whether true trend-following still works in today’s fast, algo-driven markets… well, the famous Turtle Trading system is proof that some ideas never die. And with the PZ Turtle Trading Indicator V2.0 for MT5, you don’t have to manually crunch breakout numbers or scroll through decades of chart history coz the indicator does all that heavy lifting for you. Pretty neat, tho, especially if you enjoy rule-based trading without emotions messing things up.

This blog breaks down everything: what the indicator does, how the original Turtle rules worked, how the breakout logic is applied, and whether it’s actually useful for everyday traders in 2025. Let’s dive in…

Introduction: Why Turtle Trading Still Matters

The Turtle Trading strategy isn’t just another trend-following trick; it was one of the most famous experiments in trading history. Richard Dennis and William Eckhardt, two legendary traders, basically ran a real-life “can trading be taught?” challenge. They taught a group of complete beginners a step-by-step breakout strategy… and those students reportedly turned over $175 million in profit in about five years.

That’s wild. But what’s even more interesting is that their entire rulebook was transparent, logical, and technical—no ‘intuition’, no psychology hacks, no mysterious signals.

The PZ Turtle Trading Indicator V2.0 for MT5 takes these exact breakout, stop loss, and pyramiding rules and makes them usable on any modern chart. You get clean signals, breakout levels, ATR-based risk management guidance, and systematic trade triggers. So instead of eyeballing ranges and "feeling" trends, you rely on math.

And honestly, for many traders—especially beginners—this structured approach removes a ton of stress.

Overview of the PZ Turtle Trading Indicator V2.0 MT5

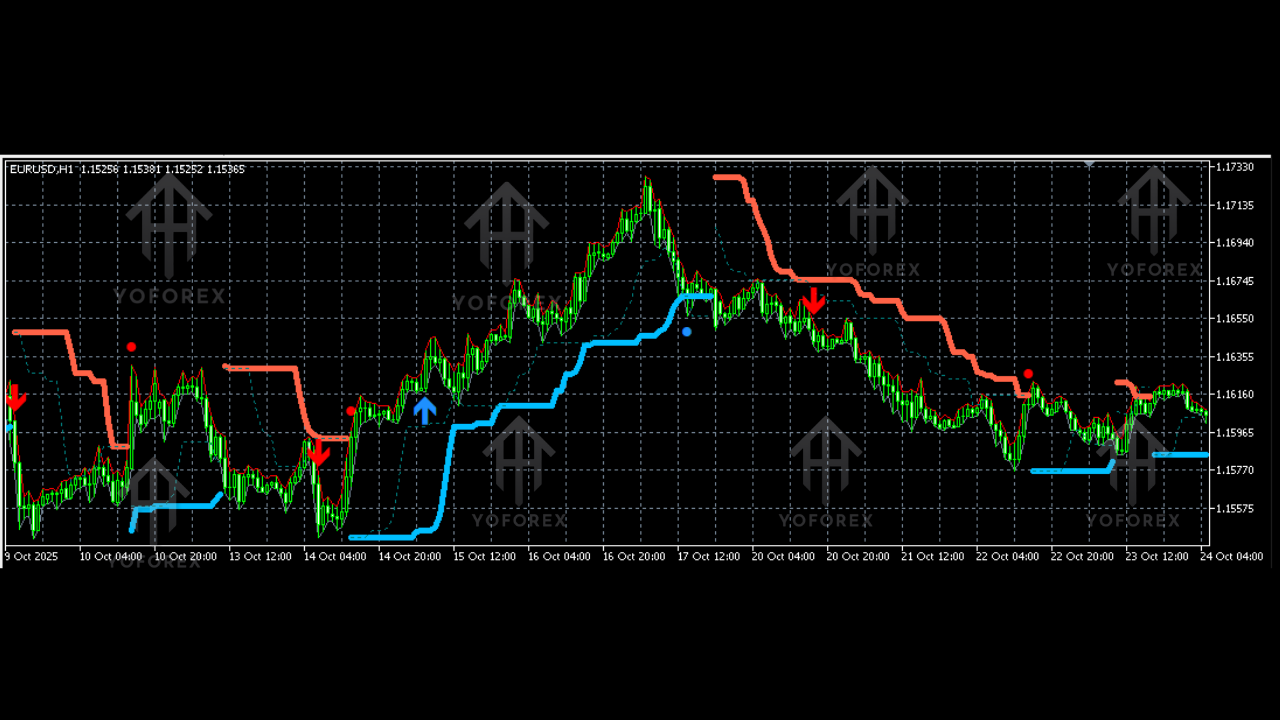

At its core, the indicator follows two things:

- Breakouts of historical highs and lows (20-day and 55-day).

- ATR-based risk and profit stacking.

The idea is simple:

If the market breaks above a historical high, the trend likely continues. Same logic for downside breaks. You’re not “predicting” a trend; you're jumping on once momentum proves itself.

The PZ MT5 version is designed to:

- Auto-draw breakout levels

- Highlight valid S1 (20-day) and S2 (55-day) entries

- Show trade direction (buy or sell)

- Mark ATR-based stop-loss levels

- Help with pyramiding entries

- Keep everything rule-based and unemotional

Unlike most indicators that repaint or act vague, this one is strict. It follows the textbook Turtle rules — which is great if you hate ambiguous systems.

The best part?

It works across all markets: forex, indices, commodities, crypto CFDs… basically anything that trends well.

Understanding the Entry Strategy (S1 & S2)

This is where the system shines, and the indicator makes everything super visual.

System One (S1): 20-Day Breakout

- Buy when price breaks above the last 20-day high.

- Sell when price breaks below the last 20-day low.

- BUT — you only take the trade if the last S1 signal was a loss.

Why? Coz S1 is designed to avoid overtrading big trends. If the last 20-day entry already caught a large move, the next 20-day breakout is often late or a fakeout. So the rule says: enter again only if the previous one didn’t work out.

It’s strangely logical… and surprisingly effective.

System Two (S2): 55-Day Breakout (Fail-Safe Trend Filter)

This is the backup system that ensures you never miss a huge market move.

- Always take the 55-day breakout.

- Buy if price breaks a 55-day high.

- Sell if price breaks a 55-day low.

This is the “just in case” entry. If S1 filtered out a trade that later turned into a monster trend, S2 gets you in anyway.

The PZ indicator marks both breakouts clearly, so you always know which one you're acting on.

Stop-Loss & Volatility (ATR-Based Risk)

The Turtles didn’t use random stop-loss levels—they used volatility units, defined as:

N = ATR(30)

Initial Stop-Loss = 2 × N

So if ATR(30) = 50 pips → Stop-loss = 100 pips.

This method adapts to the market’s behavior. If volatility is high, stops are wider. If quiet, stops are tighter.

The PZ indicator automatically calculates:

- ATR(30)

- The stop-loss zone

- Risk-based exit points

You don’t even have to think about it, which is honestly refreshing when trading gets overwhelming.

Pyramiding (Adding to Winners)

Now this part is fun — and terrifying if you’re not used to it… but it works.

The Turtles added positions only when they were already in profit.

- Add 1 new position every 0.5 × N in profit.

- Maximum of 4 total positions.

So you’re essentially scaling aggressively into winning trades.

This creates those mega-trend returns the system became famous for.

The indicator plots where each new pyramid entry should occur. Traders love this feature coz it forces discipline.

The Origins: Why It’s Called “Turtle Trading”

Richard Dennis famously said he could “grow traders like they grow turtles” (referring to turtle farms in Singapore). That’s how the name stuck.

His experiment proved that structured rules + discipline = real trading success.

The PZ Turtle Trading Indicator V2.0 keeps that spirit alive by translating those rules into simple visuals on MT5. Anyone—newbies or pros—can follow them without second-guessing.

Performance & Market Behavior

Does the strategy still work in 2025?

Short answer: Yes, but only in trending markets.

It does NOT perform well in:

- choppy sideways ranges

- low-volatility environments

- extremely news-driven false breakouts

But in strong trending conditions (like gold trends, JPY volatility, crypto rallies), the system absolutely shines.

The indicator doesn’t magically make you money — it just ensures you follow the exact mechanical rules that made Turtle Trading famous.

Who Should Use This Indicator?

It’s ideal for:

- Trend-followers

- Swing traders

- Systematic/robotic traders

- Traders who hate emotional decisions

- Anyone who likes mechanical entries and exits

It’s not great for:

- Scalpers

- Range traders

- People who want 10–20 trades a day

- Traders who panic at wide stop-losses

Pros & Cons of the PZ Turtle Trading Indicator

Pros

- Pure rule-based trading

- No repainting

- Works on all assets

- Clear breakout signals

- ATR risk management built-in

- Perfect for trend followers

- Proven strategy with decades of history

Cons

– Long periods of inactivity

– Wide stops required

– Requires patience and discipline

– False breakouts can hurt in sideways markets

But that’s the nature of trend-following systems — they wait, then strike hard.

Final Thoughts

The PZ Turtle Trading Indicator V2.0 for MT5 is perfect if you want a historically proven, rule-based, low-stress approach to trend trading. It faithfully reproduces the breakout logic, risk structure, and pyramiding that made Turtle Trading legendary.

Comments

Leave a Comment